Optical Satellite Market Research, 2033

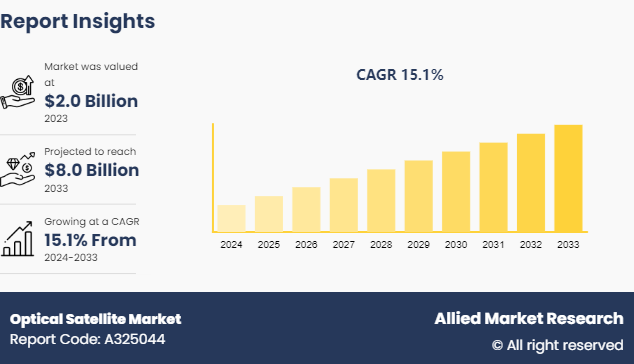

The global optical satellite market size was valued at $2.0 billion in 2023, and is projected to reach $8.0 billion by 2033, growing at a CAGR of 15.1% from 2024 to 2033.

Market Introduction and Definition

Optical satellites are able to record portions of the visible spectrum as well as some bands on the other side. Images are called multispectral when they incorporate information from at least three separate spectral bands. An optical satellite is a type of earth observation satellite equipped with optical sensors that capture images of the earth's surface using visible, infrared, and sometimes ultraviolet light.

These satellites operate by detecting the sunlight reflected off the earth's surface and converting this light into digital images. They are utilized for various applications including environmental monitoring, urban planning, agriculture, forestry, disaster response, and military reconnaissance. Optical satellites provide high-resolution imagery that is essential for mapping, analyzing land use and land cover changes, and assessing natural disasters' impact. Unlike radar satellites, which can penetrate clouds and operate in darkness, optical satellites require clear weather conditions and daylight to capture accurate images.

Key Takeaways

The optical satellite market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major optical satellite industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In March 2023, L3Harris Technologies, Inc. was awarded a contract by Maxar technologies to design and build a reflector antenna for two geostationary communication satellites.

In March 2023, Airbus won a contract from Angola for earth observation satellite Angeo-It is the first high-performance Angolan earth observation satellite, will be manufactured by airbus defense and space in France, thus strengthening the collaboration between the two countries.

Key Market Dynamics

The rise in demand for high resolution imaging is a significant driver of the optical satellite market size. There is a growing demand for high-resolution satellite imagery for various applications such as urban planning, agriculture monitoring, disaster management, and defense surveillance. Optical satellites provide high-resolution images which are crucial for accurate analysis and decision-making in these sectors. Furthermore, advancement in satellite technology, and rapid urbanization and infrastructure development have driven the demand for the optical satellite market share.

However, high initial investment cost hampered the growth of the optical satellite market growth. The development, launch, and operation of optical satellites require substantial initial investment costs. These costs include satellite manufacturing, launch vehicle procurement, ground station setup, and ongoing maintenance. High upfront costs pose a significant barrier to entry for new market players and may limit market growth. Moreover, regulatory challenges and international restrictions, and competition from alternative technologies are major factors that hamper the growth of the optical satellite market forecast.

On the contrary, expansion of commercial satellite imagery presents a significant and lucrative opportunity for the optical satellite Industry. The increase in demand for geospatial intelligence (GEOINT) and location-based services (LBS) presents opportunities for the expansion of the commercial satellite imagery market, including optical satellites. By tapping into new applications and industries such as e-commerce, transportation, and urban mobility, optical satellite operators can diversify their customer base and capture additional market share.

Enhanced Satellite Deployment of Global Optical Satellite Market

Instead of relying on individual satellites, deploying optical satellite constellations can provide enhanced coverage and revisit rates. Constellations consist of multiple satellites working together to cover a larger area and provide more frequent revisits. This approach improves the temporal resolution of optical satellite imagery, enabling faster response times for applications such as disaster monitoring, agricultural assessment, and infrastructure monitoring. Moreover, advancements in satellite miniaturization and standardization can lead to the deployment of smaller, more cost-effective optical satellites. Smaller satellites, such as CubeSats and microsatellites, can be deployed in constellations or clusters to enhance coverage and flexibility. Standardization of satellite components and interfaces can streamline the manufacturing and deployment process, reducing costs and improving scalability.

Developing rapid deployment technologies, such as air-launch systems or small dedicated launch vehicles, can expedite the deployment of optical satellites into orbit. Rapid deployment capabilities reduce lead times and enable satellite operators to respond quickly to emerging opportunities or market demands, flexible launch options allow for precise orbital placement and optimization of coverage areas. Furthermore, implementing on-orbit servicing and maintenance capabilities can prolong the operational lifespan of optical satellites and enhance their reliability. Technologies such as robotic servicing spacecraft or autonomous repair systems can perform tasks such as refueling, component replacement, and debris mitigation. On-orbit servicing reduces the need for premature satellite replacements and maximizes the return on investment for satellite operators.

Market Segmentation

The optical satellite market is segmented into size, operational orbit, application, component, end user and region. On the basis of size, the market is segmented into small satellites, medium satellites, and large satellites. As per operational orbit, the market is segregated into LEO, and MEO/GEO. On the basis of application, the market is divided into earth observation, and communication. As per component, the market is segregated into imaging and sensing system, and optical communication system. On the basis of end user, the market is segmented into commercial, government, and defense. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

Regional/Country Market Outlook

North America, particularly the U.S., is a leader in space technology and satellite development. The region is home to numerous space agencies, such as NASA and private companies like SpaceX, Boeing, and Lockheed Martin, which have made significant advancements in satellite technology. These advancements have enabled North American companies to develop cutting-edge optical satellites with high-resolution imaging capabilities, attracting customers from various industries worldwide. Furthermore, the aerospace industry in North America is highly developed and competitive, with a robust ecosystem of satellite manufacturers, launch service providers, and ground station operators. Companies like Boeing, Northrop Grumman, and Maxar Technologies have a strong presence in the optical satellite market, offering a wide range of satellite products and services tailored to customer needs. The availability of skilled workforce, infrastructure, and investment in research and development further strengthens the region's position in the global optical satellite market.

The Asia-Pacific region is experiencing rapid economic growth and urbanization, driving demand for optical satellite imagery for various applications such as urban planning, infrastructure development, and environmental monitoring. As countries in the region invest in infrastructure projects, smart city initiatives, and natural resource management, there is a growing need for high-resolution satellite data, boosting the demand for optical satellite services. Furthermore, emerging markets in Asia-Pacific, including China, India, and Southeast Asian countries, present significant growth opportunities for the optical satellite market. These countries are investing heavily in space programs, satellite technology, and remote sensing applications to address critical societal challenges and support economic development. Government initiatives, such as China's Belt and Road Initiative and India's Digital India program, are driving investment in satellite infrastructure and spurring market growth.

In April 2024, the U.S. Air Force has granted Skyloom an $18 million contract to advance the development of Hybrid Space Optical Satellite Communications, aimed at bolstering Assured Command, Control, Communications, Intelligence, Surveillance, and Reconnaissance (C3ISR) capabilities.

In March 2024, Orion Space Solutions, a subsidiary of Arcfield, confirmed the successful launch of its Rapid Revisit Optical Cloud Imager (RROCI) satellite. This cutting-edge electro-optical/infrared (EO/IR) weather system (EWS) spacecraft is designed to deliver high-resolution Earth observations and infrared data, facilitating precise and current weather forecasting for the U.S. Space Force's (USSF) Space Systems Command (SSC) .

Competitive Landscape

The report analyzes the profiles of key players operating in the optical satellite market such as Airbus Defense and Space, Ball Aerospace & Technologies Corp., Thales Alenia Space, Lockheed Martin Corporation, Maxar Technologies Inc., Boeing Company, Northrop Grumman Corporation, Space Systems/Loral, LLC (SSL) , Mitsubishi Electric Corporation, and Israel Aerospace Industries Ltd. (IAI) . These players have adopted various strategies to increase their market penetration and strengthen their position in the optical satellite market.

Industry Trends

In April 2024, a significant milestone was achieved when SpaceX’s Falcon 9 rocket successfully launched a satellite assembled by Tata Advanced Systems Limited (TASL) from Launch Complex 39A at Kennedy Space Center. This event underscores the collaboration between TASL, a leading Indian aerospace and defense company, and SpaceX, a prominent American aerospace manufacturer and space transport services company. The Falcon 9 rocket, known for its reliability and reusability, served as the launch vehicle, catapulting the TASL-assembled sub-meter optical satellite into space, this launch is a testament to the growing capabilities and ambitions of India's private space sector.

In May 2024, NASA set a record for optical data transmission distance using advanced technology from CACI International, according to a recent announcement by the company. This achievement involved successfully transmitting optical data over a staggering distance of more than 200 million kilometers, from NASA's Psyche spacecraft, currently in orbit, to the NASA Jet Propulsion Laboratory (JPL) in Southern California.

In May 2024, the KaleidEO Space Systems, a Bengaluru-based satellite asset operating startup owned by SatSure Analytics India, has distinguished itself as one of the few private Indian companies to design and develop a high-resolution optical Earth observation payload independently from scratch, which was successfully tested in the air. This achievement, deviating from the conventional reliance on Indian Space Research Organization (ISRO) designs, signifies a major advancement in the capabilities of India's private space sector.

In March 2024, Global communications face various threats, including natural disasters, cyberattacks, and geopolitical tensions. Optical satellite networks offer a resilient solution to bolster communication systems worldwide. Optical satellite networks are inherently resilient to terrestrial disruptions. They can maintain connectivity even in the event of natural disasters such as earthquakes, hurricanes, or floods, which might damage ground-based infrastructure. This resilience ensures uninterrupted communication when terrestrial networks are compromised.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the optical satellite market segments, current trends, estimations, and dynamics of the optical satellite market analysis from 2022 to 2032 to identify the prevailing optical satellite market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the optical satellite market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global optical satellite market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global optical satellite market trends, key players, market segments, application areas, and market growth strategies.

Optical Satellite Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 8.0 Billion |

| Growth Rate | CAGR of 15.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 546 |

| By Size |

|

| By Operational Orbit |

|

| By Application |

|

| By Component |

|

| By End-user |

|

| By Region |

|

| Key Market Players | Ball Aerospace & Technologies Corp., Israel Aerospace Industries Ltd. (IAI), Mitsubishi Electric Corporation, Airbus Defense and Space, Lockheed Martin Corporation, Northrop Grumman Corporation, Boeing Company, Thales Alenia Space, Space Systems/Loral, LLC (SSL), Maxar Technologies Inc. |

Upcoming trends in the global optical satellite market include the miniaturization of satellite technology, increased deployment of low Earth orbit (LEO) satellites, advancements in high-resolution imaging capabilities, integration of AI and machine learning for data analysis, growth in satellite constellations for enhanced global coverage, and rising demand for Earth observation and remote sensing applications, there is a focus on developing cost-effective launch solutions and improving satelli

Communication is the leading application of optical satellite market

North America attained highest market share for the optical satellite.

$8.0 billion is the estimated industry size of optical satellite

Airbus Defense and Space, Ball Aerospace & Technologies Corp., Thales Alenia Space, Lockheed Martin Corporation, Maxar Technologies Inc., Boeing Company, Northrop Grumman Corporation, Space Systems/Loral, LLC (SSL), Mitsubishi Electric Corporation, and Israel Aerospace Industries Ltd. (IAI) are the top companies to hold the market share in Optical Satellite

Loading Table Of Content...