Payment Card Skimming Market Research, 2032

The global payment card skimming market was valued at $2.9 billion in 2022, and is projected to reach $7.4 billion by 2032, growing at a CAGR of 9.9% from 2023 to 2032. The increased reliance on electronic payment methods, as well as the expansion of card-based transactions, all contribute to the growth of the payment card skimming market size. As more people and businesses use digital payment solutions, the sheer number of transactions provides an appealing target for hackers looking to attack payment system weaknesses.

Key Takeaways

- By component, the solution segment held the largest share in the payment card skimming market in 2022.

- By deployment mode, the on-premise segment held the largest share in the payment card skimming market in 2022.

- By organization size, the small and medium-sized enterprises segment is expected to show the fastest market growth during the forecast period.

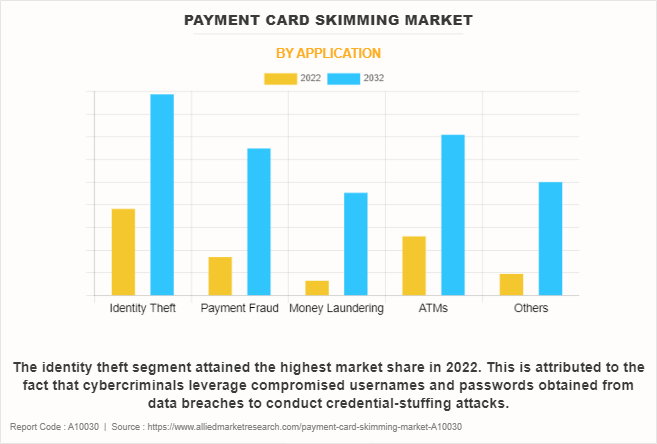

- By application, the money laundering segment is expected to show the fastest market growth during the forecast period.

- Region-wise, North America held the largest market share in the payment card skimming market in 2022. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Payment card skimming is a form of financial fraud where criminals illicitly obtain sensitive information from the magnetic stripe of credit, debit, or other payment cards. Perpetrators use discreet devices, known as skimmers, which are often inconspicuously attached to legitimate card readers like ATMs or gas pumps. These skimming devices covertly record the data embedded in the card's magnetic stripe, including the card number, expiration date, and sometimes the cardholder's name. Once collected, this stolen information is exploited to create counterfeit cards or conduct unauthorized transactions, leading to financial losses for the cardholder.

Payment card skimming poses a significant threat to individuals and businesses engaged in electronic transactions, and combating it requires a combination of technological advancements, public awareness, and regulatory measures to enhance the security of payment systems and protect against the unauthorized access and misuse of sensitive card data. Regular vigilance by consumers and the implementation of security measures by financial institutions and businesses are essential to mitigating the risks associated with payment card skimming.

The relative ease with which skimming devices may be deployed on commonly utilized platforms such as ATMs and petrol pumps allows criminals to cast a wide net, acquiring sensitive card information from unsuspecting consumers. Thus, these factors drive the growth of the payment card skimming market. However, strict restrictions and legal implications impede payment card skimming market growth. On the contrary, the ongoing evolution of payment technology, such as the move to chip-based cards and contactless payments, provides a chance to improve transaction security and reduce vulnerability to skimming. This transition to more secure payment systems compels criminals to adapt and develop new ways to exploit flaws, which drives security technology innovation.

The increased demand for complete cybersecurity solutions provides a market for businesses that specialize in fraud detection, prevention, and recovery. Businesses who can design and implement appropriate security measures stand to gain in this changing market by providing services and solutions that address the continuous issue of contactless card skimmer.

The report focuses on growth prospects, restraints, and trends of the payment card skimming market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the payment card skimming market outlook.

Segment Review

The global payment card skimming market is segmented into component, deployment mode, organization size, application, and region. On the basis of component, the payment card skimming market is categorized into solution and service. Based on deployment, the payment card skimming market is segmented into on-premise and cloud. On the basis of organization size, the market is segmented into large enterprise and small and medium-sized enterprises. By application, the payment card skimming market is divided into identity threat, payment fraud, money laundering, ATMs, and others. Region-wise, the payment card skimming market is studied across into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

On the basis of application, the identity theft segment acquired a major share in the payment card skimming market in 2022. This is attributed to the fact that identity thieves focus on exploiting weaknesses in e-commerce platforms, payment gateways, and digital wallets. This trend emphasizes the importance of securing not only physical card readers but also virtual payment channels. Furthermore, cybercriminals involved in payment card skimming are continuously enhancing their techniques and tools. Skimming devices have become more sophisticated, making them harder to detect.

Based on region, the North America segment acquired a major payment card skimming market share in 2022. This is attributed to the fact that the migration to EMV (Europay, Mastercard, Visa) chip technology has been a significant trend in North America. EMV cards provide enhanced security compared to traditional magnetic stripe cards, making it more challenging for criminals to use skimming devices. However, some regions may still face challenges in complete EMV adoption.

Competition Analysis

Competitive analysis and profiles of the major players in the payment card skimming market include Fiserv Inc., Sesame Software, Complianceforge, Investedge, Riskskill Inc., Rivial Data Security, Matrix IFS, NASDAQ BWISE, Quercia Software, C2C Smartcompliance. These players have adopted various strategies to increase their market penetration and strengthen their position in the payment card skimming industry.

Recent Partnership in the Payment Card Skimming Market

- In March 2023, Apto Payments, a one-stop-shop card issuing platform, announced its partnership with Sardine, the leading provider of fraud, compliance, and instant settlement solutions. The partnership allowed customers to quickly launch card programs with support from comprehensive transaction monitoring tools to identify and prevent fraudulent behavior.

- In February 2023, Mastercard announced that it is partnering with Network International, the leading enabler of digital commerce across the Middle East and Africa, to address fraud, declines and chargebacks in order to reduce costs and risk for acquirers. Through the partnership, Network will launch Mastercard’s Brighterion Artificial Intelligence (AI) technology across the region, providing transaction fraud screening and merchant monitoring to acquirers and businesses.

Market Landscape and Trends

Criminals increasingly target newer payment methods, such as contactless payments, and exploit vulnerabilities in emerging technologies. The use of sophisticated skimming devices and techniques persists, posing challenges for detection and prevention. Additionally, collaborative efforts among law enforcement, financial institutions, and businesses aim to combat this form of fraud. As the payment landscape evolves, ongoing innovations in security protocols and heightened public awareness play crucial roles in staying ahead of evolving payment card skimming trends.

Top Impacting Factors

Increasing Reliance on Electronic Payment

As the world increasingly embraces digital transactions, individuals and businesses conduct a substantial portion of their financial activities electronically, using credit and debit cards for purchases and transactions. This surge in electronic payments presents a lucrative opportunity for cybercriminals looking to exploit vulnerabilities in the payment ecosystem, thus driving the growth of payment card skimming market. The sheer volume of transactions conducted on platforms such as ATMs, point-of-sale terminals, and online payment gateways becomes an attractive target. Criminals deploy skimming devices, often surreptitiously attached to legitimate card-reading equipment, to harvest sensitive information from the magnetic stripes of payment cards. The widespread adoption of electronic payments amplifies the scope and scale of potential targets, making it easier for perpetrators to cast a wide net and capture valuable data from unsuspecting users.

Consequently, the increasing reliance on electronic payment methods amplifies the prevalence of payment card skimming, necessitating heightened cybersecurity measures, public awareness, and innovative technologies to mitigate the risks associated with this evolving threat landscape. As the digital transformation of financial transactions continues, the payment card skimming market adapts and exploits the expanding opportunities presented by the growing dependence on electronic payment methods.

Growing Adoption of Digital Payment Solutions

With the continuous evolution of technology and the widespread acceptance of digital transactions, individuals and businesses are increasingly turning to various forms of electronic payment methods, including credit and debit cards, mobile wallets, and contactless payments. This growing reliance on digital payment solutions creates an expansive landscape for cybercriminals seeking to exploit vulnerabilities in the payment ecosystem, hence, fueling the popularity of payment card skimming market. Skimming devices, discreetly placed on widely-used platforms such as ATMs, gas pumps, and point-of-sale terminals, enable fraudsters to clandestinely capture sensitive information from the magnetic stripes of payment cards. The ease and efficiency of deploying skimming devices in the face of the growing adoption of digital payment methods make it a lucrative avenue for criminals. As users embrace the convenience and speed of digital transactions, the sheer volume of electronic payments increases, providing a larger pool of potential targets for attackers.

Consequently, the intersection of the growing adoption of digital payment solutions and the prevalence of card skimming contactless underscores the need for robust cybersecurity measures, industry collaboration, and public awareness campaigns to mitigate the risks and protect users from falling victim to this evolving form of financial fraud. In navigating the digital landscape, stakeholders must remain vigilant and proactive in implementing security measures that safeguard the integrity of electronic payment systems and maintain the trust of consumers in the rapidly advancing world of financial technology.

Growing Demand for Comprehensive Cybersecurity Solutions

The growing awareness of vulnerabilities in electronic payment systems, coupled with the increasing frequency and sophistication of skimming attacks, has spurred a heightened demand for robust cybersecurity solutions. Organizations are investing in advanced technologies, encryption methods, and fraud detection systems to shield their payment infrastructure from skimming threats. The complexity and adaptability of modern skimming techniques necessitate a holistic approach to cybersecurity, driving the market for solutions that provide comprehensive protection against unauthorized access, data breaches, and fraudulent activities.

The imperative to maintain customer trust and secure sensitive financial information has become a driving force behind the surge in demand for cybersecurity measures tailored to counter the evolving landscape of payment card skimming. Industry stakeholders recognize that proactive investment in cybersecurity not only safeguards their operations but also ensures the protection of their clients' financial assets. This growing demand for comprehensive cybersecurity solutions underscores the ongoing battle between security experts and cybercriminals, prompting continuous innovation and collaboration within the cybersecurity industry to stay one step ahead of the ever-adapting tactics employed by those seeking to exploit vulnerabilities in electronic payment systems. Therefore, these factors drive the growth of the payment card skimming market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the payment card skimming market analysis from 2022 to 2032 to identify the prevailing payment card skimming market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the payment card skimming market segmentation assists to determine the prevailing payment card skimming market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the payment card skimming market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as payment card skimming market trends, key players, market segments, application areas, and market growth strategies.

Payment Card Skimming Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.4 billion |

| Growth Rate | CAGR of 9.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 268 |

| By Component |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | Riskskill Inc., Complianceforge, C2C Smartcompliance, Matrix IFS, Fiserv Inc., BWise, Quercia Software, Rivial Data Security, investedge, inc., Sesame Software |

Analyst Review

With enabling data security and preventing data breaches, the payment card skimming market is expected to grow in upcoming years. Moreover, consumers continue to buy insurance in order to protect their digital identity. In addition, several key players are enhancing & providing additional features, options and offerings by directing customers to buy a better plan for their coverage. While physical skimming remains a concern, the focus on securing online payment channels has also increased. This includes addressing issues such as phishing attacks, data breaches, and other cyber threats that contribute to identity theft and financial fraud. Furthermore, businesses and financial institutions have been investing in advanced security technologies to detect and prevent payment card skimming. This includes the use of point-to-point encryption, tokenization, and real-time fraud detection systems to enhance the overall security of payment transactions.

The COVID-19 outbreak has a significant impact on the global payment card skimming market, and has limited the growth of the market. Moreover, during this global health crisis, the lack of awareness among the people and consumer’s demands for better offerings has hindered the growth of the market. However, the digitalization of various industries such as banking, healthcare and IT has accelerated the growth of payment card skimming market.

The key players in the Payment card skimming market include Fiserv Inc., Sesame Software, Complianceforge, Investedge, Riskskill Inc., Rivial Data Security, Matrix IFS, NASDAQ BWISE, Quercia Software, C2C Smartcompliance. These players have adopted numerous strategies to increase their marketplace penetration and strengthen their position in the payment card skimming market.

The payment card skimming market is estimated to grow at a CAGR of 9.9% from 2023 to 2032.

The payment card skimming market is projected to reach 7.38 billion by 2032.

Increasing reliance on electronic payment, growing adoption of digital payment solutions, and growing demand for comprehensive cybersecurity solutions majorly contribute toward the growth of the market.

The key players profiled in the report include Payment card skimming market analysis includes top companies operating in the market such as Fiserv Inc., Sesame Software, Complianceforge, Investedge, Riskskill Inc., Rivial Data Security, Matrix IFS, NASDAQ BWISE, Quercia Software, C2C Smartcompliance.

The key growth strategies of payment card skimming players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...