Paper Straw Market Overview

The global paper straw market size was valued at $865.3 million in 2021, and is projected to reach $3 billion by 2031, growing at a CAGR of 13.3% from 2022 to 2031. The demand for paper straws is rapidly increasing due to growing environmental awareness and government restrictions on single-use plastic cutlery. These regulations, affecting usage in households, hotels, and restaurants, have encouraged a shift toward eco-friendly alternatives. As a result, global demand for paper straws continues to rise significantly.

Market Dynamics & Insights

- The paper straw industry in Europe held a significant share of over 33% in 2021.

- The paper straw industry in India is expected to grow significantly at a CAGR of 16.3% from 2022 to 2031

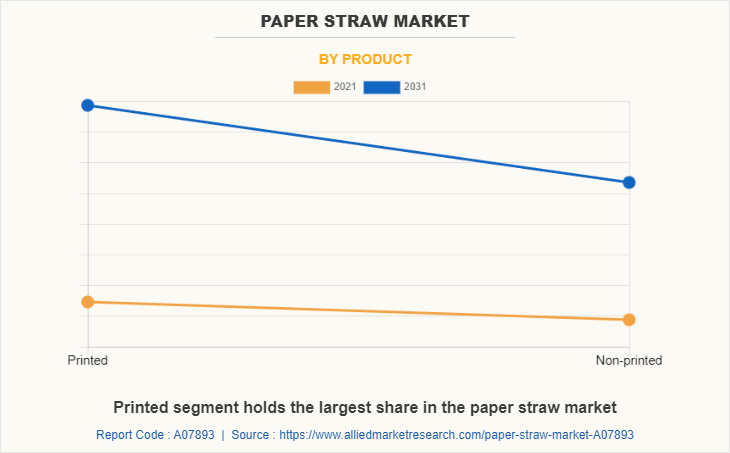

- By product type, printed segment is one of the dominating segments in the market and accounted for the revenue share of over 56.8% in 2021.

- By end-user, household segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2021 Market Size: $0.86 Billion

- 2031 Projected Market Size: $3 Billion

- CAGR (2022-2031): 13.3%

- Europe: Largest market in 2021

- Asia-Pacific: Fastest growing market

Market Introduction and Definition

Paper straw is a thin tube made of waterproof paper that is used to suck liquid into the mouth. During the paper straw manufacturing process, several thin reels of paper are run through a glue bath. These tacky reels are then wound together into a long paper cylinder. Those long cylinder tubes are then cut to size, packaged, and shipped.

The global paper straw market is in the introductory phase of the industry life cycle and is expected to explore new growth opportunities during the coming years. Some of the basic factors driving the demand for the market include, governmental initiatives to eliminate use of plastic and strict regulatory outlook against the use of conventional plastic products for manufacturing of utensils.

Industry trends are shifting toward bio-based products to reduce dependence on conventional plastics for straws. Moreover, most of the manufacturers in industries, such as packaging, textile, and agriculture are shifting toward bio-based products for manufacturing of straws and other utensils due to stringent regulations from the government. Such factors are largely impacting the paper straw market growth.

On the other hand, the growth of the market is negatively impacted by strict government regulations while installation of machines used for manufacturing of paper straws. During the outbreak of the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were majorly affected. Manufacturing activities were halted or restricted. This led to decline in manufacturing of various equipment used for manufacturing of paper straw as well as their demand in the market, thereby restraining the growth of the paper straw industry. Conversely, industries are gradually resuming their regular manufacturing and services. This is expected to lead to re-initiation of paper straw companies at their full-scale capacities, that helped the paper straw market share to recover by end of 2021.

Paper Straw Market Segmentation Overview

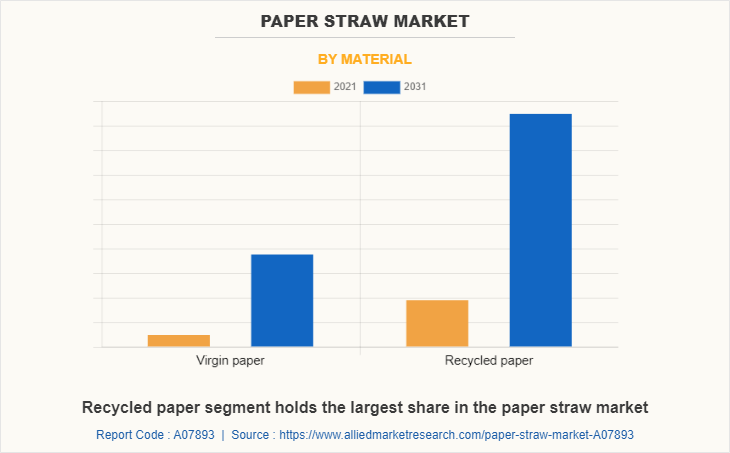

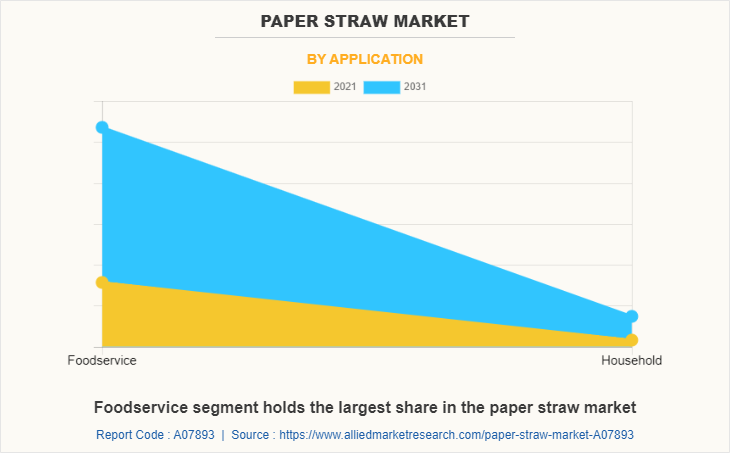

The paper straw market is segmented on the basis of material, product, end user, and region. By material, the market is fragmented into virgin paper and recycled paper. By product, the global market is categorized into printed and non-printed. By end user, the market is divided into food service and household. Region-wise, the market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (UK, France, Germany, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

On the basis of material, in 2021 the recycled paper segment dominated the paper straw market, in terms of revenue, and is expected to witness growth at the highest CAGR during the forecast period.

As per product

In 2021, the printed segment led the market, and is expected to exhibit highest CAGR in the near future.

By end user

The foodservice segment led the market in 2021, in terms of revenue and the household segment is anticipated to register highest CAGR during the forecast period.

Region wise

Europe garnered the highest revenue in 2021; however, Asia-Pacific is anticipated to register highest CAGR during the forecast period.

Competition Analysis

The major players profiled in the paper straw market report include, Aleco Industrial Co. Ltd., Biopak , Bygreen, Canada Brown Eco Products Ltd , Charta Global , Focus Technology Co., Ltd. , Footprint , Fuling Global Inc. , Hoffmaster Group, Inc. , Huhtamaki Oyj , Lollicup USA, Inc. , Ningbo Jiangbei Shenyu Industry and Trade Co., Ltd. , Shenzhen Grizzlies Industries Co., LTD , Soton Daily Necessities Co., Ltd. , Tipi Straws, Transcend Packaging Ltd., and YuTong Eco-Technology (SuQian) Co., Ltd. Major companies in the market have adopted product launch and business expansion as their key developmental strategies to offer better products and services to customers in the paper straw market.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the paper straw market analysis from 2021 to 2031 to identify the prevailing paper straw market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the paper straw market forecast.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global paper straw market trends, key players, market segments, application areas, and market growth strategies.

Paper Straw Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3 billion |

| Growth Rate | CAGR of 13.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 240 |

| By Product |

|

| By Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | BioPak, Footprint, Lollicup USA, Inc., Ningbo Jiangbei Shenyu Industry and Trade Co., Ltd., Transcend Packaging Ltd., Huhtamaki Oyj, Tipi Straws, YuTong Eco-Technology (SuQian) Co., Ltd, ALECO INDUSTRIAL CO., LTD., Canada Brown Eco Products Ltd, Shenzhen Grizzlies Industries Co., LTD, Focus Technology Co., Ltd., charta global, inc., Hoffmaster Group, Inc., Soton Daily Necessities Co., Ltd., Fuling Global Inc., Bygreen |

Analyst Review

Paper straws are considered as the major innovation from renewable material as the world is discovering alternatives to single use plastic products. It is being adopted as a perfect substitute to single use plastic as the paper products decompose easily as compared to plastic after a definite period of time by causing no harm to the environment.

Increase in number of manufacturers, favorable government policies for the adoption of sustainable and biodegradable products, and rise in availability of renewable feedstock boost the growth of the paper straw market. Rise in consumer acceptance due to various awareness and education programs regarding bio-based products is providing a new perspective to eliminate usage of conventional plastic. However, higher price of bio-based plastic as compared to traditional plastic coupled with low performance standards hamper the market growth.

At present, there is an increase in the number of restaurants and cafes around the world. This propels the growth of the paper straw market. Furthermore, rapid expansion of the food & beverage industry, along with surge in demand for the straws made from chlorine free paper that is more environment–friendly option for on-the-go food and drinks, increase the adoption of paper straws.

The global paper straw market was valued at $865.3 million in 2021, and is projected to reach $3,042.8 million by 2031, registering a CAGR of 13.3% from 2022 to 2031.

The forecast period considered for the global paper straw market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

To get latest version of global paper straw market report can be obtained on demand from the website.

The base year considered in the global paper straw market report is 2021.

The top companies holding the market share in the global paper straw market report include Aleco Industrial Co. Ltd., Biopak , Bygreen, Canada Brown Eco Products Ltd , Charta Global , Focus Technology Co., Ltd. , Footprint , Fuling Global Inc. , Hoffmaster Group, Inc. , Huhtamaki Oyj , Lollicup USA, Inc. , Ningbo Jiangbei Shenyu Industry and Trade Co., Ltd. , Shenzhen Grizzlies Industries Co., LTD , Soton Daily Necessities Co., Ltd. , Tipi Straws, Transcend Packaging Ltd., and YuTong Eco-Technology (SuQian) Co., Ltd.

The top seventeen market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

By product, the printed segment is the highest share holder of paper straw market.

Loading Table Of Content...