Paper Coating Materials Market Research, 2031

The global paper coating materials market size was valued at $2.1 billion in 2021, and paper coating materials industry is projected to reach $3.4 billion by 2031, growing at a CAGR of 4.8% from 2022 to 2031. Rise in demand for high-quality printed materials, driven by the need for superior aesthetics and enhanced readability in packaging, publishing, and advertising, is a key factor fueling the growth of the paper coating materials market. Also, advancements in paper coating technologies, such as innovative formulations and improved application methods, enable manufacturers to achieve better printability, gloss, and durability.

Market Dynamics

Paper coating materials are versatile substances used as coatings over base papers to impart properties such as luster, smoothness, and resistance. Coated paper products are processed along with plastics, latex, and clay to enhance longevity and aesthetic appearance by imparting sterility & improved recyclability.

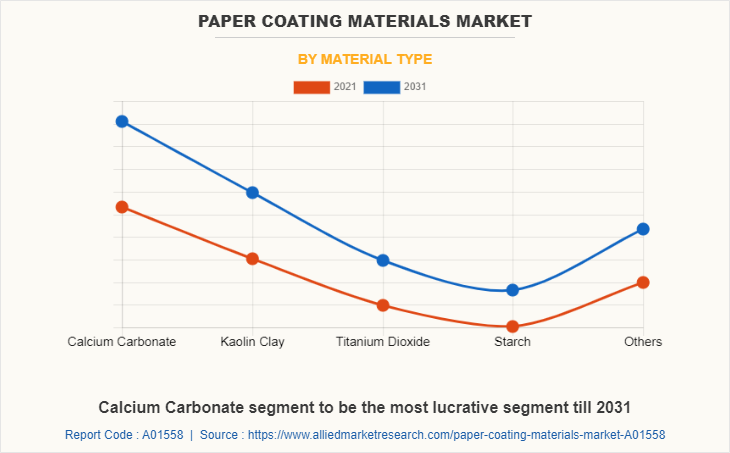

The paper coating materials market is driven by the increase in demand from the paper manufacturing industries, especially for corrugated boxes and cover bindings. Products with ground calcium carbonate are expected to boost in coming years, owing to their wide availability and low cost processing. In recent years, Kaolin clay & talc have witnessed major growth by application as fillers in coatings, which is anticipated to maintain its growth during the forecast period. With growth in paper industries, the demand for its application has increased in food packaging to ensure hygiene & sterility, with usage in stationary and binding industries. Majorly, the market is concentrated in Asia-Pacific regions, accounting rapid growth in industrial paper applications, followed by North America & Europe. Rise in disposable income is expected to surge the market growth in LAMEA. Increased use of electronic devices such as mobile phones, tablets, and e-books has restricted market growth in recent times; however, the environmental concerns on non-biodegradable plastics is expected to boost the market in the future.

The paper coating materials market is segmented by material type, coating type, end-user industry, and region. By material type, the market is divided into calcium carbonate, kaolin clay, titanium dioxide, starch, and others. By coating type, it includes single side and double side. By end use, It is classified into binding, stationary, packaging, corrugated boxes, and others.

Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, Asia-Pacific accounts for the largest paper coating materials market share , followed by North America and Europe.

The major companies profiled in this report include BASF SE, Asia Pulp & Paper (APP) Sinarmas, DuPont, Celanese Corporation, Imerys SA, Omya AG, Penford Corporation, Michelman Inc., Nippon Paper Industries Co., Ltd, and Eastman Chemical Company. Rapidly increasing consumption of paper due to environmental concerns on the usage of plastic has fueled the growth of paper coating materials market, especially in Asia Pacific and Middle East regions. Product innovation and expansion in various geographies is a key strategy adopted by the major players in the Paper Coating Materials industry. Additional growth strategies such as expansion of production capacities, acquisition, partnership and research & innovation in the application of the biodegradable coating materials on paper which led to key developments in the global paper coating materials market growth.

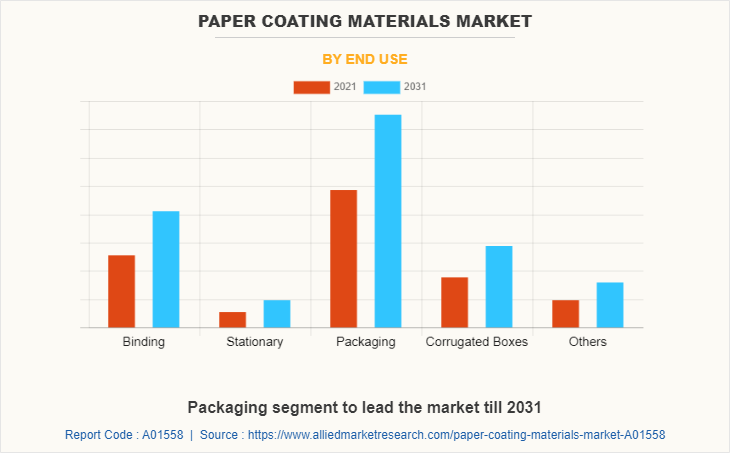

The packaging segment dominates the global paper coating materials market. Paper packaging includes flexible and rigid paper packaging formats such as corrugated boxes, paper sacks & bags, cartons, wrapping paper, inserts & dividers, cups & trays, display packaging, clamshells, and tapes & labels. Paper packaging has significant weight advantages that ensure benefits, in terms of raw material inputs and distribution efficiencies. Ban over the lightweight plastic bags and the growing demand for flexible paper packaging, owing to the rise in awareness among consumers regarding harmful effects of plastic on the environment are some of the factors augmenting the market growth.

The calcium carbonate segment dominates the global paper coating materials market. Calcium carbonate comprises more than 4% of the earth’s crust and is found throughout the world. It is the first choice for manufacturing paper and pulp. There are two kinds of calcium carbonates such as ground calcium carbonate (GCC), and precipitated calcium carbonate (PCC). These materials are widely used in manufacturing of printing paper, fillers such as ground or precipitated calcium carbonat. These are normally used to lower paper production costs and improve paper opacity and brightness. The presence of above mentioned factors will provide ample opportunities for the development of the market.

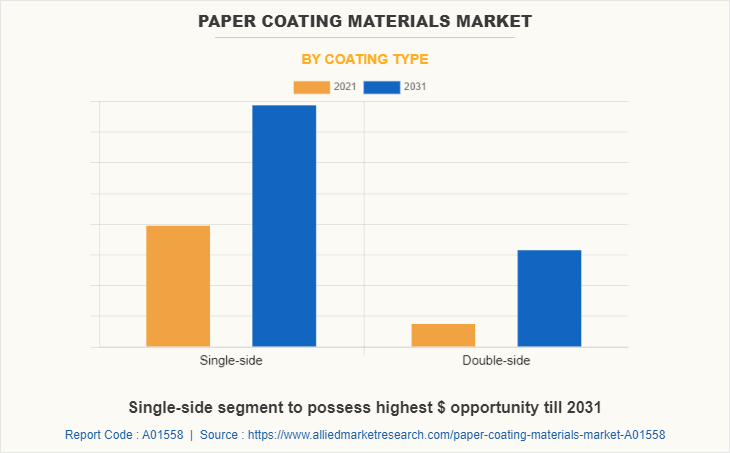

The single side segment dominates the global paper coating materials market. Single side coated paper is a product which is coated from one side. Single side coated papers are widely used in the food service industry, labels, flexible packaging, release liners, envelopes, gift wraps, thermal transfer print, posters, and others. Single-sided coated paper is a type of paper that has one side with an embossed design. Rapid change in life style among people has led to rise in demand for the food service industry, especially after the development of e-commerce. Increase in demand for gift wraps is expected to drive demand for single side coated papers. Increase in advertisement activities in developing countries through posters to increase product awareness through various means also propels the demand for single side coated paper in paper coating materials market.

Asia-Pacific dominated the paper coating materials market. Asia Pacific is projected to grow at the highest CAGR during the forecast period, owing to production and consumption of coated paper in the global market. The region is home to some of the largest paper-consuming countries such as India and China, which have expanded product scope in various industries. In addition, the booming e-commerce sector in the region has led to rise in demand for printing and packaging of products. Product use in advertising and print media also provides room for growth. Widespread digitalization, however, has adversely affected this application, and is anticipated to hamper its growth to some extent. Nonetheless, it has been anticipated that coated paper would be used in currency, security papers, and check books to ensure stable segment growth during the forecast period. Furthermore, steady use of this product as brochures and product manuals for smartphones, computers, and other electronic gadgets will maintain constant demand. Hence these are the major factors that are expected to propel growth of the market in this region during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the paper coating materials market analysis from 2021 to 2031 to identify the prevailing paper coating materials market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the paper coating materials market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global paper coating materials market trends, key players, market segments, application areas, and market growth strategies.

Paper Coating Materials Market Report Highlights

| Aspects | Details |

| By End Use |

|

| By Material Type |

|

| By Coating Type |

|

| By Region |

|

| Key Market Players | The Dow Chemical Company, Penford Corporation, Omya AG, Imerys SA, Asia Pulp & Paper (APP) Sinar Mas., Michelman Inc., Eastman Chemical Company, BASF SE, Celanese Corporation, Nippon Paper Industries Co., Ltd |

| | FKuR, Stora Enso, ATS Techno, Others |

Analyst Review

According to CXO Perspective, the global paper coating material market is expected to witness increased demand during the forecast period, owing to growth in demand for paper coating materials from the printing and packaging industry.

Coated paper is coated with a blend of materials or a polymer to give certain characteristics to the paper, including weight, surface sparkle, smoothness, or diminished ink absorbency. Rise in need for self-promotion of products on store shelves and mounting environmental concerns make packaging field the largest sector of the printing industry. Coated paper is utilized widely in printing applications to enhance aesthetic characteristics. Coated paper in food packaging prevents passage of moisture and oxygen, keeps food content fresh, and provides extended shelf-life. Hence, owing to the above-mentioned factors, application of paper coating materials in printing and packaging is expected to dominate the market during the forecast period.

Asia-Pacific is expected to dominate the market for paper coatings during the forecast period. Rise in demand for paper coating materials from the paints and coatings industry, along with growing population and construction activities in developing countries, such as China and India, is expected to drive demand for paper coating materials in this region. Largest producers of paper coating materials are located in Asia-Pacific region. Some of the leading companies in the production of paper coating materials are BASF SE, Eastman Chemical Company, Asia Pulp & Paper (APP) Sinar Mas, Nippon Paper Industries Co. Ltd, and Michelman Inc., among others. Rise in focus on eco-friendly and sustainable paper packaging is expected to gain traction with many countries, such as India and China, pushing for paper packaging products over plastic packaging.

Increase in utilization of coated papers in the packing industry and increase in need for superior quality coated papers are the key factors boosting the Paper coating materials market growth.

The market value of Paper coating materials in 2031 is expected to be $3.4 billion

BASF SE, Asia Pulp & Paper (APP) Sinarmas, DuPont, Celanese Corporation, Imerys SA, Omya AG, Penford Corporation, Michelman Inc., Nippon Paper Industries Co., Ltd, and Eastman Chemical Company.

Packaging application is projected to increase the demand for Paper coating materials Market

The report on global paper coating materials market is segmented by material type, coating type, end-use industry, and region. By material type, the market is divided into calcium carbonate, kaolin clay, titanium dioxide, starch, and others. By coating type, it includes single side and double side. By end use, it is classified into binding, stationary, packaging, corrugated boxes, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Adoption of bio-based materials and ban on plastic packaging is the Main Driver of Paper coating materials Market.

COVID-19 has impacted corrugated packaging globally as demand of finished products has declined, which resulted in lower demand for corrugated packaging. All developed and developing countries have to take strict action to curb the increasing count of the coronavirus cases which leads to the lockdown in several regions. Hence, these factors have led to decline in demand for consumer goods and raw materials for various industries in different regions. This resulted into loss to corrugated packaging manufacturers during the pandemic. The decline in demand for corrugated boxes has led to decline in demand for paper coatings materials.

Loading Table Of Content...