Orthobiologics Market Outlook - 2025

The global orthobiologics market was valued at $4,870 million in 2017 and is projected to reach $6,870 million by 2025, registering a CAGR of 4.3% from 2018 to 2025.

Orthobiologics are also called regenerative cellular therapies. Products related to orthobiologics contain growth factors or sometimes secrete growth factors to facilitate tissue healing, improve pain, and help restore the normal functioning. There are various types of orthobiologics present in the market, which rely on different mechanism of actions. An autologous is derived from patients own body, which under right conditions divide to form precursor cells. Orthobiologics find their application for the treatment of conditions such as fracture recovery, spinal fusion, and others. These are also available as hip, knee, ankle, spine wrist and other body parts. Orthobiologics mainly help in faster healing of injuries.

Surge in geriatric population across the globe, which is prone to various diseases such as osteoarthritis and others boost the growth of the orthobiologics market. Increase in awareness of orthobiologics and rise in demand for advanced treatment are other factors expected to boost the expansion of the market. Other key factors that are responsible for the growth of the orthobiologics market are surge in obesity and rise in number of sports accidents and road accidents.

Moreover, high growth potential in developing nations and upsurge in demand for advanced treatment are expected to create new opportunities for the market players during the forecast period. However, higher cost of orthobiologics and stringent approval process are the major factors that impede the growth of the market.

Global Orthobilogics Market Segmentation

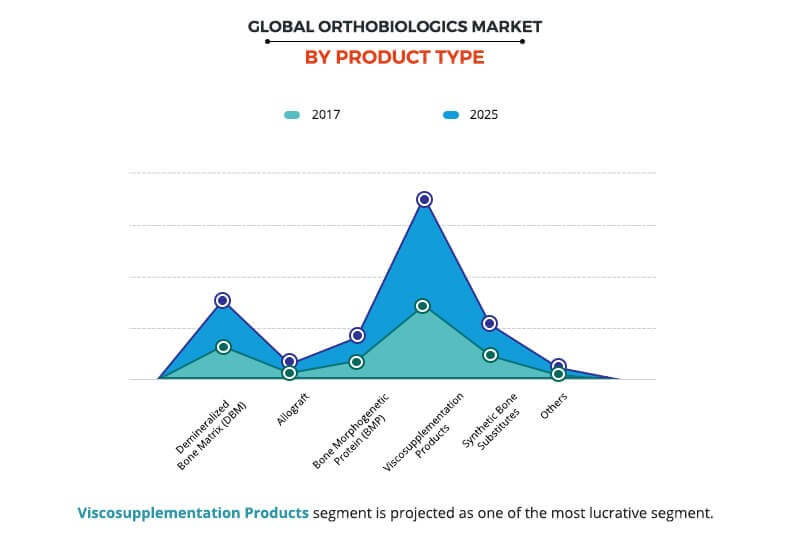

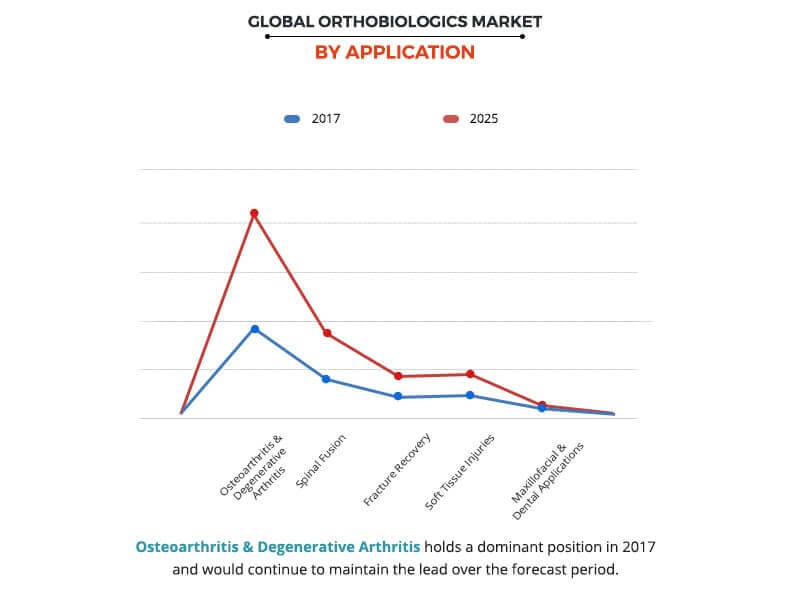

The global orthobiologics market is segmented based on product, application, type, end user, and region. Based on product, the market is classified into demineralized bone matrix (DBM), allograft, bone morphogenetic protein (BMP), Viscosupplementation products, synthetic bone substitutes, and others. Based on type, the market is categorized into knee, ankle, hip, wrist & shoulder, spine, and others. Based on end user, the market is divided into hospitals & ambulatory centers, research & academic institute, and dental clinics. Based on application, the market is further fragmented into osteoarthritis & degenerative arthritis, spinal fusion, fracture recovery, soft tissue injuries, and maxillofacial & dental applications.

Based on region, it is studied across North America (U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

Segment review

According to product, the Viscosupplementation product segment occupied the largest orthobiologics market share in 2017. This is due to better reimbursement scenario for the products as these are approved by the U.S. FDA. Moreover, the reimbursement scenario is expected to further increase the use of Viscosupplementation. France has a well-defined reimbursement policy for viscosupplementation products. In addition, the viscosupplementation product is also the fastest growing segment during the forecast period registering a CAGR of 4.8% from 2018 to 20205. This is attributed to the increase in geriatric population, rise in prevalence of osteoarthritis, and growth in lifestyle-induced disorders, such as obesity.

According to application, the osteoarthritis & degenerative arthritis segment occupied the largest orthobiologics market share in 2017. This is due to presence of huge geriatric population, which is more prone to osteoarthritis. The spinal fusion segment is the fastest growing segment during the forecast period owing to the benefits offered by orthobiologics in the treatment spine such as biological healing that promotes the spinal fusion process.

Snapshot of Asia-Pacific orthobiologics market

Asia-Pacific occupies a significant share of the orthobiologics market size and possesses high growth potential, owing to rise in geriatric population and surge in obesity. Moreover, increase in disposable income; surge in research, development, & innovation activities; and rise in awareness related to use of orthobiologics are other factors that contribute toward the growth of the orthobiologics market in this region. In addition, rise in number of sports related accidents and road accidents fuel the orthobiologics market growth.

The other factors which contribute towards the growth of orthobiologics market in Asia-Pacific include the rise in prevalence of chronic arthritis, osteoarthritis and other orthopedic conditions. These aforementioned factors have led to a rise in demand for orthobiologics in Asia-Pacific.

The report provides an extensive competitive analysis and profiles of the key market players such as Stryker Corporation, Zimmer Biomet Holdings, Inc., Wright Medical Group, Inc., Integra LifeSciences Holdings Corporation, Arthrex, Inc. (Arthrex), Johnson and Johnson (J&J), Exactec Inc., Medline Industries, Inc., Globus Medical, Inc., and NuVasive Inc.

The other players in the value chain include Kuros Biosciences AG, XTANT MEDICAL, and Bioventus.

Key Benefits for Orthobiologics Market:

- This report entails a detailed quantitative analysis along with current orthobiologics market trends of the orthobiologics market from 2017 to 2025 to identify the prevailing opportunities along with strategic assessment of the global orthobiologics market.

- The orthobiologics market forecast is studied from 2018 to 2025.

- The orthobiologics market size and estimations are based on a comprehensive analysis of key developments in the orthobiologics industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the global orthobiologics market.

Orthobiologics Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By APPLICATION |

|

| By Type |

|

| By END USER |

|

| By Region |

|

| Key Market Players | MEDLINE INDUSTRIES, INC., NUVASIVE INC., ARTHREX, INC., ZIMMER BIOMET HOLDINGS, INC, STRYKER CORPORATION, WRIGHT MEDICAL GROUP, INC., EXACTECH, INC., GLOBUS MEDICAL INC., INTEGRA LIFESCIENCES HOLDINGS CORPORATION (DERMA SCIENCES INC.), JOHNSON & JOHNSON (DEPUY SYNTHES) |

Analyst Review

Orthobiologics are biological substances designed with the capability to promote healing of the cartilage, ligament, muscle tendon, and others. Orthobiologics constitute of stem cells, extracellular membrane, platelet rich plasma (PRP), and others. These are available demineralized bone matrix (DBM), allograft, bone morphogenetic protein (BMP), viscosupplementation products, synthetic bone substitutes, and other types. Orthobiologics are used in the treatment of various diseases such as osteoarthritis & degenerative arthritis spinal fusion, fracture recovery, and soft tissue injuries. These are also used in maxillofacial & dental applications. The key factor responsible for the growth of orthobiologics market is rise in geriatric population, which is more prone to diseases such as osteoarthritis and others. The other factors that drive the growth of this market include increase in number of road accident & sports related accidents, surge in obesity across the globe, and rise in awareness among patients and athletes related to the use of orthobiologics.

North America accounted for the highest market share in 2017, due to availability of orthobiologics, increased in obesity, and favorable reimbursement rates, followed by Europe and Asia-Pacific. In addition, pharmaceutical companies have focused on expanding their presence in emerging economies, which is anticipated to drive the market growth.

Loading Table Of Content...