Oral Care Market Overview :

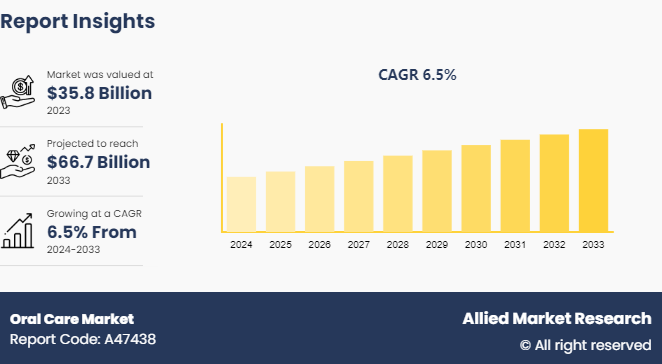

The global oral care market size was valued at $35.8 billion in 2023 and is projected to reach $66.7 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033.Oral care, encompassing cleaning such as tooth brushing and flossing, mouth washing with bland rinses, and the application of moisturizing agents for hydration and lubrication, is crucial for maintaining optimal oral health. This routine not only helps in reducing the risk of infections and inflammation within the oral cavity but also prevents systemic infections originating from the mouth. In managing oral mucositis, the primary goal of basic oral care is to diminish the bacterial load in the oral cavity, thereby preventing secondary disorders of the mucosa due to infections of the oral soft tissues. By adhering to these oral care practices, individuals can significantly lower the risk of developing oral mucositis complications and enhance overall oral hygiene, contributing to better systemic health outcomes.

Key Takeaways

- The oral care treatment market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major oral care treatment industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The rising prevalence of oral and gum-related diseases is driving substantial growth in the oral care market trends. This surge is driven by increasing awareness regarding oral hygiene and a growing elderly population. For instance, the prevalence of conditions like periodontal disease and dental caries has increased, necessitating a greater demand for oral care products and services. As individuals become more proactive about maintaining oral health, the market for dental treatments, preventive measures, and innovative oral care solutions is projected to continue to expand significantly in the upcoming years.

However, the market faces challenges due to rising antibiotic resistance and apprehensions regarding chemical ingredients in conventional products. This dual threat challenges the efficacy of treatments, and thus hampers the market growth trajectory. With consumers increasingly suspicious of potential health hazards posed by traditional oral care solutions, there is an increasing need for innovation and adoption of alternative approaches.

The surge in dental tourism has provided opportunities for oral care providers in sought-after destinations to tap into a wider clientele. Offering affordable treatments, these providers attract individuals seeking cost-effective dental services abroad. This trend benefits both parties: patients gain access to quality care at lower prices, while destination countries' oral care facilities expand their customer base. With the global dental tourism on the rise, providers in popular locales stand poised to capitalize on this opportunity, enhancing their reputation and revenue streams.

Dental Market Analysis

The dental industry is shaped by regulatory bodies ensuring standards and safety. Recent developments indicate a shift towards innovative technologies and patient-centric care. Regulatory bodies like FDA and ADA in the U.S. and the European Medicines Agency (EMA) for Europe play major roles in overseeing product approvals and ensuring adherence to quality standards. For instance, in May 2023, the American Dental Association formed a canvass committee to evaluate the 2023 revision of the Systemized Nomenclature of Dentistry (SNODENT) . ANSI/ADA Standard No. 2000.6, recognized by the American National Standards Institute. In the annual updates, dental experts play an important role in the approval process of this vital dental terminology system.

Governments worldwide are prioritizing advanced healthcare infrastructure. With numerous programs underway, the U.S. government is actively investing in expanding dental services. This initiative reflects a broader commitment toward improving public health and ensuring access to essential medical services. By allocating resources to dental expenditure on government programs, policymakers aim to enhance preventive and treatment services, catering to the diverse needs of the population.

U.S. National Dental Expenditures, 2018-2022

Year | U.S. National Dental Expenditures, 2018-2022 |

2018 | 158 |

2019 | 163 |

2020 | 156 |

2021 | 176 |

2022 | 165 |

Source : American Dental Association, AMR Analysis, Secondary Research

Market Segmentation

The oral care market share is segmented into product type, distribution channel, and region. On the basis of product type, the market is divided into toothbrush, toothpaste, mouthwash, denture products, and other dental accessories. As per distribution channel, the market is classified into online retail stores, convenience stores, supermarkets/hypermarkets, pharmacies & drug stores, and others. Region wise, the oral care market growth is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

Asia-Pacific holds the major share of the oral care market, driven by its substantial population base. According to the ESCAP's December 2023 article, the region is home to approximately 60% of the global population, amounting to around 4.7 billion people. Major economies like India and China, each with over a billion residents, significantly contribute to the demand for basic oral care products. This vast consumer base boosts the regional market growth, as a large population requires consistent oral hygiene maintenance. In addition, ongoing product innovation and the acceptance of novel oral care products are expected to positively impact market dynamics, further enhancing the regional market share.

- In January 2024, Dr. Dento, an emerging company in the oral care industry, introduced a new product range emphasizing natural ingredients for professional-grade results that are gentle on teeth and gums. Particularly developed through rigorous scientific research, these products harness nature's healing properties for holistic oral care solutions. The innovative range includes GMP-Certified electric toothbrushes, toothpaste, and mouthwash, combining advanced technology with natural ingredients like NHap, Coconut Extract, Theobromine, Amaranth Solution, Papain Enzyme, Hyaluronic Acid, and Aloe Vera. Enriched with Vitamin C and Vitamin E, Dr. Dento delivers comprehensive oral health and nourishment.

Competitive Landscape

The major players operating in the oral care market demand include GSK plc, Sunstar Suisse S.A., Colgate-Palmolive Company, Henkel AG & Co. KGaA, Church & Dwight Co., Inc., Johnson & Johnson Services, Inc., GC Corporation, Unilever PLC, Procter & Gamble, and Lion Corporation.

Other players in the oral care market include Dabur India and BURST Oral Care.

Recent Key Strategies and Developments

- In October 2023, BURST Oral Care launched the Pro Sonic Toothbrush and Curve Sonic Toothbrush, featuring innovative designs and technology. Developed with input from over 35, 000 dental professionals in BURST's Ambassador network, these brushes ensure high-quality performance at accessible prices. The BURST Pro Sonic Toothbrush, a clinically-proven product, offers an improved user experience with a new high-end color LED screen, smart responsive software for optimal care, and a category-defining rechargeable battery life of up to 9 months.

Industry Trends

- In January 2024, Lion Corporation announced the launch of OCH-TUNE brand, revolutionizing oral care with a unique approach centered around style. The brand features two distinct styles: fast and slow, each offering unique options in toothpastes, toothbrushes, and mouthwashes. The fast medicated toothpaste rapidly foams and spreads for a refreshing clean, while the slow variant provides dense, soft foam for thorough care. Fast toothbrushes boast a multi-clean design for quick, comprehensive brushing, whereas slow toothbrushes have a double-rich design for meticulous, comfortable brushing. Complementing these, the fast medicated mouthwash delivers an instant, sharp cooling sensation for quick refreshment, while the slow medicated mouthwash offers a gentle cooling effect for mild, careful oral care. This dual-style approach allows consumers to choose their oral care routine based on their personal preference for speed and thoroughness, ensuring a versatile and effective dental hygiene experience.

- Bruush Oral Care Inc. is committed toward revolutionizing the oral care market with its sonic-powered electric toothbrush and brush head refill subscription plan. In June 2023, the company announced a product expansion introducing four new complementary oral care products: toothpaste, mouthwash, dental floss, and a whitening pen. These new consumables target over 95% of the at-home consumable oral care market. Bruush’s electric toothbrush offers greater cleaning compared to manual brushes, and the new consumables are expected to further enhance oral health. Bruush aims to set a new standard in quality and efficacy for at-home oral care with its consumables, promising users’ noticeable improvements in their oral hygiene.

Key Sources Referred

- World Dental Federation (FDI)

- World Bank

- American Dental Association (ADA)

- International Association for Dental Research (IADR)

- GSK plc

- Colgate-Palmolive Company

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the oral care market analysis from 2023 to 2033 to identify the prevailing oral care market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the oral care market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global oral care market growth.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global oral care market trends, key players, market segments, application areas, and market growth strategies.

Oral Care Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 66.7 Billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 305 |

| By Product Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | GC Corporation, Johnson & Johnson Services, Inc., Procter & Gamble, Unilever PLC, Colgate-Palmolive Company, GSK plc, Lion Corporation, Sunstar Suisse S.A., Henkel AG & Co. KGaA, Church & Dwight Co., Inc. |

The surge in dental tourism has provided opportunities for oral care providers in and thus surging clientele. This would progress the market growth in coming years.

The toothbrush sub-segment is expected to dominate throughout the forecast period.

Asia-Pacific’s dominance is largely driven by the proliferation of supermarkets and hypermarkets.

The oral care market is anticipated to reach $66.7 Billion, by 2033 at 6.5% CAGR

The major players operating in the oral care market include GSK plc, Sunstar Suisse S.A., Colgate-Palmolive Company, Henkel AG & Co. KGaA, Church & Dwight Co., Inc., Johnson & Johnson Services, Inc., GC Corporation, Unilever PLC, Procter & Gamble, and Lion Corporation.

Loading Table Of Content...