Patient Blood Management Market Research, 2031

The global patient blood management market size was valued at $12.2 billion in 2021 and is projected to reach $22.1 billion by 2031, growing at a CAGR of 6.3% from 2022 to 2031. Patient blood management is used to minimize loss of blood during the time of surgical operations and optimize the blood of the patient. Patient blood management is a multimodal, multidisciplinary approach based on the timely application of a bundle of evidence‐based medical and surgical concepts aimed at improving the outcome of patients at risk. The three pillars of patient blood management encompass measures to optimize the patient's red cell mass, reduce peri‐operative blood loss and enhance anemia tolerance. There are various products used in patient blood management are blood transfusion devices, blood processing devices, blood cell processors, centrifuge, blood culture screening devices, automated blood culture systems, blood storage devices, refrigerators, freezers, diagnostic & testing instruments, and reagents and kits.

Historical overview

The patient blood management market was analyzed qualitatively and quantitatively from 2018-2020. Most of the growth during this period was derived from Asia-Pacific owing to the increase in blood donation camps, increase in patient admission for surgery, rising disposable incomes, as well as the well-established presence of domestic companies in the region.

Market dynamics

The patient blood management market has witnessed growth owing to the rise in the incidence of trauma and accidents that causes blood loss. For instance, according to the data from World Health Organization (WHO), in June 2022, road traffic injury was the leading cause of death among children and young adults aged 5-29 years. Approximately 1.3 million people die each year and 20 to 50 million are injured or disabled as a result of road traffic crashes.

In addition, cancers that start in the bone marrow (like leukemias) or cancers that spread there from other places may accumulate normal blood-making cells, leading to low blood counts. Therefore, the increase in the prevalence of blood cancer drives the growth of the patient blood management market size. For instance, according to the data from Leukemia & Lymphoma Society, in 2021, new cases of leukemia, lymphoma, and myeloma accounted for 9.8% of the estimated 1,898,160 new cancer cases in the U.S.

Furthermore, the increase in government healthcare expenditure propels to set up of new blood banks, diagnostic clinics, pathology labs, and government hospitals that further led to the high adoption of patient blood management products and boosted the growth of this market. For instance, the Indian government announced Rs. 69,000 crores (US$ 9.87 billion) outlay for the health sector that is inclusive of Rs. 6,400 crores (US$ 915.72 million) for PMJAY (Pradhan Mantri Jan Arogya Yojana) in Union Budget 2020–21. Hence, an increase in government expenditure on healthcare drives the growth of the patient blood management market share.

In addition, the growing demand for patient blood management is the result of the rise in the number of diseased people across the world. The aging population is more vulnerable to anemia and requires blood, which increases the demand for patient blood management products. For instance, according to a report published by, UNFPA Asia-Pacific, it was estimated that the number of older people in the Asia-Pacific will triple reaching 1.3 billion by 2050 out of which women constitute the majority (53 percent) of the population aged 60 or older in the region, and their share rises to 60 percent above age 80. With technological advancements, the designs of patient blood management devices have been majorly improved, thereby increasing the preference for patient blood management products among patients. This factor has led to the growth of the patient blood management market. Moreover, the rise in prevalence of hemophilia B, anemia, lymphoma, and HIV/AIDS that require blood, and the surge in incidences of chronic liver diseases that require plasma derivatives for their treatment boost the demand for blood and other blood-related products including plasma, red blood cell across the globe drives the growth of patient blood management market.

However, the patient blood management market is growing now, owing to the relaxation in lockdown, the decrease in COVID-19 cases, and releasing guidelines regarding blood donation. For instance, coronavirus guidelines for America recommended people avoid social gatherings of more than 10 people and need to practice good hygiene like hand washing, but it has urged healthy individuals to donate blood. The availability of blood and other blood components can be maintained by networking cooperation of blood services across regions. Blood donation centers can facilitate the safe donation of blood because they are skilled in infection control practices. According to the World Health Organization, the risk of transmission of COVID-19 through transfusion is likely minimal and theoretical. European National Health Competent Authorities have issued some recommendations on the prevention of transmission of COVID–19 infection through transfusion of labile blood components. The Italian National Blood Centre (Centro Nazionale Sangue, CNS), the Health Ministry's technical and scientific advisory body on matters related to blood and blood products, has issued a number of measures aimed at maintaining high standards of blood donation and blood safety in Italy, one of the countries with a higher incidence of COVID‐19‐related casualties worldwide. Therefore, a rise in government guidelines regarding blood donation increases awareness for safe blood donation and reduces fair among people regarding spreading COVID-19 infection due to blood donation and boosts the growth of this market.

Furthermore, an increased prevalence of trauma and accidents, an increase in initiatives taken by the government, and the development of innovative technologies and devices from leading vendors are likely to boost the growth of the patient blood management market during the forecast period. For instance, Sepacell TM Filters by Asahi Kasei medical revolutionized the patient blood management scenario completely and has also increased confidence in healthcare. Roche is offering a comprehensive portfolio of nucleic acid testing (NAT) solutions that deliver the highest level of safety and efficiency in donor screening. Thus, such trends are expected to bring stabilization in the market, and subsequently witness a growth rate during the forecast period.

Segmental Overview

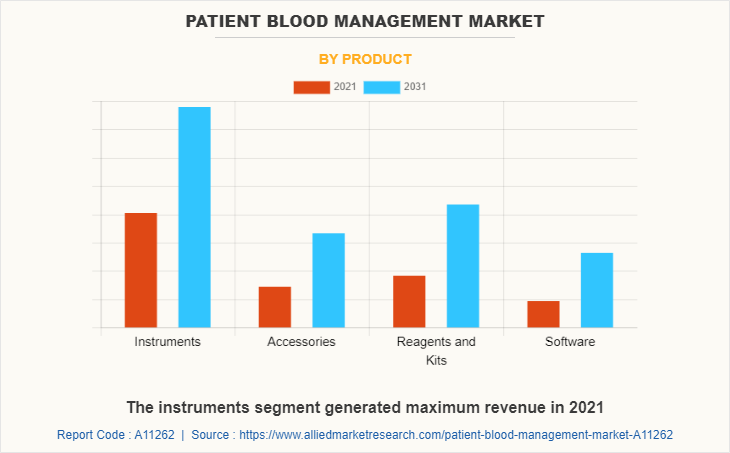

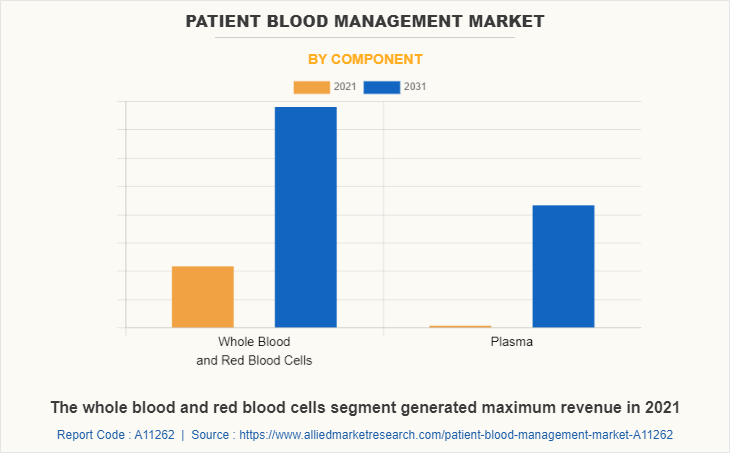

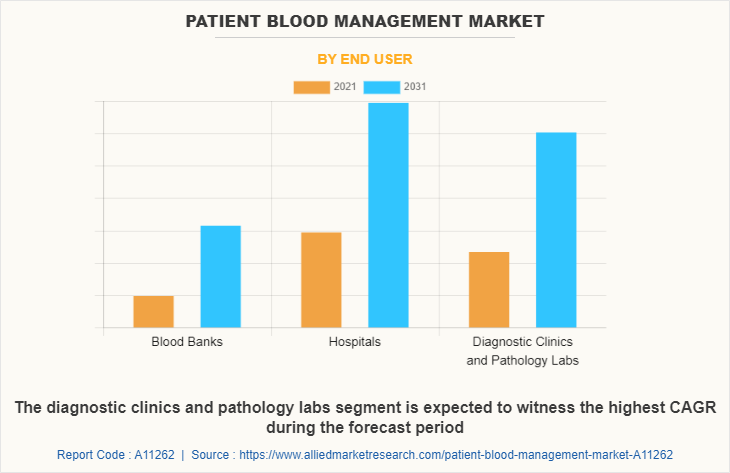

The patient blood management market is segmented on the basis of product, component, end user, and region. On the basis of product, the market is classified into instruments (blood processing devices, blood transfusion devices, blood culture screening devices, diagnostic & testing instruments, and blood storage devices), accessories (syringes & needles, vials & tubes, blood bags, and others), reagents & kits (blood culture media, blood typing reagents, slide staining reagents, and assay kits), and software. On the basis of components, the market is classified into whole blood & red blood cells, and plasma. Depending on the end user, it is fragmented into hospitals, blood banks, and diagnostic clinics & pathology labs. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, Australia, India, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product Type:

The patient blood management market is segmented into instruments, ventilators, accessories, reagents & kits, and software. The instruments segment generated maximum revenue in 2021, owing to an increase in the number of trauma cases, the presence of various government organizations that regulate blood banks, and a rise in the requirement for blood post-surgery. The reagents and kits segment is expected to witness the highest CAGR during the forecast period, owing to the high adoption of reagents and kits, rise in bloodstream infection, and increase in the incidence of sepsis.

By Component:

The patient blood management market is segregated into whole blood & red blood cells, and plasma. The whole blood and red blood cells segment generated maximum revenue in 2021, owing to the high demand for blood, a rise in blood diseases such as anemia, hemophilia, and blood clots, and blood cancers such as leukemia, and lymphoma, and an increase in a number of accidents. The plasma segment is expected to witness the highest CAGR during the forecast period, owing to the rise in the prevalence of liver diseases in the elderly population that requires the use of plasma, globally.

By End User:

The patient blood management market is classified as hospitals, blood banks, and diagnostic clinics & pathology labs. The hospital segment was the highest revenue contributor to the market in 2021, owing to an increase in health coverage for hospital-based treatment, an increase in hospital admission, and a higher preference for hospitals. The diagnostic clinics and pathology labs segment is expected to witness the highest CAGR during the forecast period, owing to an increase in demand for blood testing and a surge in the prevalence of infectious diseases such as AIDS, hepatitis, and others.

By Region:

The patient blood management market is studied across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific accounted for a major share of the patient blood management market in 2021 and is expected to grow at the highest rate during the patient blood management market forecast period. The patient blood management market growth in this region is attributable to the rise in prevalence of targeted diseases such as HIV/AIDS and tuberculosis, the rise in the number of hospitals, the growth of the elderly population that is vulnerable to blood diseases such as anemia, in this region as well as growth in the purchasing power of populated countries, such as China and India. The countries in Asia-Pacific possess a huge population base, with China being the first having 1,397,715 population in 2020 and India is the second most populated country having 1,366,417.75 population in 2020. In addition, the presence of several major players, such as Haemonetics Corporation, and LivaNova PLC, and the advancement in manufacturing technology of patient blood management devices in the region drive the growth of the market.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the patient blood management market, such as Asahi Kasei Corporation, B. Braun SE, BioMérieux, Inc., Grifols, S.A., Haemonetics Corporation, Haier Biomedical, Immucor, Inc., LivaNova PLC, Macopharma, and Terumo Corporation are provided in this report. There are some important players in the market such as Terumo Corporation, and Grifols, S.A. have adopted acquisition, agreement, collaboration, and product approval, as key developmental strategies to improve the product portfolio of the patient blood management market.

Some examples of agreement in the market

In April 2022, Terumo Corporation has received a $10.6 million contract to continue its work on freeze-dried plasma (FDP) from the U.S. government.

Acquisitions in the market

In January 2022, Grifols S.A. announced the acquisition of its first donation center in Canada to increase the availability of plasma medicines in Canada. Such an acquisition will help the company to further gain a strong foothold in the patient blood management market.

Collaboration in the market

In July 2021, Grifols S.A. a global leader in the manufacturing of plasma-derived medicines collaborated with the U.S. firm ImmunoTek Bio Centers LLC, for the development of 21 plasma collection centers.

Product Approval in the market

In March 2022, Terumo Blood and Cell Technologies has announced the U.S. Food and Drug Administration (FDA) approval of a new plasma collection system. This system is designed to optimize plasma collection in very less time. The approval of the new plasma collection system will help the company to strengthen its blood and cell technologies portfolio.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the patient blood management market analysis from 2021 to 2031 to identify the prevailing patient blood management market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the patient blood management industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes analysis of the regional as well as global patient blood management market trends, key players, market segments, application areas, and market growth strategies.

Patient Blood Management Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 22.1 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 240 |

| By Component |

|

| By End User |

|

| By Product |

|

| By Region |

|

| Key Market Players | Terumo Corporation, Biomerieux SA, Haier Biomedical, LivaNova PLC, Grifols, S.A., Macopharma, B. Braun SE, Asahi Kasei Corporation, Immucor, Inc, Haemonetics Corporation |

Analyst Review

According to CXOs, the patient blood management market has witnessed growth owing to the high prevalence of blood cancer, and blood disorders, and the availability of various patient blood management devices, which have revolutionized the field of patient blood management.

Moreover, the technological advancements in automatic blood culture test instruments and the rise in the prevalence of infectious diseases, bloodstream infection, & sepsis propel the growth of the patient blood management market. Furthermore, the increase in demand for whole blood & plasma and rise in number of blood & plasma collection centers worldwide contribute to the growth of the market. However, risks related to blood transfusion procedures and high cost of patient blood management products restrain the growth of the market. On the contrary, the rise in key strategies adopted by key players, unmet medical demands in developing countries boost the growth of patient blood management market.

Asia-Pacific witnessed the highest growth in 2021 and is expected to witness highest CAGR during the forecast period, owing to increase in awareness regarding patient’s blood management, unmet medical demands, and initiatives by government & non-governmental organization (NGO)s to promote awareness regarding blood donation and rise in public–private investments in the healthcare sector.

The increase in the prevalence of blood cancer and the rise in government expenditure on healthcare drives the Patient Blood Management Market

Yes

Asia-Pacific accounted for a major share of the patient blood management market in 2021

Low awareness and lack of skilled professionals in developing countries might impact the market negatively

Asahi Kasei Corporation, Haier Biomedical, Terumo Corporation, Grifols, S.A., Haemonetics Corporation are few major companies in the Patient Blood Management Market

The patient blood management market was valued for $12,229.51 million in 2021 and is estimated to reach $22,095.80 million by 2031, exhibiting a CAGR of 6.3% from 2022 to 2031

The whole blood and red blood cells segment generated maximum revenue in 2021

Few major trends in patient blood management market includes the utilization of automated technologies from blood collection, donation and patient management.

Loading Table Of Content...