Packaging And Protective Packaging Market Size & Insights:

The global packaging and protective packaging market size was valued at $1.0 trillion in 2021, and is projected to reach $1.5 trillion by 2031, growing at a CAGR of 4.3% from 2022 to 2031. The increasing consumer demand for sustainable packaging, driven by rising environmental awareness and preference for eco-friendly materials, is significantly boosting the packaging and protective packaging market. Consumers and businesses alike are seeking packaging solutions that minimize waste, reduce carbon footprints, and incorporate recyclable or biodegradable materials. As a result, there is expected to be high demand for packaging and protective packaging market throughout the forecast period.

Introduction

Packaging refers to the process of enclosing or protecting products for distribution, storage, sale, and use, encompassing the design, materials, and methods employed to ensure the integrity and safety of goods during transport and storage. Protective packaging, a subset of packaging, specifically focuses on safeguarding items from physical damage, environmental factors, and contamination, utilizing materials like bubble wrap, foam, or molded inserts to cushion and support the product. Both types are essential for maintaining product quality and enhancing consumer experience while facilitating efficient logistics.

Report Key Highlighters:

- The packaging and protective packaging market is consolidated in nature with few players such as Smurfit Kappa Group PLC, Pregis LLC, Sealed Air, Sonoco Products Company, Amcor PLC, Pro-Pac Packaging Limited, Storopack Hans Reichenecker GmbH, and International Paper.

- The study covers key strategies such as acquisition, merger, product launches, business expansion, agreement, and partnership of manufacturers for a better understanding of packaging and protective packaging market.

- Latest trends such as development of biodegradable, water-resistant packaging products by key manufacturers across various regions has been covered in the report. For instance, Smurfit Kappa launched AquaStop, a water-resistant paper with a coating added during the manufacturing process that reportedly does not interfere with recyclability, as part of its new TechniPaper portfolio. The new water-resistant paper is designed to withstand exposure to water without being damaged, making it suitable for e-commerce packaging and for packaging products such as flowers, detergent, fruit, and vegetables where temporary protection against water is needed.

- The report also covers key regulation analysis of packaging and protective packaging market across North America, Europe, Asia-Pacific, and LAMEA regions.

Market Dynamics

Packaging and protective packaging is a wrapping or container made of plastic, paper, wood, metal, or glass used to store products temporarily to protect and extend their shelf life. This packaging protects the product from atmospheric, magnetic, electrostatic, vibration, or shock damage during shipping and storage. It also retains the freshness, flavor, and efficacy of the food products for a longer duration by protecting them from water, oxygen, dust, and microorganisms. Packaging and protective packaging includes roller stock, wrap, thermoform container, bubble packaging, protective mailer, air pillow, paper fill, corrugated box, molded pulp, insulated shipping container, paperboard protector, molded foam, foam-in-place, and loose fill.

An increase in purchasing power of consumers and fast-paced lifestyles boost the sales of packed food items in both developed and developing economies. According to an article published by Business Standard, the packed food market in India is expected to double in the upcoming 5-10 years owing to economic growth, growing e-commerce, and demographic dividend. Packaging and protective packaging products are widely used to protect food from outside influence and damage, provide consumers with ingredient and nutritional information, and others. According to a report published by India Brands Equity Foundation in December 2020, India’s processing sector is one of the largest in the world and its output is expected to reach $535 billion by 2025-2026. This factor may surge the demand for a wide range of packaging and protective packaging products among the growing food sector during the forecast period.

The high costs associated with sustainable and advanced packaging materials significantly hamper the growth of the packaging and protective packaging market. As businesses strive to meet growing consumer demand for eco-friendly packaging, the shift towards sustainable alternatives, such as biodegradable plastics, paper-based solutions, and recyclable materials, often comes with a higher price tag compared to traditional packaging options. The production processes for these materials tend to be more complex and resource-intensive, which increases the overall manufacturing costs. All these factors are expected to hamper the growth of packaging and protective packaging market during the forecast period.

Technological advancements in smart and active packaging are creating substantial opportunities for the packaging and protective packaging market, as these innovations enhance product safety, extend shelf life, and improve consumer engagement. Smart packaging incorporates features such as sensors, QR codes, and RFID technology, allowing for real-time monitoring of product conditions, including temperature, humidity, and freshness. This level of interactivity ensures that products are stored and transported under optimal conditions and provides valuable data to manufacturers and retailers, enabling better inventory management and reducing waste. As the demand for quality assurance and traceability in supply chains grows, businesses that adopt smart packaging solutions can enhance their operational efficiency and customer satisfaction. All these factors are anticipated to offer new growth opportunities for the global packaging and protective packaging market throughout the forecast period.

Market Segmentation

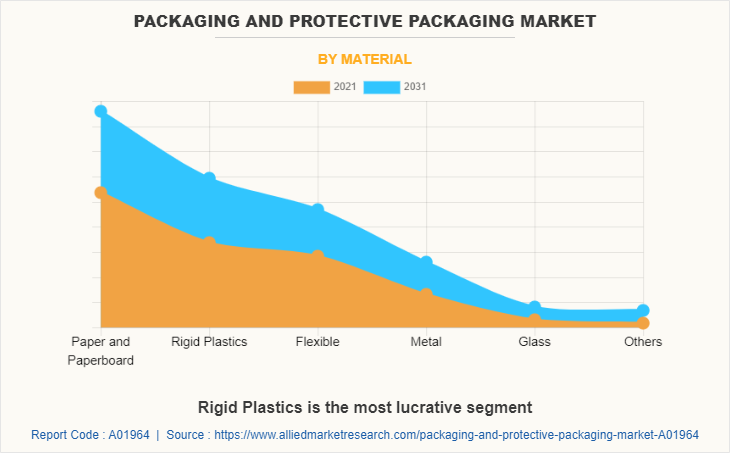

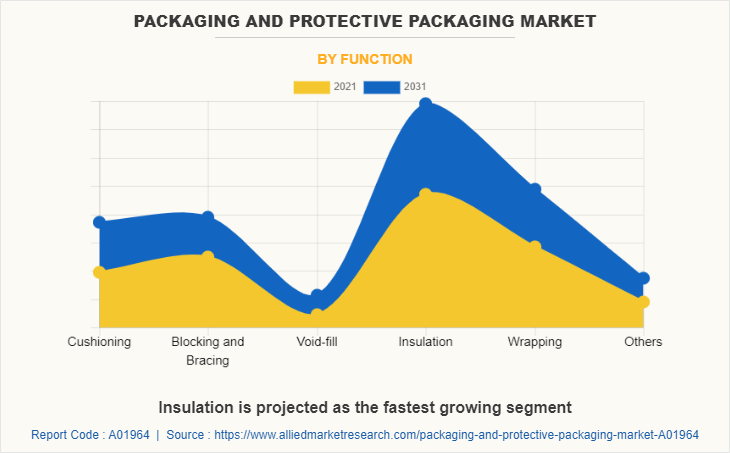

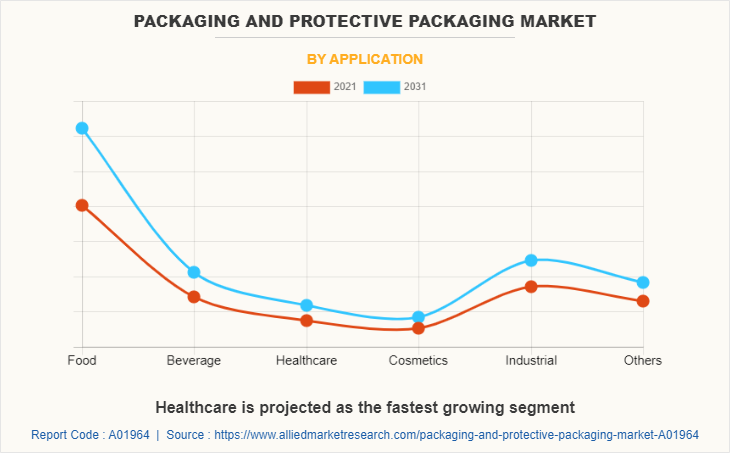

The packaging and protective packaging market is segmented on the basis of material, function, application, and region. On the basis of material, it is fragmented into paper & paperboard, rigid plastics, flexible, metal, glass, and others. By function, it is segmented into cushioning, blocking & bracing, void-fill, insulation, wrapping, and others. By application, it is classified into food, beverage, healthcare, cosmetics, industrial, and other consumer goods. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Packaging and Protective Packaging Market Material

The paper & paperboard packaging and protective packaging market size is projected to grow at the highest CAGR of 4.2% during the forecast period and accounted for 32.8% of packaging and protective packaging market share in 2021. Major applications of paperboard in packaging include frozen food packaging, beverage cartons, pharmaceutical packaging, aseptic drink boxes, cosmetic & perfume packaging, candy boxes, paper goods packaging, and cereal boxes. Increase in demand for paper & paperboard packaging, especially from the food & beverage industry, and strict regulations on the use of plastic bags are anticipated to augment the demand for paper & paperboards for packaging applications during the forecast period.

Packaging and Protective Packaging Market Function

In 2021, the insulation segment was the largest revenue generator, and is anticipated to grow at a CAGR of 4.6% during the forecast period. The increase in demand for frozen food, fish, meat, vegetables, fruits, medical supplies, and others have surged the potential application of insulation packaging that keep the product at a stable temperature regardless of the condition of packaging. This factor may act as one of the key drivers responsible for the growth of the packaging and protective packaging market for insulation packaging.‐¯

Packaging and Protective Packaging Market Application

In 2021, the food segment was the largest revenue generator, and is anticipated to grow at a CAGR of 4.5% during the forecast period. Various packaging materials used in the food sector offer benefits that lead to easy transportation and storage of food products.

For example, glass used in food packaging is impermeable to gases and vapors, maintains product freshness for a long period of time without impairing taste or flavor, and is useful for heat sterilization. Metal also provides physical protection and consumer acceptance. Paper & paperboard is a lightweight packaging material and can also be recycled. All these factors are anticipated to increase the demand for protective packaging in the food sector during the analysis period.‐¯

Packaging and Protective Packaging Market Region

By region, the Asia-Pacific segment dominated the global market in 2021, and is anticipated to grow at a CAGR of 4.8% during forecast period. Asia-Pacific is bifurcated into sub-regions such as China, India, Japan, Australia, and the Rest of Asia-Pacific. Protective packaging products such as boxes or storage containers, packing materials, liners, and spacers are designed to protect the goods from atmospheric, magnetic, electrostatic, vibration, or shock damage.

Asia-Pacific is anticipated to possess high growth potential, owing to increase in developments in the emerging economies and rapid industrialization. Moreover, accelerated manufacturing output due to rise in demand for packaged food, especially in emerging economies such as China and India supplement the market growth. Countries such as China, Japan Australia, India, and Indonesia are undergoing developments in the consumer goods industry, thereby fueling the growth of the market.

Competitive Landscape

The major companies profiled in this report include Smurfit Kappa Group PLC, DS Smith, Huhtamaki, Pregis LLC, Sealed Air, Sonoco Products Company, Amcor PLC, Pro-Pac Packaging Limited, Storopack Hans Reichenecker GmbH, and International Paper.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the packaging and protective packaging market analysis from 2021 to 2031 to identify the prevailing packaging and protective packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the packaging and protective packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global packaging and protective packaging market trends, key players, market segments, application areas, and market growth strategies.

Packaging and Protective Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1464.4 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 296 |

| By Material |

|

| By Function |

|

| By Application |

|

| By Region |

|

| Key Market Players | Smurfit Kappa Group PLC, Huhtamaki, Pro-Pac Packaging Limited, Amcor PLC, Pregis LLC, Sealed Air, International Paper, Sonoco Products Company, DS Smith, Storopack Hans Reichenecker GmbH |

Analyst Review

According to CXOs of leading companies, the global packaging and protective packaging market is expected to exhibit high growth potential during the forecast period. Packaging and protective packaging is designed to protect the consumer and industrial goods from shock & vibration, atmospheric, magnetic, and electrostatic forces. Moreover, food & beverages that requires excellent moisture resistance and reduction in product damage and food spoilage can be accomplished with the use of packaging and protective packaging.

In addition, packaging and protective packaging products are widely used in healthcare sector to protect the pharmaceutical products and to ensure that is stored correctly. This has led to increase in potential application of packaging and protective packaging in the pharmaceutical sector. Furthermore, increasing awareness for eco-friendly products may surge the utilization of biodegradable packaging and protective packaging products during the forecast period.

Moreover, rise in demand from end users, especially from the developing countries, and continuous technological advancements boost the growth of the global packaging & protective packaging market. However, lack of profit from niche market products is expected to hinder the market growth. As per the CXOs, Asia-Pacific is projected to register significant growth as compared to the saturated markets of North America and Europe. CXOs further added that sustained economic growth and development of the e-commerce sector may increase popularity of packaging and protective packaging.

The active packaging is a major trend witnessed in the food packaging industry. Active packaging is defined as a package system designed to intentionally incorporate components that would release or absorb substances into or from the packaged food or the environment surrounding the food, and it is anticipated to extend the shelf life or to maintain or improve the condition of the packaged food.

The food segment dominated the global market in terms of revenue in 2021, growing at a CAGR of 4.5% during the forecsat period.

The Asia-Pacific segment dominated the global market in 2021, and is anticipated to grow at a CAGR of 4.8% during forecast period. Asia-Pacific is anticipated to possess high growth potential, owing to increase in developments in the emerging economies and rapid industrialization.

The packaging and protective packaging market is estimated to reach $1.5 trillion by 2031

The major companies profiled in this report include Smurfit Kappa Group PLC, DS Smith, Huhtamaki, Pregis LLC, Sealed Air, Sonoco Products Company, Amcor PLC, Pro-Pac Packaging Limited, Storopack Hans Reichenecker GmbH, and International Paper.

Loading Table Of Content...