Penetration Testing Market Insights, 2031

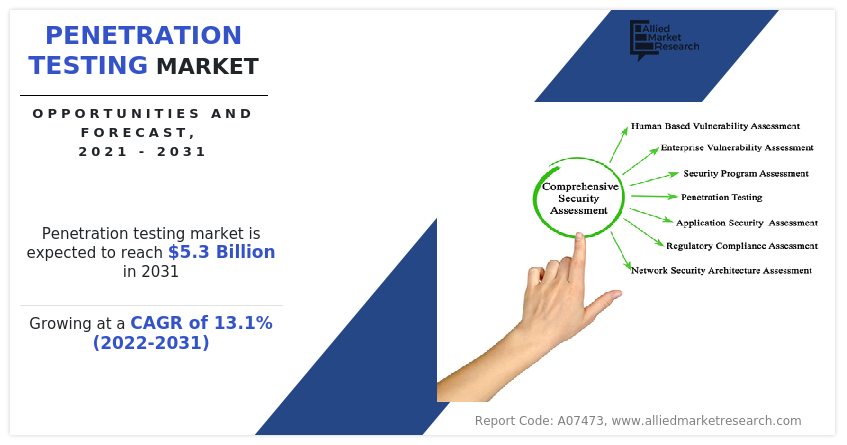

The global penetration testing market size was valued at USD 1.6 billion in 2021, and is projected to reach USD 5.3 billion by 2031, growing at a CAGR of 13.1% from 2022 to 2031.

High adoption of cloud computing solutions and services and increasing number of data centres is boosting the growth of the global market. In addition, stringent government regulations to increase the adoption of penetration testing solutions and services is positively impacts growth of the market. However, lack of skilled security professionals and high implementation cost is hampering the penetration testing market growth. On the contrary, increasing popularity of PTaaS and security assessment for remote workers is expected to offer remunerative opportunities for expansion of the market during the forecast period.

Penetration testing is a cybersecurity defense practice that aims to deceive attackers by distributing a collection of traps and decoys across a system's infrastructure to imitate genuine assets. In addition, it helps organizations to uncover vulnerabilities such as unsensitized inputs that are susceptible to code injection attacks in number of application systems, and frontend/backend servers.

The penetration testing market is segmented on the basis of by component, deployment mode, testing type, enterprise size, industry vertical, and region. On the basis of component, the market is categorized into solution and service. On the basis of deployment mode, the market is fragmented into On-Premise, and Cloud. On the basis of testing type the market is classified into network penetration testing, application penetration testing, social engineering tests, cloud penetration testing, and others. On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. By industry vertical, it is classified into BFSI, Manufacturing, Healthcare, Government and Defense, Energy and Utilities, Retail and E-commerce, IT and Telecom, and Others. By region, the penetration testingmarket is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in the penetration testing market are Breachlock Inc., Bugcrowd, Cigniti Technology Ltd., Cisco Systems, Inc., CovertSwarm, Isecurion, Netragard, NetSPI LLC, Nowsecure, PortSwigger Ltd., Rapid 7, Rebot Security, SecurityMetrics, TrustWave Holdings, Inc., Vumetric Cybersecurity, Astra Security, Vairav Technology. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

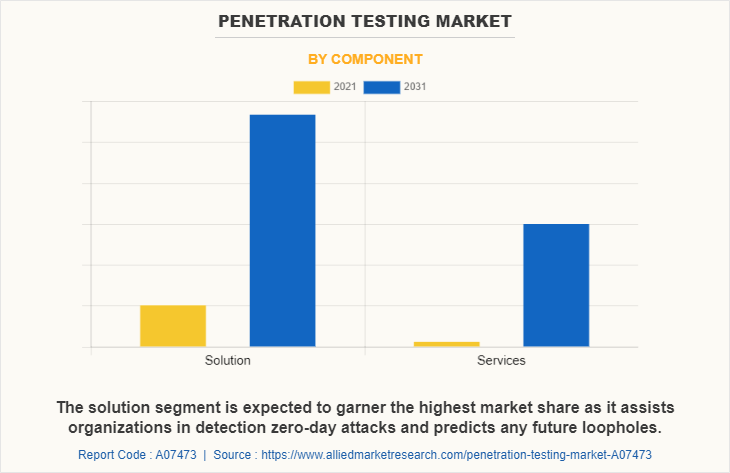

Depending upon component, solution segment holds the largest penetration testing market share as it assists organizations in detection zero-day attacks and predicts any future loopholes. However, the service segment is expected to grow at the highest rate during the forecast period, owing to rise in demand for cyber security services during remote working in COVID-19 pandemic, thus making the network more secure and convenient.

Region-wise, the penetration testing market size was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to increase in adoption of advanced technologies such as cloud technology, big data, artificial intelligence, and machine learning for automation across industries. However, Asia-Pacific is expected to witness significant growth rate during the forecast period, owing to rise in penetration testing awareness and growth in number of SMEs adopting cloud-based security testing in the region.

Top Impacting Factors

High Adoption of Cloud Computing Solutions and Services

The usage of cloud computing solutions and services is increasing rapidly across the globe, owing to the fact that the cost of cloud-based services is comparatively cheaper and does not require the setting up of dedicated IT infrastructure. Moreover, cloud deployment increases the vulnerabilities in software and makes it easily accessible for unauthorized users. Furthermore, it helps organizations achieve a more comprehensive view of cloud assets. For instance, in July 2021, Snyk launched the Cloud Security Solution designed by and for developers to realize a fully featured cloud security solution that allows modern developers to continue their rapid pace of innovation securely. In addition, cloud computing solutions and services are in high demand for penetration testing as it is designed to assess the strengths and weaknesses of a cloud system to improve its overall security posture. Such demands are driving the growth of the penetration testing industry.

Increase in Number of Data Centers

An increasing number of data centers are a centralized cluster of computing and networking equipment, and opportunities emerge regularly. The industry is expected to see new opportunities for the data center sector. In addition, the volume of data that is consumed has expanded dramatically in recent years as a result of high-speed internet connections, improved industrial automation, and increased mobile device usage. This increase in data volume has created a huge opportunity for the data center sector. Furthermore, many companies in this industry are increasingly digitizing their operations and services, putting them in a stronger position to rely on data centers. Therefore, industries are enabling data centers to collect large amounts of data and security during the pandemic, which in turn is driving the growth of the penetration testing market.

Regional Insights

The penetration testing market is experiencing significant growth across various regions due to rising cybersecurity threats, increased regulatory requirements, and growing awareness of the importance of proactive security measures.

- North America dominates the penetration testing market, driven by the strong presence of cybersecurity companies and the high adoption of digital technologies. The U.S. is a key market due to strict regulatory requirements, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA), which require organizations to ensure the security of sensitive data. The growing frequency of cyberattacks, especially in industries like finance, healthcare, and government, is driving demand for penetration testing services. Additionally, the region’s mature IT infrastructure and focus on data protection make North America a leader in the market.

- Europe is another significant player in the penetration testing market, with countries like the U.K., Germany, and France leading the way. The introduction of strict data protection regulations, such as GDPR, has pushed organizations to adopt robust security practices, including penetration testing, to ensure compliance and safeguard customer data. Europe’s financial institutions, healthcare providers, and critical infrastructure sectors are investing heavily in cybersecurity solutions to protect against sophisticated cyber threats. Additionally, government initiatives across the region to enhance cybersecurity resilience are further driving the penetration testing market.

- Asia-Pacific is the fastest-growing region in the penetration testing market, with major contributions from China, India, Japan, and Australia. The region’s rapid digital transformation, increasing cyberattacks, and growing focus on regulatory compliance are driving the demand for penetration testing services. China and India, in particular, are witnessing a surge in cyber threats targeting their financial and IT sectors. Governments and organizations in the region are prioritizing cybersecurity to protect their digital infrastructure and prevent data breaches, leading to increased adoption of penetration testing solutions. Moreover, rising investments in cloud infrastructure and digital services are boosting the demand for security testing across various industries.

- Latin America and the Middle East and Africa are emerging markets for penetration testing services. In Latin America, Brazil and Mexico are experiencing an increase in cyberattacks, particularly targeting their banking and financial sectors. As a result, organizations in the region are adopting penetration testing to strengthen their security posture. In the Middle East and Africa, countries like the UAE and Saudi Arabia are investing heavily in cybersecurity to protect critical infrastructure and financial services. The increasing adoption of cloud services and digital technologies in these regions is also contributing to the growth of the penetration testing market.

Key Industry Developments

- March 2023: IBM Security announced the expansion of its penetration testing services to North America and Europe. The new services focus on advanced threat simulation and offer specialized testing for emerging attack vectors like AI-driven threats and cloud infrastructure vulnerabilities.

- May 2023: Checkmarx, a leading provider of application security testing, launched a new penetration testing service tailored for DevOps environments in the Asia-Pacific region. This service aims to help companies integrate security testing into their continuous integration and continuous deployment (CI/CD) pipelines to reduce vulnerabilities early in the development process.

- July 2023: Rapid7, a global cybersecurity firm, introduced its new cloud-native penetration testing platform in Europe, targeting industries like healthcare and finance. The platform provides continuous security testing and vulnerability assessments for organizations migrating to the cloud, helping them comply with stringent regulatory requirements.

- September 2023: The Indian government announced the launch of a national cybersecurity program that mandates regular penetration testing for critical infrastructure sectors, including finance, healthcare, and government institutions. This initiative is part of India’s efforts to enhance national security in response to the increasing frequency of cyberattacks.

COVID-19 Impact Analysis

The penetration testing industry is projected to prosper in the COVID-19 situation, owing to various government, public, and other organizations adopting work from home culture for their employees. In addition, various IT & telecom industries are adopting penetration testing solution for improving the loss suffered, owing to the pandemic situation and to improve their penetration testing market share. In addition, there is a significant increase in cyber-crime and data breaches in enterprises during the lockdown.

Moreover, lack of skilled IT professionals and highly skilled hackers has led to surge in cyber-crimes and security breaches in organizations. In addition, different enterprises adopted penetration testing solutions due to rise in number of data breaches and lack of security within the organization to prevent unauthorized access to enterprise information using the loopholes in the security systems. As a result, rise in number of data and security breaches during the COVID-19 pandemic in enterprises drives the penetration testing market growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the Penetration testing market forecast, current trends, estimations, and dynamics of the penetration testing market analysis from 2021 to 2031 to identify the prevailing penetration testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the penetration testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global penetration testing market trends, key players, market segments, application areas, and market growth strategies.

Penetration Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 5.3 billion |

| Growth Rate | CAGR of 13.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 345 |

| By Organization Size |

|

| By Industry Vertical |

|

| By Component |

|

| By Deployment Mode |

|

| By Testing Type |

|

| By Region |

|

| Key Market Players | TrustWave Holdings, Inc., Bugcrowd, Netragard, NetSPI LLC, Isecurion, Rapid 7, Rebot Security, CovertSwarm, Astra Security, Cisco Systems, Inc., Synopsys, Vairav Technology, Nowsecure, SecurityMetrics, Vumetric Cybersecurity, Breachlock Inc., PortSwigger Ltd, Cigniti Technology Ltd. |

Analyst Review

A penetration testing is a type of software testing that reveals vulnerabilities, threats, and risks in a software application and prevents malicious attacks from intruders. Furthermore, growth of the security testing market is due to its ability to identify all possible loopholes and weaknesses of the software system, which might result in loss of information, revenue, repute at the hands of the employees, or outsiders of the organization. The security testing market has huge opportunities in the small, medium, and large-scale industries.

The global penetration testing market is expected to register high growth due to presence of stringent regulations and compliances mandating regular penetration testing practices, increasing sophistication of cyberattacks resulting in financial and reputational losses for organizations. Thus, increase in adoption of penetration testing, owing to its security is one of the most significant factors driving the growth of the market. With surge in demand for penetration testing, various companies have established alliances to increase their capabilities. For instance, in September 2021, Apiiro partnered with NetSPI to combine Apiiro’s comprehensive Application Risk Management capabilities with NetSPI’s Penetration Testing as a Service (PTaaS). The partnership enables contextual and risk-based application penetration testing for its mutual customers.

In addition, with further growth in investment across the world and the rise in demand for penetration testing, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in July 2022, Darktrace launched new set of AI products designed to deliver proactive security to help organizations pre-empt cyberthreats it works together autonomously to optimize an organization’s state of security through a continuous feedback loop. For instance, in June 2022, Bugcrowd, the leader in crowdsourced security launched Penetration Testing as a Service (PTaaS) product line to include new offerings—Basic Pen Test and Standard Pen Test to cover the gamut of customer needs, from basic assurance for simple web apps and networks to continuous, crowd-powered testing of complex apps, cloud services, mobile apps, APIs, and IoT devices for maximum risk reduction.

Moreover, with increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, August 2021, Chess acquired penetration test provider Armadillo to deliver end to end services to enterprise customers.

The global penetration testing market was valued at $1.56 billion in 2021, and is projected to reach $5.33 billion by 2031.

The penetration testing market is projected to grow at a compound annual growth rate of 13.1% from 2022 to 2031.

The key players that operate in the penetration testing market are Breachlock Inc., Bugcrowd, Cigniti Technology Ltd., Cisco Systems, Inc., CovertSwarm, Isecurion, Netragard, NetSPI LLC, Nowsecure, PortSwigger Ltd., Rapid 7, Rebot Security, SecurityMetrics, TrustWave Holdings, Inc., Vumetric Cybersecurity, Astra Security, Vairav Technology. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Region-wise, the penetration testing market size was dominated by North America in 2021 and is expected to retain its position during the forecast period.

High adoption of cloud computing solutions and services and increasing number of data centers is boosting the growth of the global penetration testing market. In addition, stringent government regulations to increase the adoption of penetration testing solutions and services is positively impacts growth of the penetration testing market

Loading Table Of Content...