Over the Counter (OTC) Drugs & Dietary Supplements Market Overview:

Global Over The Counter (OTC) Drugs & Dietary Supplements Market was valued at $223 billion in 2016, and is expected to reach $335 billion by 2023, registering a CAGR of 5.9% from 2017 to 2023. OTC drugs are also known as non-prescription medicines, as these can be availed without prescriptions. OTC medicines are safe if they are administered according to the instructions provided by healthcare professionals. However, dietary supplements contain dietary ingredients, which are used to provide nutrients to the body to fulfill the nutrient balance of the body. In addition, they provide non-nutrient chemicals, which provide biological benefit to the body.

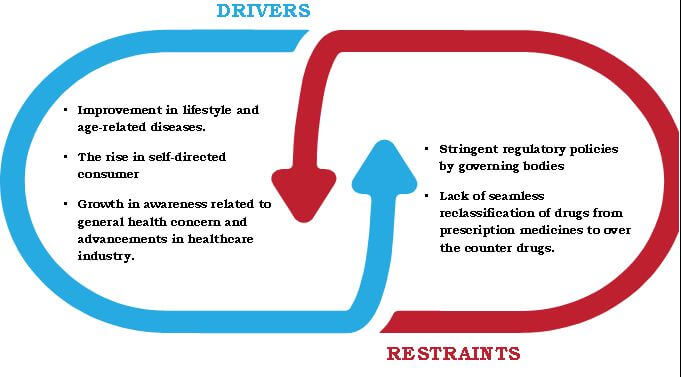

The global over the counter drugs & dietary supplements market is driven by growth in awareness related to general health concerns and advancements in healthcare and pharmaceutical industries. In addition, growing trend among individuals to select OTC drugs for minor diseases supplements the market growth. Furthermore, stringent regulations by the FDA related to the safety and efficacy of OTC drugs hamper the market growth.

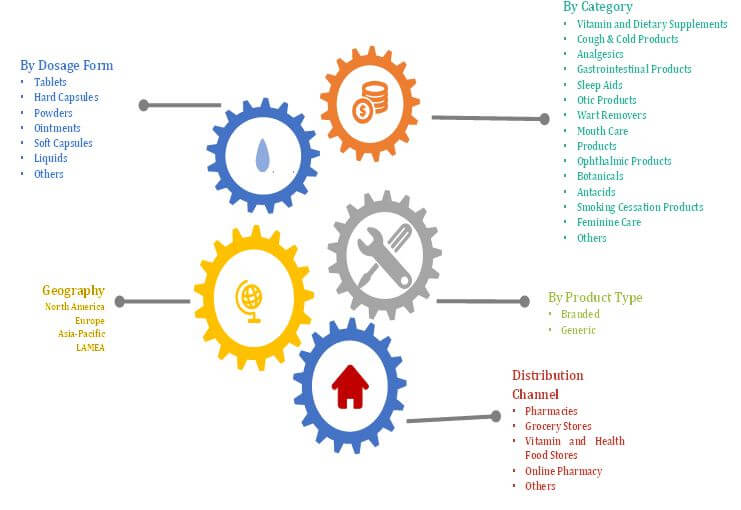

The global over the counter drugs & dietary supplements market is segmented based on category, dosage form, product, distribution channel, and geography. Based on category, it is divided into vitamin & dietary supplements, cough & cold products, analgesics, gastrointestinal products, sleep aids, otic products, wart removers, mouth care products, ophthalmic products, botanicals, antacids, smoking cessation products, feminine care, and others. Based on dosage form, it is classified into tablets, hard capsules, powders, ointments, soft capsules, liquids, and others. Based on product type, it is categorized into branded and generic drugs. On the basis of distribution channel, it is divided into pharmacies, grocery stores, vitamin & health food stores, online pharmacies, and others.

Global Over the Counter Drugs (OTC) & Dietary Supplements Market Segmentation

Geographically, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The vitamins and dietary supplements segment occupied the maximum market share in 2016, and is expected to maintain this trend during the forecast period, owing to rise in awareness about dietary supplements and their nutritional value for wellness. The soft capsules segment is expected to grow at the highest CAGR of 6.6% during the forecast period.

Drivers, Restraints, and Opportunities

The global market is driven by growing demand for personalized medicine for treating minor ailments and introduction of treatment protocols by healthcare payers. However, strict government regulations by the governing bodies and less awareness among individuals are expected to restrict the market growth. In addition, increase in R&D expenditure coupled with funding from the public & private sector is expected to provide lucrative growth opportunities to the market.

Market Dynamics: Drivers & Restraints

China Over The Counter (OTC) Drugs & Dietary Supplements

The rise in awareness towards personal care and treatment drives the market growth in China. In addition, increase in geriatric population along with the growing incidence of new diseases in this country is expected to supplement the market growth in the near future in China.

The report provides a comprehensive analysis of the key players operating in the global market such as Pfizer Inc., Novartis International AG, Roche Holding AG, Merck & Co., Inc., Sanofi S.A, Johnson & Johnson, Gilead Sciences, GlaxoSmithKline plc., Bayer Healthcare AG, and AstraZeneca plc.

The other players in the value chain include Alacer Corp., Alcon Inc., Alfresa Pharma Corporation, Alkalon A/S, Alliance Healthcare, Allergan, Plc., Reckitt Benckiser Plc., Bausch & Lomb, AbbVie Inc., and The Colgate-Palmolive Company.

Key Benefits

- The study provides an in-depth analysis of the global over the counter (OTC) drugs & dietary supplements market along with the current trends and future estimations to elucidate the imminent investment pockets.

- A quantitative analysis from 2016 to 2023 is discussed to enable stakeholders to capitalize on the prevailing market opportunities.

- Key market players are profiled and their strategies are thoroughly analyzed to understand the competitive outlook of the industry.

- Porters five forces model is expected to interpret the impact of bargaining power of suppliers & buyers, threat of new entrants & substitutes, and competition among the key players on the market growth.

Over the Counter (OTC) Drugs & Dietary Supplements Market Key Segments:

By Category

- Vitamin & Dietary Supplements

- Cough & Cold Products

- Analgesics

- Gastrointestinal Products

- Sleep Aids

- Otic Products

- Wart Removers

- Mouth Care Products

- Ophthalmic Products

- Botanicals

- Antacids

- Smoking Cessation Products

- Feminine Care

- Others

By Dosage Form

- Tablets

- Hard Capsules

- Powders

- Ointments

- Soft Capsules

- Liquids

- Others

By Product

- Branded Drugs

- Generic Drugs

By Distribution Channel

- Pharmacies

- Grocery Stores

- Vitamin and Health Food Stores

- Online Pharmacy

- Others

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Argentina

- Turkey

- South Africa

- Saudi Arabia

- Rest of LAMEA

Over the Counter (OTC) Drugs & Dietary Supplements Market Report Highlights

| Aspects | Details |

| By Category |

|

| By Dosage Form |

|

| By Product |

|

| By Distribution Channel |

|

| By Geography |

|

| Key Market Players | MERCK & CO., INC., PFIZER INC., NOVARTIS INTERNATIONAL AG, GLAXOSMITHKLINE PLC, JOHNSON & JOHNSON, GILEAD SCIENCES, SANOFI S.A, ROCHE HOLDING AG, BAYER HEALTHCARE AG, ASTRAZENECA PLC |

Analyst Review

Over the counter (OTC) drugs & dietary supplements are non-prescription medicines that can be availed from any pharmacy, health store, or via online channel. OTC drugs are not regulated based on the active pharmaceutical ingredients (API) rather than the end product. Dietary supplements are for those individuals who have a lack of appetite or those who suffer from deficiency disorders, such as vitamin and mineral deficiency, among other deficiency disorders. Hence, OTC drugs have revolutionized the healthcare and pharmaceutical sectors, as several prescription medicines have switched to OTC medicines. This switch from prescription to non-prescription drugs is more convenient for individuals especially in the developing economies for easy accessibility of medicines as per their requirement.

Common ailments, such as cold & cough, allergies, dermal infections, lung diseases, and others have high incidence rates across the globe. Thus, advertisements and endorsements by several OTC drug manufacturing giants have increased for the treatment of related ailments in the recent years. These OTC drugs are cost-effective, and are available in a variety of forms such as powder, tablets, capsules, ointments, and others.

The factors, such as increase in awareness about the advancements in pharmaceutical industry and general health concerns coupled with rising trend among individuals for self-management of medication boost the market growth. However, stringent regulations by FDA and other governing bodies have delayed the drug approval, which further impede the market growth. In addition, lack of seamless reclassification of drugs from prescription to OTC restricts the market growth. Moreover, various key players have undertaken R&D activities to enhance OTC drugs for the treatment of various ailments, such as laxatives, oral antiseptics, analgesics, and anti-smoking products, thereby creating more opportunities for market players.

Loading Table Of Content...