Paper Bag Market Summary

The global Paper Bag Market size was estimated at USD 4.8 billion in 2022 and is projected to reach USD 8.4 billion by 2032, growing at a CAGR of 5.8 % from 2023 to 2032. The paper bag market is expanding due to rising environmental awareness, increasing government regulations on single-use plastics, growing demand for sustainable packaging, consumer preference for eco-friendly alternatives, and the influence of green marketing through digital and social media platforms.

The Paper Bag Market industry in Europe held a significant share of over 44% in 2022.

The Paper Bag Market industry in the China is expected to grow significantly at a CAGR of 6.3% from 2023 to 2032.

By product type, the Sewn Open Mouth segment is one of the leading segments in the market and accounted for the revenue share of over 20% in 2022.

By end user, the chemicals segment is one of the fastest growing segment in the market in 2022.

Market Size & Forecast

2022 Market Size: USD 4.8 Billion

2032 Projected Market Size: USD8.4 Billion

CAGR (2023-2032): 5.8%

Europe: Largest market in 2022

LAMEA: Fastest market during forecast period

Market Overview

A paper bag is a type of packaging made primarily from paper or paperboard material. It is commonly used for carrying and transporting goods, groceries, and other items. Paper bags come in various shapes and sizes, including sewn open mouth, pinched bottom open mouth, pasted valve, pasted open mouth, flat bottom, to accommodate different needs and preferences. These bags serve as a popular alternative to plastic bags owing to the growing environmental concerns and regulations aimed at reducing plastic pollution.

Key Takeaways

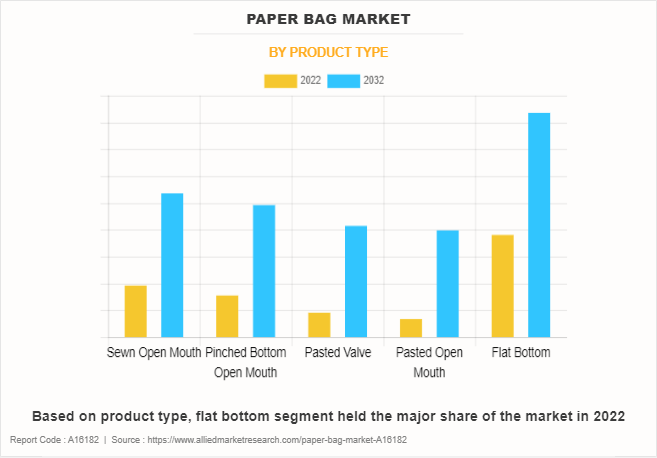

By product type, the flat bottom segment was the highest revenue contributor to the market in 2022.

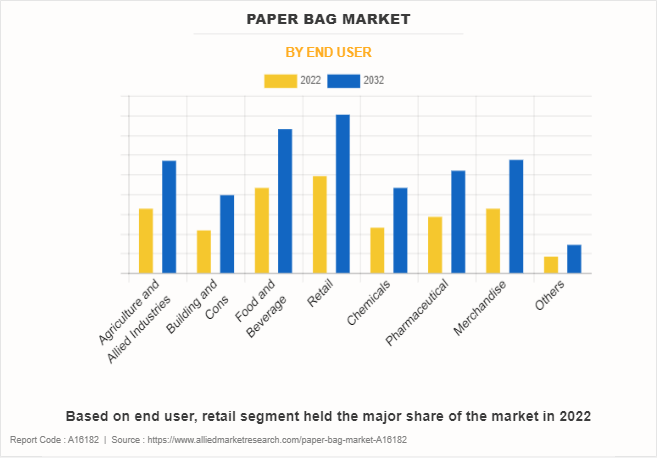

As per end user, the retail bags segment was the largest segment in the global market during the forecast period.

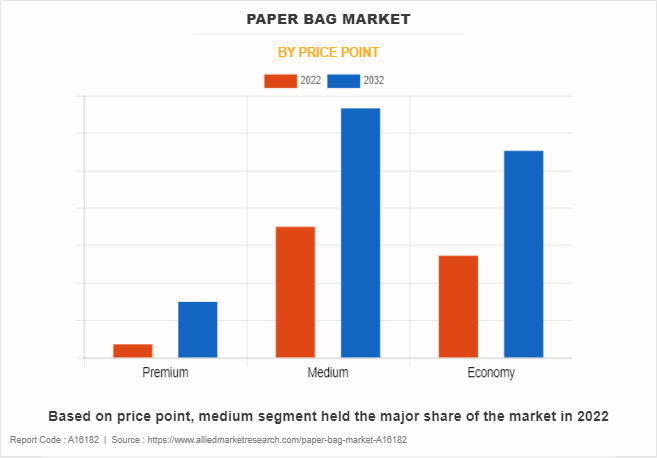

By price point, the medium segment was the largest segment in the global market during the forecast period.

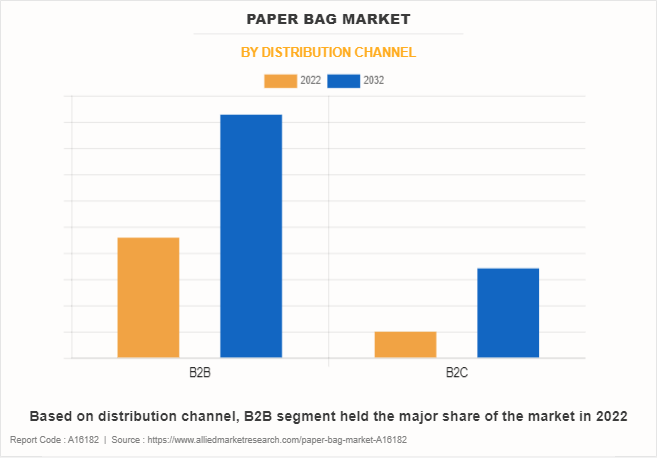

By distribution channel, the B2B segment was the largest segment in 2022 owing the B2B distribution of paper bags involves supplying bulk quantities of bags from manufacturers or wholesalers to businesses across various industries, such as retail, food service, industrial, and logistics.

Region-wise, Europe was the highest revenue contributor in 2022. The market in Europe is influenced by various factors, including environmental consciousness, regulatory measures, consumer preferences, and industry dynamics.

Market Dynamics

Increasing Awareness of Environmental Issues

Corporate Social Responsibility (CSR) initiatives play a pivotal role in driving the growth of the global market. With an increasing focus on sustainability and environmental stewardship, businesses seek to align their operations with ethical and eco-friendly practices, which is expected to notably contribute toward the paper bag market growth.

In addition, embracing as a packaging solution is a tangible way for companies to demonstrate their commitment to CSR goals, as paper bags are biodegradable, recyclable, and have a lower environmental impact compared to plastic alternatives. This not only enhances the brand image and reputation of these companies but also resonates with environmentally conscious consumers who prefer products from socially responsible brands.

Moreover, CSR initiatives often involve partnerships and collaborations with environmental organizations and governmental agencies, which promote the adoption of paper bags. By actively participating in initiatives aimed at reducing plastic waste and promoting sustainable packaging solutions, businesses not only meet their corporate citizenship responsibilities but also propel the demand for paper bags.

As a result, CSR-driven efforts contribute significantly toward the expansion of the market by creating a conducive environment for the adoption of eco-friendly alternatives and encouraging widespread consumer acceptance and adoption is expected to propel the growth of the paper bag industry.

Technological Advancements and Product Innovations

Technological advancements and product innovations play a pivotal role in surging the demand for paper bags by enhancing their functionality, appeal, and sustainability. Advanced manufacturing processes have improved the efficiency and cost-effectiveness of producing paper bags, making them more competitive compared to traditional plastic alternatives.

For instance, innovations such as automated bag-making machinery and energy-efficient production techniques have lowered production costs while maintaining quality standards, thereby driving the adoption by manufacturers and end users alike.

Moreover, product innovations in design and materials have expanded their application across various industries and consumer segments. Features such as water-resistant coatings and customizable printing options increase the versatility and attractiveness of paper bags, making them suitable for a wide range of purposes, including retail packaging, food delivery, and promotional events. These advancements not only meet the evolving needs of businesses and consumers but also align with sustainability goals, further fueling the demand for paper bags as an eco-friendly packaging solution in today's environmentally conscious market landscape.

Increase in Adoption by Retailers and E-commerce Platforms

The exponential growth of e-commerce is reshaping consumer shopping habits and creating opportunities for the paper bag market in the upcoming years. As online retail continues to expand globally, there is a corresponding surge in the demand for efficient and sustainable packaging solutions.

Paper bags, with their eco-friendly properties and recyclability, are emerging as a preferred choice for e-commerce companies aiming to reduce their environmental footprint. Manufacturers offer a cost-effective and environmentally conscious alternative to traditional plastic packaging, aligning with the sustainability goals of many e-commerce businesses.

Furthermore, the rise of e-commerce presents opportunities for paper bag manufacturers to offer customized packaging solutions tailored to the specific needs of online retailers. From branded paper bags to innovative designs optimized for shipping and handling, there is a growing demand for packaging that not only protects products during transit but also enhances the overall customer experience. By catering to the unique requirements of the e-commerce sector, paper bag manufacturers can tap into this rapidly growing market segment and establish themselves as key players in the packaging industry.

Innovations in Material and Design

Innovations in biodegradable and recyclable materials represent a significant opportunity for the market, enabling manufacturers to meet the increasing demand for sustainable packaging solutions. Advancements in material science have led to the development of bio-based alternatives to traditional materials, such as bioplastics derived from renewable sources such as cornstarch or sugarcane. These biodegradable materials offer similar functionality and durability to conventional paper bags while minimizing environmental impact, as they break down naturally without leaving harmful residues.

Furthermore, the introduction of recyclable coatings and additives enhances the recyclability of paper bags, making them more appealing to environmentally conscious consumers and businesses. By incorporating these innovative materials into their product offerings, manufacturers differentiate themselves in the market and attract customers seeking greener packaging options.

In addition, the adoption of biodegradable and recyclable materials aligns with regulatory requirements and corporate sustainability goals, positioning companies for long-term growth and success in an increasingly eco-conscious marketplace.

However, high production costs act as a significant restraint of the market, due to limited affordability and competitiveness of products compared to alternatives such as plastic bags. In addition, the production process of paper bags incur additional expenses, including raw material procurement, energy consumption, machinery maintenance, and labor costs. While technological advancements have improved efficiency and reduced some production expenses, the overall cost of producing paper bags remains relatively high, particularly when compared to the low cost of manufacturing plastic bags.

These higher production costs may deter businesses, especially small and medium-sized enterprises (SMEs), from adopting paper bags as their preferred packaging solution. SMEs, which often operate on tighter budgets and have thinner profit margins, may find it economically challenging to absorb the higher costs associated with bags. Consequently, some businesses may opt for cheaper alternatives, such as plastic bags, despite their environmental drawbacks, thus limiting the market for paper bags.

Moreover, higher production costs can translate to higher prices for consumers, potentially reducing the affordability and accessibility in the retail market, further constraining the demand.

On the contrary, manufacturers are now producing paper bags in various shapes, sizes, and colors, allowing businesses to create unique packaging solutions that align with their branding and marketing strategies.

Moreover, advancements in printing technologies enable high-quality graphics and logos to be printed on bags, which are expected to provide lucrative opportunities for businesses to strengthen their brand identity and engage consumers effectively. Overall, these innovations in material and design not only improve the performance of paper bags but also cater to the evolving needs and preferences of consumers.

Segmental Overview

The global paper bag market is segmented into product type, end user, price point, distribution channel, and region. Depending on product type, the market is divided into sewn open mouth, pinched bottom open mouth, pasted valve, pasted open mouth, and flat bottom. By end user, it is segregated into agriculture & allied industries, building & construction, food & beverage, retail, chemicals, pharmaceutical, merchandise, and others. As per price point, it is fragmented into the premium, medium, and economy.

On the basis of distribution channel, it is bifurcated into B2B and B2C. Region wise, it is analyzed across Europe (Germany, France, Italy, Spain, UK, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product Type

Depending on product type, the flat bottom segment held the major share of the market in 2022. This is attributed to the fact that with growing concerns about environmental impact, consumers are seeking eco-friendly alternatives to traditional packaging. Thus, manufacturers are responding by developing flat-bottom paper bags made from recycled materials or sourced from sustainably managed forests.

By End User

On the basis of end user, the retail segment held the major paper bag market share in 2022. This is attributed to the fact that paper bags are used predominantly to carry goods from retail stores, as these bags act as eco-friendly carriers for clothing, food, gifts, and more, aligning with customer values.

In addition, with the proliferation of brick-and-mortar stores and online shopping platforms, the demand for packaging solutions, including paper bags, continues to grow. Regulatory measures aimed at reducing plastic usage in retail further drive the growth of the market.

By Price Point

By price point, the medium segment dominated the market in 2022, as medium-priced paper bags strike a balance between quality and affordability, making them a popular choice for a wide range of businesses, from boutiques to grocery stores. Furthermore, these bags offer versatility in terms of size, color, and handle options, allowing businesses to customize their packaging to align with their branding strategy.

By Distribution Channel

As per the distribution channel, the B2B segment led the market in 2022, as the B2B distribution of paper bags involves supplying bulk quantities of bags from manufacturers or wholesalers to businesses across various industries, such as retail, food service, industrial, and logistics. The versatility and customization capabilities of paper bags to meet specific packaging needs of businesses. Manufacturers are offering a wide range of options, including various sizes, strengths, and printing options, to cater to diverse B2B requirements which is expected to create more opportunities during the paper bag market forecast.

By Rrgion

Region-wise, Europe was the largest market and held the major share in 2022. The paper bag market in Europe is influenced by various factors, including environmental consciousness, regulatory measures, consumer preferences, and industry dynamics.

A growing emphasis on sustainability and environmental responsibility driven by increasing awareness of plastic pollution and regulatory measures to reduce single-use plastics contributes toward the paper bag market growth. This trend has led to a significant shift toward eco-friendly packaging solutions such as paper bags across various industries, including agriculture & allied industries, building & construction, food & beverage, retail, chemicals, pharmaceutical, merchandise, and others.

Competition Analysis

The players in the paper bag market have adopted acquisition, business expansion, partnership, collaboration, and product launch as their key development strategies to increase profitability and improve their position in the paper bag market.

Some of the key players profiled in the paper bag market analysis include Mondi Plc, Smurfit Kappa Group Plc, International Paper Company, Novolex Holdings, Inc., Ronpak, United Bag, Inc, Global-Pak, Inc, PaperBag Limited, York Paper Company Limited, and Welton Bibby and Baron Limited.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the paper bag market analysis from 2022 to 2032 to identify the prevailing paper bag market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the paper bag market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global paper bag market trends, paper bag market statistics, key players, market segments, application areas, and market growth strategies.

Paper Bag Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.4 billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 305 |

| By Product Type |

|

| By Price Point |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Mondi Plc., United Bag, Inc., York Paper Company Ltd., Global-Pak, Inc., Ronpak, Inc., Smurfit Kappa Group, Novolex, International Paper Company, Welton Bibby And Baron Limited, Paperbags Ltd. |

Analyst Review

According to the insights of CXOs of leading companies, changing consumer preferences and lifestyle trends, environmental awareness and sustainability initiatives, and increased adoption by retailers and e-commerce platforms are increasing the demand for paper bags. However, rising production costs and competition from alternative materials require strategic pricing and operational efficiencies to maintain profitability. Investing in advanced printing technologies and eco-friendly materials can differentiate offerings and capture maximum market share. Moreover, strategic partnerships along the supply chain enhance resilience and responsiveness to evolving market dynamics.

The CXOs further added that rising awareness of environmental issues, particularly concerning plastic pollution, is creating significant opportunities for the paper bag market. As consumers become more conscious of the detrimental effects of single-use plastics on the environment and marine life, the demand for sustainable alternatives such as paper bags is expected to grow. This heightened environmental awareness is driving a shift in consumer preferences toward eco-friendly products and packaging solutions.

Thus, innovations in biodegradable and recyclable materials represent a significant opportunity for the paper bag market, enabling manufacturers to meet the increasing demand for sustainable packaging solutions. The growing awareness about recyclable and biodegradable bag is expected to propel the growth of the paper bag market in the upcoming term of the year.

The global paper bag market size was valued at $4,776.2 million in 2022 and is projected to reach $8,350 million by 2032, registering a CAGR of 5.8% from 2023 to 2032.

The paper bag market is segmented into product type, end user, price point, distribution channel, and region. Depending on product type, the market is divided into sewn open mouth, pinched bottom open mouth, pasted valve, pasted open mouth, and flat bottom. By end user, it is segregated into agriculture & allied industries, building & construction, food & beverage, retail, chemicals, pharmaceutical, merchandise, and others. As per price point, it is divided into the premium, medium, and economy. On the basis of distribution channel, it is fragmented into B2B and B2C. Region wise, it is analyzed across Europe (Germany, France, Italy, Spain, UK, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

LAMEA is the largest regional market for paper bag

The key players operating in the global paper bag market include Mondi Plc, Smurfit Kappa Group Plc, International Paper Company, Novolex Holdings, Inc., Ronpak, United Bag, Inc, Global-Pak, Inc, PaperBag Limited, York Paper Company Limited, and Welton Bibby and Baron Limited.

The global paper bag market report is available on request on the website of Allied Market Research.

The forecast period considered in the global paper bag market report is from 2023 to 2032. The report analyzes the market sizes from 2022 to 2032 along with the upcoming market trends and opportunities. The report also covers the key strategies adopted by the key players operating in the market.

Loading Table Of Content...

Loading Research Methodology...