Opioid Induced Constipation (OIC) Drugs Market Research, 2031

The global opioid induced constipation (OIC) drugs market was valued at $1105.71 million in 2021, and is projected to reach $1785.01 million by 2031, growing at a CAGR of 4.9% from 2022 to 2031. Opioid-induced constipation (OIC) is mainly caused by opioids which activate enteric -receptor, increasing tonic non propulsive contractions in the small and large intestines, increases colonic fluid absorption, and causes desiccation of stool. In addition, opioids are thought to raise the anal sphincter tone and the rectum's lowest sensory threshold, thus these combined actions lead to tougher stools as well as less frequent and ineffective defecation. The opioid induced constipation drugs market refers to the various drugs and treatments that are used to manage constipation caused by the use of opioids.

“The opioid induced constipation drugs market size was positively impacted during the lockdown period owning to increase in sales of mu-opioid receptor antagonists and chloride channel activator. In addition, increase in demand for drugs in parenteral dosage form for treating opioid induced constipation (OIC) was observed as similar symptoms were experienced in COVID patients.”

Market Dynamics

Growth & innovations in the pharmaceutical industry for the manufacturing of opioid induced constipation (OIC) drugs owing to massive pool of health-conscious consumers, creates an opportunity for the opioid induced constipation drugs market share. The growth of the opioid induced constipation (OIC) drugs market is expected to be driven by emerging markets, due to availability of improved healthcare infrastructure, increase in unmet healthcare needs, rise in prevalence of chronic pain cases in adults, and surge in demand for novel drugs for management of opioid induced constipation (OIC) disorder. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure, and development of the medical tourism industry in emerging countries. Various organizations along with government are counselling people regarding the opioid induced constipation (OIC). E-commerce (electronic commerce) has become a vital tool for small and large businesses globally, due to rise in preference of consumers for online shopping over traditional purchasing methods.

Various animations through health apps to educate people regarding opioid induced constipation (OIC) and available treatment options have contributed towards the opioid induced constipation drugs market growth. The demand for effective medications for treating opioid induced constipation (OIC) is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the OIC drugs market size. Factors such as rise in adoption of methylnaltrexone (parenteral – subcutaneous) for opioid induced constipation (OIC) treatment, and increase in awareness toward use of mu-opioid receptor antagonists and chloride channel type-2 activator, further drive the growth of the OIC drugs market. Moreover, an increase in promotional activities by manufacturers and growth in awareness for proper treatment of opioid induced constipation (OIC) among the general population are expected to fuel their adoption in the near future.

However, side effects of the drug used in opioid induced constipation (OIC) drugs restrains the growth of opioid induced constipation (OIC) drugs market. In addition, high costs of novel pharmaceuticals and unfavorable reimbursement policies are probable factors which restrain the growth of market. In contrast, rising R&D activities, rise in regulatory approvals and higher spending for opioid induced constipation (OIC) research is expected to provide lucrative opportunities to key players of the market. In addition, rise in demand for novel therapeutics for treating opioid induced constipation (OIC) is further anticipated to drive the growth of the market.

The outbreak of COVID-19 has disrupted workflows in the health care sector around the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. The COIVD-19 pandemic positively impacted to growth of opioid induced constipation drugs market, owing rise in number of patients suffering from chronic pain disorders, thus opioids were consumed for pain management. In addition, many people and geriatric population irrationally used opioids for pain management, owing to which rise in prevalence of constipation cases was observed. Further, opioid misuse increased during the pandemic as people experienced worsened mental health, more social isolation, greater job losses, and reduced access to treatment, which positively impacted to growth of opioid induced constipation (OIC) drugs market.

Segmental Overview

The opioid induced constipation (OIC) drugs market is segmented into drug type, route of administration, distribution channel and region. By Drug Type, the market is categorized into mu-opioid receptor antagonists, chloride channel-2 activators and others. By Prescription Type, the market is categorized into over the counter drugs and prescribed drugs. By Distribution Channel, the market is categorized into hospital pharmacies, online providers and drug stores and retail pharmacies. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

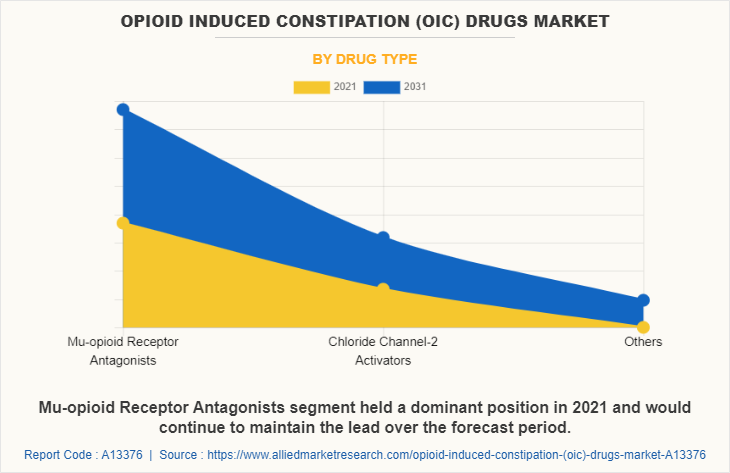

By Drug Type

The market is categorized into mu-opioid receptor antagonists, chloride channel-2 activators and others. The mu-opioid receptor antagonists segment accounted for the largest share in 2021, and is also expected to remain dominant during the opioid induced constipation drugs market forecast period, to the rise in number of product launches by the key players for treating opioid induced constipation (OIC) and the rise in research activities for evaluating safety and efficacy of these agents.

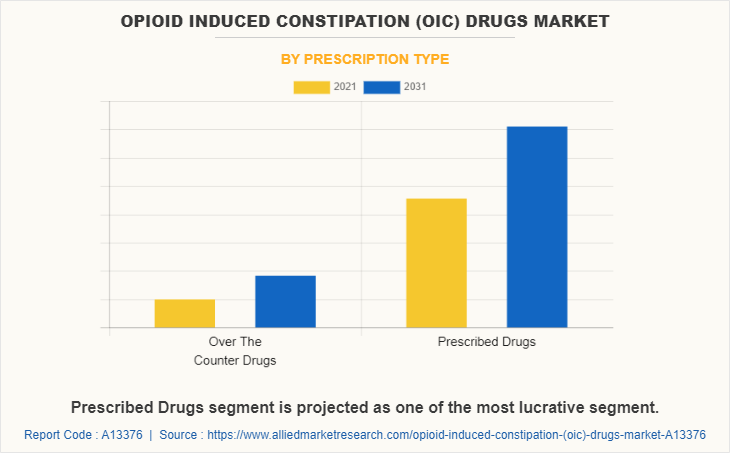

By Prescription Type

The market is categorized into over the counter drugs and prescribed drugs. The prescribed drugs segment occupied largest share in 2021 and is expected to remain dominant during forecast period owing to availability of major drugs and rise in number of key players manufacturing these formulations. The over the counter (OTC) drugs segment is projected to register highest CAGR during forecast period owing to rise in adoption of these drugs along with prescribed drugs for opioid induced constipation (OIC) management.

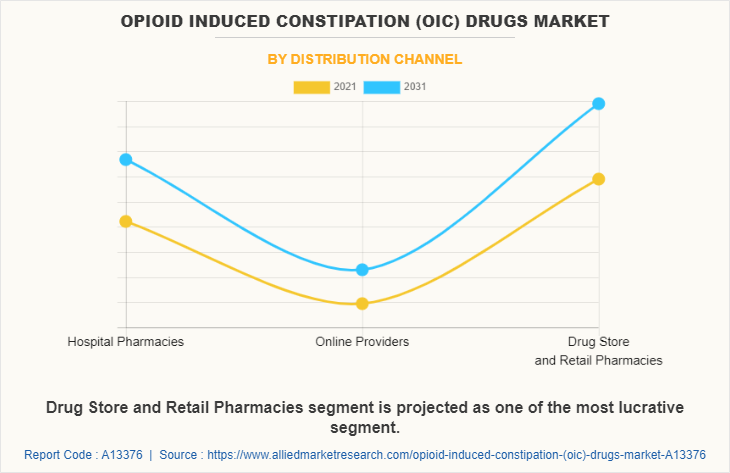

By Distribution Channel

The market is categorized into hospital pharmacies, drug stores and retail pharmacies and online providers. The drug stores and retail pharmacies segment occupied largest share in 2021 and is expected to remain dominant during forecast period owing to increase in preference of the people toward retail pharmacies, as retail pharmacies guide regarding medications and usage during treatment period. The online providers segment is projected to register highest CAGR during forecast period owing to rise in popularity of online pharmacies and number of users preferring online pharmacies.

By Region

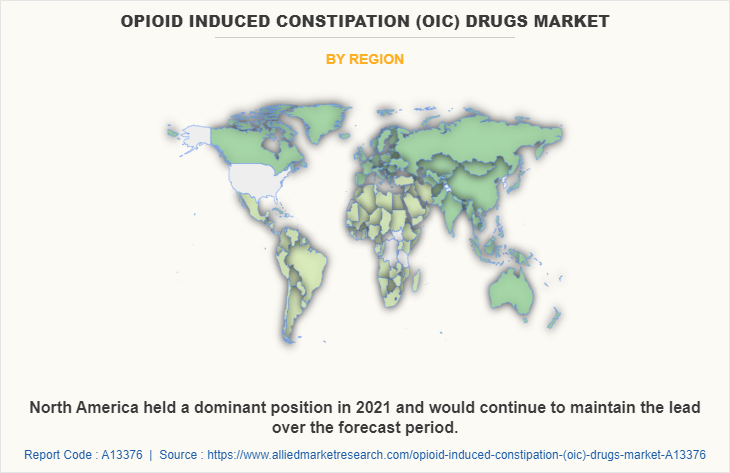

The opioid induced constipation industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America is expected to witness highest growth, in terms of revenue, owing rise in prevalence of opioid induced constipation (OIC) cases, prevalence of advanced healthcare infrastructure and increase in number of key players offering novel therapeutics, thereby driving the growth of the opioid induced constipation drugs market trends. Upsurge in healthcare expenditure in the emerging economies is anticipated to offer lucrative opportunities for the market expansion. However, Asia-Pacific is anticipated to witness notable growth, owing to increasing number of cancer cases resulting in rise in use of opioids, increase in awareness campaign and rise in investments for development of effective drugs for treating opioid induced constipation (OIC), thus, driving the growth of market during the forecast period.

Presence of several major players, such as AstraZeneca, Merck & Co., Shionogi & Co., Ltd., Mallinckrodt plc, Bausch Health Companies Inc., and advancement in manufacturing technology for development of effective medications for opioid induced constipation (OIC) treatment in the region drives the growth of the market. In addition, various private organizations organize educating camps across the globe marked the growth of this market. Furthermore, presence of well-established healthcare infrastructure, and rise in adoption rate of parenteral medication for opioid induced constipation (OIC) are expected to drive the market growth. Furthermore, various product approval and contract agreement as key strategy adopted by the key players in this region further boost the growth of the market. For instance, in April 2019, Sandoz (Novartis AG) signed an agreement with Shionogi & Co Ltd for commercialization of Rizmoic (naldemedine) in the key European markets of Germany, the UK and the Netherlands, plus right of first refusal for certain other European markets.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to presence of key players in the region. Moreover, factors such as growing use of opioids for pain management, increasing geriatric population and rise in prevalence of cancer cases is anticipated to drive the growth of opioid induced constipation (OIC) drugs market. In India, increase in use of opioids for treating pain disorder is observed which results in prevalence of constipation, thus driving the growth of market. For instance, according to article published in National Library of Medicine 2020, stated that, in India, 2.1% of total population consumed opioids for pain management which accounts for three times the global average use, thus rise in opioid use results in higher chances of opioid induced constipation prevalence, thereby driving the growth of market. Further, in Japan, rise in prevalence of cancer cases is expected to drive the market growth. In addition, doctors prescribe opioids for cancer pain management, thus rise in use of opioids is expected to drive the market growth. For instance, according to article published in Japanese Journal of Clinical Oncology 2020, stated that, patients who received opioids for lung cancer pain management, had 59% prevalence rate for opioid induced constipation, thus driving the growth of market. Asia-Pacific offers profitable opportunities for key players operating in the opioid induced constipation (OIC) drugs market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, rising in spending for chronic pain disorders, as well as well-established presence of domestic companies in the region. In addition, rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region.

Competition Analysis

Competitive analysis and profiles of the major players in the opioid induced constipation (OIC) drugs market, such as AstraZeneca, Bausch Health Companies Inc., Cosmo pharmaceuticals, Dr. Reddy’s Laboratories Ltd., Mallinckrodt plc, Merck & Co.,

Inc., Novartis AG, Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., Shionogi & Co., Ltd. are provided in this report. Major players have adopted partnership, product approval and contract agreement as key developmental strategies to improve the product portfolio of the opioid induced constipation (OIC) drugs market.

Some Examples Of Agreement In The Market

In February 2021, Cosmo Pharmaceuticals announced an agreement with RedHill Biopharma Ltd. for manufacturing of Movantik designed to treat opioid-induced constipation (OIC) in adult patients.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the opioid induced constipation drugs market analysis from 2021 to 2031 to identify the prevailing opioid induced constipation drugs market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the opioid induced constipation (OIC) drugs market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global opioid induced constipation (OIC) drugs market trends, key players, market segments, application areas, and market growth strategies.

Opioid Induced Constipation (OIC) Drugs Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.8 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 359 |

| By Drug Type |

|

| By Prescription Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Novartis AG, Takeda Pharmaceutical Company Limited, Shionogi & Co., Ltd., AstraZeneca plc, Mallinckrodt plc, cosmo pharmaceuticals, Merck & Co., Inc., Bausch Health Companies Inc., Dr. Reddy’s Laboratories Ltd., Teva Pharmaceutical Industries Ltd. |

Analyst Review

This section provides various opinions of top-level CXOs in the global opioid induced constipation (OIC) drugs market. According to the insights of CXOs, increase in demand for advanced therapeutics and rise in investments for R & D activities related to opioid induced constipation (OIC) globally, is expected to offer lucrative opportunities to key players of the market. In addition, favorable government initiatives and higher spending for opioid induced constipation (OIC), has piqued the interest of several companies to develop novel medications.

CXOs further added that rising expenditure on the development of healthcare infrastructure and surge in prevalence of opioid induced constipation (OIC) cases is expected to boost the growth of opioid induced constipation (OIC) drugs market. In addition, increasing chronic pain disorders such as cancer, back pain across the globe has resulted in rise in use of opioids leading to chances of occurrence of constipation, thus driving the growth of market. Further, geriatric people are prone to various chronic pain disorders, thus rise in geriatric populations is also fostering the growth of the opioid induced constipation drug market.

Furthermore, North America is expected to witness highest growth, in terms of revenue, owing rise in prevalence of opioid induced constipation cases and increase in number of key players offering novel therapeutics to treat opioid induced constipation (OIC), thus driving the growth of opioid induced constipation (OIC) market. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in pain disorders, increase in awareness campaign and rise in investments for development of effective drugs for treating opioid induced constipation (OIC), which is expected to drive the growth of market during the forecast period.

The major factor that fuels the growth of the opioid induced constipation (OIC) drugs market are rise in prevalence of opioid induced constipation (OIC) cases, prevalence of advanced healthcare infrastructure and increase in number of key players offering novel therapeutics.

Cancer is the leading application of Opioid Induced Constipation (OIC) Drugs Market.

North America is the largest regional market for Opioid Induced Constipation (OIC) Drugs.

The total market value of opioid induced constipation (OIC) drugs market is $1105.71 million in 2021.

Top companies such as, AstraZeneca plc, Shionogi & Co., Ltd., Teva Pharmaceutical Industries Ltd., Merck & Co., Inc. and Novartis AG held a high market position in 2021. These key players held a high market position owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The forecast period for opioid induced constipation (OIC) drugs market is 2022 to 2031.

The base year is 2021 in opioid induced constipation (OIC) drugs market.

Loading Table Of Content...