Organic Fertilizers Market Overview:

The global organic fertilizers market size was valued at $9.6 billion in 2022, and is projected to reach $17.5 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032. Advancements in organic fertilizer formulations and technologies are significantly driving the organic fertilizers market by improving their efficiency, nutrient content, and application methods. Innovations such as slow-release formulations, bio-enhanced fertilizers, and the incorporation of beneficial microorganisms are enhancing crop yield and soil health.

Key Market Insights

- By Crop Type, Cereals & grains led the organic fertilizers market in revenue and volume.

- By Form, Dry fertilizers dominated the organic fertilizers market in 2022 with the highest revenue share.

- By Region, The organic fertilizers market is set to grow fastest, with Asia-Pacific maintaining dominance in 2022.

Market Size & Forecast

- 2032 Projected Market Size: USD 17.5 Billion

- 2022 Market Size: USD 9.6 Billion

- Compound Annual Growth Rate (CAGR) (2022-2032): 6.1%

What are the Main Highlights?

The organic fertilizers has been analyzed in terms of value ($ million) and volume (ton), covering more than 15 countries.

For growth prediction, we have looked into historical trends including present and future activities of key business players.

The report covers detailed profiling of the major 10 market players.

How to Describe Organic Fertilizers

Organic fertilizer is created from natural resources such as animal waste, agricultural waste, earthworm castings, and cow dung. Due to their high concentrations of organic matter and minerals, these compounds are beneficial for increasing soil fertility and plant growth. The ability of organic fertilizers to increase soil water retention is one of their key benefits. As a result, they aid in soil moisture retention and guarantee that plants receive water even during dry spells. By loosening the soil and turning it into gaseous forms, organic fertilizers also enhance soil structure and increase soil aeration for plant roots. The improved soil structure prevents harmful salts from accumulating and harming the soil's health.

The use of organic fertilizers has increased significantly over the past several years as people have become more aware of the detrimental effects that chemical fertilizers have on the environment and human health. As more individuals opt to eat organic food, there is a rise in demand for organic agriculture practices. This shift in customer preferences is growing the market for organic fertilizer. In regions like Europe where organic farming is widely appreciated, there is a significant need for organic fertilizers on a global scale. Due to Europe's extensive reliance on the agricultural sector, the need for fertilizers has increased dramatically, supporting the market for organic fertilizers.

Despite the many advantages of organic fertilizers, several difficulties have been brought about by climate changes linked to debatable global warming. Farmers find it challenging to produce high crop yields by relying entirely on organic fertilizers due to the unpredictability of weather patterns. In order to maximize their agricultural output, some farmers feel obligated to employ chemical fertilizers in addition to organic ones. It is significant to highlight that there are numerous types of organic fertilizers, including mineral-organic, pure, microbiological, and bio-organic. By fixing nitrogen and enhancing the availability of nutrients to plants, microbiological fertilizers, such as those made from Azotobacter, Rhizobium, Cyanobacteria, and Azospirilium, contribute to soil health.

How are Market Dynamics Shaping Industry Competition

Driving Factors

Farmers are under growing pressure to maximize crop production and yield due to the restricted amount of agricultural land that is accessible for agriculture. To secure food security for a growing world population, this is especially crucial. Farmers must optimize resource use to produce increased agricultural yields. A significant strategy for increasing agricultural output is to raise the soil's quality. Crop health and yield are greatly influenced by soil quality. Improved soil quality has advantages such as enhanced microbial activity, better water retention, and higher nutrient content. For the establishment of healthy plants and enhanced crop yields, each of these components is required.

Many governments recognize the value of the agriculture sector and are actively seeking to advance it. They help farmers by implementing a range of regulations, rewards, and programs. Encouragement of farmers to take part in international agricultural fairs and expos is one such technique. These occasions offer farmers a venue to exhibit their goods and discover best practices from around the globe. The market for organic fertilizer is significantly impacted by the emphasis on improving the quality of agricultural products, which typically has an eye on international markets. Organic fertilizers are well known for improving the nutritional value and quality of crops. Demand for organic fertilizers is anticipated to rise as farmers work to create high-quality agricultural goods that meet both international standards and customer preferences. These fertilizers support the growth of nutrient-rich crops, crops that please customers and adhere to worldwide standards of quality, and soil that is in good health.

Restraint

The process of producing organic fertilizers often involves sourcing and processing natural materials, which can be more expensive compared to synthetic fertilizers. These materials require labor-intensive methods, organic certification, and adherence to stringent regulations, which increase overall costs. Furthermore, the relatively low efficiency of organic fertilizers in terms of nutrient release rates can result in higher application volumes, further adding to costs for farmers. As a result, price-sensitive farmers may prefer cheaper synthetic alternatives, limiting the widespread adoption of organic fertilizers. All these factors are expected to hamper the growth of the organic fertilizers industry.

Opportunities

Governments are not only promoting sustainable agriculture but are also implementing policies to increase domestic organic fertilizer manufacturing capacities. These regulations seek to increase domestic output, lessen dependency on imports, and help small businesses. During the forecast period, it is anticipated that the combined effects of factors including environmental concerns, governmental initiatives, rising demand, and efforts to expand domestic production capacity would open up profitable potential for the growth of the worldwide organic fertilizer market. As sustainable agriculture practices gain momentum, the organic fertilizer market is poised to grow as a key component of these practices.

Organic Fertilizers Market Segment Review:

The organic fertilizer market scope is studied based on factors like source, crop type, nutrient content, form, and region, allowing for a tailored approach to sustainable agriculture practices.

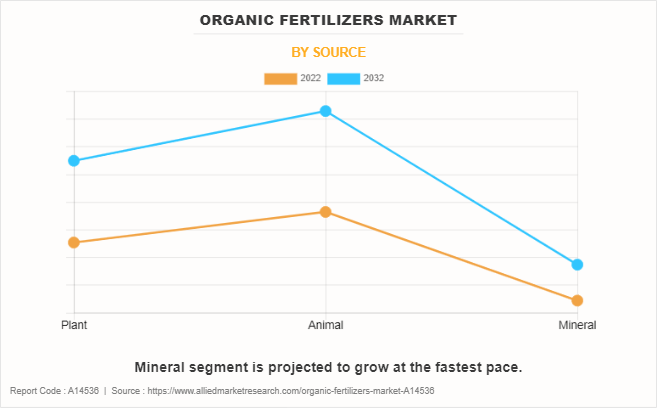

Organic Fertilizers Market by Source

Depending on the source, the market is categorized into plant, animal, and minerals. The animal segment dominated the organic fertilizers market share in 2022. Organic fertilizers derived from animal sources play a crucial role in organic agriculture, contributing to market growth. It is mixed with respect to specific crop varieties, soil types, and environmental considerations. However, the mineral segment is projected to grow at the highest pace is it offers organic fertilizers market opportunities. Concerns about soil erosion, water pollution, and the harm traditional chemical fertilizers do to the environment have prompted a change to more environmentally friendly farming methods. Mineral organic fertilizers are recommended as a way to lessen agriculture's detrimental effects on the environment.

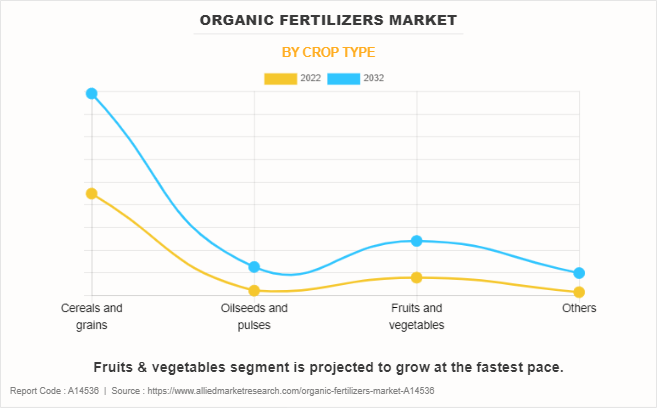

Organic Fertilizers Market by Crop Type

On the basis of crop type, it is segregated into cereals & grains, oilseeds & pulses, fruits & vegetables, and others. The cereals & grains segment dominated the organic fertilizers market size in terms of revenue and volume. Throughout the forecast period for the market for organic fertilizers, it is anticipated to expand at a noteworthy CAGR of 6.0%. The seeds of grasses like wheat, millet, rice, barley, oats, rye, triticale, sorghum, and maize (corn) are known as cereal grains. Cereal grains provide approximately 50% of the calories and over 80% of the protein that people and livestock ingest.

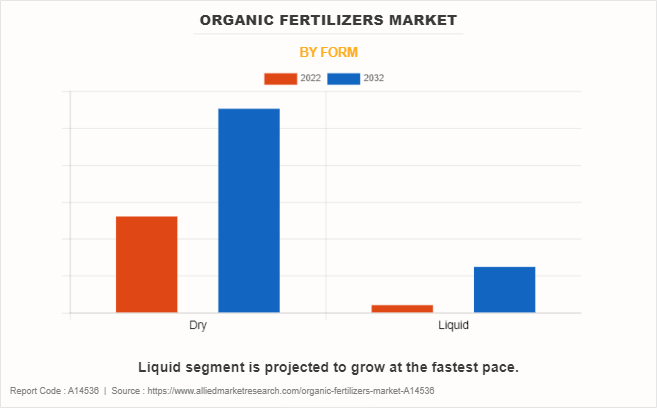

Organic Fertilizers Market by Form

By form, it is bifurcated into dry and liquid. The dry fertilizers segment dominated the organic fertilizers market growth with the highest revenue contribution in 2022. Dry organic fertilizers have a huge market opportunity due to the increasing demand for organic foods and services. Farmers are seeking organic certification and adopting organic farming practices to meet this demand. However, liquid fertilizers are expected to dominate the organic fertilizers market growth during the projection period. Liquid organic fertilizers be precisely applied through various methods, including drip irrigation and foliar spraying, supporting precision farming practices. The integration of digital technologies, such as precision agriculture tools and data analytics, is enhancing the efficiency and effectiveness of liquid organic fertilizer applications.

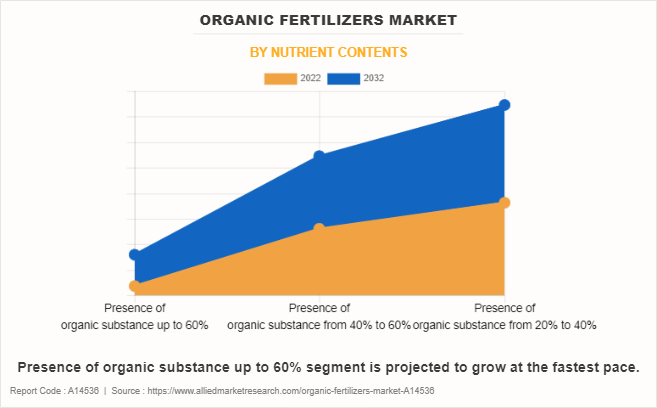

Organic Fertilizers Market by Nutrient Content

As per nutrient content, it is fragmented into presence of organic substance up to 60%, presence of organic substance from 40% to 60%, and presence of organic substance from 20% to 40%. The presence of organic substance from 20% to 40% segment dominated the market share for organic fertilizers in 2022. They help in overcoming mineral deficiency in the soil and aid the crop for optimal production. Many organic fertilizers are used for farming, such as manure, worm castings, peat, and dung. The presence of organic substance up to 60% is projected to grow at a higher pace during the forecast period. Several material sources are available in the market that are high in nitrogen, phosphorus, and potassium. Some of the fertilizers include phosphate colloidal, phosphate rock, and shrimp waste.

Organic Fertilizers Market by Region

Region-wise, the organic fertilizers market analysis is done across North America, Europe, Asia-Pacific, and LAMEA. The organic fertilizers market is expected to develop at the quickest rate during the forecast period, with the Asia-Pacific region expected to continue dominating the market in 2022. One of the biggest and most significant markets for fertilizers worldwide is Asia-Pacific. In order to ensure food security for its expanding population and contribute to the world's food supply, the agricultural industry is essential. The key drivers of the growth of the Asia-Pacific Fertilizer Market are the rising food demand brought on by population expansion, bettering farming techniques, and government measures to increase agricultural output.

Which are the Leading Companies in Organic Fertilizers

The key players operating in the organic fertilizers industry. The players have adopted several strategies such as product launch and business expansion to sustain the market competition.

Tata Chemicals Limited.

The Scotts Miracle-Gro Company

KRIBHCO

Hello Nature International

Sustane Natural Fertilizer Inc.

True Organic Products Inc.

California Organic Fertilizers Inc.

BioSTAR Renewables

ILSA S.p.A

Coromandel International Limited.

Impact of Key Government Regulations on the Organic Frtilizers Market

Governments worldwide recognize the importance of safeguarding natural resources, including land. They are increasingly committed to implementing measures to prevent land degradation and ensure its long-term sustainability. Fertilizers are increasingly being used to increase soil productivity for agricultural cultivation. The overuse of chemical fertilizers, however, has sparked worries about soil and water contamination as well as negative consequences on human health. Chemical fertilizers have a bad reputation since they contaminate the land and water supplies. To lessen these detrimental effects, governments are aggressively pushing alternatives like organic farming and organic fertilizers. Many governments are offering subsidies to incentivize and support organic farming practices. These subsidies make it more economically viable for farmers to adopt organic methods.

Governments are implementing stringent regulations to ensure the quality and authenticity of organic fertilizers in the market. This is aimed at preventing the circulation of fake or substandard organic fertilizers. Certification is often mandated for organic fertilizer manufacturers to ensure that their products meet organic farming standards and do not contain harmful chemicals.

Examples of Government Initiatives:

Indonesia's "Go Organic 2010" Program: Indonesia's Department of Agriculture launched the "Go Organic 2010" program in 2001, aiming to position Indonesia as a major organic food producer globally. This initiative involves regulating the use of proper organic fertilizers through specific ministerial regulations, emphasizing organic agriculture, and providing guidelines for manufacturing and using organic fertilizers. Subsidies on organic fertilizers are offered to boost demand.

Thai Organic Agriculture Foundation (TOAF): In Thailand, the government actively promotes organic agriculture in association with non-governmental groups like TOAF. To help farmers adopt organic agricultural methods, the National Organic Agriculture Development Plan (2017–2021) has been created. This initiative has increased the number of farmers using organic farming methods and increased the amount of land set aside for organic farming.

What are the Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the organic fertilizers market analysis from 2022 to 2032 to identify the prevailing organic fertilizers market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the organic fertilizers market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global organic fertilizers market trends, key players, market segments, application areas, and market growth strategies.

Organic Fertilizers Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 17.5 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 413 |

| By SOURCE |

|

| By CROP TYPE |

|

| By NUTRIENT CONTENTS |

|

| By FORM |

|

| By Region |

|

| Key Market Players | ILSA S.p.A, BioSTAR Renewables, California Organic Fertilizers Inc., Sustane Natural Fertilizer Inc., Hello Nature International, The Scotts Miracle-Gro Company, Tata Chemicals Limited., KRIBHCO, COROMANDEL INTERNATIONAL LIMITED, True Organic Products Inc. |

Analyst Review

The CXOs claim that the organic fertilizer market is consolidated, which means that a small number of significant firms control it. The industry is anticipated to develop significantly during the projected period despite this consolidation. Several important causes are responsible for this increase. The greater knowledge of consumers and farmers about the detrimental effects of chemical fertilizers on human health and the environment is one of the elements encouraging this trend. CXOs claim that when farmers move to organic farming practices, there will be a greater demand for organic fertilizers as a result of this increased awareness.

By providing subsidies and other incentives to help organic farming, governments all over the world are aggressively pushing the use of organic fertilizers. These programs seek to encourage more environmentally friendly agriculture methods while reducing dependency on synthetic fertilizers. This government support is seen as a significant boost to the organic fertilizer market. The rise in the international market for organic food products has created export and trade opportunities for regions involved in organic farming. CXOs acknowledge that this global demand for organic produce is further fueling the growth of the organic fertilizer market. While the market is on a growth trajectory, CXOs recognize that challenges exist. Climate change, resulting in unpredictable weather patterns and decreased crop yields, is a significant restraint. In response to these difficulties, farmers choose chemical fertilizers over organic ones in an effort to get results quickly. Despite the difficulties caused by climate change, numerous governments are actively developing action plans with precise objectives to support organic farming. These programs aim to lessen land pollution, promote ecologically friendly farming methods, and promote long-term sustainability.

The estimated industry size of Organic Fertilizers is $17.5 billion by 2032.

Farmers’ increased focus toward agricultural expansion in terms of productivity and agriculture is one of the main contributors to an economy are the upcoming trends of Organic Fertilizers Market in the world.

Animal based fertilizers is the leading source of Organic Fertilizers Market.

Asia-Pacific is the largest regional market for Organic Fertilizers.

Tata Chemicals Limited., The Scotts Miracle-Gro Company, KRIBHCO, Hello Nature International, Sustane Natural Fertilizer Inc., True Organic Products Inc., California Organic Fertilizers Inc., BioSTAR Renewables, ILSA S.p.A, and Coromandel International Limited are the top companies to hold the market share in Organic Fertilizers.

Loading Table Of Content...

Loading Research Methodology...