Overactive Bladder Treatment Market Research, 2031

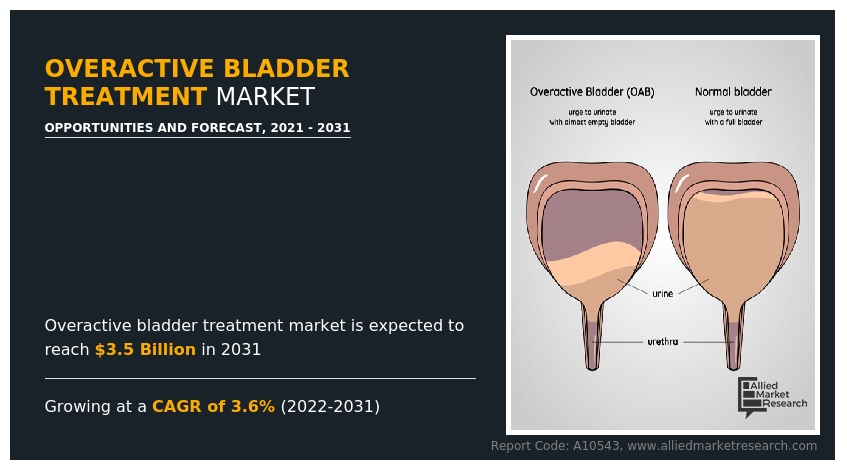

The global overactive bladder treatment market size was valued at $2.4 billion in 2021 and is projected to reach $3.5 billion by 2031, growing at a CAGR of 3.6% from 2022 to 2031. Overactive bladder (OAB) is a medical condition in which the muscles of the bladder contract involuntarily, causing a sudden and uncontrollable urge to urinate. People with OAB often experience urinary urgency, frequency (the need to urinate more often than usual), and sometimes incontinence (leakage of urine before reaching the toilet).

Furthermore, OAB can be caused by a variety of factors, including nerve damage, bladder irritation, and medication side effects. It is a common condition that can affect both men and women of all ages, but it is more prevalent in older adults. However, treatment such as medications is available that helps in relieving the symptoms of OAB.

Market dynamics

Overactive bladder treatment market trends that drive the growth of the market include increase in incidence of overactive bladder, changes in human lifestyle, and an increase in geriatric population. Moreover, increase in demand for medications such as anticholinergics and Botox for the treatment of overactive bladder and increase in awareness among the population regarding the condition and its treatment options are the factors that drive the growth of the market.

In addition, growing trends towards non-invasive treatment options, huge unmet medical needs, and increase in research and development are boosting the overactive bladder treatment market growth. There is an increase in the geriatric population around the globe which is one of the major driving factors for the growth of the overactive bladder treatment market. As the geriatric population is more prone to various chronic conditions including neurological dysfunction due to aging, there is a huge chance of the geriatric population suffering from an overactive bladder, which increases the demand for medications to treat OAB. Thus, this propels the overactive bladder treatment market size.

Although various factors drive the growth of the overactive bladder treatment market, the presence of alternate techniques for treatment is causing hindrance to the growth of the market. There are surgical treatments available for OAB, along with physical therapies to relieve the symptoms of an overactive bladder. In addition, various drugs used for the treatment of overactive bladder conditions are associated with few side effects. Side effects associated with anticholinergic drugs include dry mouth and constipation, heartburn, blurry vision, rapid heartbeat, flushed skin, and trouble during urination.

Thus, these factors act as a restraint to the overactive bladder treatment market. On the other hand, an increase in investment by the key market players in developing regions and technological advances in the manufacturing of pharmaceuticals is anticipated to boost during the overactive bladder treatment market forecast period.

The COVID-19 outbreak had a positive impact on growth of the global overactive bladder treatment industry. COVID-19 associate cystitis (CAC) significantly contributed to bladder dysfunction and also led to organ-specific complications in the patient. This positively impacted the overactive bladder treatment market during the pandemic and post pandemic. On the other hand, COVID-19 pandemic was one of the biggest challenges for the healthcare system. Outbreak of the COVID-19 pandemic had led to partial or complete shutdown of production facilities, owing to prolonged lockdown in major countries such as the U.S., China, Japan, India, and Germany. This also affected the manufacturing of overactive bladder medications to some extent. However, several developed and developing countries managed to counter the effects of the pandemic by implementing various strategies. This led to regularization of supply chain of medications and medical devices by key players after the pandemic, which will boost the growth of overactive bladder treatment industry.

Segmental Overview

The overactive bladder treatment market is segmented by drug class, disease type, distribution channel and region. By drug class, the market is categorized into anti-cholinergic drugs, beta-3 adrenergic drugs, botox, and others. On the basis of disease type, the market is segregated into idiopathic overactive bladder and neurogenic overactive bladder. On the basis of distribution channel, the market is segmented into hospital pharmacies, drug stores and retail pharmacies and online providers. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

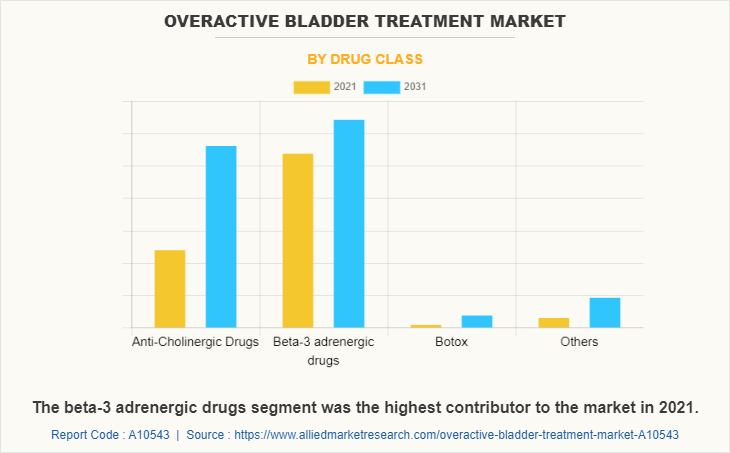

By Drug Class:

The beta-3 adrenergic drugs segment dominated the global market in 2021, which is attributed to the increase in demand for beta-3 adrenergic drugs for OAB treatment and rise in offerings by the key players in the market. On the other hand, the anti-cholinergic drugs is anticipated to grow at a fastest rate during the forecast period, which is attributed to the advantages offered by the drugs such as muscle activation and thereby reducing bladder contractility and large number of anticholinergic drug molecules available in the market for the treatment of overactive bladder treatment.

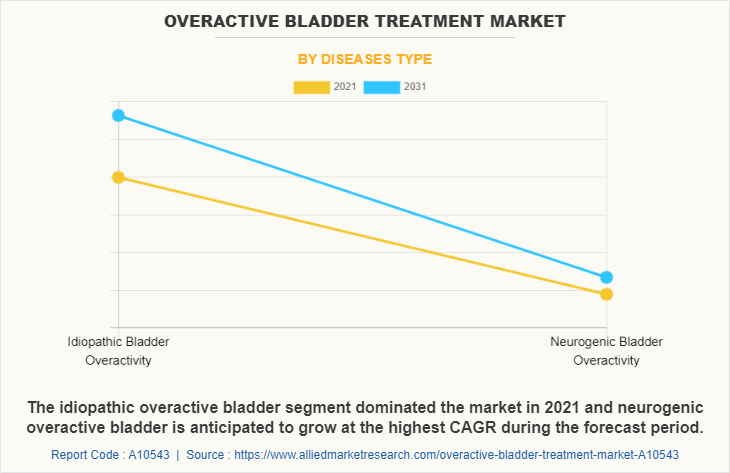

By Disease Type:

The idiopathic overactive bladder segment held highest overactive bladder treatment market share, owing to increasing incidences of idiopathic overactive bladder in patients and rising demand for overactive bladder medications for the treatment of idiopathic overactive bladder. On the other hand, neurogenic overactive bladder segment is expected to grow at the fastest rate during the forecast period, owing increase in prevalence of neurological conditions which further increases the incidences of overactive bladder condition.

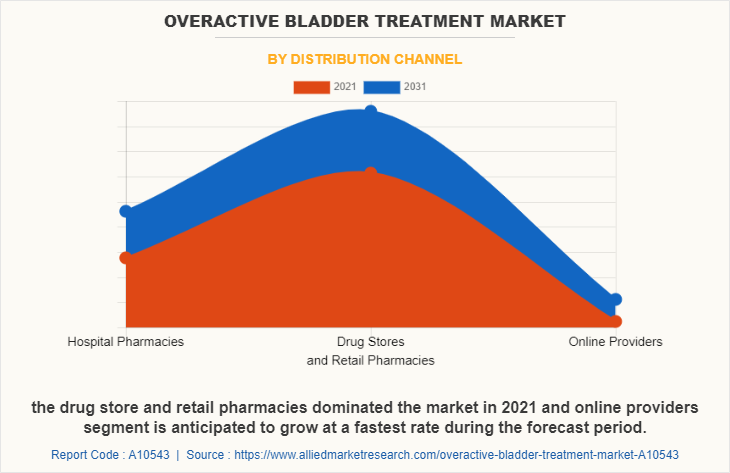

By Distribution Channel:

The drug store and retail pharmacies segment dominated the market in 2021, owing to the availability of retail pharmacy stores everywhere and availability of alternate options for medications to choose from. On the other hand, the online providers segment is anticipated to grow at fastest rate, as it is time saving and people gain heavy discounts & offers through the online platforms.

By Region:

The overactive bladder treatment market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the overactive bladder treatment market share in 2021 and is expected to maintain its dominance during the forecast period. Presence of several major players, such as AbbVie Inc., Dr. Reddy’s Laboratories Ltd., Teva Pharmaceutical Industries Limited and others is driving the market growth in this region. In addition, advancement in manufacturing technology of pharmaceutical formulations in the region also contributes to the growth of the market. In addition, the increase in incidences of overactive bladder, which increases the demand for overactive bladder treatment medications in the region, is expected to propel the market's growth.

Furthermore, the presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of anticholinergic and other medications instead of surgeries, are expected to drive the market growth. In addition, the presence of a large unmet healthcare needs, and a favorable regulatory environment are some of the key factors that are expected to increase profitable growth of the market over the forecast period. The introduction of new products and the prevalence of beneficial government initiatives in healthcare systems are some key factors contributing to its huge share.

Asia-Pacific is expected to witness growth at the highest rate during the overactive bladder treatment market forecast period. The market growth in this region is attributable to presence of pharmaceutical companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, rise in medicine expenditure and adoption of high-tech processing to improve the production of overactive bladder treatment medications, is expected to drive the growth of the market.

Furthermore, the Asia-Pacific region exhibits the largest medicine supply and the largest pharmaceuticals industry with availability of raw material in abundance, which can be easily accessed by manufacturers of pharmaceutical products. Furthermore, Asia-Pacific offers profitable market growth opportunities due to the growing infrastructure of industries, rising disposable incomes, and well-established presence of domestic companies in the region. In addition, the rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the overactive bladder treatment market, such as are provided in this report. There are some important players in the market such as AbbVie Inc., Alembic Pharmaceuticals Limited, Astellas Pharma Inc., Cipla Ltd, Dr. Reddy’s Laboratories Ltd., Lupin, Pfizer Inc., Sumitomo Pharma Co., Ltd, Inc., Sun Pharmaceutical Industries Ltd. and Teva Pharmaceutical Industries Limited. Major players have adopted product launch, product development, clinical trials, acquisition, agreement, collaboration and branding as key developmental strategies to improve the product portfolio of the overactive bladder treatment market.

Recent product launches in the overactive bladder treatment market

- In August 2020, Medtronic plc, the global leader in medical technology, announced that its FDA-approved InterStim Micro neurostimulator for sacral neuromodulation (SNM) therapy is now available in the U.S which have application in relieving the symptoms of overactive bladder.

- In April 2021, Urovant Sciences, a wholly owned subsidiary of Sumitomo Pharma Co., Ltd announced the commercial launch of GEMTESA (vibegron) 75 mg tablets, a beta-3 (β3) adrenergic receptor agonist, for the treatment of overactive bladder (OAB). It is used in the treatment of patients with urinary incontinence (UUI), urgency, and urinary frequency in adults.

Acquisitions in the overactive bladder treatment market

- In March 2021, Sumitovant Biopharma announced the completion of the merger in which Sumitovant has acquired all outstanding shares of Urovant Sciences. Urovant Sciences is a biopharmaceutical company mainly focused on developing and commercializing innovative therapies for urologic conditions such as Gemtesa, Vibegron and URO-902.

- In May 2020, AbbVie, a research-based global biopharmaceutical company, announced that it has completed its acquisition of Allergan. Allergen is mainly focused on offering products through its division namely immunology, hematologic oncology, neuroscience, and Allergan aesthetics.

Product expansion in the overactive bladder treatment market

- In June 2021, Urovant Sciences, Inc. A wholly owned subsidiary of Sumitomo Pharma Co., Ltd and Sunovion Pharmaceuticals Inc. announced the launch of co-promotion activities for GEMTESA (vibegron) 75 mg tablets. The co-promotion mainly focuses to extend promotion of GEMTESA (vibegron) to primary care physicians for treatment of patients with overactive bladder.

Agreement in the overactive bladder treatment market

- In July 2022, Urovant Sciences, a wholly owned subsidiary of Sumitovant Biopharma Ltd., announced that it has entered into an exclusive license agreement for Pierre Fabre to commercialize vibegron for the treatment of Overactive Bladder (OAB) in the European Economic Area, the UK, and Switzerland. It also includes territories such as French-speaking countries of Sub-Saharan Africa, Turkey, and certain Eastern European countries.

Clinical trials in the overactive bladder treatment market

- In May 2022, Urovant Sciences, a wholly owned subsidiary of Sumitomo Pharma Co., Ltd announced new analyses of data from the Phase 3 EMPOWUR Extension Study of GEMTESA (vibegron) 75 mg, which provides additional insight into the long-term durability of the product.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current overactive bladder treatment market trends, estimations, and dynamics of the overactive bladder treatment market analysis from 2021 to 2031 to identify the prevailing overactive bladder treatment market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the overactive bladder treatment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the overactive bladder treatment market analysis of the regional as well as global optical coherence tomography market trends, key players, market segments, application areas, and market growth strategies.

Overactive Bladder Treatment Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.5 billion |

| Growth Rate | CAGR of 3.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 268 |

| By Drug Class |

|

| By Diseases type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Astellas Pharma Inc., Alembic Pharmaceuticals Limited, Sumitomo Pharma Co., Ltd, Lupin, Sun Pharmaceutical Industries Ltd., Cipla Ltd, Pfizer Inc., AbbVie Inc., Dr. Reddy’s Laboratories Ltd., Teva Pharmaceutical Industries Limited |

Analyst Review

The increase in demand for overactive bladder treatment medications is expected to offer profitable opportunities for the expansion of the market. Also, the increase in incidences of overactive bladder in developed as well as developing regions is boosting the market. Also increase in prevalence of conditions such as neurological disorders, diabetes, urological disorders, and others which further increase the incidence of overactive bladder is propelling the market growth.

The increase in R&D activities in developed as well as developing regions has largely contributed to the market revenue in 2021 and is expected to maintain this trend throughout the forecast period. In addition, the key market players are focusing on investment in emerging countries which is anticipated to offer lucrative opportunities for the market during the forecast period. Also, an increase in awareness among the people regarding the condition, and its available treatment options significantly contributes towards the market growth.

Furthermore, North America is expected to witness highest growth, in terms of revenue, owing to increase in awareness among the people regarding management of overactive bladder condition and rise in government initiatives promoting awareness drives for detection and treatment of the same, which lead to the growth of the market. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in investments for manufacturing of medications and devices and upsurge in healthcare expenditure in the emerging economies such as India and China.

Overactive bladder is a condition that causes a frequent and sudden urge to urinate which is difficult to control for the patient.

The total market value of overactive bladder treatment market is $2426.4 million in 2021.

The base year is 2021 in overactive bladder treatment market.

Top companies such as AbbVie Inc., Alembic Pharmaceuticals Limited, Astellas Pharma Inc., Cipla Ltd., Dr. Reddy’s Laboratories Ltd., Lupin, Pfizer Inc., Sumitomo Pharma Co., Ltd, Inc., Sun Pharmaceutical Industries Ltd. and Teva Pharmaceutical Industries Limited.

Beta-3 adrenergic drugs segment is the most influencing segment in overactive bladder treatment market which is attributed to the surge in demand for beta-3 adrenergic drugs in treatment of OAB

The major factor that fuels the growth of the overactive bladder treatment market are rise in incidences of overactive bladder, increase in prevalence of conditions such as bladder tumor and bladder stones and increase in R&D activities.

The forecast period for overactive bladder treatment market is 2022 to 2031

The market value of overactive bladder treatment market in 2031 is $3465.22 million

Loading Table Of Content...