Opioids Market Statistics, 2030

The global Opioids Market size was valued at $4.4 billion in 2020 and is projected to reach $6.1 billion by 2030, growing at a CAGR of 3.2% from 2021 to 2030. Opioids are medications used for the treatment of severe or persistent pain such as chronic headaches and backaches, by patients recovering from surgery or experiencing severe pain associated with cancer, and by adults and children who got injured playing sports or who have been severely injured in falls, auto accidents, or other incidents. Opioids are also known as narcotics. Doctors prescribe different types of opioids of different strengths which can be administered in various forms, depending on the patient, the situation, and the type and level of pain. Although some opioids can be used to treat cough and diarrhea, prescription opioids are majorly used to treat moderate to severe pain. Prescription opioid drugs include hydrocodone, oxycodone, codeine, fentanyl, methadone, morphine, and others. Opioids are the most widely prescribed medications to treat moderate to severe chronic pain. These analgesics are used to manage pain in cancer patients and to treat severe constant pain in patients who suffer from terminal illnesses.

Opioids market is expected to exhibit significant growth during the forecast period, owing to a surge in demand for ideal products for the treatment of pain, cough, and diarrhea. The key factors that drive the growth of the market include an increase in consumption of these drugs to combat pain and rise in the geriatric population that is majorly prone to orthopedic pain. In addition, the rise in the number of people suffering from chronic pains globally is significantly high. This is anticipated to drive the growth of the global opioid market. For instance, according to the National Health Interview Survey (NHIS), by the Centers for Disease Control and Prevention (CDC), the prevalence of high-impact chronic pain was 7.4% in the U.S. in 2019. Furthermore, an upsurge in disposable income in developing economies such as India, China, and others contributes to the growth of the market.

However, the surge in opioid addiction (opioid crisis) across the globe and the implementation of stringent government regulations for opioid prescription are the factors anticipated to hamper the market growth. In addition, the increase in death rates owing to the overdose of these drugs is a major factor restraining the market growth. Moreover, the addictive nature of opioids has led to their drug misuse while also posing various side effects including drowsiness, nausea, constipation, euphoria, confusion, and more.

According to WHO estimates, about 0.5 million deaths worldwide are a result of drug use. More than 70% of these fatalities are associated with opioids are the key factors expected to hamper the opioids market growth. Furthermore, the rise in cases of orthopedic diseases, cancer, HIV, and other diseases are the key factors that provide Opioids Market opportunity. As per reliable estimates, chronic pain affects nearly 10% of the global population, with estimates of the same closer to 20-25% in some regions and countries. An additional 1 in 10 people suffer from chronic pain every year globally.

Global Opioids Market Segments

The Opioids market is segmented on the basis of type of product, application, and region. According to the type of product, the market is classified into codeine, fentanyl, oxycodone, methadone, morphine, hydrocodone, and others. On the basis of application, the market is divided into pain management, cough treatment, and diarrhea treatment. The pain management segment is further divided into neuropathic pain, migraine, back pain, osteoarthritis pain, and cancer pain. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

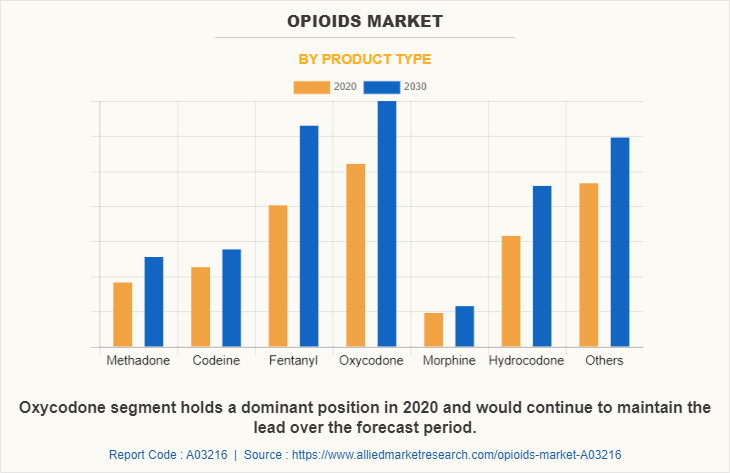

By Product Type

By type, the Opioids Industry is divided into codeine, fentanyl, oxycodone, methadone, morphine, hydrocodone, and others. The oxycodone segment was the major revenue contributor in 2020 and is anticipated to continue this trend during the forecast period, owing to the increase in the adoption of oxycodone globally. On the other side, the demand for fentanyl is projected to exhibit the fastest market growth during the forecast period, owing to a rise in the use of fentanyl.

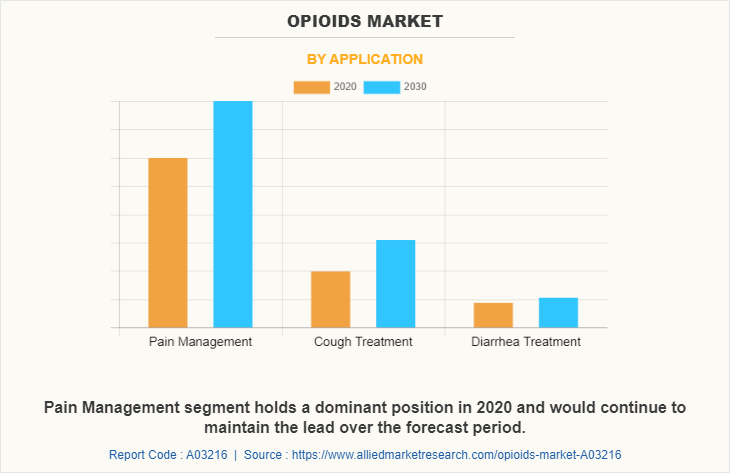

By Application

By application, the Opioids Industry is classified as pain management, cough treatment, and diarrhea treatment. The pain management segment has the largest Opioids Market share and is expected to remain dominant during the forecast period. This segment is expected to exhibit a prominent growth rate, owing to the rapid increase in the number of patients suffering from chronic headaches, migraine, and backaches; patients recuperating from surgery or undergoing severe pain associated with cancer; and individuals who are injured during sports activities, traffic collisions, or other incidents.

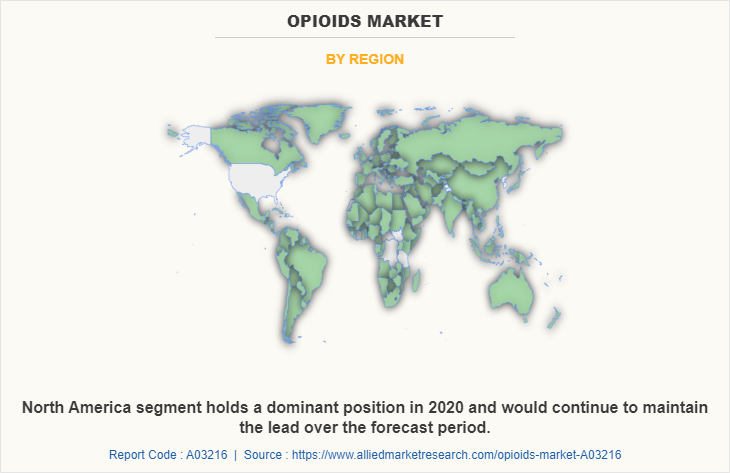

By Region

By region, the Opioids Market analysis is done across North America, Asia-Pacific, Europe, and LAMEA. North America has the Opioids Market size in 2020, accounting for the highest share, and is anticipated to maintain this trend throughout the forecast period. Owing to increasing number of product approvals by the regulatory authorities such as the U.S. Food and Drug Administration in the U.S. For instance, in August 2020, Trevena Inc., a biopharmaceutical company, received approval from the U.S. Food and Drug Administration (FDA) for Olinvyk (oliceridine), an opioid medication indicated for short-term intravenous use in hospitals or other controlled clinical settings, such as during inpatient and outpatient procedures.The Asia Pacific is expected to witness the fastest growth in the coming years as companies such as Purdue Pharma are shifting their focus towards this region with an aim to strengthen their position in the market.

Competition Analysis

This report provides a comprehensive competitive analysis and profiles of prominent market players such as key players operating in the Purdue Pharma LP, AstraZeneca Plc., C.H. Boehringer Sohn Ag, and Ko. Kg, Johnson & Johnson, Inc., Sanofi S.A.., Mallinckrodt Pharmaceuticals, Endo Pharmaceuticals Inc., Pfizer, Inc., Sun Pharmaceuticals, and Teva Pharmaceuticals.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the opioids market analysis from 2020 to 2030 to identify the prevailing opioids market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the opioids market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global opioids market trends, key players, market segments, application areas, and market growth strategies.

Opioids Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | Teva Pharmaceutical Industries Limited, C.H. Boehringer Sohn Ag and Ko. Kg, AstraZeneca Plc, Endo Pharmaceuticals Inc, Johnson & Johnson, Inc.., Sun Pharmaceuticals, Sanofi S.A., Mallinckrodt Pharmaceuticals, Pfizer, Inc., Purdue Pharma LP |

Analyst Review

Opioids are often referred to as narcotics and help in combating pain; however, they do not fall into the over-the-counter category of painkillers, such as aspirin and Tylenol. The most commonly prescribed opioids include OxyContin, Vicodin, and fentanyl.

According to the CXOs, the opioid market is anticipated to witness steady growth in future, owing to rise in prevalence of orthopedic diseases due to sedentary lifestyle, upsurge in geriatric population, and increase in consumption of opioids for pain management ranging from moderate to severe pain across the globe. However, consistent use of these prescribed drugs can increase person’s tolerance and addiction, requiring higher and more frequent doses, leading to opioid addiction. Thus, increase in opioid addition cases across the globe has limited their use, thereby restraining the growth of the market. The misuse and addiction to opioids, including prescription pain relievers, heroin, and synthetic opioids such as fentanyl and hydrocodone is a serious global crisis that has affected public health as well as social and economic welfare, which has further hampered the market growth.

$4,412.48 million is the industry size of Opioids in 2020

$6,060.17 million is the estimated industry size of Opioids in 2030

The Upcoming Trends of the Opioids Market are an increase in consumption of these drugs to combat pain and a rise in the geriatric population that is majorly prone to orthopedic pain. In addition, an upsurge in disposable income in developing economies such as India, China, and others contribute to the growth of the market

North America is the largest regional market for Opioids

Purdue Pharma LP, AstraZeneca Plc., C.H. Boehringer Sohn Ag and Ko. Kg, Johnson & Johnson, Inc are the top companies to hold the market share in Opioids

Loading Table Of Content...