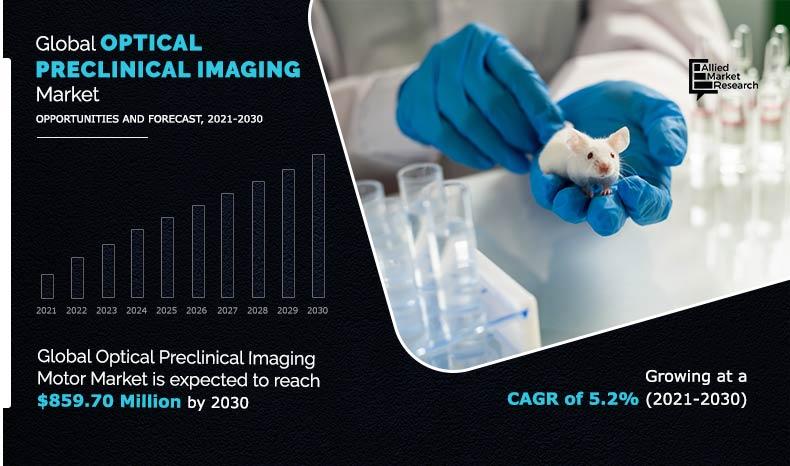

The global optical preclinical imaging market was valued at $516.10 million in 2020, and is projected to reach $859.70 million by 2030, registering a CAGR of 5.2% from 2021 to 2030. The visualization of living animals for research purposes, such as drug discovery and development, is known as optical preclinical imaging. Imaging modalities have frequently been used by researchers to monitor changes in animals in response to physiological or environmental changes, whether at the organ, tissue, cell, or molecular level. Over time, noninvasive and in vivo imaging approaches have become more useful for investigating animal models.

Preclinical optical imaging is becoming an increasingly popular feature in preclinical drug discovery and development. This modality offers a virtual window within the animal and allows for real-time tracking of biological activities at the molecular level. This technique is simple to use, has no radiation, has a high throughput, is moderately priced, and has excellent sensitivity. It can monitor disease progression and evaluate effects of drug candidates with extremely high sensitivity.

Preclinical imaging is critical for phenotyping, drug development, and identifying disease etiology. The primary goal is to increase the likelihood of clinical success while reducing the time and cost of medication research and development. Noninvasive in vivo imaging tools have advanced the use of animal models in preclinical drug discovery and development to a new level, enabling quick and efficient drug efficacy screening. Prior to the start of clinical trials, in vitro and in vivo testing are undertaken during the preclinical stage of drug discovery and development research to ensure that the drug candidate is safe to test in humans. Preclinical research use animal models to assist in the investigation of human diseases and the development of innovative therapies. The biological relevance of an animal model is critical for predicting therapeutic outcomes. The use of small animal models in basic and preclinical sciences is an important component of these type of research and development initiatives, acting as a bridge between molecular discoveries and clinical implementation.

Increase in use of optical preclinical imaging is mostly due to technological advancements in molecular imaging. Nuclear medicine and molecular imaging have made significant progress and continue to evolve, improving their impact on diagnosis and treatment. Rise in prevalence of chronic diseases, considerable increase in the ageing population, and more restricted global resources are among the major reasons driving the evolution of the nuclear medicine and molecular imaging business.

In addition, advanced imaging and hybrid modalities, such as computed tomography (CT), magnetic resonance imaging (MRI), positron emission tomography (PET)/CT, and single-photon emission computed tomography (SPECT)/CT are witnessing significant adoption. Moreover, molecular imaging has made personalized treatments possible according to the respective needs. Furthermore, there has been a considerable rise in demand for noninvasive small animal imaging techniques.

Rise in overall population has led to rise in chronic diseases as well as emergence of new diseases. In addition, this has led to the research and development of new drug molecules. Preclinical research through clinical trials are conducted on animals to study the safety and efficacy of these new drug candidates before testing them on humans. Moreover, increase in funding for preclinical research by both private and public organizations boosts the market growth. However, high cost of optical preclinical imaging acts as a key deterrent factor of the global market. Moreover, optical preclinical imaging devices require regular maintenance, which incur additional cost, thus hampering the global market growth.

In addition, the COVID-19 pandemic led to huge number of clinics and hospitals across the globe being restructured to increase the hospital capacity for patients diagnosed with COVID-19. Non-essential procedures took a potential backlog due to rapidly rising COVID-19 cases. Conversely, various preclinical research studies and activities, including clinical trials for the efficacy and safety, for the treatment of COVID-19 by various researchers, companies and government boosted the growth of the optical preclinical imaging market.

Furthermore, untapped, emerging markets are expected to offer potential growth opportunities, due to improved healthcare infrastructure, increase in unmet healthcare needs, and rise in research & development activities. In addition, availability of various facilities providing such minimally invasive procedures is an emerging opportunity for key players to invest in the optical preclinical imaging market.

Optical Preclinical Imaging Market Segmentation

The global optical preclinical imaging market is segmented into modality, reagent, end user, and region. On the basis of modality, the market is divided into bioluminescence & fluorescence imaging systems, standalone fluorescence imaging systems, and optical + x-ray & optical + CT.

By end user, it is classified into pharma and biotech companies, academic & government research institutes, and contract research organizations.

Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America and Middle East & Africa).

By Modality

Bioluminescence & Fluorescence Imaging Systems holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Segment review

Depending on the modality, the bioluminescence & fluorescence imaging systems segment dominated the market in 2020, and is expected to continue this trend during the forecast period, due to their technologically advanced integration and commercialization of imaging systems.

By end user, the contract research organizations exhibited the highest growth in 2020, and is expected to continue this trend during the forecast period.

By End User

Contract Research Organizations segment is projected as one of the most lucrative segment.

North America accounted for a majority of the global optical preclinical imaging market share in 2020, and is anticipated to remain dominant during the forecast period. This is attributed to rise in drug discovery, presence of key players, and increase in healthcare expenditure in the region. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in research & developmental activities, surge in facilities offering optical preclinical imaging services, and increased investments in the healthcare sector.

The key players operating in the global optical preclinical imaging market are Berthold Technologies GmbH & Co.KG, Endress+Hauser (Analytik Jena US LLC), Fujifilm Corporation (Fujifilm VisualSonics Inc.), LI-COR Biosciences, Inc., Miltenyi Biotec B.V. & CO. KG, PerkinElmer, Inc., Rigaku Corporation (MILabs B.V.), TriFoil Imaging, Vieworks Co., Ltd., and Vilber Smart Imaging Ltd.

By Region

Asia-Pacific is expected to experience growth at the highest rate, registering a CAGR of 8.4% during the forecast period.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the optical preclinical imaging market, and the current trends and future estimations to elucidate the imminent investment pockets.

- It presents a quantitative analysis of the market from 2021 to 2030 to enable stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of the market based on procedures and services assists to understand the trends in the industry.

- Key players and their strategies are thoroughly analyzed to understand the competitive outlook of the market.

Optical Preclinical Imaging Market Report Highlights

| Aspects | Details |

| By Modality |

|

| By End User |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

This section provides the opinions of the top level CXOs in the global optical preclinical imaging market. According to the insights of CXOs, increase in use of biomedical research to prevent and treat diseases that cause illness and death in people and in animals as well as rise in use of minimally invasive advanced imaging technologies are expected to significantly boost the growth of the optical preclinical imaging market.

The CXOs further added that rise in drug discovery & development, introduction of novel drugs for the treatment of emerging new diseases, personalization of treatments notably contributes toward the market growth. Furthermore, the use of preclinical in vivo imaging facilitates translational medicine by de-risking drug candidates, significantly shortening time to clinic and lowering costs while maximizing biological understanding.

Moreover, careful quantitative modelling and de-risking of each new molecular entity (NME) during development streamline pipeline management and make it easier to decide whether to terminate or accelerate studies. Part of this modelling helps to guarantee that sensible choices in animal models, sensors, and imaging modalities are adopted as early as feasible in the preclinical phases, decreasing time and expense in each phase of development.

The market gains interest of healthcare companies, owing to surge in R&D and increase in focus in adoption of optical preclinical imaging in research centers.

North America is expected to witness highest growth, in terms of revenue, owing to firmly established distribution channel, robust R&D infrastructure for life science researches, rapid adoption of novel molecular imaging technologies, presence of key players, and advancements in healthcare investments. Asia-Pacific was the second largest contributor to the market in 2020, and is expected to register the fastest CAGR during the forecast period, due to the continuous government support for pharmaceutical and biotechnology R&D, increase in public–private investments, and rise in number of translational research activities in the healthcare sector.

The total market value of optical preclinical imaging market is $516.10 million in 2020.

The forecast period for optical preclinical imaging market is 2021 to 2030

The market value of optical preclinical imaging market in 2021 is $544.10 million.

The base year is 2020 in optical preclinical imaging market

Top companies such as Berthold Technologies GmbH & Co.KG, Bruker Corporation, Endress+Hauser (Analytik Jena US LLC), Mediso Ltd., Miltenyi Biotec, MR Solutions, PerkinElmer, Inc., Rigaku Corporation (MILabs B.V.), TriFoil Imaging and Vieworks Co., Ltd held a high market position in 2020.

Bioluminescence & fluorescence imaging systems segment dominated the global market in 2020, and expected to continue this trend throughout the forecast period due to the technological advancements and integration of systems and thus is expected to drive the segment

Increase in demand for non-invasive small animal imaging techniques, advanced infrastructure for research & development and investments in healthcare is anticipated to drive the market in the forecast period.

North America is projected to account for a major share of the global optical preclinical imaging market during the forecast period. U.S. dominated the North America rise in investments for drug discovery in the R & D sector due to presence of key players across the country.

Loading Table Of Content...