Patient Controlled Analgesia Pumps Market Research, 2031

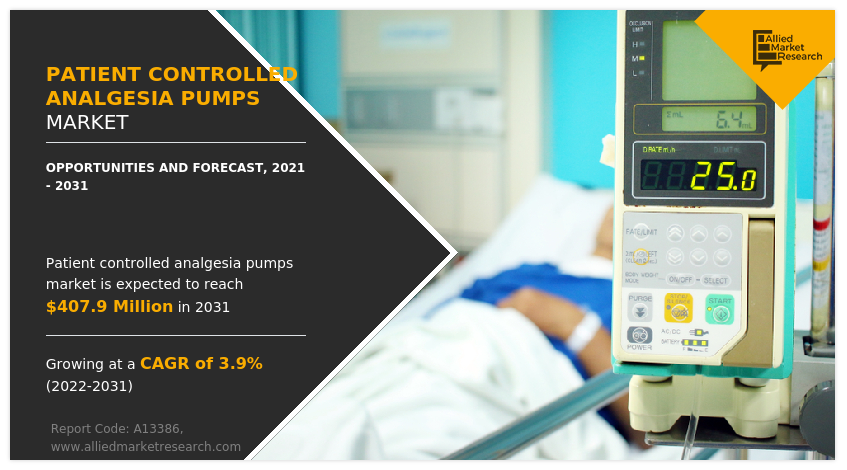

The global patient controlled analgesia pumps market size was valued at $277.7 million in 2021, and is projected to reach $407.9 million by 2031, growing at a CAGR of 3.9% from 2022 to 2031. Patient controlled analgesia pumps are medical devices, which are used to deliver medications, such as pain relievers into a patient’s body at intervals in accurate dosages. The pump is attached to an intravenous (IV) line, which is a small, flexible tube inserted into a vein. Normally, this medication is administered when the button is pressed. These pumps are medical devices that delivers the medications into a patient’s body in controlled amounts. The infused medications play vital role in therapeutics or medical treatments, and are widely used in healthcare settings such as patient, outpatient, private clinics, and at-home settings.

The patient controlled analgesia pumps market is segmented into Type, Application and End user. These analgesic pumps help to manage the patient pain during and after surgery, for treatment of burns, treatment of chronic pain, and also used in pediatric patients. The applications of these analgesic pumps for delivery of medications such as morphine, fentanyl and hydromorphone. Patient controlled analgesia infusion pumps are available in electronic and mechanical pumps. Furthermore, patient-controlled analgesic pumps promote better patient management and care, thus offering several advantages in comparison to conventional modules. Key advantages of PCA include greater patient satisfaction, fewer post-operative complications, less sedation, improved quality of recovery, and less use of medication (as doses are set).

Market Dynamics

Rise in technological advancements for patient controlled analgesia pumps owing to massive pool of chronic diseases creates an opportunity for the patient controlled analgesia pumps market. The growth of the patient controlled analgesia pumps market is expected to be driven by high potential in untapped, emerging markets, due to availability of improved healthcare infrastructure, increase in unmet healthcare needs, rise in prevalence of chronic diseases, and surge in demand for advanced analgesic pumps. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure, and development of the medical tourism industry in emerging countries.

In addition, upsurge in incidence of pain cases due to rise in surgical procedure that requires pain management, in turn increases the requirement of affordable patient-controlled analgesic (PCA) pumps. Furthermore, rapid rise in aging population is one of the major drivers for the patient controlled analgesia pumps market. Aging is accompanied by a high susceptibility of diseases due to decreased immunity and degeneration. Globally, the geriatric population has increased significantly and is vulnerable to various disorders such as cardiovascular, stroke, diabetes, gastric diseases, and intestinal illnesses.

Moreover, factors such as high demand of home-based healthcare, numerous applications of patient controlled analgesia pumps, rise in geriatric population, and surge in affordability in the developing economies are projected to supplement the market growth. Early diagnosis of chronic diseases at or near bedside or at home increases the chances of successful treatment and further minimizes the hospital expenditure. The home healthcare is gaining popularity as it is a cost-effective alternative to hospital-based treatments of chronic diseases. Home-based patient controlled analgesia pumps provide better and immediate results. Portability, compact and ergonomic design, and user-friendly features of analgesic pumps are key contributors to their widespread adoption in home care settings.

The demand for patient controlled analgesia pumps is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Furthermore, rise in health awareness related to several diseases and ease of accessibility boost the adoption of patient controlled analgesia pumps. Moreover, increase in promotional activities by manufacturers and growth in awareness for chronic diseases and early diagnosis among the general population are expected to fuel their adoption in the near future. Moreover, technological advancements in analgesic pumps such as wireless connectivity and high demand of infusion pumps for pain management drive the patient controlled analgesia pumps market opportunity.

However, stringent government regulations for the approval of medical devices and recall of several products due to errors while transporting the medications during infusion therapies are expected to hinders the market growth. For instance, according to the Food and Drug Administration (FDA) norms, the patient controlled analgesia pumps should be efficacious, accurate, and consistent. The procedure for obtaining a regulatory approval for infusion pumps (Class II) is stringent and time-consuming. The other disadvantage of the regulatory procedure includes high cost of these trials, which further limits the innovation in the products, and therefore small companies find it difficult to survive in the market without the support from large enterprises. This in turn decreases market competition, which leads to the high cost of the pumps. In addition, lack of awareness about using advanced infusion systems and stringent regulations imposed on product approval are likely to restrain the patient controlled analgesia pumps market forecast.

The outbreak of COVID-19 has disrupted workflows in the health care sector around the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. The global patient controlled analgesia pumps market experienced a decline in 2021 due to global economic recession led by COVID-19. In addition, the COVID-19 outbreak disrupted the supply chain across various end-user industries such as healthcare, and industrial. However, the market is anticipated to witness recovery in 2021, and show stable growth for patient controlled analgesia pumps market in the coming future. This is attributed to the increase in adoption patient controlled analgesia pumps. In addition, increase in the COVID-19 cases led to decline in the number of surgical procedures this had led to decrease in demand for patient controlled analgesia pumps Many key market players registered the decrease in their revenues from the analgesic pump segments, which was mainly due to the decline in the patient visit to the hospitals, reallocation of the healthcare resources and effect on the supply chain around the globe.

Segmental Overview

The patient controlled analgesia pumps market is segmented into type, application, end user, and region. By type, the market is categorized into electronic & wireless and mechanical. On the basis of application, the market is segregated into oncology & hematology, gastroenterology, and others. By end user, the market is classified into hospitals, ambulatory surgical centers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

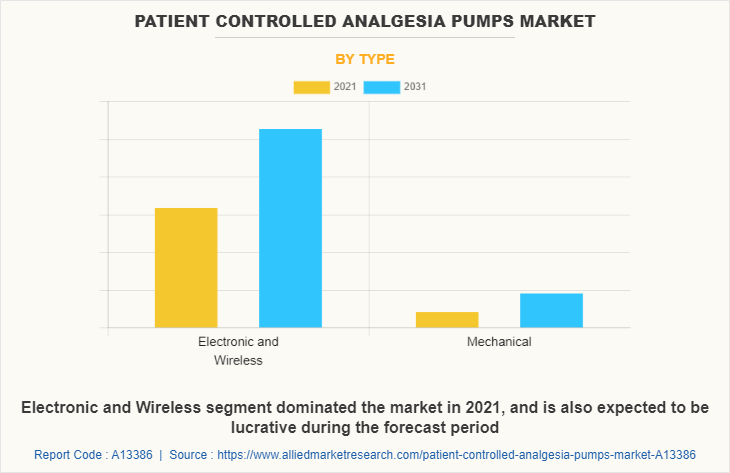

The market is segmented into electronic & wireless and mechanical. The electronic & wireless segment dominated the patient controlled analgesia pumps industry in 2021, owing to rise in advanced features in electronic patient controlled analgesia pumps.

By Application

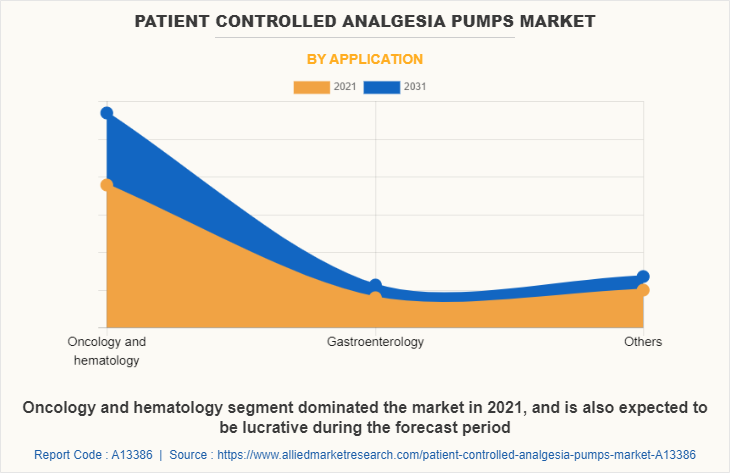

The market is segregated into oncology & hematology, gastroenterology, and others. The oncology & hematology segment dominated the patient controlled analgesia pumps market size in 2021, and is anticipated to continue this trend during the forecast period. This is attributed to rise in R&D activities in oncology and hematology field for analgesic pumps.

By End User

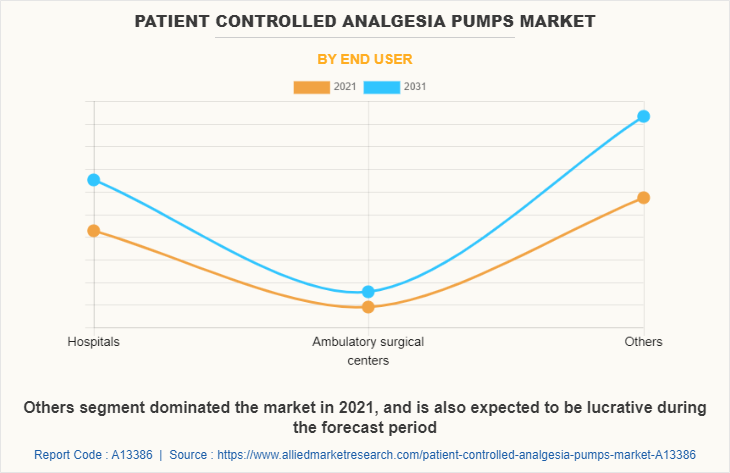

The market is classified into hospitals, ambulatory surgical centers, and others. The others segment held the largest patient controlled analgesia pumps market share in 2021, owing to rise in number of home care setting and cancer treatment centers for several diseases this has led to increases the demand for analgesic pumps. In addition, rise in number of cancer treatment centers due to surge in prevalence of cancer disease and availability of a wide range of choice of treatment in some developing nations propels the segment growth. For instance, according to National Cancer Institute (NCI), data published in U.S. 2019, there are 71 INC-Designated Cancer Centers, located in 36 states and the District of Columbia.

By Region

The patient controlled analgesia pumps market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the patient controlled analgesia pumps market in 2021, and is expected to maintain its dominance during the forecast period.

Presence of several major players, such as Becton, Dickinson and Company, ICU Medical, Inc., and advancement in manufacturing technology of patient controlled analgesia pumps in the region drive the growth of the market. Furthermore, presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption of patient controlled analgesia pumps are expected to drive the market growth.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to presence of medical devices manufacturer companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, rise in personalized healthcare expenditure and adoption of high-tech based analgesic pumps drive the growth of the market. Asia-Pacific offers profitable opportunities for key players operating in the patient controlled analgesia pumps market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, rise in disposable incomes, as well as well-established presence of domestic companies in the region.

In addition, rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region. Moreover, favorable reimbursements, rise in prevalence of chronic pain, and fibromyalgia also supports the market growth. Increase in number of initiatives and enhanced investments from the government for the overall development of healthcare system support the growth of infusion pumps in these developing regions. In addition, the increase in healthcare awareness about the infusion therapies and growth in per capita healthcare expenditure in the developing countries further provide opportunities for the patient controlled analgesia pumps market growth.

Competition Analysis

Competitive analysis and profiles of the major players in the patient controlled analgesia pumps, such as Ace-medical, Arcomed AG, B. Braun SE, Becton, Dickinson and Company, Changzhou Medical Bioengineering Co., Ltd., Fresenius SE and Co. KGaA, Henan Tuoren Medical Device Co., Ltd., ICU Medical, Inc., Micrel Medical Devices SA, and SCW Medicath Ltd. are provided in this report.

Some Example Of Acquisition In The Market

In September 2021, ICU Medical announced the acquisition of Smiths Medical to expand its product portfolio. The Smiths Medical business includes syringe and ambulatory infusion devices, vascular access, and vital care products.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the patient controlled analgesia pumps market analysis from 2021 to 2031 to identify the prevailing patient controlled analgesia pumps market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the patient controlled analgesia pumps market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global patient controlled analgesia pumps market trends, key players, market segments, application areas, and market growth strategies.

Patient Controlled Analgesia Pumps Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 407.9 million |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 235 |

| By Type |

|

| By Application |

|

| By End user |

|

| By Region |

|

| Key Market Players | Fresenius SE and Co. KGaA, SCW Medicath Ltd, Changzhou Medical Bioengineering Co., Ltd., Henan Tuoren Medical Device Co., Ltd., Ace-medical, Becton, Dickinson and Company, B. Braun SE, Arcomed AG, ICU Medical, Inc., Micrel Medical Devices SA |

Analyst Review

This section provides various opinions of top-level CXOs in the global patient controlled analgesia pumps market. According to the insights of CXOs, the global patient controlled analgesia pumps market is expected to exhibit high growth potential attributable to factors such as increase in demand for patient controlled analgesic pumps and rise in investments for analgesic pumps. Moreover, rise in number of surgeries requires analgesic pumps to manage the pain thereby, contribute towards the market growth.?

CXOs further added that patient controlled analgesic pumps includes the advanced features such as efficient pain management, bar-code readers, computer-based pump programming systems, and dose error reduction devices. Thus, such advanced features in analgesic pumps lead to increase in demand for patient controlled analgesic pumps and drive the market growth.?

Furthermore, North America is expected to witness largest growth, in terms of revenue, owing to increase in adoption of patient controlled analgesic pumps and rise in healthcare infrastructure. Upsurge in healthcare expenditure in the emerging economies is anticipated to offer lucrative opportunities for the market expansion. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in distribution network of patient controlled analgesic pumps and increase in investments for manufacturing patient controlled analgesic pumps during the forecast period.

Rise in number of surgeries such as oncology surgery, and others requires the anesthesia pump to manage the pain this has led to drive the market growth.

Oncology and hematology is the leading application of patient controlled analgesia pumps market.

North America is the largest regional market for patient controlled analgesia pumps market.

The patient controlled analgesia pumps market valued for $277.67 million in 2021 and is estimated to reach $407.89 million by 2031, exhibiting a CAGR of 3.9% from 2022 to 2031

Major Key players that operate in the global patient controlled analgesia pumps market are Ace-medical, Arcomed AG, B. Braun SE, Becton, Dickinson and Company, Changzhou Medical Bioengineering Co., Ltd., Fresenius SE and Co. KGaA, Henan Tuoren Medical Device Co., Ltd., ICU Medical, Inc., Micrel Medical Devices SA, SCW Medicath Ltd.

2021 is the base year of patient controlled analgesia pumps market.

2022-2031 is the forecast period of patient controlled analgesia pumps market.

Loading Table Of Content...