Optical Fiber Market Overview, 2032

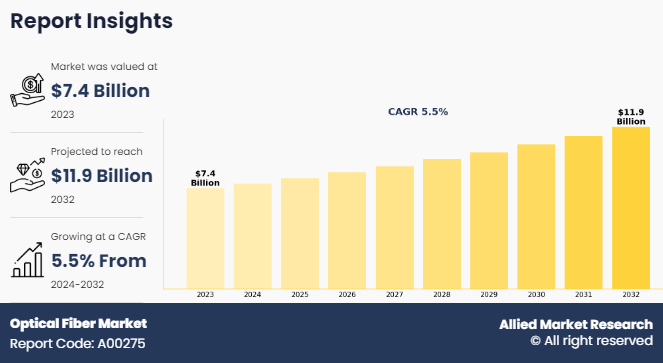

The global Optical Fiber Market was valued at $7.4 billion in 2023, and is projected to reach $11.9 billion by 2032, growing at a CAGR of 5.5% from 2024 to 2032. This is fueled by its superior data transmission capabilities in telecommunications compared to traditional metal wires. Its use spans medical, automotive, aerospace, and networking sectors. The global rollout of 5G networks further boosts demand for high-speed, low-latency connections. While high deployment costs and competition from wireless technologies pose challenges, significant opportunities exist in expanding broadband access to rural and underserved regions, where optical fiber can deliver fast, reliable internet and support next-generation digital services.

Market Dynamics & Insights

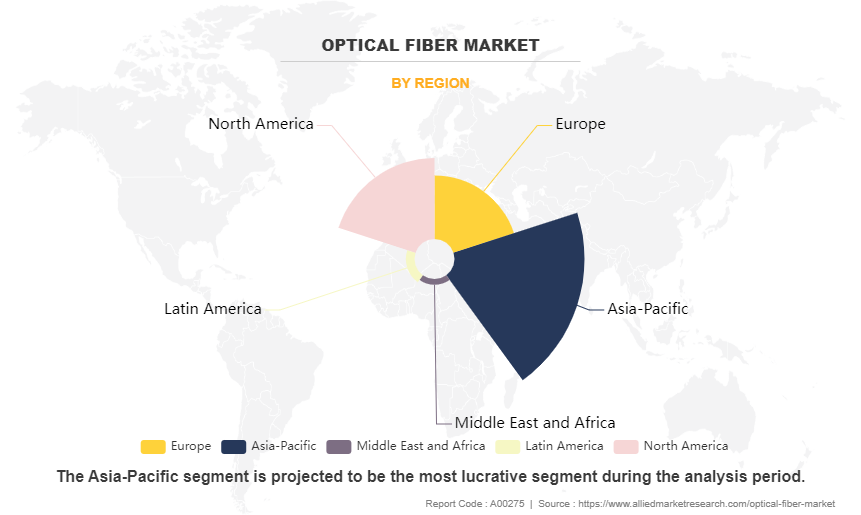

- The optical fiber industry in Asia-Pacific held a significant share of over 45% in 2023.

- The optical fiber industry in U.S. is expected to grow significantly at a CAGR of 5.7% from 2024 to 2032.

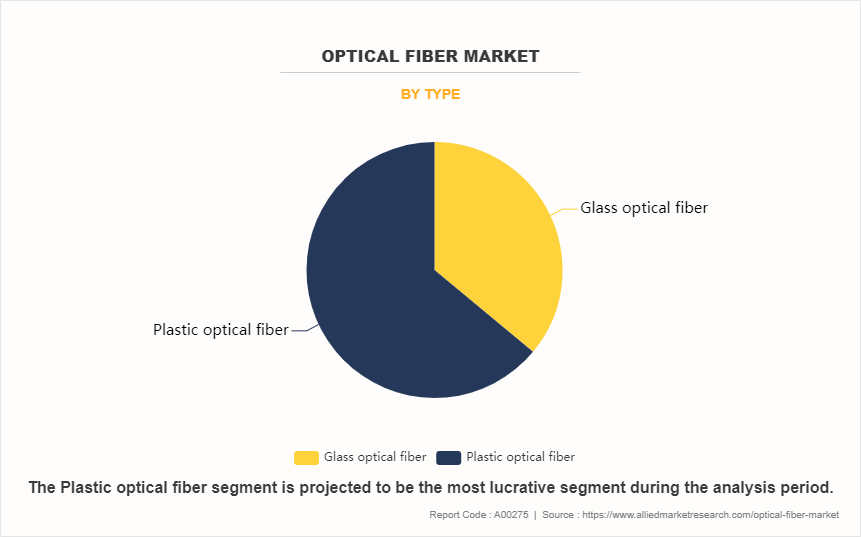

- By type, plastic optical fiber segment is one of the dominating segments in the market and accounted for the revenue share of over 64% in 2023.

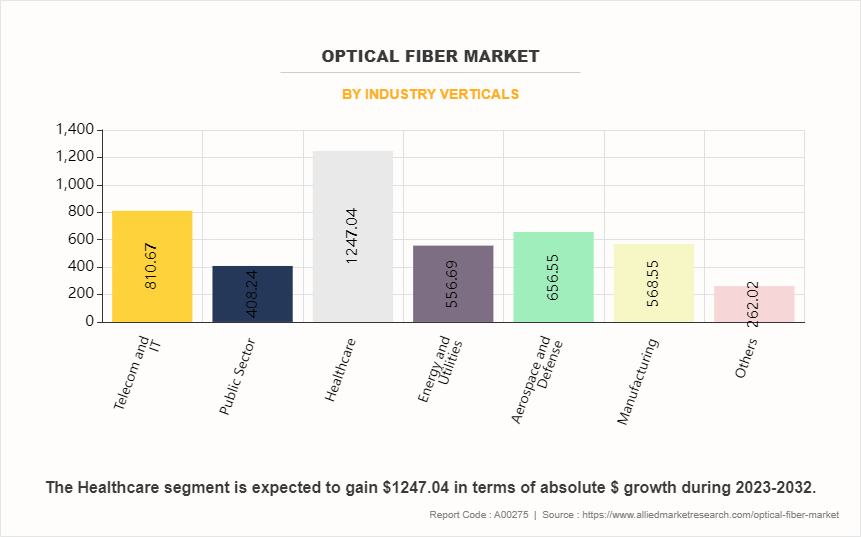

- By industry vertical, the healthcare segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2023 Market Size: $7.4 Billion

- 2032 Projected Market Size: $11.9 Billion

- CAGR (2024-2032): 5.5%

- Asia-Pacific: Largest market in 2023

- Latin America: Fastest growing market

The global optical fiber market is projected to see significant growth over the forecast period. This growth is primarily driven by several key factors, including an increase in demand for high-speed internet and advancements in telecommunications infrastructure. This growth is further fueled by the broad adoption of technologies requiring substantial data transmission capacities, such as 5G networks and cloud computing. Additionally, the development of smart cities and the increase in application of optical fibers in medical, automotive, and industrial sectors due to their reliability and efficiency in data handling are expected to further propel the market. Technological advancements in fiber technology and growing environmental sustainability concerns are also key factors contributing to the expansion of the optical fiber market.

An optical fiber, also known as an optic fiber, is a highly flexible glass or plastic fiber that enables the transmission of light signals from one end to another. These fibers play a crucial role in fiber-optic communications, offering the advantage of longer transmission distances and higher bandwidths compared to traditional electrical cables. The utilization of optical fibers is preferred over metal wires due to their lower signal loss and resistance to electromagnetic interference, which is a common issue faced by metal wires. In addition to telecommunications, optical fibers are extensively used for applications such as illumination, imaging, and carrying light or images into confined spaces.

Key Takeaways

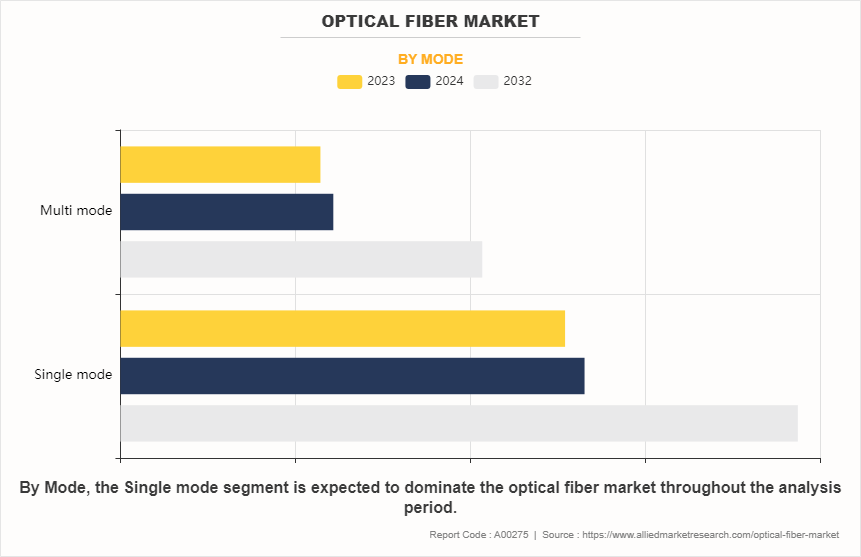

By mode, the single-mode segment held the largest share of the optical fiber market in 2023, while the multi-mode segment is anticipated to grow at the fastest CAGR during the forecast period.

By type, the plastic optical fiber segment held the largest share in the optical fiber industry in 2023, however, the glass optical fiber segment is anticipated to grow at the fastest CAGR during the forecast period.

By industry vertical, the telecom & IT segment held the largest share in the optical fiber industry in 2023, however, the healthcare segment is anticipated to grow at the fastest CAGR during the forecast period.

Region-wise, Asia-Pacific held the largest market share in 2023. China dominates the optical fiber market size by Country in the Asia-Pacific region. However, Latin America is expected to witness the highest CAGR during the forecast period.

Market Dynamics:

Rise in demand for high-speed internet is driving growth in the optical fiber market

The exponential growth of data-intensive technologies such as streaming services, cloud computing, and the Internet of Things (IoT) has led to a surge in the demand for high-speed internet connectivity. Optical fiber, known for its high bandwidth capabilities, has become a crucial infrastructure component in meeting these needs. Unlike traditional copper wires, optical fibers transmit data at the speed of light, offering significantly faster internet speeds and higher data capacity. This makes them ideal for supporting the large volumes of data generated by modern digital activities and the real-time, seamless connectivity expected by users today.

For instance, in February 2022, Google announced a major investment in fiber optic technology. The company committed to spending billions of dollars to expand its Google Fiber service across several U.S. cities. This expansion aimed to provide gigabit internet speeds to more households, highlighting the important role of high-capacity optical fibers in supporting the bandwidth requirements of advanced technologies and enhancing consumer internet access.

High initial Investment restraining market growth

The high initial investment required for deploying optical fiber infrastructure presents a significant hurdle, especially in economically challenged or less developed regions. The costs of laying cables and installing associated equipment, such as optical nodes and amplifiers, are very high. Moreover, the process often involves complex civil engineering tasks, including road digging and the installation of underground passages, which further raise the costs. These initial financial barriers can hinder extensive fiber optic deployment, limiting technological advancements and broadband accessibility in areas that cannot afford such large-scale investment projects.

For example, Nigeria started a plan in 2020 to greatly improve internet access by 2025. But, the high costs of building fiber optic networks across the country's big and different landscapes have slowed things down. In February 2021, the Nigerian government looked for help and money from international organizations to reduce the costs of this important project. The need for money from outside shows how hard it is to deal with the initial costs of setting up large fiber optic networks, especially in developing countries that want to improve their internet connections.

Emerging 5G infrastructure creates significant opportunities in the optical fiber market

The implementation of 5G networks represents a substantial opportunity for optical fiber manufacturers and service providers. 5G technology demands dense fiber networks to facilitate both backhaul and fronthaul connectivity, crucial for supporting ultra-fast speeds and low-latency communication. Fiber-optic infrastructure enables the high-capacity data transmission required by 5G networks, ensuring efficient and reliable delivery of services to end-users. As a result, companies that produce optical fibers are likely to benefit greatly from the growing demand for their products and services as the deployment of 5G technology continues to grow globally.

For instance, in March 2022, Verizon announced a major expansion of its 5G network infrastructure across the U.S. This project included significant investments in new fiber optic lines to enhance both backhaul and fronthaul capacities essential for supporting the high data rates and low latency required by 5G technology. Verizon's effort to enhance its fiber network shows how important optical fiber is for making 5G networks successful. This example demonstrates how telecom companies are actively working to improve their networks to support the advanced features of 5G technology.

Segment Overview

The global optical fiber market is analyzed by mode, type, Industry Vertical, and region.

On the basis of mode, the optical fiber market is bifurcated into single-mode and multi-mode. In 2023, the single-mode segment held the largest optical fiber market share due to the growing need for long-distance transmission applications.

On the basis of type, the optical fiber market is segmented into glass optical fiber, and plastic optical fiber. In 2023, the plastic optical fiber segment held the largest optical fiber market size due to cost-effectiveness, flexibility, ease of installation, and robust performance in short-distance applications such as in-home networks, automotive, and industrial environments.

On the basis of Industry Vertical, the optical fiber industry is segmented into telecom & IT, public sector, healthcare, energy & utilities, aerospace & defense, manufacturing, and others. In 2023, the telecom & IT segment was the highest revenue generator in the optical fiber industry, primarily due to the increase in demand for high-speed internet and data services.

On the basis of region, the optical fiber market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, Chile, rest of Latin America ), and Middle East & Africa (UAE, Saudi Arabia, South Africa, rest of MEA). According to optical fiber industry report, in 2023, Asia Pacific held the largest market share in the optical fiber industry due to rapid technological advancements, substantial investments in telecommunications infrastructure, and the growing demand for high-speed internet connectivity in the region.

Top Impacting Factors

According to optical fiber market insights, the growth of the optical fiber market is significantly influenced by a variety of factors. Key drivers include the increase in demand for high-speed internet driven by the surge of streaming services, cloud computing, and IoT devices, which necessitate high bandwidth capabilities provided by optical fiber. Additionally, the growing need for wireless connectivity, particularly with the deployment of technologies like 5G and Wi-Fi, relies heavily on robust fiber optic backhaul networks to ensure high-speed and low-latency connectivity. However, the high initial investment required for deploying optical fiber infrastructure, such as laying cables and installing equipment, can be a significant barrier, particularly in less developed regions. Despite these challenges, the emerging 5G infrastructure presents substantial opportunities for optical fiber manufacturers and service providers, as 5G networks require dense fiber setups for effective backhaul and fronthaul connectivity to support ultra-fast and low-latency communications.

Regional/Country Market Outlook

The optical fiber market share is experiencing substantial growth, with North America playing a pivotal role in this expansion. North America leads the market, propelled by robust demand from the telecommunications sector, the rapid deployment of 5G networks, and significant investments in data center infrastructure. The region's strong technological advancements, along with government initiatives to improve broadband access, further drive market growth, positioning North America as a key player in the optical fiber industry. Further, the Latin America optical fiber market is witnessing rapid growth due to increasing demand for high-speed internet, expanding telecommunications infrastructure, and the rise of data centers. Enhanced connectivity needs across various industries and government initiatives promoting digital transformation further drive this growth, leading to significant investments in optical fiber technologies.

Competitive Analysis

The optical fiber market analysis report highlights the highly competitive nature of the optical fiber market, owing to the strong presence of existing vendors. Vendors with extensive technical and financial resources are expected to gain a competitive advantage over their counterparts by effectively addressing optical fiber market demands. The competitive environment in this market is expected to increase as product launch, partnership, acquisition, and geographical expansion kind of strategies adopted by key vendors increase. Competitive analysis and profiles of the major optical fiber market players that have been provided in the report include TATA Communications, Corning Inc, Nexans S.A., Furukawa Electric Co. Ltd, Sumitomo Electric Industries Ltd, Reflex Photonics, The Prysmian Group, Finisar Corporation, Sterlite Technologies Ltd, Fujikura Ltd.

The optical fiber market value is significantly influenced by the increasing deployment of fiber optic cable in various industries. Among the primary optical fiber growth drivers are the expanding requirements for high-speed data transmission and the widespread adoption of cloud services. This surge in demand for fiber optic cable and fiber cable technologies is propelling advancements and innovations, further boosting the optical fiber market value. Companies leveraging these optical fiber growth drivers are focusing on enhancing the efficiency and capacity of fiber cable networks to meet the growing demands of modern digital communication systems.

Report Coverage & Deliverables

This report delivers in-depth insights into the optical fiber market covered by mode, type, and industry vertical employed by major players. It offers detailed market forecasts and emerging trends.

Mode Insights

Single-mode fiber optics transmit data over long distances with minimal signal loss, making them ideal for telecommunications and high-speed networks. In contrast, multi-mode fiber supports shorter distances, allowing multiple light modes to propagate, which is suitable for data centers and local area networks. Each mode serves distinct applications effectively.

Type Insights

Glass optical fibers offer high performance and low attenuation, making them ideal for long-distance communication and high-bandwidth applications. In contrast, plastic optical fibers are more flexible and easier to install, making them suitable for short-distance connections and consumer electronics. Each type serves specific needs in optical communication.

Industry Vertical Insights

The optical fiber market serves various industries, including telecom and IT for high-speed communication, the public sector for secure data transmission, and healthcare for advanced medical imaging. In energy and utilities, optical fibers enhance monitoring, while aerospace and defense use them for reliable communication. Manufacturing benefits from automation and connectivity solutions.

Regional Insights

Regional insights indicate that North America leads in optical fiber adoption, driven by robust telecom infrastructure and high data demand. Europe follows, focusing on network upgrades. In Asia-Pacific, rapid urbanization and digital transformation propel growth, while Latin America shows increasing investments in connectivity, enhancing overall regional market dynamics.

Key Developments/ Strategies

According to the latest optical fiber market forecast, Corning Inc, holds the highest optical fiber market share by company, followed by other optical fiber companies Fujikura Ltd, Sterlite Technologies Ltd, Furukawa Electric Co. Ltd, and The Prysmian Group the leading optical fiber companies are adopting strategies such as product launch, partnership, acquisition, and geographical expansion to strengthen their market position in the optical fiber market.

In September 2023, Corning Incorporated opened a new optical fiber manufacturing facility in Mszczonow, Poland, to meet the growing demand for high-speed connectivity in the European Union and surrounding regions. The facility, one of the largest optical fiber plants in the European Union, is Corning's latest in a series of global investments in fiber and cable manufacturing totaling more than US$ 500 million since 2020, supported by growing demand and strong customer commitments.

In April 2023, Prysmian Group introduced the first optical cables that are certified as environmentally friendly. The ECO CABLE products aim to meet the increasing demand for sustainability from the telecom market and all its stakeholders.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the optical fiber market forecast from 2023 to 2032 to identify the prevailing optical fiber market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the optical fiber market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global optical fiber market trends, key players, market segments, application areas, and market growth strategies.

Optical Fiber Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.9 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2023 - 2032 |

| Report Pages | 300 |

| By Mode |

|

| By Type |

|

| By Industry Verticals |

|

| By Region |

|

| Key Market Players | Furukawa Electric Co. Ltd., Sterlite Technologies Ltd, FINISAR CORPORATION, The Prysmian Group, Fujikura Ltd., Corning Incorporated, Tata Communications Ltd., Nexans S.A., Reflex Photonics Inc., Sumitomo Electric Industries Ltd |

Analyst Review

Rise in adoption of optical fiber in end-use applications such as CATV, telecom, sensors, premises, and others, are driving the growth of the optical fiber market. Along with these, copper wires in the communication sector are being replaced by optical fibers owing to their numerous advantages associated with electrical transmission such as high security, high bandwidth, resistance to electromagnetic interference, and transmission of long-range signals. Moreover, in the upcoming years silicon-based optic fibers are expected to be replaced by polymer optical fibers that offer cost-efficient and easy processing of optical signals. This is expected to boost the growth of the optical fiber market during the forecast period.

Furthermore, ongoing R&D for developing polymer or plastic optical fibers as transmission media for an aircraft is expected to provide numerous opportunities for the market. Along with this, growth in demand for internet applications such the Internet of Things (IoT), cloud computing, data storage, data transfer, video streaming, and over-the-top content are also driving the market. The global optical fiber market is highly competitive owing to strong presence of the existing vendors. Optical fiber vendors who have access to extensive technical and financial resources are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the global market requirements. The competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, new product launches and different growth strategies adopted by the key vendors.

Some of the key players profiled in the report include Fujikura Ltd., Corning Incorporated, Sterlite Technologies Ltd., Furukawa Electric Co., Ltd., The Prysmian Group, Finisar Corporation, Sumitomo Electric Industries, Ltd., Nexans S.A., Reflex Photonics, Inc., and Tata Communications Ltd. in its outer diameter and weight. Also, in March 2018,reductionThese players have adopted various strategies to enhance their product offerings and increase their market penetration. For instance, in November 2017, Fujikura Ltd. launched the world's highest density optical fiber ribbon cable, 3456 fiber wrapping tube cable (WTC), which allows 12 fiber mass fusion splicing owing to its flexible spider web-like structure with Corning Inc. launched its latest optical fiber cable innovation RocketRibbon, an extreme density cable, which allows up to 30% quicker installation than other high-density ribbon cables designed for data center and carrier environments.

The industry size of Optical Fiber is estimated to be $7.4 billion in 2023.

The Optical Fiber Market is expected to grow at a CAGR of 5.5% during the period of 2024 to 2032.

Asia-Pacific is the largest regional market for Optical Fiber.

The top companies holding significant market share in the Optical Fiber industry include TATA Communications, Corning Inc, Nexans S.A., Furukawa Electric Co. Ltd, Sumitomo Electric Industries Ltd, Reflex Photonics, The Prysmian Group, Finisar Corporation, Sterlite Technologies Ltd, and Fujikura Ltd.

Optical Fiber market growth is primarily driven by several key factors, including an increase in demand for high-speed internet and advancements in telecommunications infrastructure.

Loading Table Of Content...

Loading Research Methodology...