Optical Coating Equipment Market Overview:

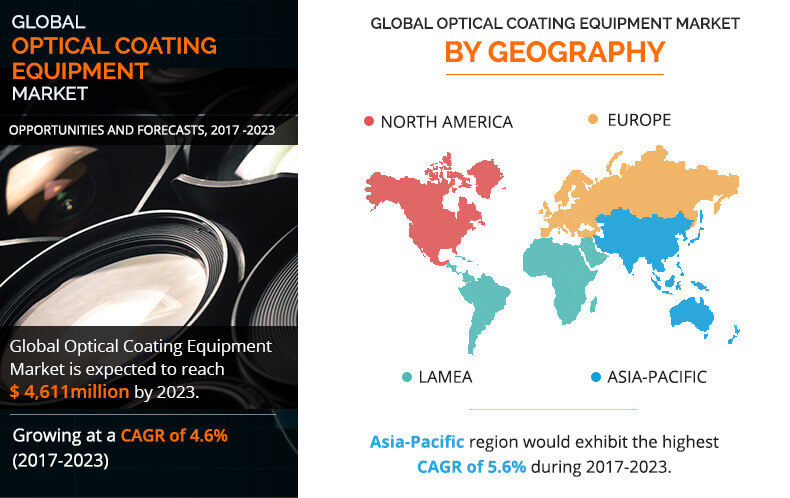

Global Optical Coating Equipment Market is expected to reach $3,402 million in 2023, from $4,611 million in 2016, growing at a CAGR of 4.6% from 2017 to 2023. The optical coating equipment provide assistance in application of optical coatings over the target materials. The optical coatings owing to their ability to reflect, filter or absorb light waves from varying frequencies and wavelength has numerous applications across different industry verticals.

The optical coating equipment utilizes the application of state-of-the art technology for applying thin-films of optical coatings on various devices, components, and target materials. Further, the advancement of fabrication technology has enhanced the optical coating capabilities to deliver sophisticated, high quality, and multilayer coatings. Based on the type of materials used for optical coatings it can enhance the reflective, antireflective, filter, and dichroic capabilities of the materials. Subsequently, it can be used for improving the visual appeal of the buildings, protect the infrastructure from harmful radiations, medical imaging, and reduce the optical glare for lenses.

Technological advancement in fabrication techniques has profound influence over the market growth of optical coating equipment and continues to be one of the major driving factor for the optical coating equipment market. Moreover, the rise in adoption of optically coated materials across different industry verticals is also expected to fuel the demand for the optical coating equipment in the forecast period. As the equipment utilize the application of sophisticated technology such as such as advanced sputtering, magnetron sputtering and ion led deposition to name a few results in high cost of installation as well maintenance of the equipment. Consequently, the high cost of installation for the equipment is expected to hinder the market growth in the coming years. However, development of equipment with lower operations costs and large production of optical coatings is expected to provide profitable opportunities to the manufacturers during the forecast period.

The key players operating in the global market are Alluxa Inc., Bühler Holding AG, Coburn Technologies Inc., DuPont, Mastang Vacuum Systems LLC, Optimax Systems Inc., Optorun Co. Ltd., Optotech GmbH, Satisloh AG, and Ultra Optics.

Segment Overview

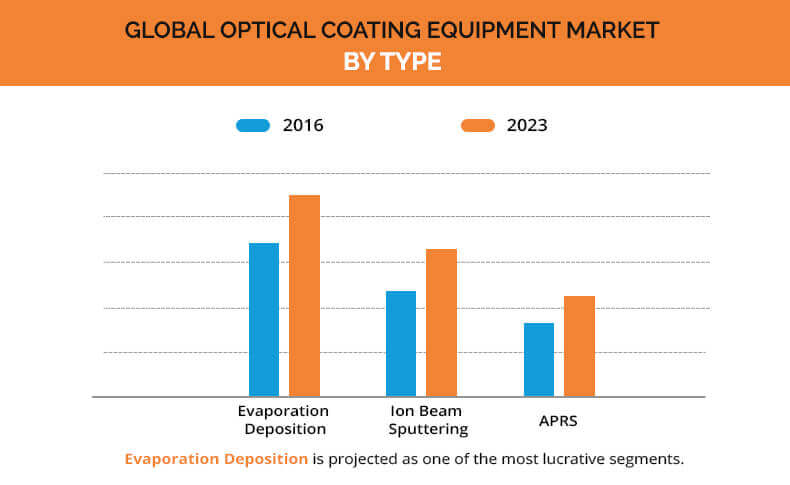

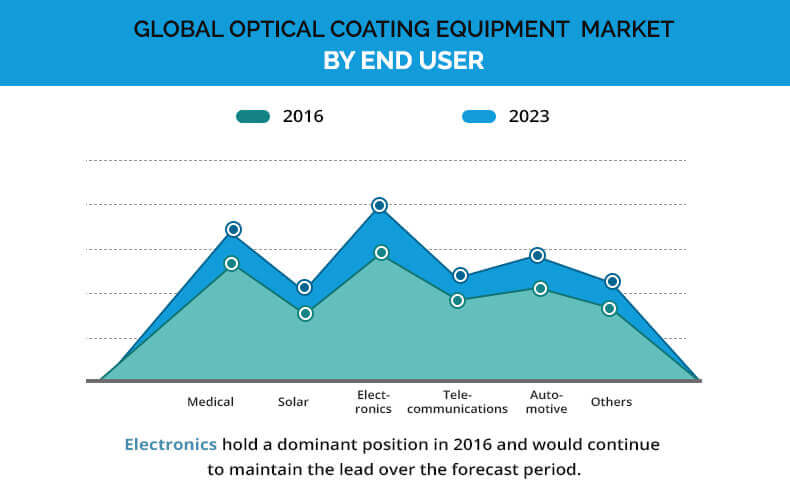

The optical coating equipment market is segmented based on materials, technology, end-user industry, and region. By materials, the global optical coating equipment market is classified into reflective coatings, antireflective coatings, filter coatings, transparent conductive coatings, and others. Furthermore, based on technology the market is divided into evaporation deposition, ion beam sputtering, and advanced plasma reactive sputtering (APRS). Based on the end-user industry, the market is divided into medical, solar, electronics, telecommunications, automotive, and others. Based on region, the optical coating equipment market is analyzed across four regions including North America, Asia-Pacific, Europe, and LAMEA.

The increase in scope of application for optical coatings in aerospace, consumer electronics, semiconductors, and fiber optics boost the demand for equipment in the recent years. Based on region, Asia-Pacific is expected to witness surge in demand for optical coating equipment owing to the rise in electronics and automotive industry. Moreover, the emerging economies in Africa along with Asia is expected provide attractive business opportunities for the market players in medical, telecommunications, and electronics industries.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global optical coating equipment market and current & future trends to elucidate the imminent investment pockets.

- Information about key drivers, restrains, and opportunities and their impact analysis on the market is provided.

- Porter’s Five Forces analysis illustrates the potency of buyers & suppliers operating in the industry.

- The quantitative analysis of the market from 2017 to 2023 is provided to determine the market potential.

Optical Coating Equipment Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By TECHNOLOGY |

|

| By END-USER INDUSTRY |

|

| By Region |

|

| Key Market Players | OPTORUN CO., LTD., COBURN TECHNOLOGIES, INC., OPTIMAX SYSTEMS, INC., MUSTANG VACUUM SYSTEMS, LLC, ESSILOR INTERNATIONAL SA (SATISLOH AG), BUHLER HOLDING AG, ULTRA OPTICS COMPANY, E I DUPONT DE NEMOURS AND COMPANY, OPTOTECH OPTIKMASCHINEN GMBH, ALLUXA, INC. |

Analyst Review

The optical coating equipment provide assistance in the application of thin-film optical coatings over the target materials. The optical coatings enhance the reflective, antireflective, dichroic, and optical glare capabilities of the target materials on which the coating is applied. Currently, out of the available coating equipment type by technology the evaporation deposition holds the largest share of the global market. However, the ion beam sputtering is expected to provide profitable lucrative CAGR growth during the forecast period owing to their lower coat of operations and ability to furnish sophisticated optical coating across different curvatures. In addition, the increase in scope of application for optical coatings across various end users is also anticipated to drive the growth of this market during the forecast period.

Based on region, the North America accounts for a major market share in the global optical coating equipment market in 2016, owing to high demand from aerospace, military, medical, and other end users. However, Asia-Pacific is expected to exhibit the highest growth rate of 5.65% during the forecast period owing to rise in demand form consumer electronics and automotive industries.

The advancement in fabrication technology drives the demand for optical coating equipment across different end-user industries. As a result, the solar, aerospace, consumer electronics and military industries are expected to provide profitable business opportunities for equipment manufacturers.

Loading Table Of Content...