Optic Nerve Disorders Treatment Market Research, 2031

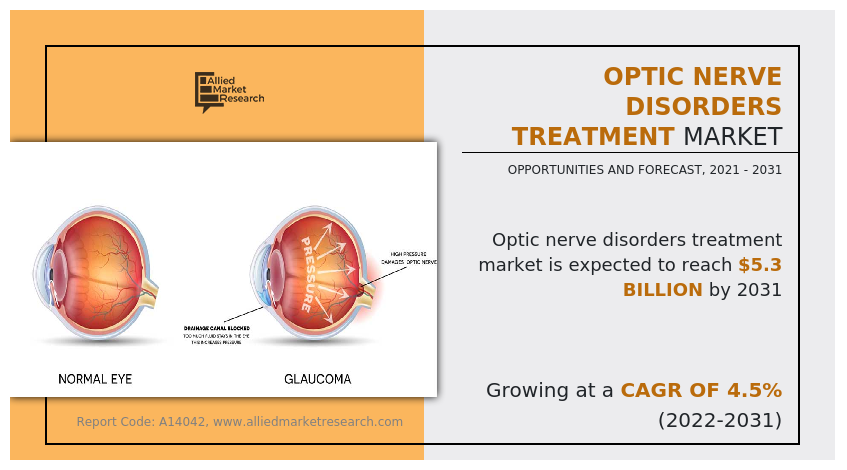

The global optic nerve disorders treatment market size was valued at $3.4 billion in 2021, and is projected to reach $5.3 billion by 2031, growing at a CAGR of 4.5% from 2022 to 2031. Optic nerve is the most crucial element of eye which transforms the images that are acquired to the brain for interpretation. Optic nerve damage is commonly caused by Multiple sclerosis, glaucoma, and trauma. Reduced vision or visual loss could happen 3-6 weeks after the trauma if the optic nerve has been damaged.

MS is an autoimmune disease, in which the immune system attacks the healthy body tissues and is characterized by vision loss or reduction in over 50% of cases. Glaucoma, optic neuritis, optic nerve atrophy, and optic nerve head drusen are some of the example of optic nerve disorders. Symptomatic optic nerve disorders treatment including, steroidal therapy which includes various corticosteroids such as methylprednisolone and immunomodulators therapy which include prostaglandins, beta blockers, beta interferon and alpha-adrenergic agonists are used for optic nerve never disorder treatment which may not have an improvement in vision but can prevent further vision loss.

Market Dynamics

Growth & innovations in the pharmaceutical industry for the manufacturing of optic nerve disorder treatment products owing to the increase in the prevalence of optic nerve disorders creates an opportunity for the optic nerve disorders treatment market growth. The growth of the optic nerve disorder treatment market is expected to be driven by the high potential in untapped, emerging markets, due to the availability of improved healthcare infrastructure, increase in unmet healthcare needs, rise in prevalence of eye disease, and surge in demand for optic nerve disorder treatment drugs. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure, and development of the medical tourism industry in emerging countries.

E-commerce (electronic commerce) has become a vital tool for small and large businesses globally, due to rise in preference of consumers for online shopping over traditional purchasing methods. This is attributed to further supports for market growth. The demand for optic nerve disorder treatment products is not only limited to developed countries but is also being witnessed in developing countries, such as China, Brazil, and India, which fuel the growth of the market. Moreover, the increase in the number of product launches by different key players further propels market growth. For instance, in February 2021, Santen Pharmaceutical Co., Ltd. and Ube Industries, Ltd. announced the launch of EYBELIS Ophthalmic Solution 0.002% for glaucoma and ocular hypertension treatment in Korea.

In addition, the geriatric population is more susceptible to eye diseases. Thus, the increase in geriatric population boosts the growth of the market. For instance, according to Population Reference Bureau, in 2019, regions such as Asia and Europe were home to some of the world's oldest populations reporting to 28 % (Japan) and (Italy) 23% of the total population. Moreover, according to the article published in Geriatric Ophthalmology, in January 2021, 3.6 million individuals, or 18% of people over the age of 70 were visually impaired.

The COVID-19 outbreak is anticipated to have a negative impact on the optic nerve disorders industry. This is attributed to lack of workforce and high risk considering the proximity to patients while monitoring or treating the patients. Ophthalmology practice requires the routine use of reusable equipment with close contact with patients. This increases the risk of disease transmission among ophthalmology patients and healthcare professionals.

The Centers for Medicare & Medicaid Services (CMS) issued guidelines regarding the nonessential planned surgeries and procedures based on the need of critical situations. The guidelines suggest providing surgical services to patients who require urgent attention and postponing the surgeries if they are not urgent.

Thus, the demand for optic nerve disorder treatment has declined. Moreover, increase in recovery in coronavirus patients has resulted in relaxation toward the companies reopening to some extent at the end of July 2020. For instance, Pfizer, Inc. has reopened all its factories and laboratories and about 90% of its retail stores. Furthermore, eye care professionals (ECPs) have completely reopened in most countries, except parts of Latin America. Moreover, the UK charitable organization, Fight for Sight has extended efforts to gather broader insights on the personal impact of COVID-19 on people with loss of sight and other eye conditions. Hence, ophthalmologists are focusing on teletherapy for treating patients during the lockdown, till the market opens completely.

Segmental Overview

The optic nerve disorders treatment market size is segmented into treatment type, indication, distribution channel and region. By treatment type, the market is categorized into steroidal therapy, immunomodulators therapy and others. On the basis of indications, the market is segregated into optic neuritis, glaucoma and others. By distribution channel, the market is classified into hospital pharmacies, drug stores, retail pharmacies and online providers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

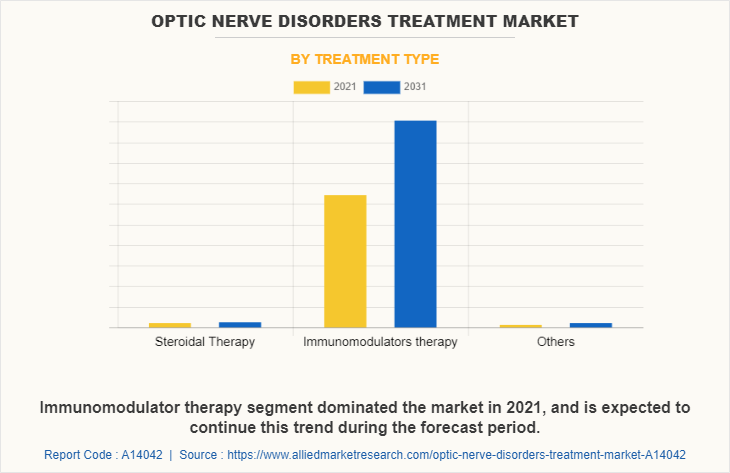

By treatment type, the market is segmented into steroidal therapy, immunomodulators therapy and others. The immunomodulators therapy segment dominated the global market in 2021 and is expected to remain dominant throughout the optic nerve disorders treatment market forecast period, owing to increase in research and development activities for the manufacturing of immunomodulators for optic nerve disorder treatments along with increase in number of key players has resulted surge in the launch of novel drugs which further boost the market growth. For instance, in February 2021, Santen Pharmaceutical Co., Ltd. and Ube Industries, Ltd. announced the launch of EYBELIS Ophthalmic Solution 0.002% for glaucoma and ocular hypertension treatment in Korea.

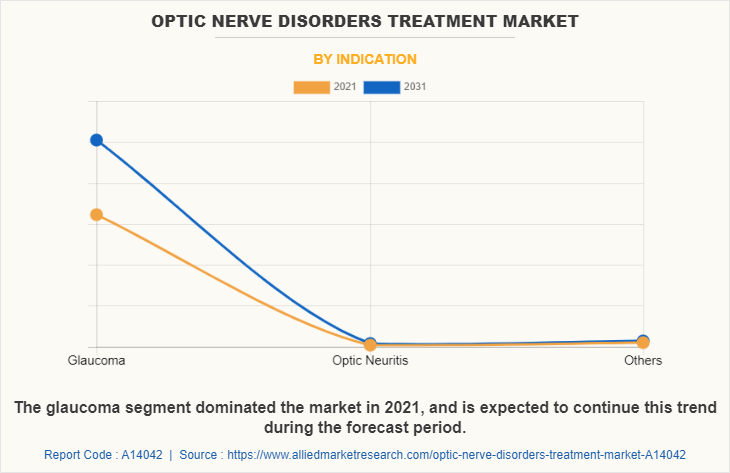

By indication, the optic nerve disorder treatment market is segregated into optic neuritis, glaucoma and others. The glaucoma segment dominated the global market in 2021 and is expected to remain dominant throughout the forecast period, owing to a rise in prevalence of open angle glaucoma. In addition, increase in number of approvals for drugs for the treatment of open angle glaucoma is anticipated to boost the market growth. Furthermore, the optic neuritis treatment market is expected to exhibit the fastest growth during the forecast period. This is attributed to the increase in prevalence of optic neuritis, availability of reimbursement policies, and growing awareness among the population regarding multiple sclerosis drives the growth of the market.

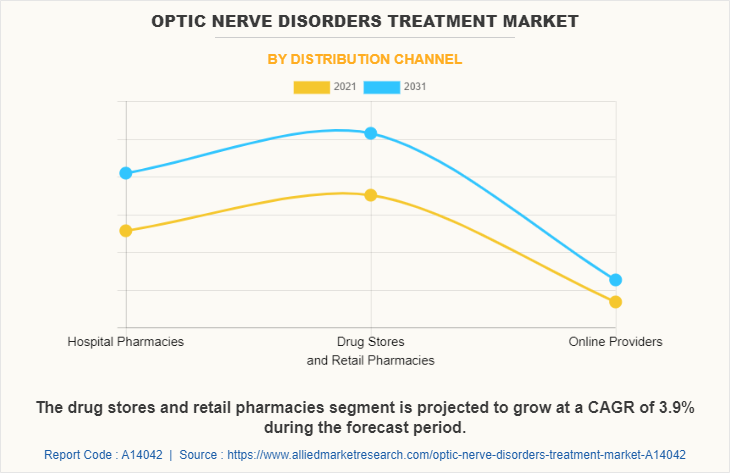

By distribution channel, the market is classified into hospital pharmacies, drug stores and retail pharmacies and online providers. The drug stores and retail pharmacies segment held the largest market share in 2021 and is expected to remain dominant throughout the forecast period. growing number of independent pharmacies and chains along with the availability of various rare disease medications in supermarkets and mass retailers. Furthermore, the online providers segment is expected to exhibit the fastest growth during the forecast period. This is attributed to online provider often offer the drugs at low cost. In addition, online providers also interact with the patient regarding the disease and advise to take drugs suitable for their specific eye treatment which further boost the market growth.

By region, the optic nerve disorder treatment market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major optic nerve disorders treatment market share in 2021 and is expected to maintain its dominance during the forecast period. Key factors drive the growth of the market are the substantial presence of major pharmaceutical and biopharmaceutical companies in the North American region. Additionally, it is anticipated that rising demand for preventative healthcare further boost the market growth. Moreover, increasing government and private sector efforts to promote healthy lifestyles are anticipated to fuel market expansion in the region during the forecast period.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to the presence of pharmaceutical companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, rise in geriatric population and increase in prevalence of optic nerve disorders such as glaucoma and optic neuritis drive the growth of the market.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the optic nerve disorder treatment, such as AbbVie Inc., Alcon Inc, Bausch Health Companies, Inc., Cipla Ltd., Mallinckrodt pharmaceuticals, Merck & Co., Inc., Novartis AG, Pfizer, Inc., Santen Pharmaceutical Co., Ltd., Teva pharmaceutical industries ltd. are provided in this report. There are some important players in the market such as AbbVie Inc., Novartis AG, Santen Pharmaceutical Co., Ltd., Teva pharmaceutical industries ltd. and other Major players have adopted product launch and product approval as key developmental strategies to improve the product portfolio of the optic nerve disorder treatment market.

Some examples of product launches in the market

In February 2021, Santen Pharmaceutical Co., Ltd. and Ube Industries, Ltd. announced the launch of EYBELIS Ophthalmic Solution 0.002% for glaucoma and ocular hypertension treatment in Korea.

Product Approval in the market

In September 2022, Santen Pharmaceutical Co., Ltd. and UBE Corporation announced that the U.S. Food and Drug Administration (FDA) has approved OMLONTI (omidenepag isopropyl ophthalmic solution) 0.002% eye drops for the reduction of elevated intraocular pressure (IOP) in patients with primary open-angle glaucoma or ocular hypertension.

In August 2020, FDA approved Novartis Kesimpta (ofatumumab), the first and only self-administered, targeted B-cell therapy for patients with relapsing multiple sclerosis.

In March 2021, Teva Pharmaceutical Industries Ltd. announced the launch of the first available generic version of AZOPT (brinzolamide ophthalmic suspension) 1%, approved by the U.S. Food and Drug Administration to treat high pressure inside the eye due to ocular hypertension and open-angle glaucoma.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the optic nerve disorders treatment market analysis from 2021 to 2031 to identify the prevailing optic nerve disorders treatment market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the optic nerve disorders treatment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global optic nerve disorders treatment market trends, key players, market segments, application areas, and market growth strategies.

Optic Nerve Disorders Treatment Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 5.3 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 257 |

| By Treatment Type |

|

| By Indication |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Cipla Ltd, Santen Pharmaceutical Co., Ltd., .Aerie Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd., Merck & Co., Inc., AbbVie Inc., Bausch Health Companies, Inc., Pfizer, Inc., Novartis AG, mallinckrodt pharmaceuticals |

Analyst Review

Optic nerve disorder treatment is gaining high traction in the market, owing to increase in prevalence of glaucoma and other eye disorders, rise in R&D investments in drug discovery & development, and increase in awareness optic nerve disorder treatments.

Furthermore, key players in the market are focusing on adopting strategies to increase accessibility and utilization of optic nerve disorder treatment products in developing economies. Moreover, the market gains interest of healthcare companies, owing to its unmet demands in developing economies such as India and China where the population is growing rapidly, which further propel the market growth.

North America is expected to witness the highest growth, in terms of revenue, owing to robust healthcare infrastructure, presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in geriatric population, unmet medical demands and increase in public–private investments in the healthcare sector.

The optic nerve of the eye is a second cranial nerve which transports electrical impulses from photoreceptor cells in the retina of the eye to the visual cortex in the brain. The steroid-based medications such as methylprednisolone, a synthetic corticosteroid administered intravenously as an anti-inflammatory and immunosuppressive treatment.

Increasing geriatric population suffering from eye diseases, the launch of innovative technologies, a boost in healthcare expenditure, and higher government support

Asia-Pacific is expected to experience the highest growth rate during the forecast period, owing to The evolving healthcare regulatory landscape and the government's emphasis on enhancing R&D capabilities for innovative product development.

Top companies such as AbbVie Inc., Cipla Ltd., Mallinckrodt pharmaceuticals, Merck & Co., Inc., Novartis AG and Pfizer, Inc. held a high market position in 2021.

Immunomodulators segment is the most influencing segment owing to increase in research and development activities for the manufacturing of immunomodulators for optic nerve disorder treatments along with increase in number of key players has resulted surge in the launch of novel drugs which further boost the market growth.

The forcast period for healthcare assistive robot is 2022 to 2031

The base year is 2021 in optic nerve disorder treatment market

The market value of optic nerve disorder treatment market in 2031 is $5,247.82 million.

The total market value of optic nerve disorder treatment marketis $3,372.46 million in 2021.

Loading Table Of Content...