Organic Pesticides Market Research, 2032

The global organic pesticides market was valued at $3.0 billion in 2022, and is projected to reach $7.6 billion by 2032, growing at a CAGR of 9.7% from 2023 to 2032.

Report Key Highlighters

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The organic pesticides market is fragmented in nature among prominent companies such as Andermatt Group AG, Bayer AG, Certis USA LLC, Dow Inc., Mark Agri Genetics Pvt. Ltd., Parry America, Inc., Redox Industries Limited., and Sikkoindia..

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global organic pesticides market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,800 organic pesticides-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global organic pesticides market.

Organic pesticides, also known as biopesticides or natural pesticides, are substances derived from natural sources that are used to control pests and diseases in agriculture and gardening. Unlike synthetic chemical pesticides, organic pesticides are derived from plants, animals, minerals, or microorganisms and are considered to be more environment friendly and less harmful to humans and other non-target organisms. There are several types of organic pesticides that are used for pest management practices such as botanical pesticides, microbial pesticides, mineral-based pesticides, and others.

One of the primary drivers of the organic pesticides market is the changing consumer preferences towards organic products. Consumers are becoming more conscious about their health and the environment, leading to an increased demand for organic food and other organic products. Organic pesticides are seen as a safer alternative to synthetic pesticides, as they are derived from natural sources and are less likely to leave harmful residues on crops. The growing consumer demand for organic products has prompted farmers to adopt organic farming practices, including the use of organic pesticides, to meet the market demand.

Moreover, growing environmental concerns regarding the negative impacts of synthetic pesticides on ecosystems and biodiversity have fueled the demand for organic pesticides. Synthetic pesticides have been found to contaminate soil, water bodies, and air, leading to adverse effects on non-target organisms, such as pollinators and beneficial insects. Organic pesticides, on the other hand, are less persistent in the environment and have minimal impacts on non-target species. The increasing awareness about the importance of biodiversity conservation and sustainable agricultural practices has motivated farmers to shift towards organic pesticides to minimize their ecological footprint.

However, one of the primary restraints of the organic pesticides market is the perceived limitations in efficacy and availability compared to synthetic pesticides. Organic pesticides have a slower mode of action and may not provide the same level of control over pests and diseases as their synthetic counterparts. This can pose challenges for farmers, especially in regions with high pest pressure or for crops that are highly susceptible to certain pests. Additionally, the availability of organic pesticides may be limited compared to synthetic pesticides, which are often more widely produced and readily accessible in the market.

On the contrary, governments worldwide are increasingly supporting organic agriculture through various initiatives, policies, and financial incentives. These measures create opportunities for the organic pesticides market. Governments may provide financial support, tax incentives, or subsidies to farmers transitioning to organic farming practices, including the use of organic pesticides. Furthermore, regulations and certification programs that promote organic farming can provide a favorable environment for the growth of the organic pesticides market. Government support can help overcome some of the financial barriers associated with organic farming and make organic pesticides more accessible to farmers.

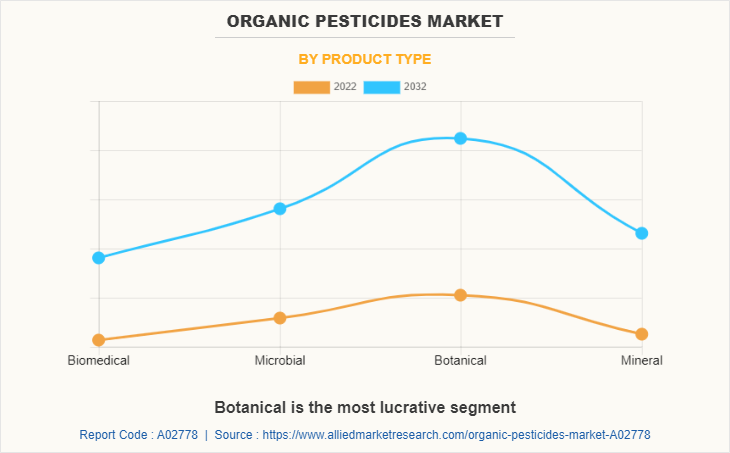

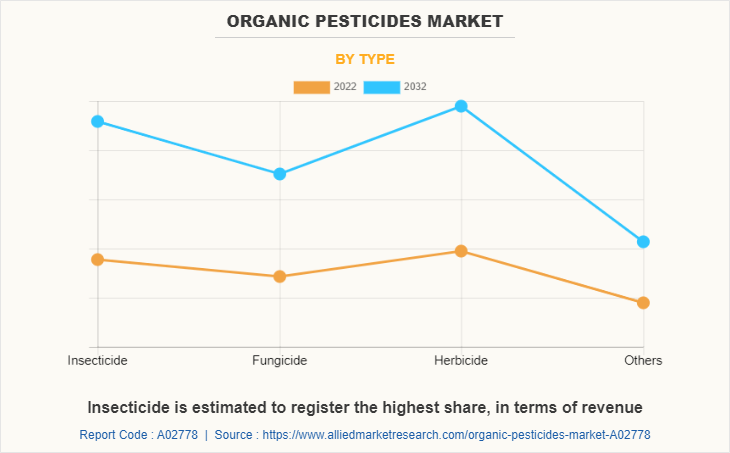

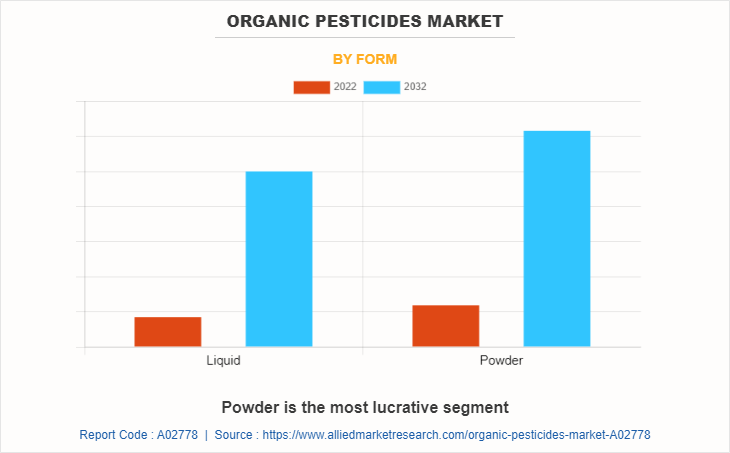

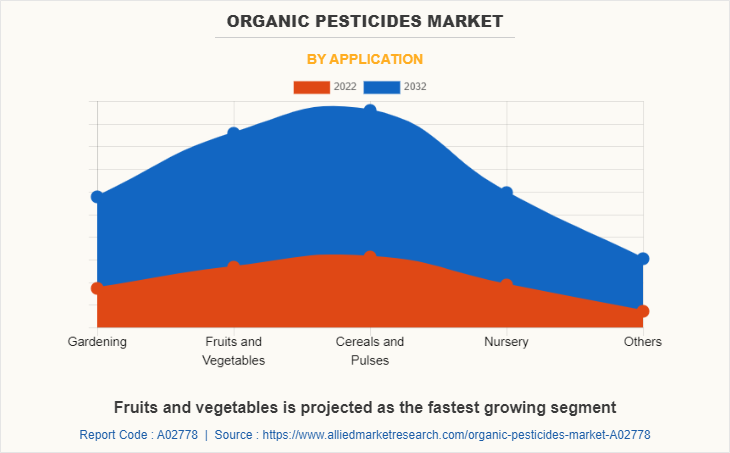

The organic pesticides market is segmented on the basis of product type, type, form, application, and region. On the basis of product type, the market is categorized into biochemical, microbial, botanical, and mineral. By type, the market is segregated into insecticide, fungicide, herbicide, and others. By form, the market is segregated into liquid or spray and powder or granules. By application, it is divided into gardening, fruits & vegetables, cereals & pulses, nursery, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

In 2022, the botanical segment was the largest revenue generator, and is anticipated to grow at a CAGR of 9.9% during the forecast period. There is a growing consumer preference for organic food and agricultural products due to concerns about synthetic pesticide residues and environmental sustainability. Botanical organic pesticides are an important type of pesticide for farmers practicing organic agriculture, as they align with organic certification standards and are considered compatible with organic farming practices. This may act as one of the key drivers responsible for the growth of the organic pesticides market for botanical types. Furthermore, consumers are becoming more conscious of the impact of their purchasing choices on the environment and their health. The demand for pesticide-free or low-residue food products is increasing, driving the adoption of botanical organic pesticides as a safer and more sustainable pest control option.

In 2022, the herbicide segment was the largest revenue generator, and is anticipated to grow at a CAGR of 9.7% during the forecast period. Prolonged and extensive use of synthetic chemical herbicides has led to the development of herbicide-resistant weed populations. Organic herbicides with different modes of action offer alternative control options for weeds that have developed resistance to conventional herbicides. Their use supports resistance management strategies and helps maintain effective weed control in agricultural systems. Additionally, the adoption of organic herbicides helps ensure effective weed management while meeting the growing demand for environmentally friendly and healthier food options. These factors may drive the demand for organic herbicides in the organic pesticides market.

In 2022, the powder segment was the largest revenue generator, and is anticipated to grow at a CAGR of 9.9% during the forecast period. Powder or granule form of organic pesticides possess various significant characteristics such as application flexibility, long-lasting effect, enhanced stability, ease of storage & transportation, reduced risk of drift, and others which in turn has surged the demand for powdered or granulated form of organic pesticides; thus, fueling the market growth. Furthermore, powder or granule organic pesticides can contribute to water conservation and efficiency in pest management. Unlike liquid formulations that require dilution with water, powder or granule pesticides can be directly applied to the target area without the need for additional water. This can be advantageous in regions facing water scarcity or in situations where water use needs to be minimized. This factor may further aid the demand for organic pesticides market for powder or granules type.

By application, the cereals and pulses segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 9.9% during forecast period. he demand for organic cereals and pulses is increasing as consumers become more conscious of the chemicals used in food production. Using organic pesticides in cereal and pulse cultivation offers a pesticide-free or low-residue option for consumers who prioritize food safety and seek healthier alternatives. This may act as one of the key drivers responsible for the growth of the organic pesticides market for cereals and pulses.

Furthermore, there is a growing interest in organic and sustainable farming practices across the agricultural industry. Farmers and consumers alike recognize the importance of reducing the environmental impact of farming and preserving natural resources. The use of organic pesticides in cereal and pulse cultivation aligns with these principles, as organic farming promotes soil health, biodiversity, and the overall sustainability of agricultural ecosystems. These factors altogether may surge the demand for organic pesticides for growing cereals and pulses.

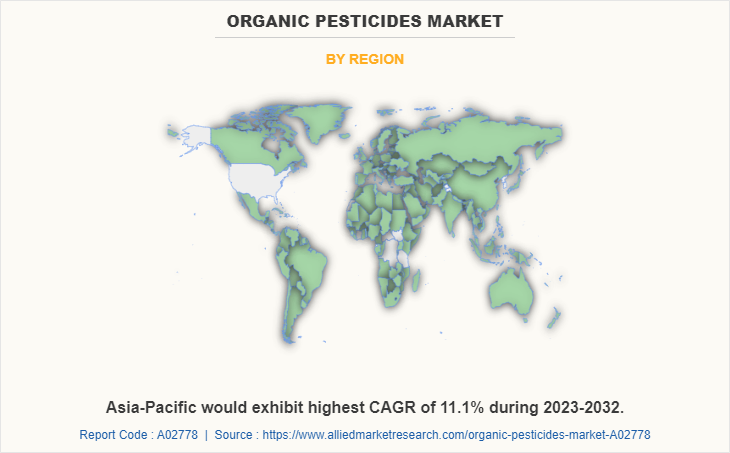

The Asia-Pacific organic pesticides market size is projected to grow at the highest CAGR of 11.1% during the forecast period and accounted for 24.5% of organic pesticides market share in 2022. The organic pesticides market in the Asia-Pacific region has been growing rapidly due to increasing consumer awareness and demand for organic products. The region has a large population, and consumers are becoming more conscious of the potential health and environmental impacts of synthetic pesticides. As a result, there is a growing preference for organic alternatives. According to a report by Research and Markets, the Asia-Pacific organic pesticides market is expected to grow at a compound annual growth rate (CAGR) of around 7% during the forecast period.

Moreover, organic agriculture is gaining momentum in the Asia-Pacific region, creating opportunities for the organic pesticides market. Governments in countries such as India, China, and Japan are promoting organic farming through policy support, subsidies, and awareness campaigns. For instance, India has implemented the National Program for Organic Production (NPOP) to facilitate the adoption of organic farming practices. The increasing adoption of organic agriculture practices provides a favorable environment for the growth of the organic pesticides market in the region.

The global organic pesticides market profiles leading players that include Andermatt Group AG, Arysta LifeScience Corporation., Bayer AG, Certis USA LLC, Dow Inc., Mark Agri Genetics Pvt. Ltd., Parry America, Inc., Redox Industries Limited., Satpura Bio Fertiliser India Pvt Ltd, and Sikkoindia. The global organic pesticides market report provides in-depth competitive analysis as well as profiles of these major players.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the organic pesticides market analysis from 2022 to 2032 to identify the prevailing organic pesticides market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the organic pesticides market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global organic pesticides market trends, key players, market segments, application areas, and market growth strategies.

Organic Pesticides Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.6 billion |

| Growth Rate | CAGR of 9.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 408 |

| By Product Type |

|

| By Application |

|

| By Type |

|

| By Form |

|

| By Region |

|

| Key Market Players | Arysta LifeScience Corporation., Mark Agri Genetics Pvt. Ltd., Satpura Bio Fertiliser India Pvt Ltd, Certis USA LLC, Parry America, Inc., Bayer AG, Dow Inc., Andermatt Group AG, Redox Industries Limited., sikkoindia |

Analyst Review

The global organic pesticides market is expected to exhibit high growth potential, owing to its use in the pest control in organic farming, integrated pest management (IPM), gardening and landscaping, public spaces & parks, pest control in organic food storage, and others. Moreover, there has been a significant rise in consumer demand for organic food products. Consumers are becoming more aware of the potential health and environmental risks associated with synthetic chemical pesticides used in conventional agriculture. As a result, farmers are increasingly transitioning to organic farming practices, which require the use of organic pesticides to meet certification standards.

Furthermore, governments and regulatory agencies in many countries are promoting sustainable agriculture and organic farming practices. They are implementing stricter regulations on the use of synthetic chemical pesticides and providing incentives and support for organic farming. This regulatory support has contributed to the increased demand for organic pesticides as farmers seek alternatives to conventional pesticides.

CXOs further added that sustained economic growth coupled with rapid development of organic farming sector may lead the organic pigments market to witness a significant growth.

Increasing consumer preference for organic products, government regulations, growing environmental concerns, and technological advancements are the upcoming trends of organic pesticides market.

Cereals and pulses is the leading application of organic pesticides market.

North America is the largest regional market for organic pesticides.

The organic pesticides market was valued for $3.0 billion in 2022 and is estimated to reach $7.6 billion by 2032, exhibiting a CAGR of 9.7% from 2023 to 2032.

Andermatt Group AG, Arysta LifeScience Corporation., Bayer AG, Certis USA LLC, Dow Inc., Mark Agri Genetics Pvt. Ltd., Parry America, Inc., Redox Industries Limited., Satpura Bio Fertiliser India Pvt Ltd, and Sikkoindia are the top companies that hold prominent market share in organic pesticides market.

Loading Table Of Content...

Loading Research Methodology...