Outsourced Semiconductor Assembly and Testing Market Outlook – 2031

The Global Outsourced Semiconductor Assembly and Testing Market size was valued at $34.6 billion in 2021, and is projected to reach $60.3 billion by 2031, growing at a CAGR of 6.3% from 2022 to 2031. Assembly and testing (manufacturing) of outsourced semiconductors offer IC-packaging and testing facilities to third parties. OSATs are merchant vendors. Integrated database management system and foundries often outsource a certain percentage of their IC-packaging production to OSATs with internal packaging operations.

Fabless companies often outsource their packaging to foundries and/or OSATs. Semiconductors are also used by many modern consumer goods in daily uses, such as in cell phones, laptops, video cameras, televisions, washing machines, refrigerators, and LED bulbs. In addition, preference for large displays and curved OLEDs, owing to growth in popularity of smart TVs, 4K ultra-HD TVs, 3D programming, and video-on-demand content drives OSAT revenues. OSATs offer cost-effective and creative solutions, which deliver higher efficiency, processing speeds, and functionality with space reduction in electronic devices.

![]()

Increase in demand for consumer electronics and surge in degree of urbanization across the globe, primarily fuels outsourced semiconductor assembly and testing market growth. In addition, rise in disposable income of people across the globe significantly fuels sales of consumer electronics devices such as TV, mobile phones, and tablets, which boosts demand for outsourced semiconductor assembly and test services. Moreover, increase in adoption of smartphones significantly propels the market growth. However, high cost associated with OSAT services is anticipated to hamper growth of the market during the forecast period. On the contrary, growing chip market is anticipated to provide outsourced semiconductor assembly and testing market opportunity. Furthermore, rise in transition toward OSAT in emerging economies such as India, China, and South Korea is opportunistic for the market growth.

Segment Overview

The outsourced semiconductor assembly and testing industry is segmented into Process, Packaging Type and Application.

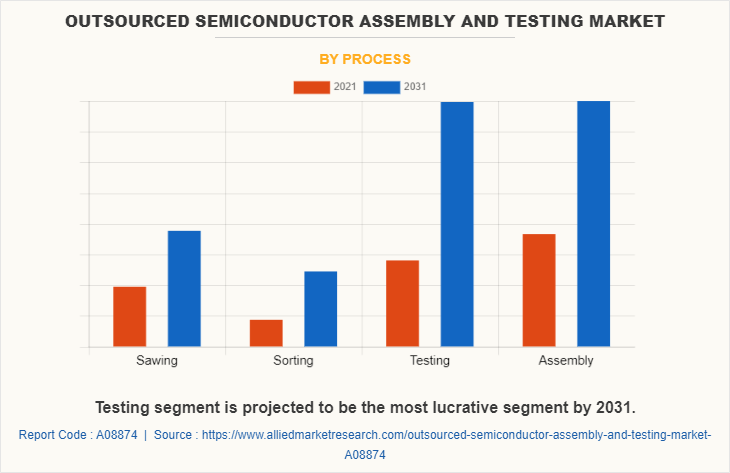

On the basis of process the market is segmented into sawing, sorting, testing and assembly. The assembly segment was the highest revenue contributor to the market in 2021 of outsourced semiconductor assembly and testing market share. This growth is attributed owing to surge in demand for telecom infrastructure as well as consumer electronics around the globe primarily fuels growth in demand for assembly services. In addition, rise in demand for semiconductor wafers fuel growth of the market.

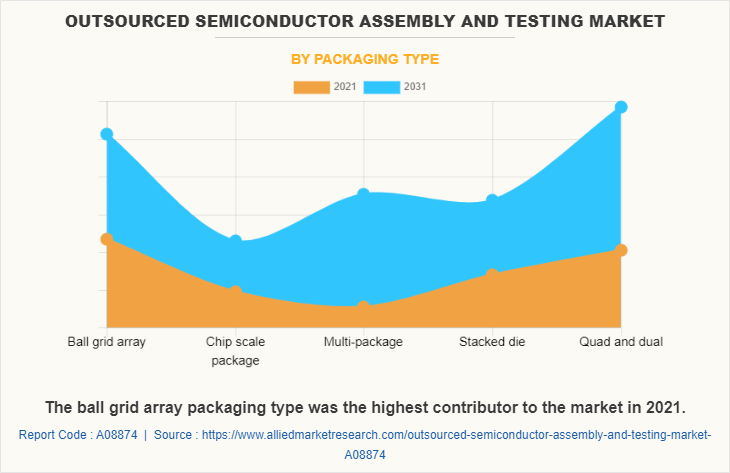

On the basis of packaging type the market is segmented into ball grid array, chip scale package, multi-package, stacked die, and quad & dual. The ball grid array segment was the highest revenue contributor to the market in 2021. The factor primarily drives growth of the ball grid array type of packaging, is owing to several miniaturization advantages that it offers. In addition, BGA components offer various benefits such as lower soldering defects, higher packaging reliability, more solid soldering joints, excellent electrical and frequency characteristics, higher number of I/O ends & large I/O end spacing, and guaranteed BGA soldering planarity.

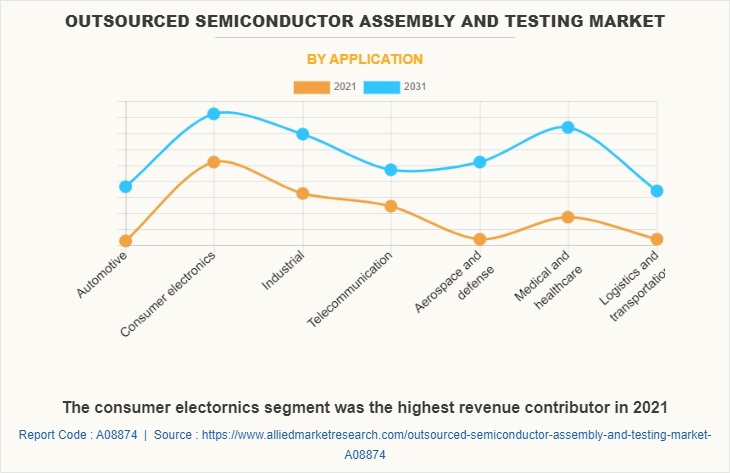

By Application the market is segmented into automotive, consumer electronics, industrial, telecommunication, and aerospace and defense, medical and healthcare, logistics and transportation.The consumer electronics segment was the highest revenue contributor to the market in 2021. The aerospace and defense and medical and healthcare segments are expected to witness considerable growth during the forecast period.

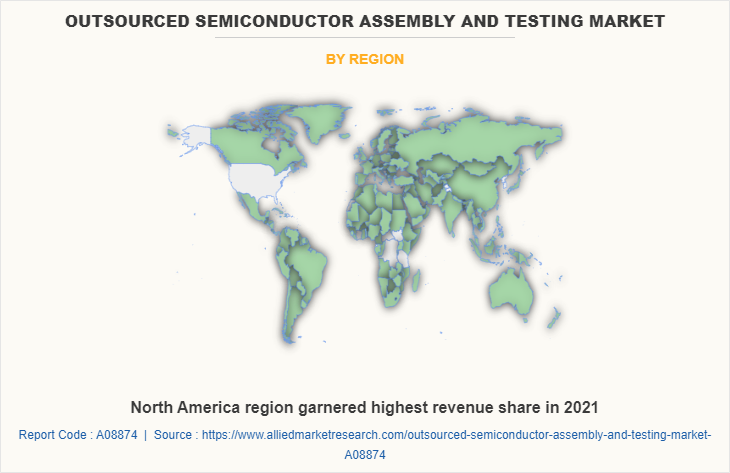

By region, the market is analyzed across North America, Europe, Asia pacific, and LAMEA. North America was the highest revenue contributor in 2021. Surge in development of advance chip applications in the U.S and Canada is the major factor for growth of the market. Besides, new government initiatives in North America such as new legislation in the U.S and Canadian initiative to build a $7 billion semiconductor industry are anticipated to propel growth of the outsourced semiconductor market in the region. Furthermore, Asia Pacific is anicpated witness significant growth during the forecast period. This growth is attributed owing to the presence of number of outsoucing facilities in the region.

Competitive Analysis

The key players profiled in the outsourced semiconductor assembly and testing market outlook include Advanced Silicon S.A., Alphacore Inc., Amkor Technology, Inc., Device Engineering Inc., HiDensity Group (HMT microelectronic AG), Luminar Technologies, Inc. (Black Forest Engineering), Presto Engineering Group, Sencio BV, ShortLink group, and SiFive, Inc. (OpenFive). Market players have adopted various strategies such as product launch, expansion, collaboration, partnership, and acquisition to strengthen their foothold in the outsourced semiconductor assembly and test industry.

Historical Data & Information

The global outsourced semiconductor assembly and test (OSAT) market is highly competitive owing to the strong presence of existing vendors. Vendors of the market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they can cater to the market demands. The competitive environment in this market is expected to intensify as technological innovations, product launch, and different strategies adopted by key vendors increase.

Key Developments/Strategies

Advanced Silicon S.A., Alphacore Inc., Amkor Technology, Inc., Device Engineering Inc., HiDensity Group (HMT microelectronic AG), Luminar Technologies, Inc. (Black Forest Engineering), Presto Engineering Group, Sencio BV, ShortLink group, and SiFive, Inc. (OpenFive) are the top companies holding a prime share in the outsourced semiconductor assembly and test (OSAT) market. These market players have adopted various strategies, such as product launch, expansion, collaboration, partnership, and acquisition to expand their foothold in the outsourced semiconductor assembly and test (OSAT) market.

- In July 2022, Jiangsu Changjiang Electronics Technology Co. Ltd (JCET) started the construction of a new high-end manufacturing base in Jiangyin. According to the JCET, the products to be produced in this new global-class manufacturing facility would be focused on the high-performance packaging & testing of microsystem integration applications combining high-density flip-chip technology and high-density wafer-level technology, representing the main development direction of the packaging and testing industry.

- In June 2022, UTAC Holdings Ltd announced a new cost-effective, next-generation test system solution for CMOS image sensors. The test solution was jointly developed by AEM, a leading semiconductor test and handling solution provider based in Singapore.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the outsourced semiconductor assembly and testing market analysis from 2021 to 2031 to identify the prevailing outsourced semiconductor assembly and testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the outsourced semiconductor assembly and testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The outsourced semiconductor assembly and testing market forecast includes the analysis of the regional as well as global outsourced semiconductor assembly and testing market trends, key players, market segments, application areas, and market growth strategies.

Outsourced Semiconductor Assembly and Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 60.3 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 225 |

| By Process |

|

| By Packaging Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | LUMINAR TECHNOLOGIES, INC. (BLACK FOREST ENGINEERING), Sencio BV, PRESTO ENGINEERING GROUP, AMKOR TECHNOLOGY, INC., SHORTLINK GROUP, ADVANCED SILICON S.A., ALPHACORE INC., DEVICE ENGINEERING INC., SIFIVE, INC. (OPENFIVE), HIDENSITY GROUP (HMT MICROELECTRONIC AG) |

Analyst Review

The outsourced semiconductor assembly and test market is going through enormous transformation and growth. Surge in demand from automotive subsystems and connected devices fuels growth of the market.

In addition, increase in demand for consumer electronics and surge in urbanization across the globe drives the outsourced semiconductor assembly and test market growth. Moreover, increase in adoption of smartphones significantly propels the market growth. However, high cost associated with OSAT services is anticipated to hamper growth of the market during the forecast period. On the contrary, growing chip market is anticipated to provide a huge opportunity for OSAT companies. Furthermore, rise in transition toward OSAT in emerging economies such as India, China, and South Korea is opportunistic for the market growth.

The outsourced semiconductor assembly and test market is competitive and comprises a number of regional and global vendors competing based on factors such as cost of services, reliability, and support services. Owing to the competition, vendors operating in the market are offering advanced outsourced semiconductor assembly and test services facilities to improve their market presence.

For instance, in June 2020, four top companies in the assembly, testing, marking, and packaging (ATMP) business discussed to set up their manufacturing units as well as develop export hubs to undertake outsourced semiconductor packaging and test services in India. These companies include Taiwanese majors ASE Technology Holding, Powertech Technology Inc., SPIL, and US-based Amkor Technology. In addition, key players are heavily investing in R&D activities to develop effective outsourced semiconductor assembly and test technology and services offerings, which is opportunistic for the market.

The global outsourced semiconductor assembly and test market is mainly driven by increase in demand for consumer electronics and surge in degree of urbanization. In addition, increase in adoption of smartphones significantly fuels the market growth.

The consumer electronics segment was the highest revenue contributor segment in 2021.

Asia Pacific is largest regional market for Outsourced Semiconductor Assembly and Testing owing to presence of number of outsourcing facilities in the region.

The top companies profiled in the report include Advanced Silicon S.A., Alphacore Inc., Amkor Technology, Inc., Device Engineering Inc., HiDensity Group (HMT microelectronic AG), Luminar Technologies, Inc. (Black Forest Engineering), Presto Engineering Group, Sencio BV, ShortLink group, and SiFive, Inc. (OpenFive).

The global outsourced semiconductor assembly and test market was valued at $34,553.5 million in 2021, and is projected to reach $60,334.5 million by 2031, registering a CAGR of 6.32% from 2022 to 2031.

Loading Table Of Content...