Payday Loans Market Outlook - 2030

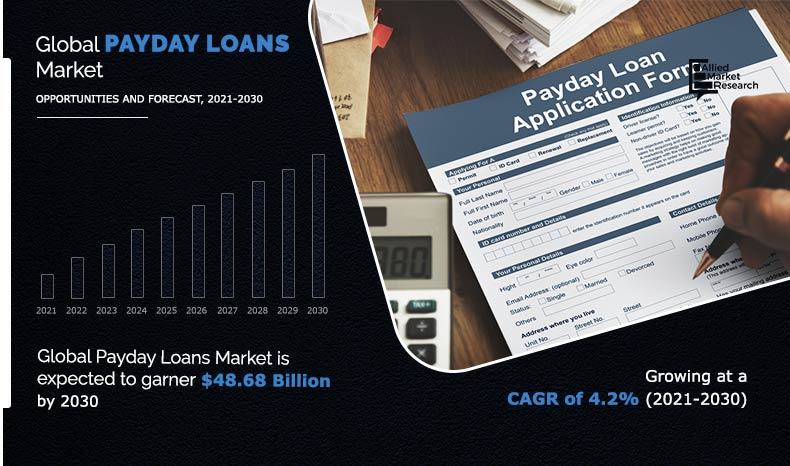

The global payday loans market size was valued at $32.48 billion in 2020, and is projected to reach $48.68 billion by 2030, growing at a CAGR of 4.2% from 2021 to 2030.

A payday loan is a short-term unsecured loan, often characterized by high interest rates. This allows borrower to write a post-dated check to the lender for the payday salary but receives part of that payday sum in immediate cash from the lender.

Furthermore, it’s easy to get approved as there are very few requirements such as borrower must be 18 years old or above and have a job, driver’s license, and a bank account, these few requirements make larger number of people eligible for approval.

The growing awareness regarding payday loans among the youth population is significantly boosting the growth of the global payday loans market. Many young people today face financial instability due to various factors, such as student loans and rising living costs. As a result, payday loans, particularly high-interest personal loans and short-term cash advances, have become an attractive option for quick financial relief. The ease of access, minimal requirements, and fast approval processes with no restrictions on how the loan is used make payday loans a convenient solution for many individuals. Moreover, the increase in the adoption of payday loans among younger demographics is driving market growth. Furthermore, the rising number of payday lenders entering the market further fuels market expansion.

However, factors such high interest rates and the negative impact of payday loans challenge on credit score are expected to hamper the payday loans market growth.

On the contrary, the payday loans market is expected to offer several opportunities for new players in the market. Rise in adoption of advanced technology among the payday lenders is expected to offer remunerative opportunities for the expansion of the payday loans market. In addition, the integration of digital payment methods, such as mobile wallets and instant transfers, is making it easier for borrowers to access funds and repay loans quickly, offering lucrative opportunities for the market growth during the forecast period.

On the basis of type, the storefront payday loans segment dominated the market share in 2020, and is expected to maintain its dominance in the upcoming years owing to growing adoption of storefront payday loans among the developing nations of Asia-Pacific and LAMEA region. In addition, the online pay day loans segment is expected to witness the highest growth rate in the upcoming years, owing to its varied advantages which include faster processing speed, easier payment system and minimal paperwork.

Region wise, the payday loans market was dominated by North America in 2020, and is expected to retain its position during the forecast period. This is attributed to a number of factors such as penetration of new payday loans among the youth and improvement in economy. In addition, presence of large number of payday loan vendors across the U.S. and Canada is expected to provide lucrative payday loans market opportunity for the growth. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to wide presence of large number of payday loan enterprises, which are turning toward digital solutions to efficiently manage their business processes, particularly in developing countries such as China, India, and Singapore.

The report focuses on growth prospects, restraints, and trends of the global payday loans market analysis. The study provides Porter’s five forces analysis to understand impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the global payday loans market share.

Segment Review

The global payday loans market is segmented on the basis of type, marital status, customer age and region. By type, the market is divided storefront payday loans and online payday loans. By marital status, payday loans market is categorized as married, single and others. As per customer age, the market is bifurcated into less than 21, 21-30, 31-40, 41-50 and more than 50. Region-wise, the payday loans market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

Online segment is projected as one of the most lucrative segments. .

Competitive Analysis

The key players profiled in the global payday loans industry analysis are Cashfloat, CashNetUSA, Creditstar, Lending Stream, Myjar, Silver Cloud Financial, Inc., Speedy Cash, THL Direct, Titlemax, and TMG Loan Processing. These payday loans companies have adopted various strategies to increase their market penetration and strengthen their position in the payday loans market outlook.

For instance, according to a report by California Department of Financial Protection and Innovation in 2020, California saw a 40% decline in payday loans as compared to 2019, a drop equivalent to $1.1 billion. Almost half a million fewer people didn’t rely on payday loans, a 30% drop compared to 2019. This was attributed to California’s new $262.6 billion budget, with multiple programs aimed at reducing economic inequality within the state with an unprecedented $11.9 billion spent on Golden State Stimulus payments.

By Martial Status

Single end-users segment accounted for the highest market share in 2020.

Top Impacting Factors

Growing Awareness about the Payday Loan among the Youth Population

Payday loans are gaining popularity among the youth as young people today are experiencing more financial instability than any other generation. In addition, it is estimated that one-third of all adults aged between 25 and 34 years have a student loan, which is the primary source of debt for members of Generation Z. This is forcing them to apply for high-interest personal loans, particularly emergency payday lending, which is driving the growth of the market. Furthermore, due to Trump administration’s CFPB proposal of putting an end to a rule that protects borrowers from loans with interest rates of 400% or more, payday lenders have started focusing on young population with attractive digital advertisements. Moreover, according to reports from Citizens Advice, up to 4 in 10 young adults will use a payday loan at some stage or another. In addition, with the rising cost of living across the globe, students who have education loans are under huge pressure to repay their debts and many youngsters are trying for online payday loans market, which is driving the growth of the payday loans market.

Large Number of Payday Lenders

Payday lenders are gaining attraction and many lenders are following them and entering the business as it is very easy to enter. In addition, as many payday lenders that offer triple-digit balloon payment loans and are expanding their products to offer installment loans for shorter term drives the growth of the market. Furthermore, due to various regulations supporting payday lenders, more are willing to enter during the pandemic situations to provide loans to the financially unstable people, which propels the growth of the payday loans market.

For instance, The Consumer Financial Protection Bureau (CFPB) under President Donald Trump, has weakened the consumer protection that applies to protect people who are not able to pay loans from taking any type of loan. However, with the removal of the bill, payday lenders are freer to target anybody with high interest loans and indulge them in further deeper loans. Thus, this is increasing the growth of payday loans. Furthermore, with the rising number of competitors, the loans are becoming more diverse and more affordable but still expensive as compared to any other type of loan, which is expected to drive the growth of the market in the upcoming years.

By Region

Asia-Pacific would exhibit the highest CAGR of 6.1% during 2021-2030

Report Coverage & Deliverables

The payday loans market report covers an in-depth analysis, encompassing global and regional market size estimations, growth forecasts, and key industry trends. It explores the primary drivers, challenges, and opportunities influencing the payday loans sector, along with detailed insights into evolving consumer behavior and regulatory impacts. The report also highlights significant technological innovations and digital transformation within the market, including advancements in mobile platforms and online loan applications.

Key deliverables include comprehensive market forecasts, along with a thorough examination of competitive strategies employed by major market players. In addition, the report provides remarkable insights into the strategic partnerships, mergers, and acquisitions shaping the market landscape. Key highlights focus on the financial performance of leading players, evolving business models, and regional variations in market dynamics.

Type Insights

The payday loans market is anticipated to witness considerable growth during the forecast period. This is due to an increased in the demand from consumers for fast, short-term cash advances. These loans are generally small with high-interest rates and are intended to be paid back with the borrower’s next paycheck, often utilized for urgent needs such as medical expenses, vehicle repairs, or unforeseen bills. In spite of their convenience, payday loans are often criticized for their high costs and the potential for leading borrowers into debt cycles. More stringent regulations are being implemented to tackle these problems, resulting in more flexible terms and reduced interest rates from certain lenders. Furthermore, the growth of digital platforms has accelerated market expansion by facilitating quick and efficient loan access via mobile applications and online websites.

Technology Insights

The payday loans market is anticipated to witness significant growth during the forecast period. This is owing to the increase in the adoption of online platforms and mobile apps. These digital innovations have revolutionized the way payday loans are accessed, offering borrowers greater convenience and speed. With the ability to apply for loans online, borrowers can access funds quickly without needing to visit a physical location. The ease of application, faster approval processes, and the availability of loans through smartphones have contributed to the expanding customer base and growing demand. Furthermore, the flexibility of payday loans, which cater to individuals in urgent need of short-term financial assistance, has further fueled market growth. In addition, the rise of fintech companies offering personalized loan terms, easy repayment schedules, and competitive interest rates has led to increase in the appeal of payday loans, especially for individuals who may not qualify for traditional bank loans.

As more people turn to digital platforms for financial solutions, the payday loans sector is poised to grow further. However, it is essential to address the challenges such as high-interest rates and regulatory scrutiny, which continue to shape the industry’s future. Despite these concerns, the market's expansion, fueled by technological advancements, shows no signs of slowing down.

Application Insights

The payday loans market is expected to witness steady growth, driven primarily by individuals facing urgent financial needs. Payday loans, short-term, high-interest loans, offer a quick solution for people who require immediate funds to cover unexpected expenses, such as medical bills, car repairs, or other emergency situations. These loans are typically repaid on the borrower’s next payday, making them accessible to a wide range of consumers, particularly those without access to traditional credit sources.

The market for payday loans is largely influenced by economic conditions, income disparities, and the availability of alternative lending options. As financial pressures continue to affect a significant portion of the population, payday loans provide an avenue for quick relief. However, the high interest rates and fees associated with payday loans often lead to a cycle of debt for borrowers, sparking debates about regulation and consumer protection.

Regional Insights

North America leads in payday loans value, followed by Europe and emerging markets in Asia-Pacific.

Key Companies & Market Share Insights

Key players in the payday loans market include CashNetUSA, Speedy Cash, and Check Into Cash, each holding a significant share of the market. These payday loans companies hold significant market shares and are known for their comprehensive range of payday loans products and services. Market share is influenced by factors such as the variety of loan options offered, interest rates, customer service quality, brand reputation, and the convenience of digital platforms. The competition among these key companies shapes the market dynamics and drives innovation in the payday loans industry.

Key Industry Developments

January 2025, Canadian start-up LottoLend has launched a new service offering a safe, fair, and rewarding alternative to traditional payday loans. LottoLend provides prize-linked short-term loans, allowing borrowers to access up to $1,500 instantly without a credit check12. For every $10 borrowed, customers receive a ticket for weekly cash prize draws, adding an element of excitement and potential reward to the borrowing process.

May 2024, Digital bank Chime has launched an advance wage product called MyPay, allowing customers to access up to $500 of their wages before payday. This product, which has no mandatory fees, interest, or credit checks, is part of Chime's efforts to enter the earned wage access market. The launch comes ahead of Chime's anticipated IPO in 2025.

March 2025, ATD Finance partnered with ATD Money to offer hassle-free, instant salary advances to employees. This service aims to provide quick financial relief to employees, helping them manage mid-month cash crunches without resorting to high-interest payday loans. By offering these salary advances, the partnership seeks to provide a more affordable and accessible alternative to traditional payday loans, promoting better financial stability for employees.

Key Benefits For Stakeholders

The study provides an in-depth analysis of the global payday loans market forecast along with the current trends and future estimations to explain the imminent investment pockets.

Information about key drivers, restraints, & opportunities and their impact analysis on the global payday loans market trends is provided in the report.

Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the payday loans market.

An extensive analysis of the key segments of the industry helps to understand the global payday loans market trends.

The quantitative analysis of the market from 2021 to 2030 is provided to determine the market potential.

Payday Loans Market Report Highlights

| Aspects | Details |

| By Type |

|

| By MARITAL STATUS |

|

| By CUSTOMER AGE |

|

| By Region |

|

| Key Market Players | THL DIRECT, CREDITSTAR, CASHFLOAT, CASHNETUSA, MYJAR, SILVER CLOUD FINANCIAL, INC, TMG LOAN PROCESSING, TITLEMAX, LENDING STREAM, SPEEDY CASH |

Analyst Review

Adoption of payday loan has increased over the years as payday loans are providing cash to people in need for money at high interest rate that should be returned in 1-2 weeks or on the date of pay check of the borrower. In addition, with the fast approval of the loans without any proof of spending it is attracting many youngsters who are borrowing money for entertainment purposes, which is driving the growth of the market.

Furthermore, according to a survey in 2019, it was found the majority of the students with education loans have taken payday loans at least once to repay the education loan, which is enhancing the growth of the market. Moreover, rise in adoption of advance technology such as AI, business intelligence among the payday lenders to automate the application process and target more customers who are most likely to take payday loans is providing lucrative opportunity for the market.

Key providers of the global payday loan market such as CashNetUSA, Lending Stream, Silver Cloud Financial, Inc., and TMG Loan Processing account for a significant share in the market. Furthermore, payday lenders are growing at a fast pace as payday loans can have interest rates over 600%, more and more lenders are entering this market to earn more money at fast pace. In addition, with rise in payday lenders the rate of workers taking payday loans tripled as a result of the pandemic, which enhances the growth of the market.

For instance, according to a recent survey by Gusto of 530 small business workers, about 2% of these employees reported using a payday loan prior to the start of the pandemic, but about 6% used this type of loan since March 2019. This increase in payday loans drive the growth among small earners. Moreover, due to high cost of interest many payday borrowers are unable to repay the loan and take another loan for paying the small amount, which is providing lucrative opportunity for the market.

Furthermore, even though payday loan is said to be an emergency loan, but majority of the borrowers are using it for daily uses and not for emergency use. For instance, according to Pew Charitable Trusts in 2020, most payday loans in the U.S. are used to cover regular expenses like utilities, credit card bills, food, rent, or mortgage and only about 16% use them for unexpected expenses such as car repair or medical emergencies. Moreover, with the reducing trust in payday loans with 3-digit interest, many borrowers are fearing to take another new payday loan, so to increase the trust in payday loans, some payday lenders are agreeing with government bill to standardize interest rate. For instance, in March 2021, Illinois Governor JB Pritzker signed into law Senate Bill 1792, which will cap interest at 36% for all payday loans. In addition, it applies to a wide array of businesses, and voids any contract that exceeds the rate cap. This protects borrowers from any unanticipated high interest and save from long loan sequences.

Thus, number of such developments across the globe is driving the growth of the market. According to the industry experts, the payday loan market is expected to witness increased adoption in the coming years, owing to rise in improved payday loans to manage the various unexpected expense or emergencies and growing awareness about the benefits of payday loans among the youth. North America is expected to dominate the market during the forecast period, while emerging countries in Asia-Pacific and Latin America are projected to offer significant growth opportunities.

The Payday Loans Market is estimated to grow at a CAGR of 4.2% from 2021 to 2030.

The Payday Loans Market is projected to reach $48.68 billion by 2030.

To get the latest version of sample report

Factors such as high interest rates and negative impact of payday loans on credit score drives the growth of the Payday Loans market

The key players profiled in the report include Cashfloat, CashNetUSA, Creditstar, Lending Stream, Myjar, Silver Cloud Financial, Inc., Speedy Cash, THL Direct, Titlemax, and TMG Loan Processing, and many more.

On the basis of top growing big corporations, we select top 10 players.

The Payday Loans Market is segmented on the basis of type, marital status, customer age, and region.

The key growth strategies of Payday Loans market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

subsegments of Customer Age are less than 21, 21-30, 31-40, 41-50 and more than 50.

Online Payday Loans segment will grow at a highest CAGR of 5.7% during 2021 - 2030.

Loading Table Of Content...