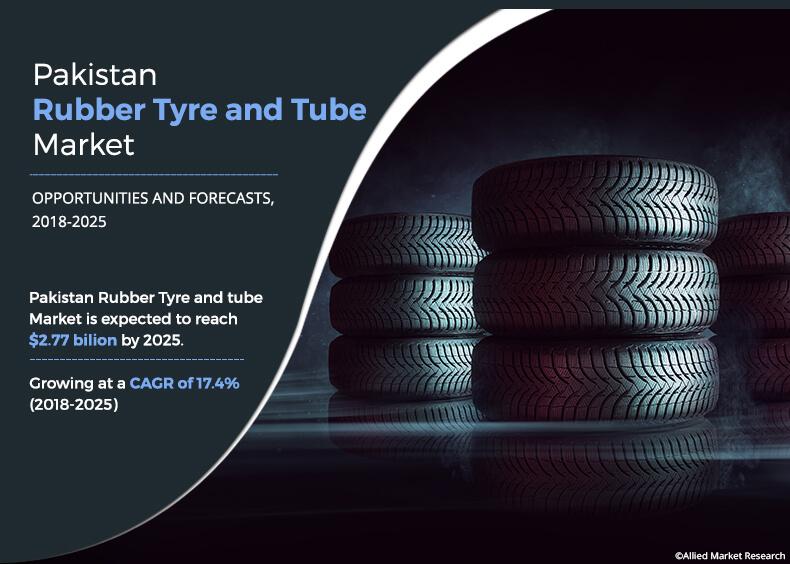

Pakistan Rubber Tyre and Tube Market Outlook: 2025

Pakistan rubber tyre and tube market size was valued at $762.7 million in 2017, and is projected to reach $2.77 billion by 2025, registering a CAGR of 17.4% from 2018 to 2025. The radial type by design segment was the highest revenue contributor in 2017, accounting for $595.8 million, and is estimated to reach $2.11 billion by 2025, registering a CAGR of 17.1% during the forecast period.

A tyre is a component fitted around the rim of a wheel to transfer the load of a vehicle from the axle to the ground. Rubber tyre consists of tread, jointless cap piles, beads, and other materials, which include synthetic rubber, carbon black, and fabric. The major function of the tyre is to protect the wheel rim and offer tractive force between the road surface and the vehicle. Since, it is manufactured from rubber, it also provides a flexible cushion, thereby reducing the impact of the vibrations and absorbing the shock of the vehicle. There is an exponential increase in the demand for tyre due to the rise in vehicle production in Pakistan to cater the increase in requirement of vehicles across all segments. Thus, the tyre demand is ultimately governed by automobile production.

In addition, the growth of Pakistan rubber tyre and tube market is driven due to the intense competition between tyre manufacturers to produce sustainable, durable in quality, and also due to the production of low cost tyres to meet the demand for tyre are the factors anticipated to lead the growth of Pakistan rubber tyre and tube market. In addition, the adoption of advanced technology in the manufacturing process of tyre to offer high product differentiation to the consumer leads to a high level of performance and durability, which is also expected to drive the growth of the rubber tyre market in Pakistan. Furthermore, the rise in trend of using nitrogen gas in car tyre in Pakistan and an increase in the lifespan of vehicles are the factors expected to project the aftermarket growth of the rubber tyre market in Pakistan. Pakistan rubber tyre and tube market share is rising due to increasing production of all type vehicles in this region.

However, the developments in the market of retreading tyre in which worn tyres are replaced by tread are expected to limit the growth of new tyre market. The cost of raw material required for this process is lesser than manufacturing new tyre. Therefore, a rise in services in Pakistan related to retreading process is expected to restrain the Pakistan rubber tyre and tube market growth. However, the fluctuating prices of raw materials such as natural rubber and reinforcing materials hinder the growth of the tyre market in Pakistan. Pakistan rubber tyre and tube market trends are decided on the basis of forecast from 2018 to 2025 and the driving factors that are affecting to their growth.

Furthermore, improvements in economy that result in favorable conditions for the manufacturing sector and anticipated rise in automotive sector create an opportunity for the expansion of the rubber tyre market in Pakistan. Such factors along with the governments supports and latest innovation in rubber industry is helping to rise the Pakistan rubber tyre and tube market share.

The Pakistan rubber tyre and tube market is segmented based on tyre, component, design, and vehicle type. The Pakistan rubber tyre and tube market forecasted on the basis of year on year growth from 2018 to 2025 by considering the driving and restraining factors. One of the major factors that is driving the growth of the market includes increase in sales of passenger and electric vehicles and rapid economic improvement. Furthermore, automotive manufacturers are shifting their focus to reduce the overall vehicle weight with the use of advanced tyre material; thus driving the growth of the Pakistan rubber tyre and tube market.

By Channel Type

OEM by channel type segment is projected as the most lucrative segments

The key players operating in the Pakistan rubber tyre and tube market include General Tyre and Rubber Co. Ltd., Servis Tyre, the Goodyear Tyre & Rubber Company, Bridgestone group, Pirelli Tyre S.p.A, Michelin, Ghauri Tyre & Tube Ltd., Continental Corporation, Sumitomo Rubber Industries Ltd., and Yokohama Rubber Co., Ltd. Also some local manufacturers such as panther tyres limited, Crown Tyres limited , CECO tyres, HAQ tyres & rubber industries and others.

Rise in competition among tyre manufacturers

Pakistan automotive sector is experiencing exponential growth due to a rise in the demand for automobiles and use of collaborative & consolidation manufacturing in tyre business. This in turn boosts the growth of the automotive tyres, as tyres are one of the basic components of the vehicle. Thus, the rubber tyre manufacturers in Pakistan are witnessing strong competition to capture a larger market share. For instance, South Korea’s second largest tyre manufacturer Kumho Tyre has sealed a deal with a Pakistani company—Century Engineering Industries—to transfer its tyre making technology for the next 10 years due to rise in intense competition in the rubber tyre market. Also, this factor is responsible for swift changes in the tyre market that makes it more dynamic. Original tyres are installed by vehicle manufacturers at the factory, which is recognized as a primary division of the tyre market, whereas the replacement aftermarket is another division market. Thus, tyre manufacturers are engaged in producing sustainable and high durable tyres with a high level of performance to attract more vehicle manufacturers. Therefore, there is a rise in competition among tyre manufacturers in Pakistan. This in turn fosters the growth of Pakistan rubber tyre and tube market.

By Vehicle Type

Two wheeler by vehicle type segment is projected as the most lucrative segments

Increase in total vehicle production in Pakistan

In the recent years, consumers have shifted their interest to automotive vehicles, as these vehicles facilitate luxury features such as advance driving assistance system (ADAS), and others that are technologically advanced as against traditional vehicles. In addition, there is a rise in number of electric vehicles in Pakistan due to favorable government policies. This creates a demand for the production of different variant of electric vehicle. For instance, there is an increase of 15-18% from 2014 to 2017 in the overall production of vehicles in Pakistan. The implementation of advanced technologies in production helps boost the growth for Pakistan rubber tyre and tube market. All such factors are creating awareness in Pakistan. Also, the easy availability, affordability and company expansions in this region are important factors that create a huge demand for the rubber tyre industry in Pakistan.

By Design Type

Radial by design type segment is projected as the most lucrative segments

Growth in market of retreading tyres

The retreading tyre Pakistan rubber tyre and tube market is witnessing huge investments from manufacturers. This fosters the growth of the market. Retreading is the process that replaces the tread on worn tyres. It helps save tyre and material cost to a huge extent, when compared to manufacturing a new one. Retreading directly reduces the aftermarket cost of the OEMs. Factors such as existence of cheaper tyre brands and discomfort of roads are responsible for the growth of the retreading tyre market. Thus, the retreading tyre market poses as a serious threat to the Pakistan rubber tyre and tube market.

By Component Type

Tyre by design type segment is projected as the most lucrative segments

Volatile prices of raw materials

The materials used to manufacture rubber tyres are tread, jointless cap plies, steel-cord for belt plies, textile cord ply, Bead reinforcement, apex, and core. Also, it consists of synthetic rubber, natural rubber, steel wire, and carbon black along with the petrochemical reinforcing materials such as polyester, fabric, nylon, steel, and rayon. The pricing of these raw materials plays a vital role in deciding the overall price of the tyre. Prices of these metals fluctuate occasionally due to global economic ups and downs in the market, as these are traded on a community exchange basis. Inflation and increase in the demand for these raw materials fuel their prices in the recent past. Domestic players that are currently operating in Pakistan Rubber Tyre and tube market are satisfying only 20% demand for tyre and for their expansion they require a large amount of raw materials. In addition, the rise in price of such raw materials hinder the market growth for local players. Uncertainty in the pricing of these raw materials along with the high dominance of smuggled tyre proves to be a major restraint for the Pakistan rubber tyre and tube market growth.

Improving economy that results in favorable conditions for the manufacturing sector

Due to the rapid enhancement of technology, most of the manufacturing companies are adopting automation to increase the productivity and profitability. To increase safety concerns governments are coming up with stringent tyre performance regulation including fuel saving and wet grip-related braking distance reduction. Thus, creating ample growth opportunities for tyre manufacturing companies to launch tyres that can address the government regulations. Therefore, with increase in technological advancements, vendors are coming up with high efficient tyres that enhance the overall fuel efficiency of vehicles. Kumho tyres launched pneumatic tyres “Ecsta PA31” that can offer high performance in the vehicles such as sport sedans and coupes. These steps from giant player will helps to boost the Pakistan rubber tyre and tube market opportunity in future.

This results in speedy industrialization and urbanization. Furthermore, this company has sealed a deal with a Pakistani company—Century Engineering Industries to transfer its tyre making technology. This influences the sales of passenger cars, which may provide opportunities to the rubber tyre market in Pakistan.

Anticipated rise in the automobile sector

There is rapid change in the world automotive environment due to globalization. This results in a rapid rise in the demand for vehicles across all segments in all the countries. Thus, there is a global expansion of the automobile sector, which leads to an anticipated speedy growth of the automobile sector. The auto industry of Pakistan eventually plans to shift to electric vehicles to keep the environment clean, and safe. For instance, CNEVROVER brand has imported 4 Units in CBU condition of Chinese battery-operated cars in Karachi and more units are on the way to Pakistan, which are currently for R&D and testing phase. Also, they are planning to build an assembly plant in Karachi for the manufacturing and assembling of Cnevrover electric cars. This factor directly creates opportunities for the growth of the Pakistan rubber tyre and tube market.

Key Benefits for Pakistan Rubber Tyre and Tube Market:

- This study presents analytical depiction of Pakistan rubber tyre and tube market analysis along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities of the market with a detailed impact analysis.

- The current Pakistan rubber tyre and tube market size is quantitatively analyzed from 2017 to 2025 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the Pakistan rubber tyre industry.

Pakistan Rubber Tyre and Tube Market Report Highlights

| Aspects | Details |

| By Channel Type |

|

| By Component |

|

| By Design |

|

| By Vehicle Type |

|

| Key Market Players | HAQ TYRES & RUBBER INDUSTRIES, CONTINENTAL CORPORATION, MICHELIN, THE YOKOHAMA RUBBER CO., LTD., GHAURI TYRE & TUBE (PVT) LTD., CROWN TYRES LIMITED, SUMITOMO RUBBER INDUSTRIES LTD., BRIDGESTONE GROUP, THE GOODYEAR TYRE & RUBBER COMPANY, DIAMOND TYRES LTD, CECO TYRE, SERVIS TYRES, PIRELLI TYRE S.P.A., PANTHER TYRES LIMITED, GENERAL TYRE AND RUBBER CO. LTD |

Analyst Review

A rubber tyre is a component fitted around the rim of a wheel to transfer the load of a vehicle from the axle to the ground. Majority of the tyre are pneumatically inflated that offers a flexible cushion with shock absorption when the tyre travels over a rough surface. Furthermore, there is an exponential increase in the demand for tyre due to the rise in vehicle production in Pakistan to cater the increase in requirement of vehicles across all segments. Thus, the tyre demand is ultimately governed by automobile production.

The growth of Pakistan rubber tyre is driven by rise in intensive competition between tyre manufacturers to produce sustainable, durable, and low cost tyres to meet the demand for tyre. Moreover, the adoption of advanced technology in the manufacturing process of tyre to offer high product differentiation to the consumer leads to a high level of performance and durability, which is also expected to drive the growth of the rubber tyre market in Pakistan. Furthermore, the rise in trend of using nitrogen gas in car tyre in Pakistan and an increase in the lifespan of vehicles are the factors expected to project the aftermarket growth of the rubber tyre market in Pakistan.

Growth in market of retreading tyres and volatile prices of raw materials are the key factors that limit the growth of the market. Furthermore, improvements in economy that result in favorable conditions for the manufacturing sector and anticipated rise in automotive sector create an opportunity for the expansion of the rubber tyre market in Pakistan.

Loading Table Of Content...