Pain Patch Market Research, 2031

The global pain patch market size was valued at $4.8 billion in 2021, and is projected to reach $7.3 billion by 2031, growing at a CAGR of 4.3% from 2022 to 2031. Pain patches are transdermal patches that contain medication to relieve pain. They are a popular alternative to traditional pain medication, such as pills or injections, as they offer a convenient and non-invasive way to deliver medication directly to the site of pain.

Pain patches work by using a matrix or reservoir system to deliver medication through the skin and into the bloodstream. These are available in a variety of formulations, including those that contain opioids, nonsteroidal anti-inflammatory drugs (NSAIDs), and other pain-relieving medications. They can be used to treat a range of acute and chronic pain conditions, including postoperative pain, arthritis, cancer, and neuropathic pain. One of the advantages of a pain patch is that it can provide long-lasting pain relief without the need for frequent dosing. This is because the medication is delivered slowly and continuously over a period of time, rather than in a single dose. In addition, pain patches can help minimize systemic side effects associated with oral pain medication, such as gastrointestinal upset or drowsiness as these are applied directly to the skin.

Market Dynamics:

The major factor driving the growth of the pain patch market size includes rise in pain disorders, availability of improved healthcare infrastructure, increase in unmet healthcare needs, rise in prevalence of chronic diseases cases, and surge in demand for effective pain medicines with less side effects. In addition, the rise in popularity of personalization in pain management is driving the demand for effective pain patch thus driving the growth of the market.

Furthermore, geriatric populations are more prone to chronic pain-causing diseases such as joint disorders, neuropathic pain, cancer and others. Thus, rise in cases of chronic pain potentially drives the market growth. For instance, according to an article published in National Library of Medicine 2021, increase in diabetic neuropathic cases was observed from 30 million in 2019 to 85 million in the U.S. which drives the growth during pain patch market growth.

Further, an increase in incidence of sports and work related trauma injuries such as sprains and strains, fractures, tendinitis and back injuries is expected to fuel the growth of the market. In addition, there is a rise in prevalence of low back pain cases in adults which further contributes to market growth. For instance, according to article published in Springer 2022, it stated that 54% adults suffer from back pain with 24 – 80% reoccurrence pain disorder in one year.

E-commerce (electronic commerce) has become a vital tool for small and large businesses globally, due to rise in preference of consumers for online shopping over traditional purchasing methods. Various animations through health apps to educate people regarding pain management and usage of novel drug delivery system have contributed toward the growth of the pain patch market. The demand for effective pain management solutions is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Moreover, an increase in promotional activities by manufacturers and growth in awareness for proper treatment medications for pain disorders among the general population are expected to fuel their adoption during the forecast period.

However, availability of various alternative therapies like pain management devices chiropractic manipulation and acupuncture is anticipated to hamper the growth of market. In addition, various side effects such as skin irritation, allergic reaction, misuse and habit-forming drugs used in pain patch restrain the market growth. Furthermore, various new advancements like innovative technologies and regulations to formulate pain patch containing opioid drugs while minimizing the risks of addiction, dependence, and overdose provide lucrative opportunities to key players of the pain patch market.

The outbreak of COVID-19 has disrupted growth in many economies across various domains. The pandemic is anticipated to impact the growth of the pain patch industry. As most chronic pain facilities were deemed non-urgent, both outpatient and elective interventional procedures were limited or stopped during the COVID-19 pandemic to minimize risk of the viral spread. Further, according to American Society of Regional Anesthesia and Pain Medicine report in May 2020, patients with COVID-19 who are receiving opioids treatment can be more susceptible to respiratory depression and the absorption of fentanyl drug during transdermal administration such as fentanyl patch may increase with fever and could increase opioid side-effects. Thus, such side effects limited the use of pain patches and therefore had negative impact on the growth of the market.

However, post-COVID-19 pandemic, there was an observed rise in number of patients suffering from chronic pain disorders such as neuropathic pain, muscoskeletal pain and joint pain was observed resulting in demand of appropriate pain management solutions. For instance, article published by National Library of Medicine (NIH) 2023, stated that, post-COVID chronic pain exhibited both musculoskeletal and neuropathic pain features, where prevalence of neuropathic pain was estimated to be 24.4%. Thus, rise in prevalence of chronic pain cases is expected to increase the market growth in near future.

Furthermore, the pain patch market is anticipated to show growth in during pain patch market forecast attributing to the increase in adoption of novel drug delivery systems for pain management with less side effects, rise in diagnosis of chronic pain disorder, and increase cases of arthritis, cancer and neuropathic pain. Further, proper counselling for post operative pain conditions and approvals for novel pain patch drive the market growth. Thus, pandemic positively impacted the growth of the market.

Segmental Overview

The pain patch market is segmented into product type, type, distribution channel, and region. On the basis of product type, the market is categorized into non-opioids and opioids. The non-opioid segment is further categorized into nonsteroidal anti-inflammatory drugs (NSAIDS), methyl salicylate, lidocaine and others. The opioid segment is further categorized into buprenorphine and fentanyl. On the basis of type, the market is categorized into prescription medicines and OTC medicines. On the basis of distribution channel, the market is segregated into hospital pharmacies, drug stores and retail pharmacies and online providers. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

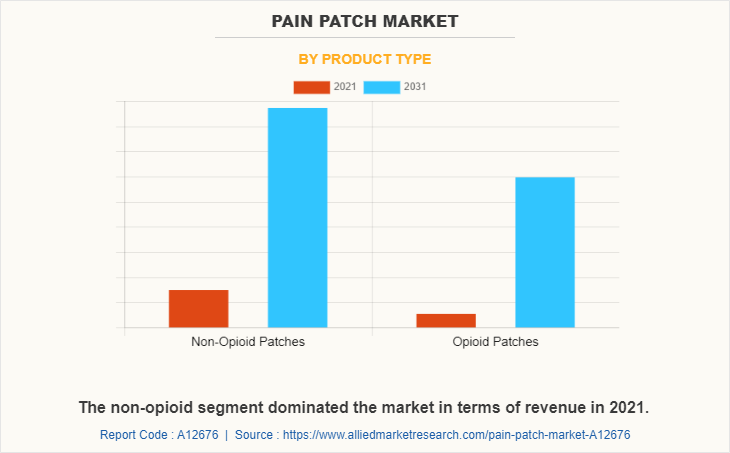

By Product Type

The pain patch market is categorized into active non-opioids and opioids. The non-opioids segment accounted for the largest share in 2021 and is expected to witness highest CAGR during the forecast period, owing to an increase in demand for alternative pain management options that can provide effective relief without the risks associated with opioids.

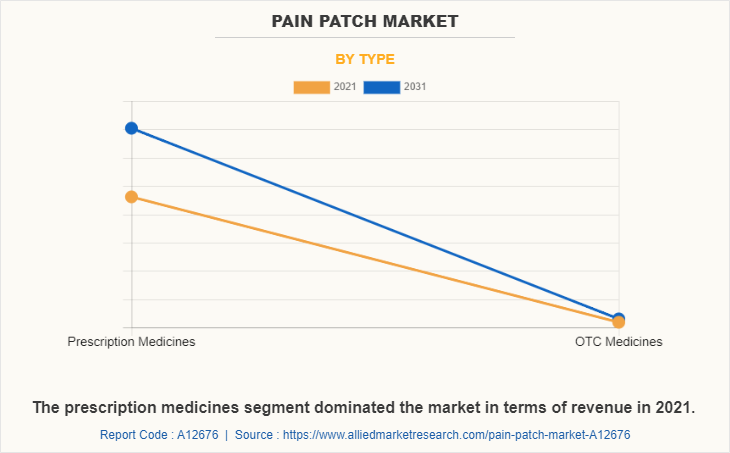

By Type

The pain patch industry is categorized into prescription medicines and OTC medicines. The prescription medicines segment accounted for largest share in 2021 and is expected to witness highest CAGR during the forecast period owing to advantages as they provide correct number of drugs in the treatment of pain without causing much side effects, and commonly the opioids patches and NSAIDS are prescribed which are proven to be more effective in chronic pain management.

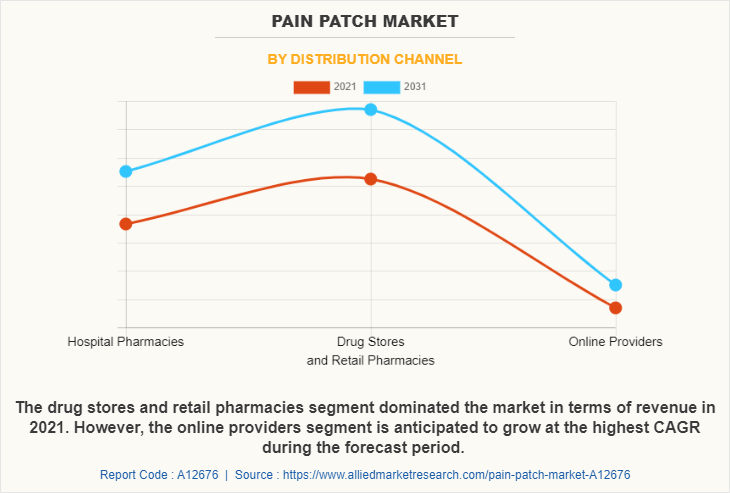

By Distribution Channel

The pain patch market is categorized into hospital pharmacies, drug stores and retail pharmacies and online providers. The drug stores and retail pharmacies segment occupied largest pain patch market share in 2021 and is expected to remain dominant during the forecast period owing to increase in preference of the people toward retail pharmacies, as retail pharmacies guide regarding medications and usage during treatment period. The online providers segment is projected to register the highest CAGR during the forecast period owing to the rise in popularity of online pharmacies and the number of users preferring online pharmacies.

By Region

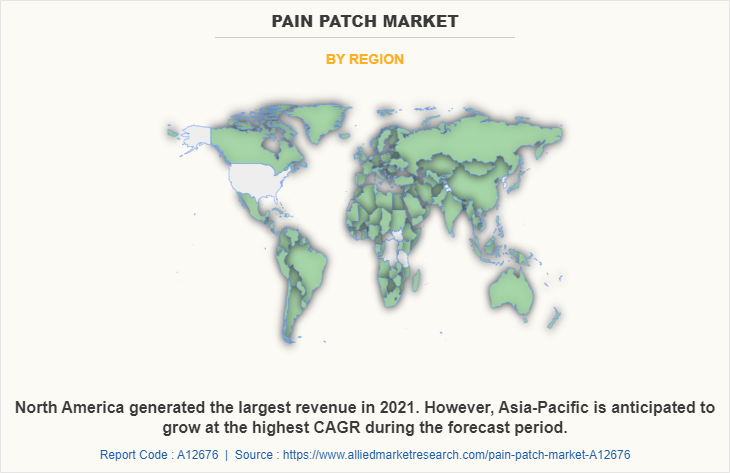

The pain patch market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for largest pain patch market share in 2021 and is expected to remain dominant during the forecast period owing to rise in prevalence of chronic pain cases, presence of key players offering Pain patch and rise in healthcare infrastructure drive the growth of Pain patch market. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in investments for development of novel drug delivery system, increases in geriatric population and surge in personalization of pain management, thereby driving the growth of market during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major players in the Pain patch market, such as NEXGEL Advanced Hydrogel Solutions, Viatris Inc., Johnson and Johnson, Teva Pharmaceutical Industries Ltd., Sorrento Therapeutics Inc., Hisamitsu Pharmaceutical Co.,Inc., Endo International plc., Purdue Pharma L.P., Amneal Pharmaceuticals LLC, and Grunenthal are provided in this report. Major players have adopted product approval, launch, business expansion and product upgradation as key developmental strategies to improve the product portfolio of the Pain patch market.

Recent Approvals and Advancements in Pain Patch Market

- In August 2020, Amneal Pharmaceuticals, Inc., a pharmaceutical manufacturing company, announced that it has received Abbreviated New Drug Application (ANDA) approval from the U.S. Food and Drug Administration (FDA) for a generic version of Lidocaine Patch, 5%. Lidocaine Patch, 5% is the generic version of Lidoderm Patch, 5% for treatment of post-herpetic neuralgia.

- In January 2021, Hisamitsu Pharmaceutical Co., Inc. announce that it has obtained approval of partial change of the approved matters for a new formulation of transdermal analgesic anti-inflammatory patches “Mohrus Paps XR 120 mg and 240 mg". This was done to reduce the irritation caused by existing additives.

Product Launch in Pain Patch Market

- In March 2019, Teva Pharmaceutical Industries Ltd., one of the global leader in generic and specialty medicines, announced the launch of an authorized generic of Flector1 Patch, 1.3 %, in the U.S. This Flector patch is an important addition to Teva’s portfolio of over 40 generic pain management medicines.

Business Expansion in Pain Patch Market

- In August 2022, Sorrento Therapeutics Inc., announced that, ZTlido (lidocaine topical system) 1.8% will be added to one of the largest National Pharmacy Benefit Managers (PBMs) and a national health plan – thereby expanding coverage to 30 million lives and Scilex will continue to work with them to access an additional 20 million lives.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pain patch market analysis from 2021 to 2031 to identify the prevailing pain patch market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pain patch market segmentation assists to determine the prevailing pain patch market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pain patch market trends, key players, market segments, application areas, and market growth strategies.

Pain Patch Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 7.3 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 374 |

| By Product Type |

|

| By Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Grunenthal, Endo International plc., Sorrento Therapeutics Inc., Purdue Pharma L.P., NEXGEL Advanced Hydrogel Solutions, Johnson and Johnson, Viatris Inc., Amneal Pharmaceuticals LLC, Hisamitsu Pharmaceutical Co.,Inc., Teva Pharmaceutical Industries Ltd. |

Analyst Review

The increase in demand for novel pain management solutions and rise in investments for pain patches globally are expected to offer profitable opportunities for the expansion of the market. In addition, favorable government initiatives regarding awareness of effective pain management solutions and higher spending for development of novel drug delivery system, has piqued the interest of several companies to develop pain patches.??

The increase in adoption of pain patches owing to its advantages over traditional medications is expected to boost the growth of the market. In addition, increase in cases of chronic pain across the globe has resulted in rise in demand for novel drug delivery system, thus driving the growth of the market. Further, rise in number of patients suffering from bone pain conditions such as osteoarthritis and diabetic neuropathy, especially the geriatric population, is the major factor that drives the growth of the pain patch market.?

Furthermore, North America accounted for largest share in 2021 and is expected to remain dominant during the forecast period owing to rise in prevalence of chronic pain cases, surge in disposable income of general population, higher awareness regarding pain patch, presence of key players offering pain patches and? developed healthcare infrastructure drive the growth of the pain patch market. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in investments for development of pain patches, rise in geriatric population and number of pipeline medications for treating chronic pain conditions, thereby driving the growth of the market during the forecast period.?

The market value of pain patch market in 2031 is $7,338.07 million

The base year is 2021 in pain patch market.

Pain patches are transdermal patches that deliver medication through the skin to provide pain relief.

Top companies such as, Hisamitsu Pharmaceutical Co.,Inc., Amneal Pharmaceuticals LLC, Johnson & Johnson., and Viatris Inc., held a high market position in 2021. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The major factor that fuels the growth of the pain patch market are rise in adoption of pain patches for pain management, increase in cases of chronic pain diseases and rise in research activities related to effective pain management formulations

The non-opioid is the most influencing segment in pain patch market, owing to increase in demand for alternative pain management options that can provide effective relief without the risks associated with opioids and rise in number of key players offering novel formulations.

The total market value of pain patch market is $4,803.70 million in 2021.

The forecast period for pain patch market is 2022 to 2031

Loading Table Of Content...

Loading Research Methodology...