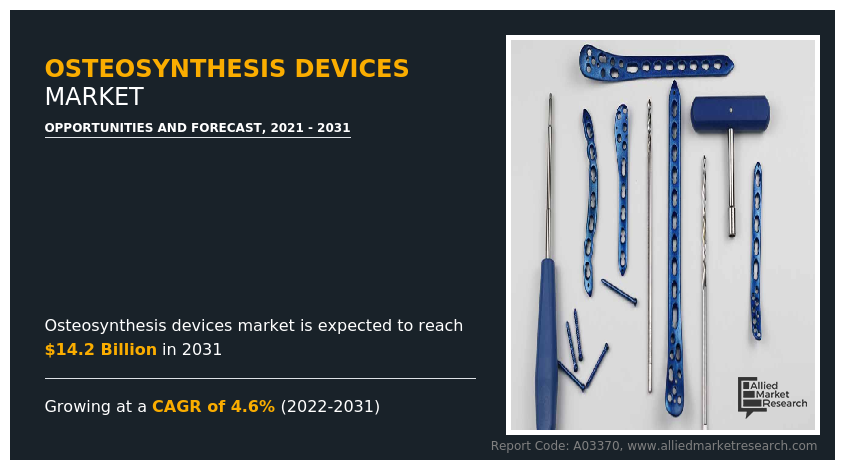

Osteosynthesis Devices Market Research, 2031

The global Osteosynthesis Devices Market Size was valued at $9,061.20 million in 2021 and is estimated to reach $14,214.92 million by 2031, growing at a CAGR of 4.6% from 2022 to 2031. Osteosynthesis devices are medical implants used to stabilize and support broken or fractured bones during the healing process. These devices are designed to hold bone fragments together in the correct position to allow new bone tissue to grow and fuse the fragments back into a single, solid bone. Osteosynthesis devices such as screws & plates, wires & pins, intramedullary rods & nails, and spinal fixation devices are used for joining the ends of a broken bone after a fracture, an osteotomy, or a non-union from a previous fracture.

Historical overview

The Osteosynthesis Devices Market Size was analyzed qualitatively and quantitatively from 2018 to 2020. Most of the growth during this period was derived from the Asia-Pacific, owing to the rise in the prevalence of sports-related injuries and road accidents. In addition, rise in disposable incomes, as well as the well-established presence of key pharmaceutical device manufacturers in the region.

Market dynamics

The key factor that drives the growth of the market is a rise in the number of sports injuries which has led to increasing in the demand for osteosynthesis devices for the treatment of various fractures across the world. For instance, according to a John Hopkins Medicine article, 30 million individuals participate in organized sports, resulting in more than 3.5 million sports injuries annually in the U.S.

Moreover, the rise in the incidence of road accidents further led to fractures which further boost the growth of market. For instance, according to the data of the World Health Organization, in June 2021, about 1.3 million people die every year due to road traffic accidents and about 20 to 50 million people suffer from non-fatal injuries, with many incurring disabilities owing to the injury.

In addition, osteoporosis is a disease in which bones become very weak and are more likely to break. Therefore, the rise in the prevalence of orthopedic disorders such as arthritis and osteoporosis drives the growth of the osteosynthesis devices market. For instance, according to the American Academy of Orthopedic Surgeons 2019, an estimated 54 million Americans have either osteoporosis or low bone mass. Moreover, in old age, the body builds fewer new bone cells to replace the old bone cells. Therefore, older people are at greater risk for osteoporosis and fracture. Thus, a rise in the geriatric population is more susceptible to bone fracture is anticipated to drive the demand for osteosynthesis devices.

Furthermore, the launch of novel osteosynthesis devices by key players provides a lucrative opportunity for the growth of the osteosynthesis devices market during the forecast period. For instance, in May 2020, Precision Spine, Inc., a medical device company, announced the national launch of Simplicity HP Anterior Cervical Plating (ACP) System, which enables surgeons to accommodate diverse patient anatomies and pathologies with low profile constrained semi-constrained or hybrid constructs.

The overall impact of the COVID-19 pandemic was negative on the osteosynthesis devices market owing to the cancellation of appointments with doctors and postponed surgeries. For instance, according to a study published in the British Journal of Surgery, in May 2020, based on 12 weeks of peak disruption to hospital services due to COVID-19, around 28.4 million elective surgeries worldwide were canceled or postponed in 2020. In addition, according to a study conducted by an international consortium in May 2020, more than 580,000 planned surgeries in India might be canceled or delayed due to the COVID-19 pandemic. Thus, with the delay of these non-emergent services, the demand for osteosynthesis devices decreases.

In addition, with the pandemic, researchers identify an alarming shortage of critical osteosynthesis devices. According to the review article “Effects of COVID-19 pandemic in the field of orthopedics” of National Library Medicine, published in 2020, performing orthopedics surgery has become a significant challenge with the non-availability of hospital staff and operation facilities during COVID-19. It had a significant effect on the manufacturing of osteosynthesis devices including orthopedic implants, prosthetics, tools, orthopedic biomedicine, and routine ongoing research and development.

Furthermore, the overall impact of the COVID-19 pandemic had negative for key players in the osteosynthesis devices market industry. For instance, 12-month revenue from Zimmer Biomet declined by 12% to around $7 billion in 2020, while orthopedics’ revenue from Johnson and Johnson decreased by 12.2% to nearly $7.8 billion. Stryker Orthopedics’ organic net sales decreased by 8.1% in 2020, including 6.6% from decreased unit volume and 1.5% from lower prices. Smith and Nephew reported a revenue loss of around 13% for its orthopedics and sports medicine business.

However, with relaxation in lockdowns, the positive impacts of vaccinations, and the decline in COVID-19 cases, companies have re-started their processes to meet the demand for products. In countries such as Japan and India, quarantine and the pandemic situation are improving and showing obvious signs of recovery. Various practitioners have started their service by implementing international and local guidance.

Furthermore, the osteosynthesis devices market witnessed an incline in the sales of osteosynthesis devices during the forecast period, owing to an increase in the number of patients for screening of orthopedic disorders, a rise in technological advancement in osteosynthesis devices, an increase in initiatives taken by the government to reduce the burden of orthopedic disorders, and increase in product launch. For instance, in September 2021, Precision Spine, Inc., a medical device company, announced the launch of the Dakota ACDF Standalone System in the treatment of degenerative disc disease (DDD). This system features a titanium plate polyetheretherketone (PEEK) cage with cortical cancellous screws for maximum support and a generous cavity for the autogenous bone graft to help facilitate fusion.

In addition, a rise in accidents, sports injuries, and a significant rise in the geriatric population are expected to witness the growth of the osteosynthesis devices market during the forecast period. Thus, such trends are expected to offer various lucrative Osteosynthesis Devices Market Opportunity during the forecast period.

Segmental Overview

The osteosynthesis devices market is segmented on the basis of device type, fracture type, end user, and region. On the basis of device type, the market is classified into internal fixation devices and external fixation devices. The internal fixation device segment is further divided into screws & plates, wires & pins, intramedullary rods & nails, and spinal fixation devices. The external fixation device segment is further divided into fracture fixation devices and bone lengthening devices. On the basis of fracture type, the market is classified into hip, knee, spine, shoulder, foot & ankle, facial bones, and others.

On the basis of end users, the market is classified into hospitals, orthopedic clinics, and ambulatory surgical centers. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

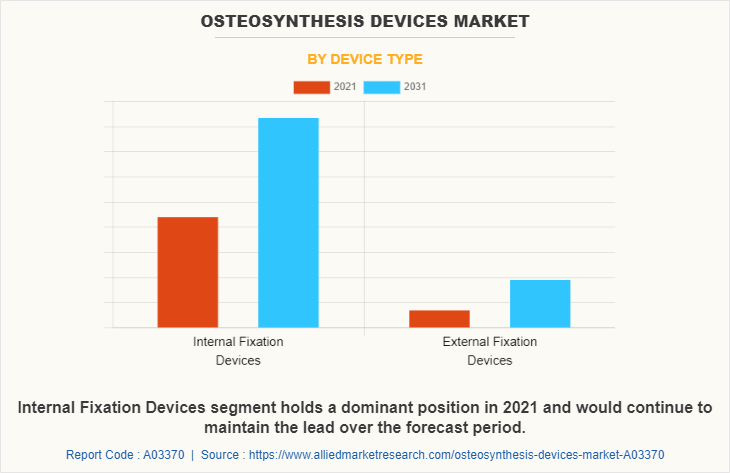

By Device Type

The osteosynthesis devices market is segmented into internal fixation devices and external fixation devices. The internal fixation device segment generated the maximum Osteosynthesis Devices Market share in 2021, owing to the high adoption of internal fixation devices, and the availability of various internal fixation devices such as screws and plates. The same segment is expected to witness the highest CAGR during the forecast period, owing to an increase in the use of internal fixation devices such as screws & plates, wires & pins, intramedullary rods & nails, and a rise in the prevalence of osteoporosis disease that further led to the fracture.

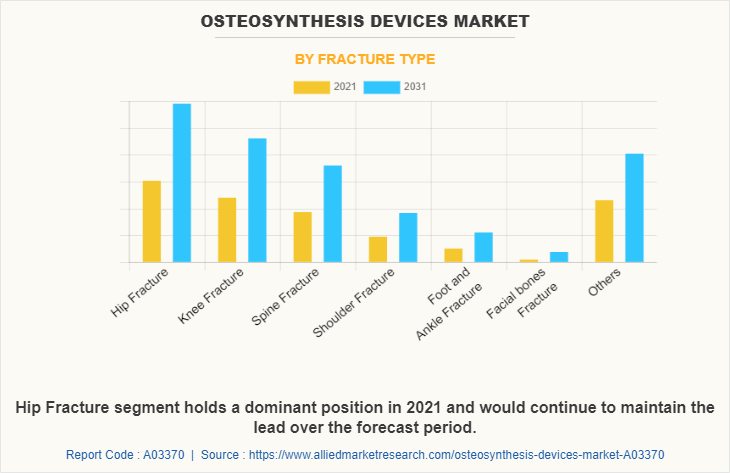

By Fracture Type

The osteosynthesis devices market is segregated into hip, knee, spine, shoulder, foot & ankle, facial bones, and others. The hip segment generated the maximum Osteosynthesis Devices Market share in 2021, owing to the high demand for osteosynthesis devices for hip fractures, and the high incidence of hip fractures. The same segment is expected to witness the highest CAGR during the forecast period, owing to a rise in accidental cases & sports injuries, and an increase in cases of hip fractures in elderly people.

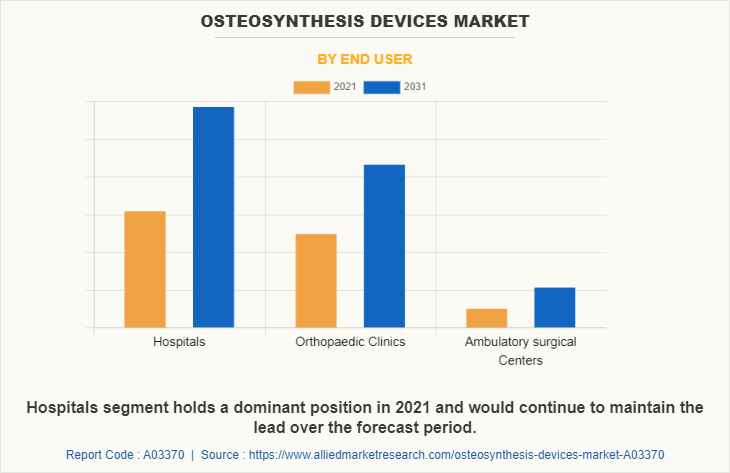

By End User

The Osteosynthesis Devices Industry is segregated into hospitals, orthopedic clinics, and ambulatory surgical centers. The hospital's segment generated maximum revenue in 2021, owing to an increase in health coverage for hospital-based treatment, an increase in hospital admission, and a higher preference for hospitals. The same segment is expected to witness the highest CAGR during the forecast period, owing to a rise in the prevalence of sports injuries, and road accidents which led to major fractures, and the presence of skilled orthopedic doctors in hospitals is the key factor that drives the growth of the market.

By Region

The Osteosynthesis Devices Industry market is studied across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the osteosynthesis devices market in 2021 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Arthrex, Inc., Johnson & Johnson (DePuy Synthes, Inc.), Globus Medical, Inc., GS Solutions, Inc., Life Spine, Inc., Precision Spine, Inc, Stryker Corporation, Zimmer Biomet Inc. and advancement in manufacturing technology of osteosynthesis devices in the region drive the growth of the market.

Furthermore, the existence of a sophisticated reimbursement structure that aims to reduce expenditure levels drives the growth of the market. Hence, such factors propel market growth. In addition, the U.S. is anticipated to contribute to a major share of the regional market and is expected to drive the growth of the osteosynthesis devices market throughout the forecast period. The presence of well-established healthcare infrastructure, high purchasing power, a rise in the adoption rate of osteosynthesis devices, and a significant rise in capital income in developed countries are expected to drive market growth.

Asia-Pacific is expected to grow at the highest rate during the osteosynthesis devices market forecast period. The osteosynthesis devices market growth in this region is attributable to the rise in the number of road accidents and orthopedic diseases in this region as well as growth in the purchasing power of populated countries, such as China and India. The countries in Asia-Pacific possess a huge population base, with China being the first having 1,397,715 population in 2020 and India being the second most populated country having 1,366,417.75 population in 2020.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the osteosynthesis devices market, such as Arthrex, Inc., Johnson & Johnson (DePuy Synthes, Inc.), Globus Medical, Inc., GS Solutions, Inc., Life Spine, Inc., Medtronic plc, Precision Spine, Inc, Smith & Nephew, Stryker Corporation, and Zimmer Biomet Inc. are provided in the report. There are some important players in the market such as Arthrex, Inc., Johnson & Johnson (DePuy Synthes, Inc.), Life Spine, Inc., Precision Spine, Inc, and Medtronic plc., which have adopted agreement, product development, product launch, and product approval, as key developmental strategies to improve the product portfolio of the osteosynthesis devices market.

Some examples of Product Approval in the market

- In March 2022, Life Spine, a medical device company that designs, develops, manufactures, and markets products for the surgical treatment of spinal disorders, received clearance from the U.S. Food & Drug Administration (FDA) to market SImpact Si Joint Fixation System for Posterior-Oblique approaches.

- In June 2021, Medtronic plc, one of the global leaders in medical technology, announced the U.S. Food and Drug Administration (FDA) approval of patient-specific UNiD Rods for use with Medtronic CD Horizon Solera Voyager and Infinity OCT spinal systems, expanding the utility of the company's UNiD Adaptative Spine Intelligence (ASI) technology. These are designed for each patient and industrially pre-bent prior to surgery to accurately match an artificial intelligence (AI)-driven pre-operative surgical plan.

Product Upgrade/development in the market

- In October 2021, Globus Medical, Inc., a leading musculoskeletal solutions company, announced to feature of its new ANTHEM Mini Fragment Fracture System at the annual Orthopedic Trauma Association (OTA) meeting in Fort Worth, Texas. This addition to the growing Globus trauma portfolio aligns with the upward trend among surgeons to supplement the treatment of complex long bone fractures with mini fragment plates.

Product Launch in the market

- In September 2021, Precision Spine, Inc., a medical device company, announced the launch of the Dakota ACDF Standalone System in the treatment of degenerative disc disease (DDD). This system features a titanium plate polyetheretherketone (PEEK) cage with cortical cancellous screws for maximum support and a generous cavity for the autogenous bone graft to help facilitate fusion.

- In June 2021, Johnson & Johnson (DePuy Synthes), a healthcare company announced the launch of 2.7 mm Variable Angle Locking Compression Plate (VA LCP) Clavicle Plate System for the treatment of lateral, shaft and medial fractures for small, medium, and large clavicles. This new system offers plate shapes that reflect the correlation between patient stature and clavicle size to match the bow and contour of the clavicle and accommodate a broad range of anatomic variability of the clavicle.

- In April 2020, Precision Spine, Inc., a medical device company, announced the national launch of ShurFit ACIF 2C Anterior Cervical, TLIF 2C, and TPLIF 2C Posterior Interbody Systems, which is made from medical grade polyetheretherketone (Peek Optima, LT1) and coated with both commercially pure Titanium (Ti) and Hydroxyapatite (HA).

- In March 2020, Precision Spine, Inc., a medical device company, announced the national launch of the SureLOK MIS 3L Percutaneous Screw System, which provides spine surgeons with outstanding versatility and flexibility in terms of procedural approaches and application of its various components.

Agreement in the market

- In December 2020, Globus Medical, Inc., a leading musculoskeletal solutions company, received an award for a group purchasing agreement with Premier, one of the largest group purchasing organizations in the U.S. The agreement covers Globus’ Trauma Platform, which includes ANTHEM Plating, AUTOBAHN Nailing, ARBOR External Fixation, and CAPTIVATE Screw Platforms.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the osteosynthesis devices market analysis from 2021 to 2031 to identify the prevailing osteosynthesis devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the osteosynthesis devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global osteosynthesis devices market trends, key players, market segments, application areas, and market growth strategies.

Osteosynthesis Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 14.2 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 256 |

| By Device Type |

|

| By Fracture Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Arthrex, Inc., Precision Spine, Inc., Medtronic plc, Johnson & Johnson, Globus Medical, Inc., GS Solutions, Inc., Stryker Corporation, Zimmer Biomet Holding Inc., Smith & Nephew plc, Life Spine, Inc. |

Analyst Review

This section provides opinions of top-level CXOs in the osteosynthesis devices market. The osteosynthesis devices market has witnessed growth, owing to an increase in the prevalence of osteoporosis and osteoarthritis, an increase in orthopedic injuries, and the launch of osteosynthesis devices.

According to the perspectives of CXOs, the global osteosynthesis devices market is expected to witness steady growth in the future. The rise in the prevalence of orthopedic disorders, a rise in cases of accidents & sports injuries, rise in awareness regarding the potential benefits of orthopedic implants have led to an increase in demand for osteosynthesis devices and boosted the growth of the market. Furthermore, the surge in the geriatric population who are susceptible to falls that cause fractures drives the growth of the osteosynthesis devices market. In addition, the increase in the preference of healthcare professionals for osteosynthesis devices, and the rise in acceptance of orthopedic implants, drive the growth of the osteosynthesis devices market.

North America is expected to witness the highest growth, in terms of revenue, owing to an increase in cases of orthopedic injuries, robust healthcare infrastructure, presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth, owing to an increase in the use of osteosynthesis devices to treat bone fracture, unmet medical demands, a high population base and an increase in public-private investments in the healthcare sector

The Upcoming trends are the rise in technological advancement in osteosynthesis devices, rise in the prevalence of orthopedic disorders such as osteoarthritis and osteoporosis that are more prone to fracture, as well a rise in the awareness of potential benefits of orthopedic implants drives the growth of the osteosynthesis devices market.

The total market value of the Osteosynthesis Devices is $14,214.92 Million in 2031

North America is the largest regional market for Osteosynthesis Devices

There are 10 Osteosynthesis Devices Market companies are profiled in the report

Arthrex, Inc., Johnson & Johnson (DePuy Synthes, Inc.), Globus Medical, Inc., GS Solutions, Inc., Life Spine, Inc., Medtronic plc are the top companies to hold the market share in Osteosynthesis Devices Market.

The forecast period in the report is from 2022 to 2031

The base year for the Osteosynthesis Devices Market report is 2021

Yes, the Osteosynthesis Devices Market report includes competitive landscape

Loading Table Of Content...