Parametric Insurance Market Overview

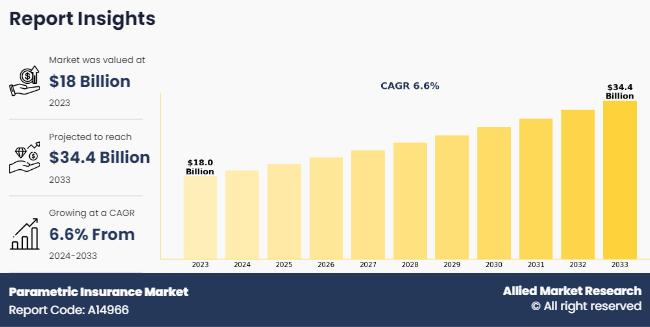

The global parametric insurance market was valued at $18 billion in 2023, and is projected to reach $34.4 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033. Rising natural disasters from climate change, advanced data analytics, IoT adoption, and growing awareness of alternative risk transfer solutions are contributing to the growth of the market.

Market Dynamics & Insights

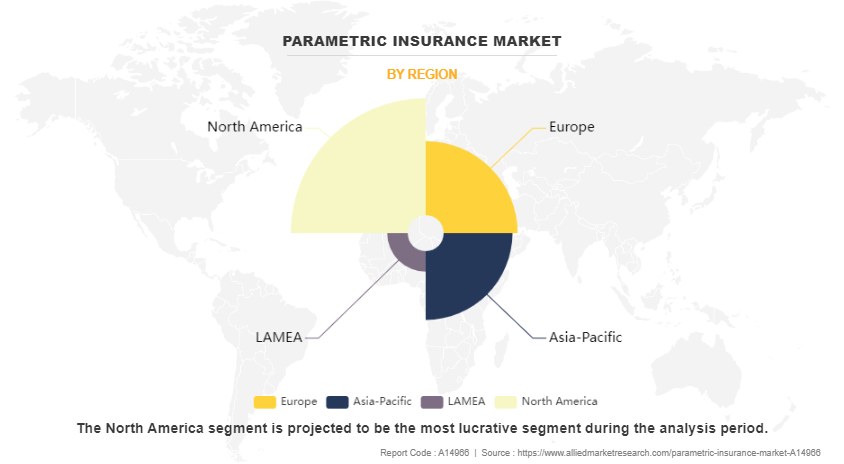

- The parametric insurance industry in North America held a significant share of 42% in 2023.

- The parametric insurance industry in India is expected to grow significantly at a CAGR of 12.9% from 2024 to 2033.

- By type, the natural catastrophes insurance segment is one of the dominating segment in the market, accounting for the revenue share of 74% in 2023.

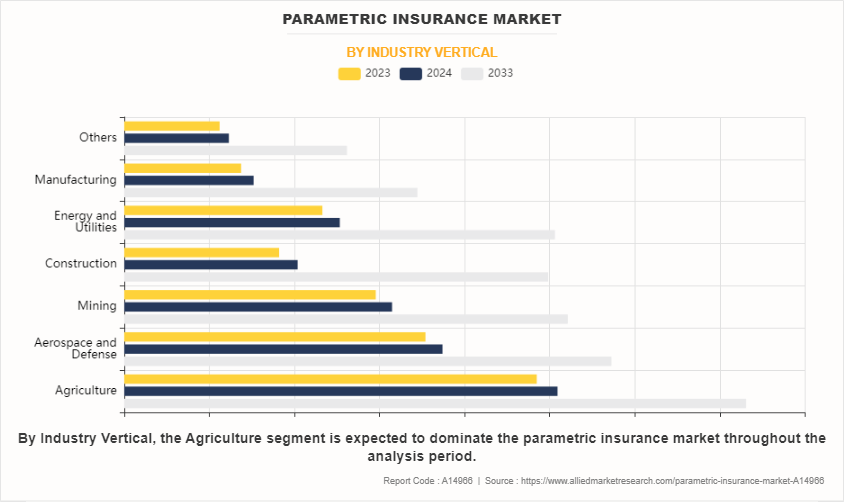

- By industry vertical, the agriculture segment dominated the industry in 2023 and accounted for the largest revenue share of 27%.

Market Size & Future Outlook

- 2023 Market Size: $18 Billion

- 2033 Projected Market Size: $34.4 Billion

- CAGR (2024-2033): 6.6%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

What is Meant by Parametric Insurance

Parametric insurance market is an innovative risk management solution that provides coverage based on the occurrence of predefined events, rather than the traditional indemnity model that relies on assessing actual losses. This type of insurance offers several benefits, including faster payouts since claims are triggered by objective parameters, such as a specific amount of rainfall or wind speed, reducing the need for time-consuming loss assessments. It enhances transparency and reduces disputes over claims, as the criteria for payouts are clearly defined and agreed upon in advance. In addition, parametric insurance covers a wide range of risks, including those that are difficult to insure through traditional methods, making it a versatile tool for managing both natural and man-made disasters. It helps businesses and individuals recover more swiftly from adverse events by providing quick financial relief, thereby improving resilience and stability.

The increase in frequency and severity of natural disasters, driven by climate change, has highlighted the need for quicker and more efficient claims processes, which drive the growth of parametric insurance market. In addition, technological advancements, such as improved data analytics and the proliferation of IoT devices, boost the demand for parametric insurance model. Moreover, rise in awareness and acceptance of alternative risk transfer solutions drive market growth. Furthermore, expanding parametric insurance across regions, leveraging big data & AI to refine risk models, and increasing innovative products tailored to specific risks such as pandemics or cyber events are expected to provide lucrative opportunities for market growth during the forecast period. However, the complexity of accurately defining and measuring parameters, and regulatory challenges in different jurisdictions. Overcoming these hurdles is epected to be crucial for the widespread adoption and success of parametric insurance coming years.

The parametric insurance industry has experienced significant growth as it addresses the surge in demand for more efficient and transparent risk management solutions. Unlike traditional insurance models, parametric insurance offers quick payouts on the basis of predefined criteria, which is particularly valuable in managing natural disaster risks and other high-frequency, high-impact events. The industry expansion is fueled by advancements in data analytics, IoT technology, and the rise in acceptance of alternative risk transfer solutions. These developments enhance the precision of risk assessment and trigger mechanisms, making parametric insurance more attractive to both businesses and individuals. However, the industry navigates challenges such as accurately defining parameters, managing basis risk, and complying with diverse regulatory environments. Addressing these obstacles is expected to be essential for leveraging the full potential of the parametric insurance market opportunity.

Parametric Insurance Market Segment Review

The parametric insurance market is segmented on the basis of type, industry vertical, and region. By type, it is classified into natural catastrophes, specialty insurance, and others. By industry vertical, it is segregated into agriculture, construction, mining, manufacturing, energy & utility, aerospace & defense, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By industry vertical, the construction segment is expected to grow at the fastest rate during the forecast period. This is attributed to the fact that traditional property damage plans ignore the impact of seasonal fluctuations in temperature, rainfall, or snow on a portfolio of construction projects, even though this cost is frequently significantly higher than the cost of repairing a structure after flooding or wind damage. Hence, the parametric insurance market opportunity cover increasingly helps contractors to mitigate weather-related perils during construction and operations.

By region, theParametric Insurance Market Forecast is dominated by North America in 2023 and is expected to maintain this trend during the forecast period. This is attributed to the fact that in places such as the U.S. and Canada, parametric insurance has become a more feasible alternative for helping organizations create climate resilience and boost catastrophe response & recovery. Moreover, insurance companies are increasingly expanding theirParametric Insurance Market Outlook business to the North America region, resulting in growth of the market.

The report analyzes the profiles of key players operating in the parametric insurance market, such as Munich Re, QBE Insurance Group Limited, Hannover, Rück SE, Chubb, Jumpstart Insurance Solutions, Inc., AXA XL, FloodFlash, Global Parametrics, Swiss Re, Zurich American Insurance Company, SCOR SE, Sompo Holdings, Inc., Beazley Group, Allianz and Berkshire Hathaway Specialty Insurance. These players have adopted various strategies to increase their parametric insurance market penetration and strengthen their position in the Parametric Insurance Market Analysis.

Market Landscape and Parametric Insurance Market Trends

Parametric insurance is an innovative insurance model that provides payouts based on predefined parameters or indices, rather than on the actual loss incurred. This type of insurance triggers payments when specific conditions, such as weather events or seismic activity, meet or exceed predetermined thresholds. This model enhances the efficiency and transparency of the claims process by eliminating the need for complex loss assessments and reducing administrative delays. The impact on the industry is profound: it allows for faster and more predictable claims settlement, improves risk management through precise data & parameter-based assessments, and expands coverage options for events that traditional insurance struggles to addressi n parametric insurance market . As a result, parametric insurance market streamlines operations and reduces costs. It drives innovation in risk management and provides more accessible and reliable insurance solutions for high-frequency, low-severity events of the parametric insurance market.

What are the Top Impacting Factors in Parametric Insurance Market

Increasing frequency of natural disasters and climate-related events

Increase in frequency of natural disasters and climate-related events is a crucial driver for the parametric insurance industry. As extreme weather events, such as hurricanes, floods, and wildfires, become more common and severe due to climate change, there is a heightened need for insurance solutions that can provide rapid and reliable payouts. Parametric Insurance Market Share addresses this need by offering payouts based on predefined triggers, such as rainfall levels or wind speeds, which allows for quick and straightforward claims processing without the delays of traditional loss assessments. This ability to promptly respond to large-scale, high-frequency events makes parametric insurance market an attractive option for managing the financial impacts of such disasters, driving its adoption and growth in response to the increasing challenges posed by climate-related risks.

Faster and more transparent claims processing

Faster and more transparent claims processing drive the growth of the parametric insurance industry by addressing the inefficiencies of traditional insurance claims. Traditional insurance often involves complex and time-consuming assessments to determine the amount of a claim, which can delay payments and cause frustration. In contrast, parametric insurance simplifies this by providing payouts based on predefined conditions, such as weather data or seismic measurements, that are objectively recorded. This means that once these conditions are met, payments are made quickly and without the need for detailed loss evaluations. This efficiency and clarity in the claims process make parametric insurance a more appealing option for businesses and individuals who need timely and predictable coverage responses. Therefore, this is a major factor that propels the parametric insurance market growth.

Lack of awareness

Many potential clients are unfamiliar with how parametric insurance market works, including its benefits and differences from traditional insurance. This lack of understanding leads to skepticism and reluctance to adopt parametric policies, limiting market growth. To address this challenge, there is a need for increased education and awareness efforts to inform stakeholders about the advantages of parametric insurance, such as faster claims processing and greater transparency, and how it can effectively manage specific risks. Improving awareness can help build confidence in parametric insurance and drive broader acceptance across various sectors.

Surge in adoption of advanced technologies

The surge in adoption of advanced technologies presents significant for the parametric insurance industry in paramatric insurance market. Technologies such as real-time data analytics, Internet of Things (IoT) devices, and blockchain are enhancing the precision and efficiency of parametric insurance models. Real-time data analytics enable insurers to accurately monitor and assess parameters, ensuring timely and precise trigger activation. IoT devices, such as weather sensors and seismic monitors, provide continuous and reliable data that helps in defining and verifying the conditions for payouts. Blockchain technology offers secure and transparent transaction records, reducing fraud and ensuring the integrity of claims processing. These advancements improve the accuracy of risk assessments and streamline claims management, making parametric insurance more attractive and effective. As technology continues to evolve, it opens new possibilities for customizing coverage, expanding into new markets, and offering innovative products tailored to specific risks. Therefore, these factors are expected to provide major lucrative Parametric Insurance Market for the growth of the Parametric Insurance Market Size during the forecast period of the parametric insurance market.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market forecast from 2024 to 2034 to identify the prevailing parametric insurance market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of parametric insurance market.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the parametric insurance market segmentation assists to determine the prevailing market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global parametric insurance market trends, key players, market segments, application areas, and market growth strategies.

Parametric Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 34.4 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 312 |

| By Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Jumpstart Insurance Solutions, Inc., SCOR SE, Zurich American Insurance Company, Sompo Holdings, Inc., Swiss Re, Global Parametrics, Hannover Rück SE, Munich Re, Berkshire Hathaway Specialty Insurance, QBE Insurance Group Limited, Chubb, Allianz, Beazley Group, AXA XL, FloodFlash |

Analyst Review

With the rise in awareness of secondary perils and surge in economic costs, risk managers have become more pro-active and seek improved ways to appraise & mitigate the risk rather than simply relying on traditional insurance and risk transfer. To avoid steep economic losses, demand has grown for flexible, alternative insurance products that address protection gaps. For this reason, the parametric insurance market is anticipated to grow significantly. Advancements in data analytics and improvements in modelling techniques have made parametric insurance a more preferred option, allowing for improved modelling of risks previously deemed uninsurable. Better data also means increased risk assessment certainty, allowing businesses to put sound continuity plans in place and make better-informed insurance purchasing decisions.

Moreover, parametric insurance provides certainty in uncertain times. Policy terms are clearly outlined and based on objective, third party data from public agencies or specialist firms. Since the data is incontrovertible, there is no lengthy negotiation over the policyholder is owed. During the pandemic, many firms appreciated what they were covered for and what they were not covered for. With parametric insurance, the parameters are clearly defined and settled swiftly, without any need for lengthy, complex loss adjustment processes. Resultantly, these policies have become increasingly attractive. Many companies were affected by the extent and severity of disruption caused by the pandemic. This made corporations more aware of their upstream exposure to natural catastrophes and potential gaps in their current insurance programs. Consequently, an increasing number of companies are looking for solutions in the alternative risk transfer market.

As a result, a rise in interest in parametric insurance is a very effective instrument to fill the gaps left by traditional insurance programs. A post-COVID world demands certainty and adaptability, and parametric insurance offers just that. The market also craves flexibility, further driving up demand for parametric insurance. These premiums are tailored to a customer’s specific budget, as well as being bundled in with indemnity insurance in a bespoke manner to bridge any gaps in coverage.

With parametric insurance, customers are provided with flexible protection through bespoke indexing and pay out structures. On the other hand, the impacts of climate change on the planet have become more catastrophic and unpredictable. Global warming has seen the severity and frequency of Nat Cat events rise, with much of the global population now at risk of climate-related threats. For instance, in December 2022, Swiss Re data showed that Hurricane Ian and other extreme weather events such as the winter storms in Europe, flooding in Australia & South Africa as well as hailstorms in France and in the U.S. resulted in an estimated $115 billions of natural catastrophe insured losses. Parametric insurance is perfectly positioned to protect against these perils, as well as others such as hurricanes and storm surges.

There is a growing interest in parametric insurance in emerging markets, particularly in regions prone to natural disasters. This is driven by the need for more efficient and transparent claims processes.

Manufacturing is the leading industry vertical of Parametric Insurance Market.

North America is the largest regional market for Parametric Insurance in 2023.

$34.4 billion is the estimated industry size of Parametric Insurance in 2033.

Munich Re, QBE Insurance Group Limited, Hannover, Rück SE, Chubb, Jumpstart Insurance Solutions, Inc., AXA XL, FloodFlash, Global Parametrics, Swiss Re, Zurich American Insurance Company, SCOR SE, Sompo Holdings, Inc., Beazley Group, Allianz and Berkshire Hathaway Specialty Insurance are the top companies to hold the market share in Parametric Insurance

Loading Table Of Content...

Loading Research Methodology...