Orthopedic Implants Market Research, 2033

The global orthopedic implants market size was valued at $49.4 billion in 2023, and is projected to reach $76.4 billion by 2033, growing at a CAGR of 4.4% from 2024 to 2033. Major factors drive the orthopedic implants market growth include rising incidence of orthopedic conditions and musculoskeletal disorders, technological advancements in implant materials and designs, increasing demand for minimally invasive surgical procedures, and expanding access to healthcare services in developing regions.

Market Introduction and Definition

Orthopedic implants encompass medical devices designed to replace or support damaged or diseased bones and joints. These implants are commonly used in orthopedic surgeries to restore mobility, relieve pain, and improve the quality of life for patients suffering from conditions such as arthritis, fractures, or sports injuries. Orthopedic implants can range from screws and plates for fracture fixation to joint replacements like hip and knee prostheses. These implants are meticulously engineered to mimic the function and structure of natural bones and joints, facilitating better patient outcomes and enhancing overall orthopedic care.

Key Takeaways

- The orthopedic implants market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major orthopedic implants industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The main factor which contributes to the growth of the global orthopedic implant market is rise in number of orthopedic disorders such as impairments in the muscles, bones, joints, and adjacent connective tissues leading to temporary or lifelong limitations in functioning and participation. For instance, a report by Centers for Disease Control and Prevention (CDC) 2021, estimated 78.4 million adults aged 18 years and older will have doctor-diagnosed arthritis by 2040. Thus, the rise in orthopedic disorders results in demand for orthopedic implants, thereby driving the orthopedic implants market size.

In addition, technological advancements have led to significant improvements in the design and materials used in orthopedic implants, which have made them more effective and durable, thus driving the growth of the market. For instance, Cuvis Joint Robotic System developed the most advanced surgical cutting-edge robotic technology supporting surgeons with personalized preplanning and obtain precise results for knee replacement surgeries. Thus, such advancements and adoption of orthopedic implant system are expected to drive the market growth.

Further, the geriatric population is prone to many orthopedic disorders such as arthritis, back pain, and neck pain, which results in rise in demand for orthopedic implants thereby provides orthopedic implants market opportunity. For instance, data by the World Health Organization (WHO) 2021 stated that 1.4 billion of the world’s population is aged 60 years and over and is expected to double by 2050. However, the high cost of orthopedic implant and limited reimbursement policies by insurance companies make them less accessible to patients which may restrain the market growth. On the other hand, a rise in regulatory approvals for orthopedic implants for various new applications, rise in adoption of orthopedic implant, and rise in demand of orthopedic implants for joint disorders is expected to drive the growth during the orthopedic implants market forecast period.

Prevalence Statistics of Orthopedic Disorders

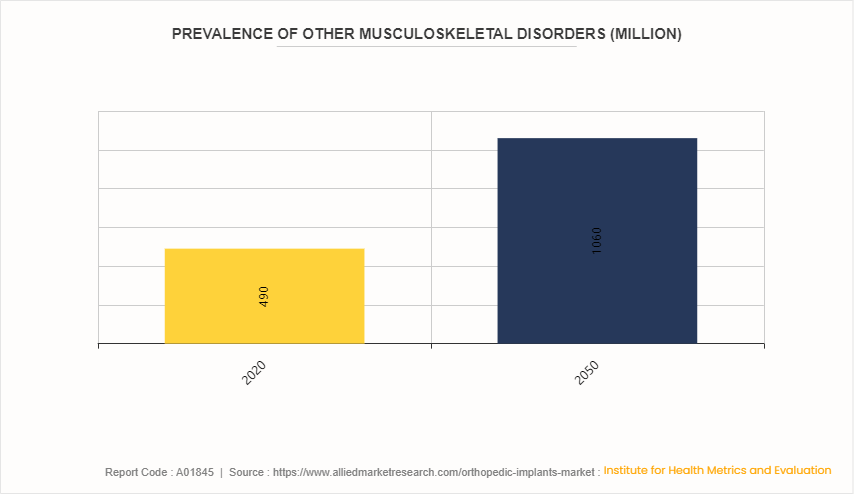

Rise in number of orthopedic disorders such as impairments in the muscles, bones, joints, and adjacent connective tissues, leading to temporary or lifelong limitations in functioning and participation. In addition, rise in number of people suffering from other musculoskeletal disorders such as carpal tunnel syndrome, Fibromyalgia, osteoarthritis, and others drive the demand for orthopedic implants. For instance, according to the Institute for Health Metrics and Evaluation, cases of other musculoskeletal disorders are projected to increase by 116% from 2020 to 2050, to an estimated 1, 060 million. In addition, according to data by the World Health Organization (WHO) 2022, 1.71 billion people have musculoskeletal conditions, including low back pain, neck pain, fractures, other injuries, osteoarthritis, amputation, and rheumatoid arthritis.

Market Segmentation

The orthopedic implants market is segmented into product type, biomaterial, type, and region. On the basis of product type, the market is segmented into reconstructive joint replacements, spinal implants, dental implants, trauma, orthobiologics, and others. The reconstructive joint replacements segment is further segmented into knee replacement implants, hip replacement implants, extremities that include upper extremity reconstruction, and lower extremity reconstruction.

In addition, the spinal implants segment is further segmented into spinal fusion implants, vertebral compression fracture (VCF) devices, and motion preservation devices/non-fusion devices. Furthermore, dental implant is further segmented into root form dental implants and plate form dental implants. On the basis of biomaterial, the market is categorized into metallic biomaterials, ceramic biomaterials, polymers biomaterials, and others. On the basis of type, the market is classified into knee, hip, wrist & shoulder, dental, spine, ankle, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America, dominated the orthopedic implants market share in 2023. This is attributed to advanced healthcare infrastructure present in North America facilitates the delivery of orthopedic care. Access to state-of-the-art medical facilities, specialized orthopedic surgeons, and cutting-edge technology ensures that patients have access to high-quality treatment options, including various types of orthopedic implants. The Asia-Pacific region, encompassing countries such as China, Japan, India, and South Korea, presents significant opportunities in the orthopedic implant market. The region's large and diverse population base presents a significant pool of potential patients requiring orthopedic interventions. As lifestyles change and populations age, the prevalence of orthopedic conditions such as osteoarthritis and fractures is expected to rise, thus driving the demand for orthopedic implants.

In September 2023, an article published by the National Center for Biotechnology and Information (NCBI) stated that more than 1.5 million fractures each year occur due to osteoporosis in America. Approximately 50% of women and 25% of men aged 50 years and above are at risk of experiencing a fracture linked to osteoporosis.

In February 2021, the U.S. Food and Drug Administration approved the Patient Specific Talus Spacer 3D-printed talus implant for humanitarian use. The Patient Specific Talus Spacer is the first in the world and first-of-its-kind implant to replace the talus—the bone in the ankle joint that connects the leg and the foot—for the treatment of avascular necrosis (AVN) of the ankle joint.

Industry Trends

An article published by Australian Institute of Health and Welfare in 2023, estimated that 6.9 million or 27% of people in Australia were affected by chronic musculoskeletal conditions, on the basis of self-reported data from the Australian Bureau of Statistics (ABS) 2020–21 National Health Survey (NHS) .

An article published by the National Center for Biotechnology and Information (NCBI) in 2023, globally, 494 million people had other musculoskeletal disorders in 2020.

Competitive Landscape

The major players operating in the orthopedic implants market include Arthrex, Inc., Colfax Corporation (DJO, LLC) , CONMED CORPORATION, GLOBUS MEDICAL INC., Johnson & Johnson (DEPUY SYNTHES) , Medtronic Plc, NuVasive Inc., Smith & Nephew plc, Stryker Corporation, and Zimmer Biomet Holdings Inc. Other players in orthopedic implants market includes Vast Ortho, B. Braun SE, and so on.

Recent Key Strategies and Developments in Orthopedic Implants Industry

In May 2023, Stryker launched the Ortho Q Guidance system, enabling advanced surgical planning and guidance for hip and knee procedures, easily controlled by the surgeon from the sterile field. The system combines new optical tracking options via a redesigned, state-of-the-art camera with sophisticated algorithms of the newly launched Ortho Guidance software to deliver additional surgical planning and guidance capabilities.

In November 2022, NuVasive, Inc., the leader in spine technology innovation, focused on transforming spine surgery with minimally disruptive, procedurally integrated solutions, announced the commercial launch of the NuVasive Tube System (NTS) and Excavation Micro, a new minimally invasive surgery (MIS) system that provides comprehensive solutions for both TLIF and decompression.

In November 2022, Zimmer Biomet Holdings, Inc., a global medical technology leader, announced the U.S. Food and Drug Administration (FDA) 510 (k) clearance for the Persona OsseoTi Keel Tibia for cementless knee replacement.

In October 2022, Johnson & Johnson MedTech announced that DePuy Synthes, the Orthopedics Company of Johnson & Johnson, has received the U.S. Food and Drug Administration (FDA) approval for its TELIGENTM System, an integrated technology platform that enables minimally invasive surgical transforaminal lumbar interbody fusion (MIS-TLIF) procedures through digital tools for visualization and access.

Key Sources Referred

National Center for Biotechnology and Information (NCBI)

Centers for Medicare & Medicaid Services (CMS)

National Health Service (NHS)

Australian Government Department of Health and Aged Care

Government of Canada's Health and Wellness

Ministry of Health and Family Welfare (MoHFW)

National Health Mission (NHM)

Ayushman Bharat - Health and Wellness Centers (AB-HWCs)

Centers for Disease Control and Prevention (CDC)

Food and Drug Administration (FDA)

National Institutes of Health (NIH)

World Health Organization (WHO)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the orthopedic implants market analysis from 2024 to 2033 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the orthopedic implants market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global orthopedic implants market trends, key players, market segments, application areas, and market growth strategies.

Orthopedic Implants Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 76.4 Billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 351 |

| By Product Type |

|

| By Biomaterial |

|

| By Type |

|

| By Region |

|

| Key Market Players | Colfax Corporation, Smith & Nephew plc, CONMED Corporation, Globus Medical, Inc., Zimmer Biomet Holdings Inc., NuVasive Inc., Stryker Corporation, Johnson & Johnson,, Arthrex, Inc., Medtronic plc |

Analyst Review

The adoption of orthopedic implants, such as orthobiologics, hip, and knee replacements implants, is expected to increase in the near future, owing to high prevalence of orthopedic diseases, such as arthritis and osteoporosis, and rise in geriatric population. The orthopedic implants market has garnered interest of healthcare providers due to the benefits offered in the effective treatment of orthopedic diseases. Significant technological advancements in orthopedic implants have had a significant impact on orthopedic disease treatment. Currently, joint replacement and reconstruction procedures are widely adopted in clinical practice, owing to their benefits, such as improved patient outcomes and pain relief. Asia-Pacific and LAMEA are expected to offer lucrative opportunities to market players, as the markets in developed nations are saturated with large number of orthopedic implants.

The global market is driven by emergence of new trends in the orthopedic implants industry, growth in incidence of chronic orthopedic diseases, rapid surge in aging population, technological advancements, rise in acceptance of orthopedic implants, and improvement of healthcare infrastructure in the emerging nations. However, this growth is restricted by high cost of these implants (especially in the developing nations) and stringent regulatory policies for their approval. Conversely, the emerging markets of the Asia-Pacific and LAMEA are expected to provide several growth opportunities during the forecast period.

Increase in obesity and rise in osteoporosis-related fracture in the U.S. are expected to maintain the demand for orthopedic interventions. In addition, the emerging markets have gained more importance for the majority of the orthopedic implant manufacturers and distributors. A rapid growth was observed in the shipments of these implants during the study period to provide improved healthcare services in the emerging nations, and is expected to offset the challenging conditions in the mature markets, such as North America and Europe. In addition, North America is expected to dominate the global orthopedic implants market during the forecast period, followed by Europe.

The major factor that fuels the growth of the orthopedic implants market are rise in prevalence of orthopedic injuries such as arthritis, osteoarthritis as well as rapid increase in the aging population globally who are more prone to orthopedic diseases.

Reconstructive joint replacements is the most influencing application in orthopedic implants market which is attributed to rise in prevalence of osteoporosis and osteoarthritis and investment by key players in R&D of orthopedic implants.

North America is the largest regional market for Orthopedic Implants.

The total market value of orthopedic implants market is $49.4 billion in 2023.

Top companies such as Johnson & Johnson, Zimmer Biomet Holdings, Inc., Stryker Corporation, Globus Medical Inc, and Smith & Nephew plc held a high market position in 2023. These key players held a high market position owing to the strong geographical foothold in different regions.

The forecast period for orthopedic implants market is 2024 to 2033.

The base year is 2023 in orthopedic implants market.

Orthopedic implants are medical devices surgically placed to replace or support damaged bones, joints, or cartilage. They are commonly used in procedures such as joint replacements, spinal fusions, and fracture fixation.

Loading Table Of Content...