Passenger Security Equipment Market Statistics, 2030

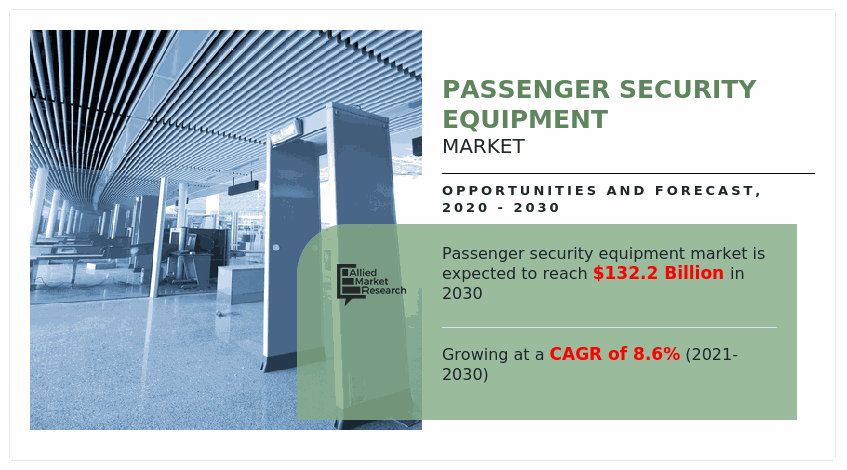

The global passenger security equipment market was valued at $58.4 billion in 2020, and is projected to reach $132.2 billion by 2030, growing at a CAGR of 8.6% from 2021 to 2030.

Rise in demand to minimize the risk of accidents propels global passenger security equipment market growth. Furthermore, improving passenger satisfaction and safety is also expected to aid in growth of the passenger security equipment industry. However, complex installation and infrastructural requirements hamper the market growth. Conversely, advancements in the field of IoT and cloud technology is expected to offer remunerative opportunities for expansion of the passenger security equipment market during the forecast period.

Passenger security is a mechanism that aids in protection of people and property against unintentional injuries, crimes, and other hazards. Such protocols assist governments to safely regulate movement of passengers from one place to another safely. Moreover, passenger security systems are designed to screen for any potentially harmful substances. Such applications of passenger security equipment are expected to contribute toward development of the passenger security equipment industry in the coming years.

Segment Review

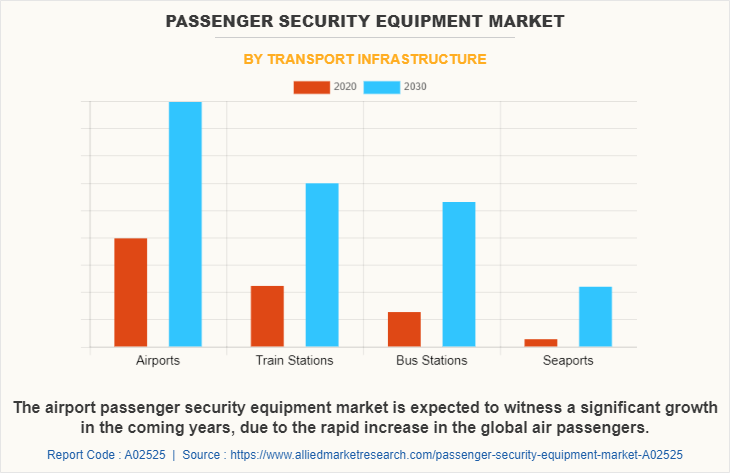

The passenger security equipment market size is segmented on the basis of offering, transport infrastructure, type, and region. Based on offering, the market is bifurcated into equipment and services. On the basis of transport infrastructure, the market is divided into airports, train stations, bus stations, and seaports. Depending on type, the market is classified into baggage inspection system, explosive detection system, video surveillance system, intrusion detection & prevention system, fire safety & detection system, people screening system, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global passenger security equipment market size is dominated by key players such as Autoclear, Axis Communications AB, Bosch Sicherheitssysteme GmbH, Honeywell International Inc., Kapsch TrafficCom AG, L3Harris Technologies, Inc., Rapiscan Systems, SITA, Simens AG, and Smiths Group plc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Depending on transport infrastructure, the airport segment dominated the passenger security equipment market share in 2020, and is expected to continue this trend during the forecast period as air travel is projected to remain the most predominant means of transportation for international travelers, necessitating appropriate passenger safety and measures. However, the bus stations segment is expected to witness highest growth in the upcoming years, owing surge in need for passenger safety at domestic and short-distance transportation alternatives such as inter-city bus terminals and stations.

Region wise, the passenger security equipment market was dominated by Asia-Pacific in 2020, and is expected to retain its position during the forecast period, owing to high concentration of passenger security solution vendors in the region, which is expected to drive the market for passenger security equipment technology during the forecast period.

The report focuses on growth prospects, restraints, and analysis of the global passenger security equipment market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global passenger security equipment market share.

Top Impacting Factors

Increase in number of people using public transportation facilities

More than 80% of the world's population relies on public transportation (buses, metros, trams, and local trains) for their intra-city and inter-city travel needs. Furthermore, with growing population, particularly in the Asian and Middle Eastern countries, it is expected that the number of people using public transportation would grow dramatically in these regions. Convenient travel, low-cost travel, and a worldwide push to decrease carbon impact encourage individuals to use public transportation more. For instance, in Singapore, more than 7 million people used public transportation every day before the outbreak of COVID-19 pandemic. As a result, governments throughout the world are investing more resources to implement passenger security technology such as baggage check systems and video surveillance systems to offer safer public travelling solutions.

Increase in risk regarding terrorist attacks on public transportation infrastructure

Surge in terrorist attacks post 2001 has encouraged governments throughout the world to increase their spending on passenger security systems. Moreover, increase in turmoil in Gulf and European areas have resulted in tightening of security measures at public transportation facilities by governments. Furthermore, in response to increased need for more secure and time-saving processes, equipment makers have started to provide improved computed tomography (CT) screening systems. By giving a more detailed 3D image of screened baggage, CT technologies boost threat detection capabilities.

COVID-19 Impact Analysis

The global outbreak of COVID-19 resulted in most countries to implement a temporary lockdown which further led to economic slowdowns in many business sectors, this especially affected the travel and tourism sector as COVID-19 restrictions made travel difficult for common people. However, stringent travel polices and regulations enforced by many governments during the period facilitated an increase in demand for passenger security solutions from essential sectors such as law enforcement and public infrastructure authorities that were responsible to enforce new standards of safety and security such as temperature and mask checks. Such trends provided great opportunities for development of the passenger security equipment market during the period of the COVID-19 pandemic.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the passenger security equipment market forecast from 2020 to 2030 to identify the prevailing passenger security equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the passenger security equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global passenger security market analysis.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global passenger security equipment market trends, key players, market segments, application areas, and market growth strategies.

Passenger Security Equipment Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Offering |

|

| By Transport Infrastructure |

|

| By Region |

|

| Key Market Players | Simens AG, Honeywell International Inc., SITA, Bosch Sicherheitssysteme GmbH, Autoclear, Rapiscan Systems, L3Harris Technologies, Inc., Smiths Group plc, Axis Communications AB, Kapsch TrafficCom AG |

Analyst Review

Demand for passenger security equipment systems has been increasing in past few years, and is expected to maintain this trend in the coming years as well, owing to growing demands for better level of passenger safety and security standards. Moreover, rise in need to upgrade existing passenger safety equipment has increased demand for passenger security equipment. In addition, growth in digital and internet penetration in many regions of the world are promising new opportunities for growth of the passenger security equipment market.

Key providers of the passenger security equipment market such as Bosch Security Systems GmbH, Simens AG, andRapiscan Systems account for a significant share in the market. With larger requirement from passenger security equipment, various companies are establishing partnerships to increase their passenger security equipment offerings. For instance, in January 2022, Kapsch Trafficcom AG, a transportation and mobility solutions provider announced partnership with New Hampshire Department of Transportation (NHDOT) to convert three remaining NHDOT toll zones to mainline all-electronic tolling (AET) from mixed-mode payment. With these systems in place drivers will no longer need to stop, slow down, or change lanes at any point along these five sites to pay tolls, which help improve traffic congestion, road safety, and vehicle emissions. As part of the project, Kapsch is expected to enhance its existing multiprotocol readers (MPR2.3) along NHDOT toll sites, enabling agencies to process all tolling protocols and support the goal of national tolling interoperability.

In addition, with increase in demand for passenger security equipment, various companies are expanding their current product portfolio with increasing diversification. For instance, in December 2020, Honeywell International Inc. announced launch of new updated features in its Honeywell Forge platform for business aviation flight departments. Network monitoring capabilities are incorporated in Honeywell Forge so that users can now stay better informed of vulnerabilities within their cabin connectivity service. The service is visualized on Honeywell Forge dashboard via network monitoring tile and enabled by installing GoDirect Router software package on an equipped aircraft.

Moreover, market players are expanding their business operations and customers by increasing their acquisition. For instance, in October 2021, Bosch Security Systems GmbH announced acquisition of Protec Fire and Security Group Ltd., one of the leading system integrators for security and fire detection technology. With acquisition of Protec, Bosch aims to expand its business and grow further in the Europe market.

Growth in global political tension and the fear of terrorist attacks are signaling significant growth opportunities for future of the global passenger security equipment market. In addition, the aviation industry getting back on track post a pandemic is positively impacting growth of the passenger security equipment market. However, the potential of abuse of passenger security equipment with unconstitutional or biased searching hampers the market growth. On the contrary, increase in government initiatives and automation trends are expected to offer remunerative opportunities for expansion of the passenger security equipment industry during the forecast period.

Asia-Pacific is the largest regional market for Passenger Security Equipment

The global Passenger Security Equipment market was valued at $58,426.0 million in 2020, and is projected to reach $132,168.63 million by 2030, registering a CAGR of 8.6% from 2021 to 2030.

The global Passenger security equipment market is dominated by key players such as Autoclear, Axis Communications AB, Bosch Sicherheitssysteme GmbH, Honeywell International Inc., Kapsch TrafficCom AG, L3Harris Technologies, Inc., Rapiscan Systems, SITA, Simens AG, and Smiths Group plc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...