Orthopedic 3D Printing Devices Market Research, 2032

The global orthopedic 3D printing devices Market size was valued at $2 billion in 2022, and is projected to reach $5.3 billion by 2032, growing at a CAGR of 11.2% from 2023 to 2032. 3D printing is commonly used in orthopedics to create custom implants, devices, and instruments. One significant advantage of 3D printing in the orthopedic profession is for testing and planning. In orthopedics, 3D printing has also been used for preoperative planning and teaching students and patients about procedures. It is critical to be able to test therapies or implants on precise replicas.

The ability to customize and personalize implants and prosthetics for specific patients are made possible by the use of orthopedic 3D printing devices. Traditional orthopedic devices typically use a uniform, one-size-fits-all approach that may also not fully line with each patient's specific anatomical requirements. This can result in suboptimal fit, discomfort, and restricted functionality. Moreover, the customization and personalization provided by using 3D printing technology offer several benefits. Customized devices can closely replicate the patient's natural anatomy, facilitating applicable alignment, biomechanical function, and reduced threat of complications. In addition, personalized orthopedic devices can enhance affected person’s comfort. They are designed to conform to the patient's unique shape and contours, reducing pain and providing an extra natural feel. By eliminating the need for excessive padding or adjustments, 3D-printed devices can improve usual patient satisfaction and quality of life. These advancements in orthopedic 3D printing technology are projected to significantly drive the market revenue growth.

Strict regulatory guidelines (particularly in the U.S.) are a major factor restraining the growth of the orthopedic 3D printing devices market size. In the U.S., it takes about 3 to 7 years for a new device to prove medically safe. By law, even new sizes of devices that have already been approved must go through an entire process before being released in the market. While manufacturing customized products/devices, companies need to go through a lengthy process where every part of the device must be individually tested and approved. All these factors are anticipated to restrain the orthopedic 3D printing devices market growth during the forecast period.

The market for orthopedic 3D printing devices has a sizable opportunity due to ongoing technological advancements. Ongoing advancements in 3D printing materials, such as biocompatible polymers and metal alloys, offer new possibilities for orthopedic implants. These materials can provide the required mechanical properties, biocompatibility, and durability needed for long-term implant success. Moreover, the development of bioresorbable materials allows for the creation of temporary implants that gradually dissolve as the patient's natural bone regenerates. Orthopedic implants can be designed with more intricate and complex geometries with improved print resolution and expanded material options. This opens possibilities for creating implants with optimized structures, such as lattices, that can mimic the properties of natural bone and promote bone growth. Advanced design capabilities can also lead to the development of patient-specific instruments and surgical guides, improving surgical precision. In addition, faster printing speeds and improved software algorithms contribute to shorter manufacturing times for orthopedic implants. This can lead to reduced waiting times for patients and increased efficiency in healthcare facilities. Accelerated production also enables better inventory management, as implants can be manufactured on demand, reducing the need for stockpiling. All these factor are anticipated to boost the orthopedic 3D printing devices market opportunity.

The key players profiled in this report include Stryker, 3D Systems Corp, ENVISIONTEC US LLC, EOS GmbH Electro Optical Systems, General Electric, Smith & Nephew, Johnson & Johnson, Abbott, Zimmer Biomet Holding Inc., and Aspect Biosystems Ltd.

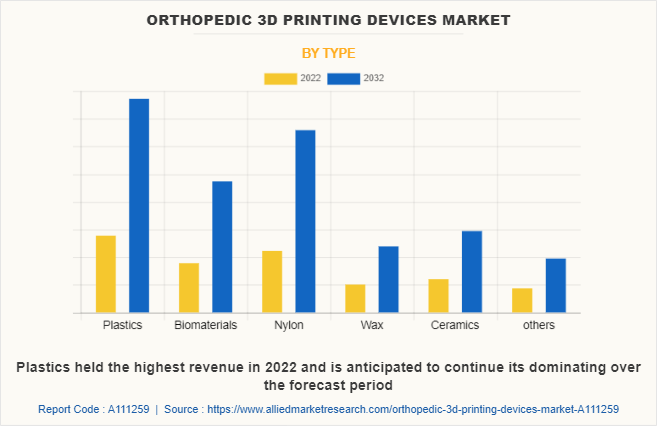

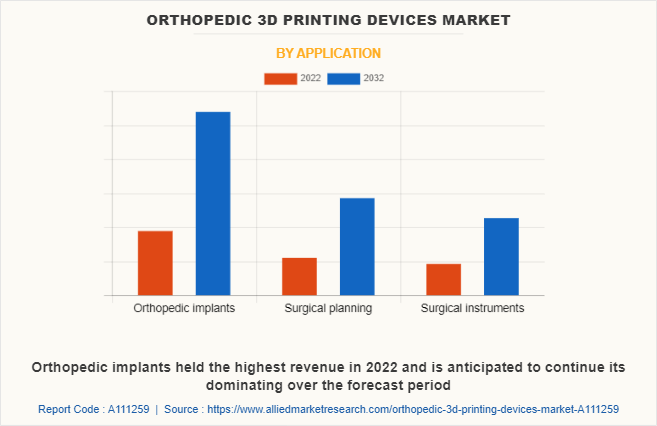

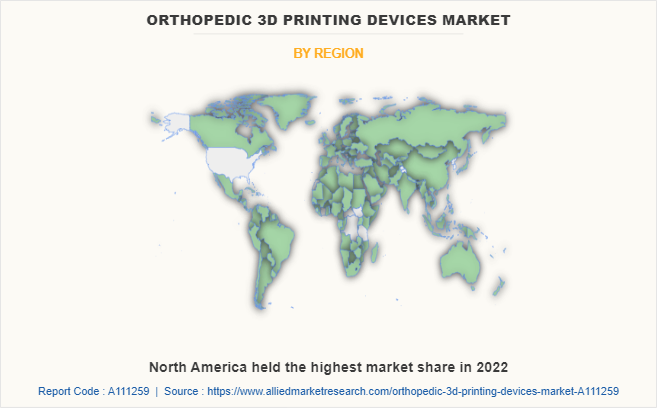

The orthopedic 3D printing devices market is segmented on the basis of type, application, and region. By type, the market is divided into plastics, biomaterials, nylon, wax, ceramics, and others. By application, the market is classified into orthopedic implants, surgical planning, and surgical instruments. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The orthopedic 3d printing devices market is segmented into Type and Application.

By type, the plastics sub-segment dominated the orthopedic 3D printing devices market share in 2022. Plastics are used in the global orthopedic 3D printing devices market to make devices like knee joints and bones. Plastics play an important role in the medical device industry due to their unique properties such as incompatibility, low cost, and ready availability. Therefore, it has become an essential material that is widely used in a variety of applications, including surgical implants and instruments. Furthermore, plastic 3D printing can be used to make lightweight orthopedic tools without sacrificing strength or longevity. This is particularly useful for equipment like prostheses, which can increase patient comfort and mobility by reducing weight. All of these factors are expected to drive the plastics segment growth of the orthopedic 3D printing devices market.

By application, the orthopedic implants sub-segment dominated the global orthopedic 3D printing devices market share in 2022. A rise in the number of patients seeking orthopedic implant surgery is likely to drive the orthopedic implants sub-segment growth. The rising number of hospitals and ambulatory surgery centers, as well as the aging population, are important factors driving the demand for orthopedic equipment. Other factors driving the global market include an increase in the number of injuries caused by accidents, sports, and adventure, an increase in the usage of technologically advanced devices, and an increase in government initiatives to satisfy unmet medical needs.

By region, North America dominated the global market in 2022 and is projected to be the fastest-growing region during the forecast period. In the U.S., the increasing prevalence of orthopedic diseases such as osteoporosis and other bone related diseases, and the increasing risk of fractures due to an aging population, are expected to increase the demand for orthopedic procedures. According to a 2021 Lancet article, the incidence of new fractures was reported to be 178 million instances globally, with a prevalence of 455 million fracture cases. The rising occurrence of fractures is expected to lead to an increase in demand for orthopedic treatments and an increase in implant usage. These are the major factors projected to drive the regional market growth during the orthopedic 3D printing devices market forecast period.

Impact of COVID-19 on the Global Orthopedic 3D Printing Devices Industry

- The pandemic caused disruptions in supply chains, affecting the production and distribution of various medical devices, including orthopedic 3D printing devices. Restrictions on manufacturing, transportation, and trade have led to delays in the delivery of components, equipment, and materials, affecting the overall orthopedic 3D printing devices industry.

- Moreover, many countries implemented measures to prioritize COVID-19 patients and reduce the burden on healthcare systems. Therefore, elective surgeries, including orthopedic procedures, were postponed or canceled. This had a significant impact on the demand for orthopedic 3D printing devices, as hospitals and healthcare facilities focused on urgent and essential treatments.

- During the initial stages of the pandemic, there was a surge in demand for personal protective equipment (PPE) such as masks, face shields, and ventilators. Some 3D printing companies shifted their production capabilities to address the immediate need for PPE, diverting resources from orthopedic 3D printing devices.

- Furthermore, to minimize patient contact and reduce the risk of transmission, healthcare providers embraced telemedicine and remote technologies. This shift affected the demand for certain orthopedic devices, including 3D-printed implants and prosthetics. However, it also created new opportunities for the development of customized and patient-specific devices that can be remotely designed and manufactured using 3D printing technology.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the orthopedic 3d printing devices market analysis from 2022 to 2032 to identify the prevailing orthopedic 3d printing devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the orthopedic 3d printing devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global orthopedic 3d printing devices market trends, key players, market segments, application areas, and market growth strategies.

Orthopedic 3D Printing Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.3 billion |

| Growth Rate | CAGR of 11.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Abbott, 3D Systems Corp, Johnson & Johnson, Stryker, Zimmer Biomet Holding Inc., Smith & Nephew, General Electric, EOS GmbH Electro Optical Systems, ENVISIONTEC US LLC, Aspect Biosystems Ltd. |

The traditional manufacturing methods for orthopedic implants often involve complex processes. With 3D printing, the production process can be streamlined, reducing material waste, and eliminating the need for specialized tooling. This can lead to cost savings for healthcare providers and patients, which is estimated to generate excellent opportunities in the orthopedic 3D printing devices market.

The major growth strategies adopted by orthopedic 3D printing devices market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global orthopedic 3D printing devices market in the future.

Stryker, 3D Systems Corp, ENVISIONTEC US LLC, EOS GmbH Electro Optical Systems, and General Electric are the major players in the orthopedic 3D printing devices market.

The plastics sub-segment of the type acquired the maximum share of the global orthopedic 3D printing devices market in 2022.

Hospitals & clinics and orthopedic surgeons are the major customers in the global orthopedic 3D printing devices market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global orthopedic 3D printing devices market from 2022 to 2032 to determine the prevailing opportunities.

The prevalence of orthopedic disorders and injuries, such as osteoarthritis, fractures, and sports injuries, is increasing globally. This rising patient population requires innovative solutions for orthopedic treatments. 3D printing provides a promising technology to address these needs by offering patient-specific implants and devices, which is estimated to drive the adoption of orthopedic 3D printing devices.

Regulatory agencies, such as the U.S. Food and Drug Administration (FDA), have been actively involved in supporting the adoption of 3D printing in the healthcare industry. They have provided guidelines and clearances for the use of 3D-printed medical devices, including orthopedic implants. Regulatory support has encouraged manufacturers and healthcare providers to explore and adopt 3D printing technology, which is anticipated to boost the orthopedic 3D printing devices market in the upcoming years.

Loading Table Of Content...

Loading Research Methodology...