PCB Design Software Market Research, 2032

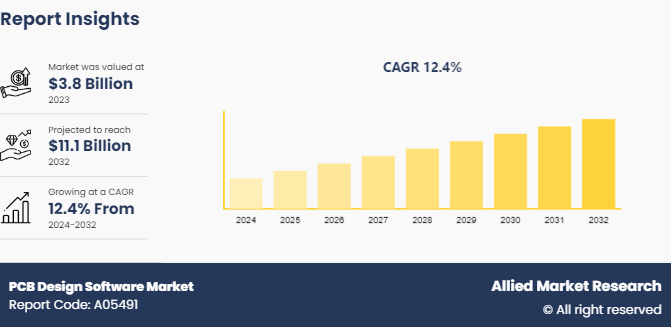

The global PCB design software market was valued at $3.8 billion in 2023, and is projected to reach $11.1 billion by 2032, growing at a CAGR of 12.4% from 2024 to 2032. The global PCB design software market is experiencing growth due to the increased consumer electronics adoption among consumers. The compact and advanced design of these electronics are leading to the need for advanced and miniature designs of PCB thereby contributing to the PCB design software market growth.

Market Introduction and Definition

Engineers and designers utilize specialized tools called printed circuit board (PCB) design software, sometimes referred to as electronic design automation (EDA) software, to build PCB layouts. A full range of functions for PCB design, simulation, testing, and manufacturing are offered by these software programs.

The ability to create a visual representation of electronic components and their connections using schematic capture is a common feature of PCB design software. Other features include PCB layout design, which involves placing components and routing electrical connections on a virtual board, simulation tools for analyzing circuit behavior and confirming functionality prior to physical prototyping, and manufacturing output generation, which makes it easier to produce PCBs.

Key Findings

The PCB design software market size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

Several product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global PCB design software market forecast and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

The growing need for PCB design software that can handle complicated designs and incorporate cutting-edge features such as signal integrity analysis, thermal management, and 3D modelling is attributed by the Internet of Things and Industry 4.0 ambitions. Software that allows design teams to collaborate seamlessly is becoming more and more necessary as firms aim for innovation and faster time-to-market, which streamlines the entire product development process.

In addition, the PCB design software market size is expanding owing to the growing popularity of cloud-based solutions, which provide scalability, accessibility, and affordability. With the trend toward cloud-based platforms, software developers have the chance to provide integrated solutions that incorporate design, simulation, and manufacturing capabilities, enabling engineers to create innovative PCBs with greater efficiency.

Parent Market Analysis

The electronics industry's persistent growth and rise in demand for advanced electronic gadgets across a range of industries are driving the PCB (Printed Circuit Board) market's steady rise. The global PCB market is expected to increase at a CAGR of around 4.6% during the forecast period, from its estimated valuation of $63.1 billion in 2022 to over $89 billion by 2030, according to market research firm Allied Market Research. This development trajectory is attributed to several causes, including the increasing number of Internet of Things (IoT) devices, the introduction of 5G technology, and the growing popularity of electric vehicles. Furthermore, developments in PCB manufacturing technologies—like flexible PCBs and HDI (High-Density Interconnect) —are spurring innovation and broadening the industry. The PCB market is also changing because of the growing emphasis on sustainability and environmentally friendly manufacturing techniques, which is putting more attention on recyclable materials and energy-efficient production techniques.

Market Segmentation

The PCB design software industry is segmented into component, deployment mode, end user, and region. Based on component, the market is classified into software and services. Based on deployment mode, the market is bifurcated into cloud and on-premises. Based on end user, the market is categorized into healthcare, consumer electronics, automotive, aerospace & defense, industrial, and other. Based on region, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The North America PCB design software industry accounted for the largest share in 2023. A strong ecosystem of tech businesses, academic institutions, and knowledgeable individuals can be found in the region, which promotes creativity and advances the creation of state-of-the-art PCB design solutions. The presence of several established electronics manufacturing companies such as Texas Instruments, Qualcomm, and Intel, in North America is further propelling the demand for PCB design software across the region, which is contributing to the growth of PCB design software market share. Furthermore, the rise in startup and venture capital investment environment in North America are flourishing, which contributes to the rise of creative software businesses that focus on PCB design tools. Also, advanced PCB design software is required to meet compliance requirements owing to the region's strict regulatory standards and emphasis on quality and reliability in industries including aerospace & defence, and medical devices. North America's technological capability, industry knowledge, and market demand continue to position it as a major region in the global PCB design software market.

Industry Trends:

In January 2023, a reputed supplier of electronic design automation software launched its next generation EDA software. It includes cloud collaboration features, AI-driven design optimization, and sophisticated simulation capabilities. This breakthrough raised the bar for PCB design creativity and efficiency.

Several PCB solution providers introduced a range of 5G-compatible PCB solutions in May 2023 that were designed to meet the demands of the upcoming telecom infrastructure. To facilitate the quick rollout of 5G networks across the globe, these solutions combined high-frequency performance, improved RF (Radio Frequency) architecture, and advanced signal integrity features.

In November 2023, AI-based quality control and inspection technologies were added to PCB assembly lines, improving manufacturing process accuracy and efficiency. Real-time defect identification, process optimization, and predictive maintenance were made possible by these AI-driven technologies, which guaranteed high-quality PCB assemblies while lowering manufacturing costs and time-to-market.

Competitive Landscape

The major players operating in the PCB design software market forecast include Altium Limited, Autodesk Inc., EasyEDA, Cadence Design Systems, Inc., and Siemens. Other players in the PCB design software market include Labcenter Electronics, ANSYS, Inc, Zuken, Synopsys, Inc., Novarm Limited. and others.

Recent Key Strategies and Developments

In January 2022, Altium LLC and MacroFab, Inc. announced their partnership to launch its new integrated PCB designed with manufacturing application. The solution combines real-time supply chain data on Altium’s exiting electronics design platform.

In May 2021, Zuken announced the launch of eCADSTAR 2021.0 version. The eCADSTAR PCB design software is integrated with several new features 3D safety checks in PCB designing processes, and enhanced bus management.

Key Sources Referred

IPC - Association Connecting Electronics Industries

Printed Circuit Engineering Association (PCEA)

Electronic Design Automation Consortium (EDAC)

European Institute of Printed Circuits (EIPC)

Association Connecting Electronics Industries in China (ACEIC)

Japan Electronics Packaging and Circuits Association (JPCA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pcb design software market analysis from 2024 to 2032 to identify the prevailing pcb design software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pcb design software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pcb design software market trends, key players, market segments, application areas, and market growth strategies.

PCB Design Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.1 Billion |

| Growth Rate | CAGR of 12.4% |

| Forecast period | 2024 - 2032 |

| Report Pages | 200 |

| By Component |

|

| By Deployment |

|

| By End User |

|

| By Region |

|

| Key Market Players | Synopsys, Inc., Zuken Inc., EasyEDA, Labcenter Electronics, Altium Limited, Autodesk Inc., Siemens AG, Cadence Design Systems, Inc. , Novarm Limited, ANSYS, Inc |

The integration on AI and machine learning coupled with the rise in focus of Design for Manufacturing (DFM) is the major trend in the PCB design software market.

The consumer electronics industry is the major user of the PCB design software.

Asia-Pacific is the largest regional market for the PCB design software market as of 2023.

The PCB design software market is expected to reach $11.1 billion by 2032.

The major companies operating in the global PCB design software market include Altium Limited, Autodesk Inc., EasyEDA, Cadence Design Systems, Inc., Siemens AG, Labcenter Electronics, ANSYS, Inc, Zuken, Synopsys, Inc., and Novarm Limited.

Loading Table Of Content...