Payment as a Service Market Insights:

The global payment as a service market size was valued at $8 billion in 2021 and is projected to reach $53.6 billion by 2031, growing at a CAGR of 21.4% from 2022 to 2031.

Surge in usage of smartphone and massive internet penetration across several countries drive the demand for online payments, which in turn boost the growth of the global payment as a service market. In addition, increased requirement to improve the payment process & providing customers with integrated & value-added services to maintain associated demand for the digital processing, notably contributes toward the market growth. However, privacy & security concern and lack of standardization for international transactions are some of the factors that limit the market growth.

Furthermore, developing economies offer significant opportunities for payment as a service provider to expand & develop their offerings, especially among emerging economies such as Australia, China, India, Singapore, and South Korea. In addition, increased support from regulatory bodies to enhance the expansion & penetration of payment industry by executing tie-ups with e-wallets, e-commerce distribution, and other payment platforms in the market. This, as a result, is expected to provide lucrative opportunities for the expansion of the payment as a service market in the coming years.

Platforms and developers can rapidly and simply offer payment options, such as ACH and credit cards, to the user base of the platform owing to payments as a service, or PaaS, which also allows for the creation of income from transaction fees. In addition, payments as a service leverages powerful, elegant APIs that developers can easily test, deploy and go to market in a matter of days, rather than the many months typically required to integrate a payment solution.

The report focuses on growth prospects, restraints, and trends of the payment as a service market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the payment as a service market outlook. The market is segmented into Component, Payment Method and Industry Vertical.

Segment Review:

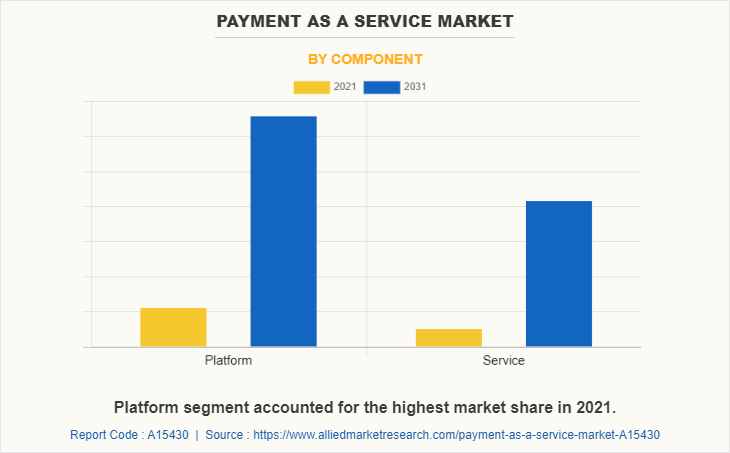

The payment as a service market is segmented into component, payment method, industry vertical, and region. On the basis of component, the market is differentiated into platform and service. The service segment is further segregated into professional services and managed services. The professional services segment is further segregated into system implementation & integration, support & maintenance and training & consulting.

The payment method segment is categorized into cards, app/eWallet, automated clearing house (ACH) and others. The cards segment is further bifurcated into credit card and debit card. On the basis of industry vertical, it is fragmented into BFSI, IT & telecom, healthcare, retail & ecommerce, media & entertainment, government & utilities, travel & hospitality, and others. On the basis of region, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the platform segment is estimated to acquire the highest share of payment as a service market size in 2021. This is attributed to the fact that these payment platforms help protect sensitive card payment information with encryption and tokenization that authenticate cardholder identity and make data virtually useless to fraudsters and provide a convenient & secure payments experience.

On the basis of region, North America dominated the payment as a service market share in 2021 during the forecast period. This is attributed to growth in technology adoption in the payment industry and rise in online transactions has increased the adoption of payment processing as a service in the region.

The key players operating in the global payment as a service market include Aurus, Inc., Alpha Fintech, ACI Worldwide, Apple Inc., First Data (Fiserv, Inc.), Google, LLC, Ingenico, Mastercard, Paysafe, PayPal Holdings, Inc., Paystand, Pineapple payments (Fiserv, Inc.), VeriFone, Inc., Visa Inc., Valitor, PayU, and Obopay. These players have adopted various strategies to increase their market penetration and strengthen their position in the payment as a service industry.

Top Impacting Factors:

Increased smartphone penetration & incorporation of online payment services

The demand for online payments is experiencing continuous growth, and is expected to maintain its dominance in the market with increase in emphasis on smartphone usage and massive internet penetration across several countries.

In addition, customers are using online payment channels more frequently as banks & financial institutions are providing real-time payment services, allowing regular online transactions, features of bill payments, and others. Therefore, demand for online payments is experiencing continuous rise in the market due to massive change in consumer behavior & preferences toward payment options. This, as a result, is promoting payment as a service market in terms of maintaining secured payment processes and increasing brand loyalty among consumers; thereby, propelling the market growth.

Rise in e-commerce sales

E-commerce refers to the online platform for providing products & services to the consumer directly from the business owners. A rapid increase in e-commerce has been witnessed over past few years, owing to growth in penetration of smartphones, coupled with faster internet connectivity. Consumers are gradually opting for online purchase for a number of goods and services such as apparel & accessories, groceries, health & beauty, computer & electronics, and books, owing to ease of ordering and receiving it at one’s doorstep. This, as a result, promotes demand for hassle-free payment as a service, which therefore drives the payment as a service market growth.

Increase in reliance on cloud technologies

The payment industry has experienced a significant transformation, and the old payment modules have been replaced by new ones that only require a click to complete the transaction. Moreover, payment as a service (PaaS) is not only changing the scene for retailers; banks are now realizing that the rise in PaaS use is an opportunity to give their clients a reliable choice. Increase in use of cloud-based service models as opposed to on-premise models is another driver boosting the market expansion.

Further, payment providers are progressively moving away from their conventional physical servers and on-premise strategy in favor of cloud-based deployment, to save operational expenses and deliver goods more quickly. Furthermore, alternate omnichannel solutions and digital wallets are now being developed as a result of the change in the cloud deployment strategy. Thus, the increase in reliance on cloud technologies is fueling the growth of payment as a service market.

Regional Insights:

North America: The North American payment as a service market is driven by a well-established financial infrastructure and high digital payment adoption rates, especially in the U.S. and Canada. E-commerce growth, coupled with mobile wallets and contactless payments, has accelerated the demand for advanced payment platforms. Traditional financial institutions are increasingly collaborating with fintech companies to offer innovative, multi-channel payment services. The region's focus on security, speed, and scalability further enhances the adoption of PaaS solutions.

Europe: Europe is a prominent player in the payment as a service market, fueled by the region’s strict regulatory environment, particularly the Payment Services Directive (PSD2), which promotes open banking. This regulatory shift has led to a surge in cloud-based payment services as banks and third-party providers collaborate to offer secure and efficient payment platforms. The rise of contactless payments, digital wallets, and the integration of cryptocurrency payment solutions in countries like the UK and Germany further accelerates the market’s growth.

Asia-Pacific: Asia-Pacific is the fastest-growing region in the payment as a service market, with countries like China, India, and Southeast Asia leading the charge due to their high mobile payment adoption rates. Mobile-first payment platforms, such as Alipay, WeChat Pay, and India's UPI, are transforming the payment landscape. The region’s large unbanked population is also a major growth driver, with fintech companies offering cloud-based solutions to promote financial inclusion across emerging markets.

Latin America: The Latin American payment as a service market is expanding rapidly, driven by the increasing use of digital wallets and mobile banking services in countries like Brazil and Mexico. The region's focus on financial inclusion, coupled with a growing demand for cross-border payment solutions, is contributing to the market's growth. With a large population of unbanked individuals, PaaS platforms are offering affordable and accessible payment options, especially in the mobile and peer-to-peer payment space.

Middle East and Africa: The Middle East and Africa are witnessing gradual growth in the Payment as a service market, supported by government initiatives aimed at reducing cash dependency and promoting digital payments. The rise of fintech startups offering mobile payment solutions, e-wallets, and real-time payment platforms in the UAE, South Africa, and Nigeria is driving market growth. In Africa, the success of mobile money services like M-Pesa is paving the way for further expansion of PaaS platforms, targeting the large unbanked population and SMEs.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the payment as a service market forecast from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities of payment as a service market overview.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the payment as a service market segmentation assists to determine the prevailing payment as a service market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global payment as a service market trends, key players, market segments, application areas, and market growth strategies.

Payment as a Service Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 53.6 billion |

| Growth Rate | CAGR of 21.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 427 |

| By Component |

|

| By Payment Method |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Google, One97 Communications Limited, PayPal Holdings Inc., Obopay, Samsung, Amazon Payments, Inc., Mastercard, PayU, FIS, ACI Worldwide, Inc., Alipay.com, Block, Inc., Apple Inc., Ingenico, Visa Inc., JPMorgan Chase & Co., American Express |

Analyst Review

Emergence of advanced technologies such as virtual reality (VR) & artificial intelligence (AI) in the banking sector and increase in number of partnerships & investment in digitalized platforms in the development of new & innovative products are becoming major trends in the payment as a service industry. For instance, in October 2020, Silverflow, a renowned payment technology company, announced a $3.19 million seed investment to launch its new cloud-native card payments platform by 2021.

Moreover, during the unprecedented COVID-19 health crisis, payment as a service is expected to be intact by the economic downturn and the demand for these solutions is expected to remain high during the forecast period. In addition, several merchants & retailers were adaptable toward online payment technologies in their response to the challenges such as increased demand for safer & secured transactions among consumers during the global health crisis. However, a considerable number of companies perceive that they have minimum payment as a service exposure. There is a change in this scenario and the year 2020 has witnessed an increase in sale of payment as a service, owing to stringent government regulations over using cash and promoting digitalized usage of payments, which boosts the payment as a service market.

The payment as a service market is fragmented with the presence of regional vendors such as Aurus, Inc., Alpha Fintech, ACI Worldwide, Apple Inc., First Data (Fiserv, Inc.), Google, LLC, Ingenico, Mastercard, Paysafe, PayPal Holdings, Inc., Paystand, Pineapple payments (Fiserv, Inc.), VeriFone, Inc., Visa Inc., Valitor, PayU, and Obopay. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. Major players are collaborating their product portfolio to provide differentiated and innovative products with increase in awareness & demand for payment as a service across the globe

The payment as a service market is estimated to grow at a CAGR of 21.4% from 2022 to 2031.

The payment as a service market is projected to reach $53.58 billion by 2031.

Increased smartphone penetration & incorporation of online payment services, rise in e-commerce sales, and increasing reliance on cloud technologies majorly contribute toward the growth of the market.

The key players profiled in the report include Aurus, Inc., Alpha Fintech, ACI Worldwide, Apple Inc., First Data (Fiserv, Inc.), Google, LLC, Ingenico, Mastercard, Paysafe, PayPal Holdings, Inc., Paystand, Pineapple payments (Fiserv, Inc.), VeriFone, Inc., Visa Inc., Valitor, PayU, and Obopay.

The key growth strategies of payment as a service market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...