Payment Gateway Market Overview

The global payment gateway market size was valued at USD 22.4 billion in 2021, and is projected to reach USD 98.2 billion by 2030, growing at a CAGR of 17.7% from 2022 to 2030. The payment gateway market is growing as a result of the increase in big transaction data and increased usage of different online payment methods such as credit cards, debit cards, net banking, and mobile wallets. High-speed Internet's growing popularity and accessibility are further factors driving industry expansion.

Key Market Trends & Insights

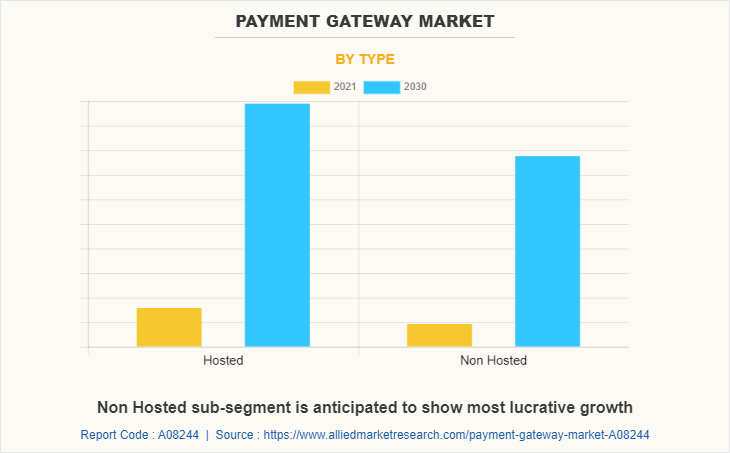

- By type, the non hosted sub-segment is expected to have the fastest growth.

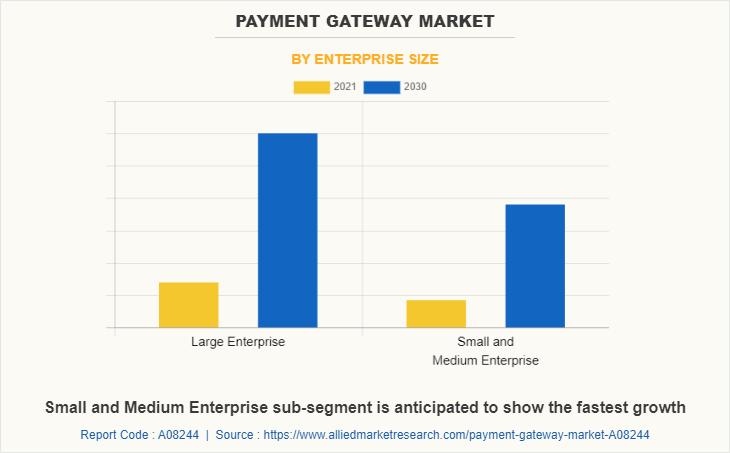

- By enterprise size, the large enterprise sub-segment dominated the payment gateway market share in 2021.

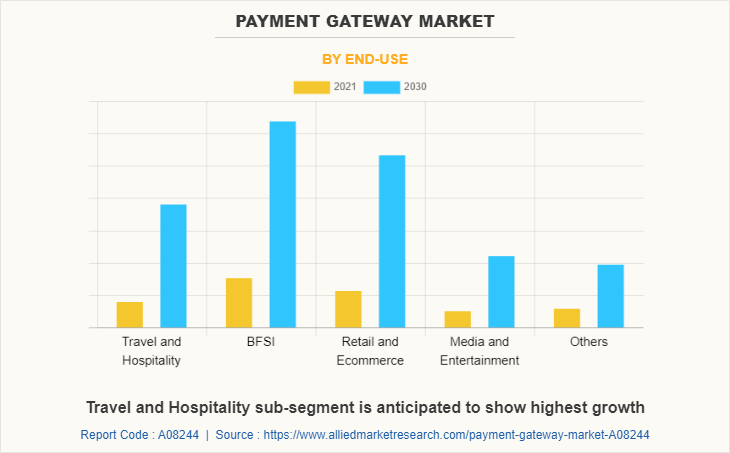

- By end-use, BFSI held a major share in 2021.

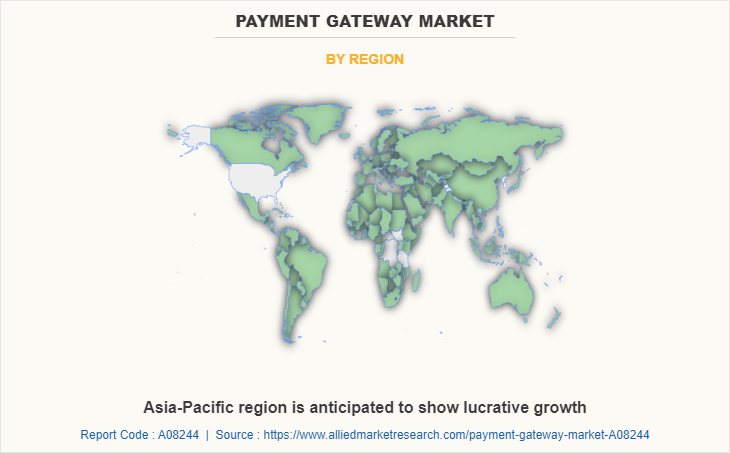

- By region, Asia-Pacific is expected to have the largest market share during the forecast period.

Market Size & Forecast

- 2021 Market Size: USD 22.4 Billion

- 2030 Projected Market Size: USD 98.2 Billion

- Compound Annual Growth Rate (CAGR) (2022-2030): 17.7%

- Asia Pacific: Largest market share during 2021 - 2030

What is Payment Gateway?

Payment gateway is an online money operating gateway which joins customer and the merchant together through digital mode. A payment gateway authenticates the customer’s card details safely, ensures enough funds availability in the bank account, and eventually enables merchants to get paid. In short, payment gateway is an online interface for money transfer between the customer and the merchant. Online payment option is an asset to any business because the online mode ensures secure & smooth payment transactions and helps in decreasing company’s financial losses due to late payments.

Important aspects that are projected to help the growth of the payment gateway market include increasing e-commerce sales as it saves time and increasing internet penetration internationally. Additionally, it is anticipated that the market would develop in the coming years due to the shift in merchant and client preferences toward digital channels for permitting online money transfers.

Customers' increased danger of online fraud serves as the payment gateway's primary impediment. There is a great likelihood that some socially irresponsible element may misuse the account information that must be entered in order to make an online payment on the online payment gateway application. This is the primary factor impeding the market expansion for payment gateways.

The major market players are investing a lot of their efforts and money on the research and development of smart and unique strategies to sustain their growth in the market. These strategies include product launches, mergers & acquisitions, collaborations, partnerships, and refurbishing of existing technology. For instance, according to a news published on Live Mint, an online magazine, on June 24, 2021 , Pine Labs, a market leader in providing payment solutions to its customers, announced the acquisition of Setu, fintech infrastructure provider, for $70-75 million. The main objective behind company’s acquisition move is to expand its presence in online lending and on payment platforms. Such factors are anticipated to have a positive impact on payment gateway market growth.

Segmentation Overview

The global payment gateway market is segmented on the basis of type, enterprise size, end-use, and region. By type, the market is sub-segmented into hosted and non hosted. By enterprise type, the market is segmented into small & medium enterprise (SME) and large enterprise. By end-use, the market is classified into travel & hospitality, BFSI, retail & ecommerce, media & entertainment and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the non hosted sub-segment is expected to have the fastest growth. As businesses can maintain control over the entire checkout process, including the layout and design process, while offering customers a smooth purchasing experience, many merchants around the world prefer a non hosted payment gateway for their website. Merchants can allow customers to complete payments by directly entering their debit or credit card details on the checkout page using APIs. Additionally, any device can use APIs to combine non hosted gateways with online payment systems, opening up new growth prospects for the market during the course of the forecast period. These are predicted to be the major factors affecting the payment gateway market size during the forecast period too.

By enterprise size, the large enterprise sub-segment dominated the global payment gateway market share in 2021. Large businesses typically receive more website traffic. Thus, they must implement efficient checkout solutions for their clients. By enabling a variety of digital payment methods, such as net banking and credit or debit cards, payment gateway systems can guarantee a simple checkout process for clients. Such applications of payment gateway in the large enterprises are bound to create a scope of growth for the sub-segment during the forecast period.

By end-use, BFSI held a major share in 2021. Due to the fact that payment gateway systems offer a complete environment for financial services, the BFSI sector has adopted them widely. Complex cash flows, where money is gathered from different sources and sent to various accounts, provide difficulty for financial institutions. Financial institutions may simply control cash flow from a single dashboard thanks to gateway systems.

By region, Asia-Pacific is expected to have the largest market share during 2021 to 2030, owing to presence of emerging economies like India, China, and South Korea and increase in smartphone users in the Asian countries. Also, the e-commerce sector in countries like India are growing at a very fast pace. People like to buy things online instead of going to the store, which is creating the demand for payment gateway solutions, fuelling the growth of the market.

Top Impacting Factors:

The growing requirements for better consumer experience, initiatives in the form of cashback for the promotion of digital payments, and increase in adoption of smartphones are driving the growth of the market. However, lack of digital literacy in developing countries is expected to hamper the growth of the market. Contrarily, progressive & advanced changes in regulatory framework for the payment gateway can be seen as an opportunity for the market investments. The global payment gateway market trends are as follows:

The growing requirement for improved consumer experience:

In the fast-changing business environment, organizations are investing in the innovative & advanced technologies such as payment processing architecture to succeed & provide improved consumer experience. Furthermore, the digital payments play a vital role in improvising the consumer experience & increasing the e-commerce revenues. Moreover, the data management & payment gateway analytics helps in collecting the data from payment devices in order to gather useful information. Additionally, the data helps the e-commerce companies to better understand the consumer preferences. Also, the payment gateway is expected to help the consumer with a responsive, radical, and convenient shopping experience from the online payment. Therefore, growing requirement for improved consumer experience is expected to foster the global payment gateway market during the forecast period.

Lack of digital literacy in developing countries:

Consumers are required to understand the digital-related literacy towards an easier & convenient digital payment options through the gateway. Furthermore, the illiteracy hinders the market growth for the digital payment gateway as the ability of understanding technical skill while operating the digital device is absent. Moreover, due to the lack of digital payment gateway literacy, technological industries show a bit of hesitant behavior during the investment in the developing countries. In addition, individuals are not able to explore the potential of the digital technologies. Therefore, lack of digital literacy in developing countries, will hamper the growth of payment gateway market during the forecast period.

Key Payment Gateway Companies:

The following are the leading companies in the payment gateway market.

- PayPal Holdings, Inc.

- STRIPE, Visa Inc.

- Amazon.com Inc.

- FIS(Worldpay)

- Mastercard

- PayU

- BitPay, Inc.

- FISERV

- BluePay

- JPMorgan Chase & Co.

Highlights of the Report

- The report provides exclusive and comprehensive analysis of the global payment gateway market trends along with the payment gateway market forecast.

- The report elucidates the payment gateway market opportunity along with key drivers and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the payment gateway market analysis maps the qualitative sway of various industry factors on such as payment gateway services across different geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the payment gateway services.

Payment Gateway Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Enterprise Size |

|

| By End-use |

|

| By Region |

|

| Key Market Players | Amazon.com Inc., FIS(Worldpay), PayPal Holdings, Inc., Visa Inc., FISERV, INC.(BluePay), JPMorgan Chase & Co., BitPay, Inc., MASTERCARD, PayU, STRIPE |

Analyst Review

Rising demand for digital payment mode among people of all age group for hassle free money transaction is expected to drive payment gateway market share growth in the anticipated time period. However, major concerns of account data leakages and its misuse by some hackers are likely to restrain payment gateway market growth in the anticipated time frame. Furthermore, technological advancements and integration of latest technology in online payment applications by major market players are likely to generate huge growth opportunity for payment gateway market growth in forecast time period.

Among the analyzed regions, Asia Pacific is expected to account for the highest revenue in the market by the end of 2030, followed by North America, Europe, and LAMEA. Rapid industrialization and high penetration of internet services in the market are the key factors responsible for leading position of Asia-Pacific in the global payment gateway market.

Growing adoption of cashless and online payment transactions among people are the upcoming trends in the payment gateway market.

Some of the leading applications of payment gateway market include financial services, travel & hospitaltiy, and retail & e-commerce.

Asia-Pacific is the largest regional market for payment gateway industry.

Payment gateway industry is estimated to reach $98,198.70 million by 2030.

The top companies namely PayPal Holdings, Inc., STRIPE, Visa Inc., and Amazon.com Inc. will hold the highest market share in the payment gateway market.

Loading Table Of Content...