Paper Pallet Market Research, 2032

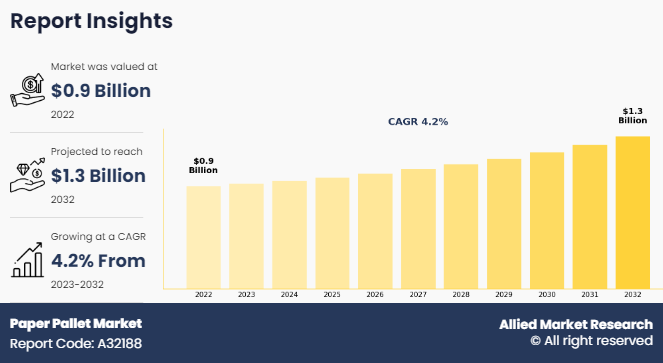

The global paper pallet market size was valued at $0.9 billion in 2022, and is projected to reach $1.3 billion by 2032, growing at a CAGR of 4.2% from 2023 to 2032. The paper pallet market share is driven by eco-friendliness, cost-effectiveness, recyclability, and lightweight nature, catering to increasing demand for sustainable packaging solutions across various industries globally.

Paper pallet is a type of pallet made primarily from paper-based materials, designed to serve as a versatile and environmentally friendly alternative for traditional wooden or plastic pallets. Paper pallets are constructed using various forms of paper, such as corrugated cardboard or recycled paper fibers, combined with adhesives and sometimes additional strengthening materials. Paper pallets are categorized in corrugated cardboard sheets, honeycomb paperboard, and recycled paper fibers. These pallets are used in shipping, logistics, and retailing, meeting international standards for transportation while providing a lightweight and powerful solution for various load capacities.

Key Takeaways

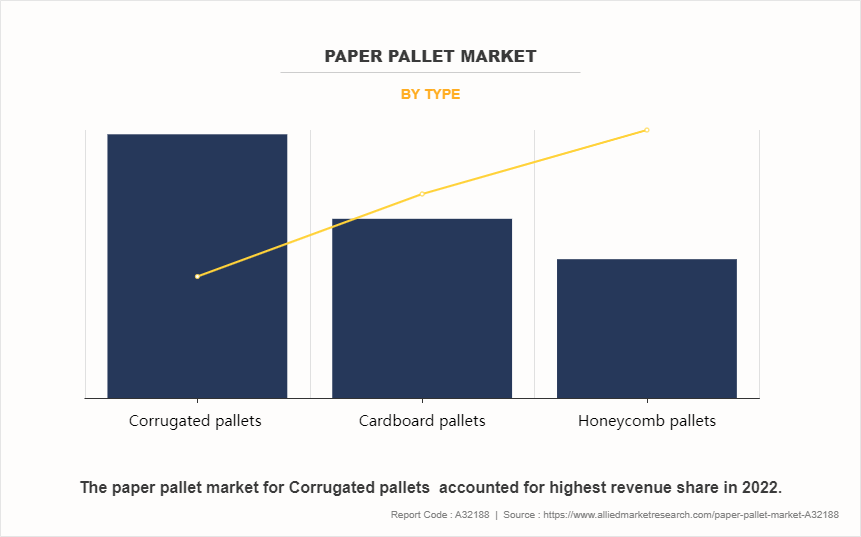

- By type, the corrugated pallets segment was the highest revenue contributor to the paper pallet market in 2022.

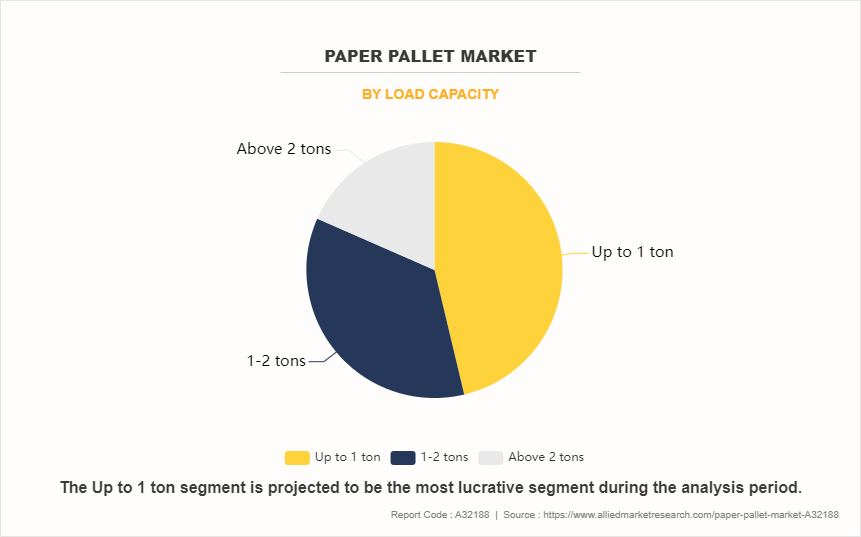

- As per load capacity, up to 1 ton segment was the largest segment in the global paper pallet market during the forecast period.

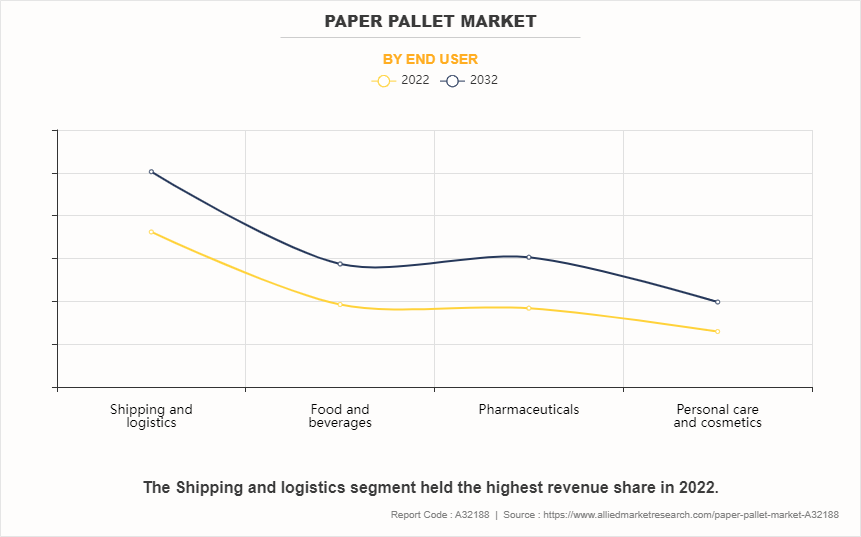

- Depending on end user, shipping & logistics segment was the largest segment in 2022.

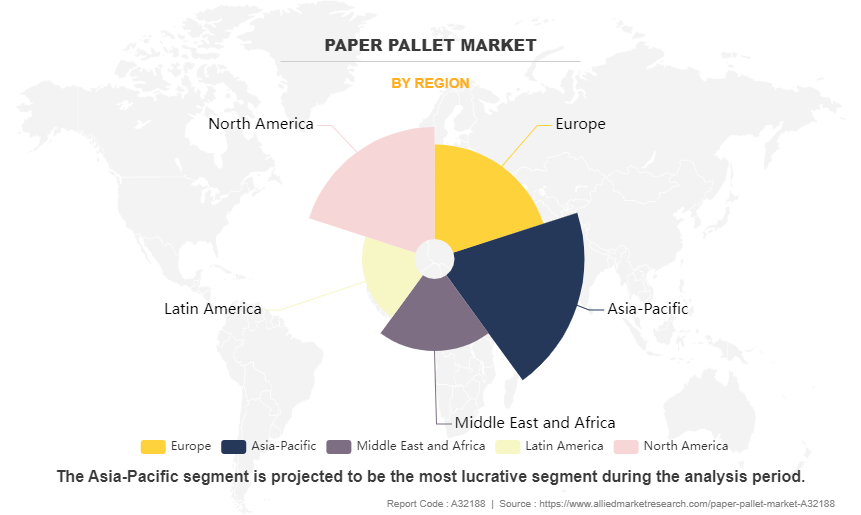

- Region-wise, Asia-Pacific was the highest revenue contributor in 2022.

Market Dynamics

The rise in demand for eco-friendly packaging solutions is anticipated to drive the demand for paper pallet market. With a growing global consciousness about environmental sustainability, businesses are increasing pressure to adopt green practices throughout their operations, including packaging. Paper pallets, being biodegradable, recyclable, and sourced from renewable materials, emerge as a preferred choice for companies seeking to align with these eco-friendly aspirations. The latest paper pallet market statistics reveal a significant uptick in demand, with a 10% increase in sales attributed to the rising preference for sustainable packaging solutions worldwide. As consumer awareness continues to rise regarding the environmental impact of packaging materials, businesses are bound to adopt sustainable alternatives which significantly benefit the paper pallet market from this shift in preference.

Moreover, companies recognize that adopting sustainable packaging solutions enhances their brand image and aligns with consumer expectations. The versatility of paper pallets in meeting these dual objectives of environmental responsibility and brand enhancement makes them a fascinating choice. As a result, the increasing demand for eco-friendly packaging solutions drives the paper pallet market demand.

The demand for paper pallets experiences a significant surge in the compelling factor of cost-effectiveness. As businesses seek to optimize their operational expenses, the cost advantages combined with paper pallets become a significant driver of adoption. Unlike traditional wooden or plastic pallets, paper pallets are often produced at a lower cost and make them an economically attractive option for companies looking to enhance their bottom line. The reduced production expenses translate into cost savings for businesses without compromising on the essential functions and durability required for efficient material handling and storage. In addition, the lightweight nature of paper pallets contributes to substantial savings in transportation costs. As logistics play a pivotal role in supply chain efficiency, the reduced weight of paper pallets leads to lower fuel consumption and shipping expenses. Furthermore, this feature becomes particularly advantageous in the context of global trade and distribution, where minimizing transportation costs is a key consideration for businesses. The cost-effectiveness of paper pallets addresses the immediate financial concerns of companies and aligns with broader industry trends favoring sustainable and economically viable packaging solutions. Thus, all these factors contribute in the growth of the paper pallet market.

Limited load capacity significantly impacts the market demand for paper pallets despite their eco-friendly and cost-effective attributes. The essential structural limitations of paper pallets in terms of load-bearing capacity restrict their adoption in industries requiring heavy-duty pallets. Certain sectors which deal with substantial or dense products, such as construction materials or automotive parts, may find paper pallets unsuitable due to concerns about load stability and potential damage during transportation and storage. As a result, businesses with high-load requirements are likely to favor alternative materials like wooden or plastic pallets that can reliably support heavier weights.

Moreover, the limited load capacity presents challenges in supply chain optimization, particularly in industries where there are large or heavy shipments. Businesses prioritize pallets which accommodate diverse product loads without compromising safety or efficiency. The restriction on load capacity hinders the broader adoption of paper pallets across various sectors, as industries seek pallet solutions which align with their sustainability goals and logistical requirements. Thus, all these factors limit the growth of the paper pallet market.

Durability concerns act as a restraint on the demand for paper pallets market. As advancements have been made to improve the durability of paper pallets, they still face challenges, particularly in demanding environments. Paper pallets may be susceptible to damage from moisture, impact, or rough handling, which compromise their structural integrity and overall longevity. In industries where pallets are exposed to harsh conditions, such as outdoor storage or transportation through unpredictable weather, the perceived vulnerability of paper pallets discourage potential users from adopting them, as they seek materials with a higher level of resilience.

Furthermore, the durability issue limits the scope of applications for paper pallets, particularly in industries where long-term use or repeated handling is essential. In sectors like manufacturing or distribution, where pallets are used for frequent loading and unloading processes, concerns about the wear and tear of paper pallets over time may lead businesses to opt for more durable alternatives like plastic or metal pallets which often limit the growth of the paper pallet market.

The growing e-commerce sector presents significant opportunities for the paper pallet market as the demand for online shopping continues to surge globally and the need for efficient and sustainable packaging solutions have increased. Paper pallets are lightweight, have easily customizable features and are well-suited for the specific requirements of the e-commerce supply chain. Moreover, the ease of handling and transport associated with paper pallets aligns with the smaller-sized shipments typical in e-commerce which offers a cost-effective and eco-friendly alternative to traditional pallet materials. The scalability and adaptability of paper pallets cater to the dynamic nature of the e-commerce sector and provide a strategic advantage for businesses seeking to streamline their packaging processes.

In addition, the growth of the e-commerce sector presents opportunities for collaboration between paper pallet manufacturers and e-commerce companies. Establishing partnerships with major online retailers allows paper pallet suppliers to integrate their sustainable packaging solutions into the e-commerce logistics infrastructure. Furthermore, this collaboration promotes the adoption of paper pallets, enhances brand visibility and credibility as environmentally responsible partners in the rapidly expanding e-commerce market. Thus, all these factors present several opportunities for the paper pallet market.

Segmental Overview

The paper pallet market is segmented into type, load capacity, end user, and region. By type, the market is classified into corrugated pallets, cardboard pallets, and honeycomb pallets. By load capacity, the market is classified into up to 1 ton, 1-2 tons and above 2 tons. As per end user, the market is classified into shipping & logistics, food & beverages, pharmaceuticals, and personal care & cosmetics. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (France, Germany, the UK, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, ASEAN, and the rest of Asia-Pacific), and Latin America (Brazil, Argentina, Colombia, and Rest of Latin America) and Middle East & Africa (South Africa, Saudi Arabia, UAE and Rest of MEA).

By Type

By type, the corrugated pallets segment dominated the global paper pallet market in 2022 and is anticipated to maintain its dominance during the paper pallet market forecast period. Corrugated pallets are naturally eco-friendly, being made from renewable and recyclable materials, which aligns with the growing sustainability trend in packaging. Furthermore, they often boast a lower price point compared to alternatives, offering cost savings without compromising on performance. They offer a compelling combination of strength and durability, capable of supporting heavy loads while withstanding the rigors of transportation and storage. Secondly, corrugated pallets are lightweight compared to traditional wooden pallets, reducing shipping costs and enhancing handling efficiency.

By Load Capacity

By load capacity, up to 1 ton segment dominated the global paper pallet market in 2022 and is anticipated to maintain its dominance during the forecast period. It caters to a broad range of industries and applications, including retail, food and beverage, pharmaceuticals, and automotive, among others. This versatility ensures widespread adoption and demand across diverse sectors. Moreover, paper pallets within this weight capacity range offer a balance between strength and lightweight design, making them suitable for a wide variety of goods and shipping requirements. They efficiently handle substantial loads while still being easy to handle and transport. Furthermore, paper pallets in the up to 1-ton segment typically offer cost advantages over heavier alternatives, contributing to their widespread adoption among cost-conscious businesses.

By End User

By end user, the shipping & logistics segment dominated the global paper pallet market in 2022 and is anticipated to maintain its dominance during the forecast period. The industry's massive scale and reliance on efficient, cost-effective packaging solutions drive significant demand for paper pallets. Given the high volume of goods transported globally, the shipping and logistics sector requires pallets that are lightweight yet sturdy enough to support various loads. Paper pallets fulfill this need admirably by offering a balance between strength and weight which promotes optimizing transportation costs and efficiency.

By Region

Region-wise, Asia-Pacific is anticipated to dominate the market with the largest share during the forecast period. Asia-Pacific emerges as the most dominating region in the paper pallet market due to several key factors such as the region is home to some of the world's largest manufacturing hubs, including China and India which drives substantial demand for packaging solutions like paper pallets. The growing emphasis on sustainability and environmental concerns in countries across Asia-Pacific aligns well with the eco-friendly nature of paper pallets, encouraging their adoption.

Competitive Analysis

Key players profiled in this report include Conitex Sonoco, DS Smith Plc, Kimmo (Pty) Ltd., Kraft Pal Technologies Ltd., Interpak Industries Pte. Ltd., Oji Holdings Corporation, Mondi Group, The Alternative Pallet Company Ltd., The Corrugated Pallet Company, and Smurfit Kappa Group.

Several upcoming brands are vying for market dominance in the expanding paper pallet industry. Smaller, niche firms are more well-known for catering to consumer demands and tastes. Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they have different recognition or range of products than well-known companies. An important competition component is innovation in paper pallet products, sourcing, and sustainability policies. Brands that are able to change the tastes of their target market and align with their ethical & environmental values have an advantage over rivals.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the paper pallet market analysis from 2022 to 2032 to identify the prevailing paper pallet market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the paper pallet market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global paper pallet market trends, key players, market segments, application areas, and market growth strategies.

Paper Pallet Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Type |

|

| By Load Capacity |

|

| By End User |

|

| By Region |

|

| Key Market Players | Mondi Group, Interpak Industries Pte. Ltd., KraftPal Technologies Ltd., Conitex Sonoco, The Corrugated Pallet Company, DS Smith Plc, Kimmo (Pty) Ltd., The Alternative Pallet Company Ltd., Oji Holdings Corporation, Smurfit Kappa Group |

Analyst Review

According to CXOs of leading companies, the global paper pallet market is growing at a considerable pace owing to several factors such as rise in demand for eco-friendly packaging solutions. As consumer awareness continues to rise regarding the environmental impact of packaging materials, businesses are bound to adopt sustainable alternatives which significantly benefits paper pallet market from this shift in preference. The reduced weight of paper pallets directly translates into lower fuel consumption and transportation costs and presents an attractive plan for businesses aiming to optimize their logistics expenses. All these factors fuel the increase in sales of the paper pallet market.

Furthermore, the lightweight and standardized design of paper pallets enables efficient use of storage space which contributes to better warehouse organization and inventory management. This becomes particularly crucial in industries with high-volume, fast-moving goods, where optimizing storage and transportation processes directly impacts overall operational productivity. The ease of handling and transport associated with paper pallets aligns with the smaller-sized shipments typical in e-commerce which offers a cost-effective and eco-friendly alternative to traditional pallet materials. Moreover, the scalability and adaptability of paper pallets cater to the dynamic nature of the e-commerce sector and provide a strategic advantage for businesses seeking to streamline their packaging processes and contribute to the growing demand for paper pallet market.

The global paper pallet market was valued at $ 868.2 Million in 2022 and is projected to reach $ 1,290.9 million by 2032, registering a CAGR of 4.2%.

The forecast period in the paper pallet market report is 2023 to 2032.

The base year calculated in the paper pallet market report is 2022.

The top companies analyzed for global paper pallet market report are Conitex Sonoco, DS Smith Plc, Kimmo (Pty) Ltd., Kraft Pal Technologies Ltd., Interpak Industries Pte. Ltd., Oji Holdings Corporation, Mondi Group, The Alternative Pallet Company Ltd., The Corrugated Pallet Company, and Smurfit Kappa Group.

The corrugated segment is the most influential segment in the paper pallet market report.

Asia-Pacific holds the maximum market share of the paper pallet market.

The company profile has been selected on the basis of revenue, product offerings, and market penetration

The market value of the paper pallet market in 2022 was $ 868.2 million.

Loading Table Of Content...

Loading Research Methodology...