Pension Administration Software Market Research, 2032

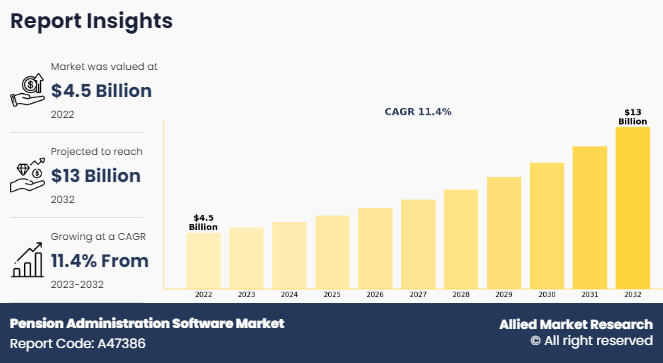

The global pension administration software market was valued at $4.5 billion in 2022, and is projected to reach $13 billion by 2032, growing at a CAGR of 11.4% from 2023 to 2032.

Pension is a kind of retirement income that individual planned throughout the life to ensure an income source. Moreover, it is an investment that grows through regular contributions. In addition, pension administration software helps in establishing, maintaining, and investing the pension fund in accordance with the plan terms; maintaining complete and accurate plan records; ensuring that appropriate contributions are made to the pension plan; and making benefit payments to plan beneficiaries. The pension administration software helps to reduce process turnaround time by automating pension processes which use to take a long time to do manually.

Moreover, posting late fees, creating and delivering letters of default, and calculating penalties and fees are all just a few of the tasks which are done through software management. Also, this pension administration software helps to streamline many elements of day-to-day work, allowing the team to focus their efforts and energy on what is extremely crucial and simply eliminate lower-value, time-consuming duties. Moreover, pension administration software helps to save money by changing the process to work in a better way. Such advancement in technology helps to improve the organization's bottom line by decreasing procurement costs and improving efficiencies across the board. In addition, with the long process of managing and investing the pension funds in the employee's retirement savings account (RSA), had been made easy by adopting such pension administration software technology.

Key Takeaways:

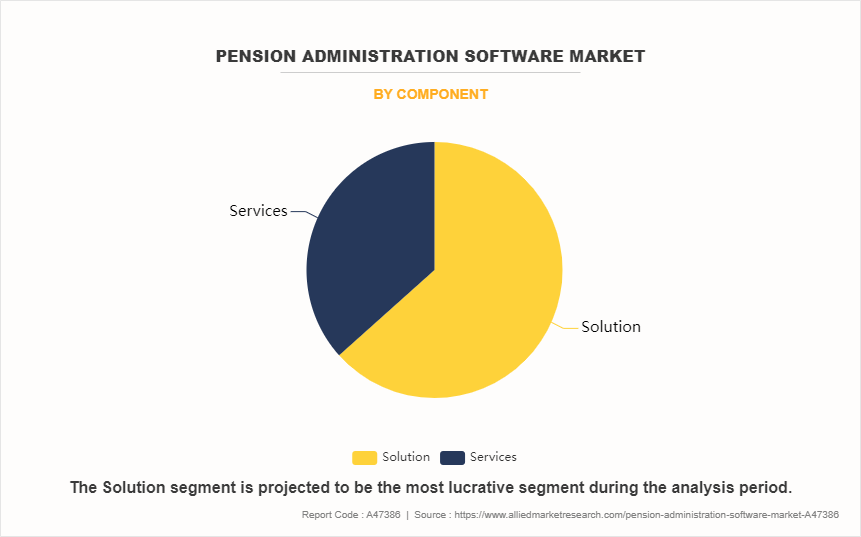

- By component, the solution segment held the largest share in the pension administration software market for 2023.

- By deployment mode, the on-premise held the largest share in the pension administration software market for 2023.

- By type, the private pension segment is expected to show the fastest pension administration software market growth during the forecast period.

- By end users, the pension plan administrators segment is expected to show the fastest pension administration software market growth during the forecast period.

- By pension fund size, $1 billion to $5 billion held the largest share in the global pension administration software market for 2023.

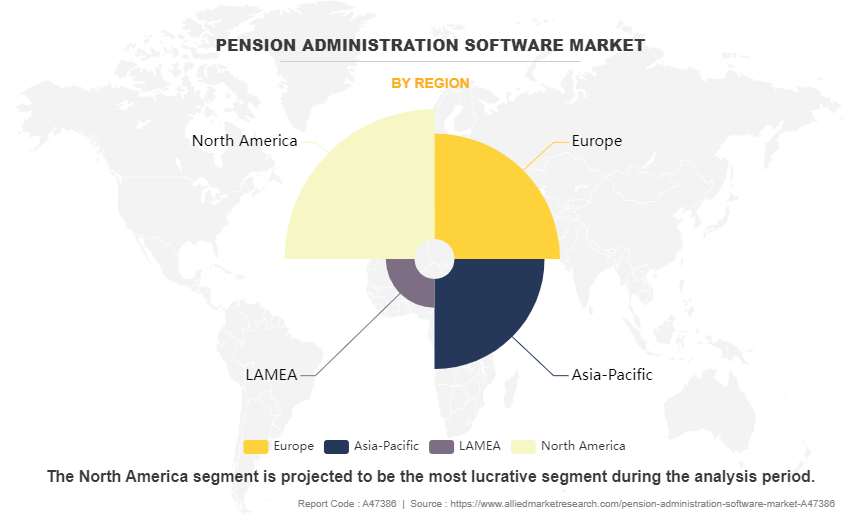

- Region-wise, North America held the largest pension administration software market share in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

In addition, the pension administration software market is expected to witness notable growth, owing to modern customer experience, pension administration software helps to reduce processing time, efficiency and cost effectiveness and increase in demand for pension administration software market. Moreover, technological advancements in the field of administration and integration of mobile technology in pension administration software are expected to provide lucrative opportunities for the growth of pension administration software market during the forecast period. On the contrary, technology limitation on the aged/old age people and high implementation costs limits the growth of the pension administration software market.

Segment Review

The pension administration software market is segmented on the basis of component, deployment mode, type, end users, pension fund size, and region. By component, it is segmented into solution and service. By deployment mode, it is bifurcated into on-premise and cloud. By type, it is segmented into public pension and private pension. By end users, it is segmented into employers, pension plan administrators, government agencies, and others. By pension fund size it is segmented into less than $500 million, $500 million to $1 billion, $1 billion to $5 billion, $5 billion to $10 billion, and $10 billion and above. By region, the pension administration software market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the solution dominated the pension administration software market size in 2022, owing to improve productivity and cut costs by automating numerous manual processes and reducing the requirement for paper-based record keeping. Furthermore, by making it simpler to track and report on plan operations, pension administration software assists governmental organizations in delivering better openness and responsibility to plan participants. However, services are expected to witness the fastest pension administration software market growth, owing to increase in the adoption of digital technologies across various industries and availability of desired information from anywhere at any time are putting data privacy and protection at greater risk. Moreover, pension administration services help organizations in threat detection and risk management.

Region-wise, the pension administration software market share was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to fund management and investment management are increasing in the U.S. for which customers demand a robust pension settlement procedure. Therefore, companies in this region are adopting pension administration software to do the work fast and efficiently. However, Asia-Pacific is expected to witness significant growth in pension administration software market during the forecast period, owing to influencing the use of pension administration software in the banking and financial institution industry for better decisions, better customer experiences, and significant cost savings. Furthermore, as a result of the coronavirus disease (COVID-19) outbreak, financial institutions all over the world are increasingly turning to digital/automation channels to provide pension related services and dealing with pandemic challenges.

Competitive Analysis

Competitive analysis and profiles of the major players in the pension administration software market include Capita plc., Civica, Congruent Solutions, Inc., Equiniti, Levi, Ray & Shoup Inc., PensionSoft Corporation, LLC, Sagitec Solutions, TatvaSoft Software Development Company, WTW, and Zellis. Major players have adopted product launch, partnership, collaborations, and acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the pension administration software industry.

On November 2023, Capita PLC secured a $261.18 million contract spanning 10 years to manage the Civil Service Pension Scheme (CSPS) for the UK Cabinet Office, effective September 2025. The CSPS, among the UK's largest public sector pension schemes, is planned for modernization with advanced system design and digital innovation. Capita intends to incorporate generative artificial intelligence (GenAI) technology to personalize and enhance the pension experience for CSPS members.

On October 2023, Congruent Solutions, the U.S. retirement plan administration software provider, partners with Chennai's Catalincs Partners to drive growth and stakeholder value. Catalincs employs a "Grow First, Pay Later" model, incentivized by hitting revenue and valuation targets. Backed by Sanaka Capital, Congruent offers end-to-end retirement solutions with its CORE suite. The collaboration seeks accelerated growth, leveraging Catalincs' expertise and Congruent's industry leadership.

On October 2022, WTW announced the sale of its Dutch Premium Pension Institution (PPI), LifeSight, to Athora Netherlands pending regulatory approval. The merger with Athora's Zwitserleven PPI is expected to create a $2.65 billion pension vehicle with 126,000 participants. WTW is seeking a new sponsor to accelerate growth, citing challenges in the competitive PPI market. The transaction marks the fourth such deal in two years, signaling insurance firms' dominance in the Dutch PPI market.

On November 2022, Standard Life, a financial services company, part of Phoenix Group, partnered with Equiniti, to carry out administration of both buy-in and buy-out BPA (bulk purchase annuity) policies. This partnership is expected to provide a full administration offer designed to meet the needs of both customers and trustees in this specialist area. Through this partnership, Equiniti will deliver a self-service portal that places customer experience at the center of the proposition.

On December 2023, Zellis, the leading provider of payroll and HR software in the UK and Ireland, has unveiled significant updates through its HCM Cloud 7.0 release, designed to enhance customer operations and colleague experiences. The release encompasses enhancements to National Minimum Wage calculations, the introduction of a developer portal for API guidance, and a real-time connector to SAP SuccessFactors, aimed at streamlining data synchronization.

Top Impacting Factors

Pension Administration Software helps to Reduce Processing Time

The pension administration software helps to reduce process turnaround time by automating pension processes which use to take a long time to do manually. Moreover, posting late fees, creating and delivering letters of default, and calculating penalties and fees are all just a few of the tasks which are done through software management. Also, this pension administration software helps to streamline many elements of day-to-day work, allowing the team to focus their efforts and energy on what is extremely crucial and simply eliminate lower-value, time-consuming duties. However, the major component of administration function is monitoring pension, providing better pension plan to customers. Furthermore, it helps in creating and generating the accounting reports and often invoices and statements for the customers, which is another critical aspect. In addition, it helps to ensure the accuracy of the data and makes it easy to extract the right information in real-time and when required for any reporting period, thus this helps to reduce the processing time. Therefore, this is a major factor to boost the pension administration software market.

Increase in Demand for Pension Administration Solutions

The demand for software solutions to manage pensions is booming. As people get older and economies change, there's a growing need for better pension management. This has created a demand for software that can make managing pensions easier and ensure rules are being followed. For example, in the UK, the number of people receiving the State Pension went up by 140,000 to 12.6 million in August 2023.

Pension systems are getting more complicated, with more ways to invest money and rules that keep changing. So, there's a big demand for software that can handle all these complexities and do tasks automatically. Plus, many organizations are now going digital, which means they're using software to manage pensions more efficiently and save money. In India, they're using new technology to make life easier for pensioners. For instance, the government introduced Face Authentication Technology, making it simple for pensioners to submit documents online from their homes. Furthermore, there's a growing push for transparency and accountability in managing pensions. Everyone involved, from pensioners to regulators, wants real-time updates and insights. This has led to a strong demand for pension administration software market that can provide this kind of information.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the pension administration software market segments, current trends, estimations, and dynamics of the pension administration software market analysis from 2022 to 2032 to identify the prevailing pension administration software market opportunities.

- The pension administration software market forecast research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pension administration software market growth assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the pension administration software market opportunity.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the pension administration software market outlook.

- The report includes the analysis of the regional as well as global pension administration software market trends, key players, market segments, application areas, and retirement administration strategies.

Pension Administration Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13 billion |

| Growth Rate | CAGR of 11.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 330 |

| By Component |

|

| By Deployment Mode |

|

| By Type |

|

| By End User |

|

| By Pension Fund Size |

|

| By Region |

|

| Key Market Players | Civica, Equiniti, WTW, Capita plc., PensionSoft Corporation, LLC, Sagitec Solutions, Congruent Solutions, Inc., Levi, Ray & Shoup Inc., Zellis, TatvaSoft Software Development Company |

Analyst Review

Pension administration software typically includes a range of features and tools to help administrators manage these tasks efficiently and accurately. This may include tools for tracking and managing plan assets and investments, calculating benefits, generating reports and statements for plan participants, and handling plan enrollments and terminations. Moreover, some pension administration software systems may also include features for managing other types of employee benefit plans, such as health insurance, life insurance, and 401(k) plans. The Pension administration software system facilitates the smooth and hassle-free administration of retirement benefits management. All aspects like superannuation, gratuity, accounting and provident funds are easily managed through this pension administration software. In addition, employees get the facility to view PF balance and update PF yearly passbook in this pension management software. The software can also avail handy tools like the pension calculation sheet and gratuity calculation sheet.

Furthermore, market players are adopting partnership strategies for enhancing their services in the market and improving customer satisfaction. For instance, in November 2022, Standard Life, part of Phoenix Group, has partnered with Equiniti, a market leader in defined benefit pension administration and software services in the UK, to carry out administration of both buy-in and buy-out BPA (bulk purchase annuity) policies. This partnership will provide a full administration offer designed to meet the needs of both customers and trustees in this specialist area. Through this partnership, Equiniti will deliver a self-service portal that places customer experience at the heart of the proposition. Moreover, some of the key players profiled in the report include Capita plc., Civica, Congruent Solutions, Inc., Equiniti, Levi, Ray & Shoup Inc., PensionSoft Corporation, LLC, Sagitec Solutions, TatvaSoft Software Development Company, WTW, and Zellis. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The Pension Administration Software Market was valued at $4,529.04 million in 2022 and is estimated to reach $12,994.23 million by 2032, exhibiting a CAGR of 11.4% from 2023 to 2032.

North America is the largest regional market for Pension Administration Software

The report analyzes the profiles of key players operating in the pension administration software market such as Capita plc., Civica, Congruent Solutions, Inc., Equiniti, Levi, Ray & Shoup Inc., PensionSoft Corporation, LLC, Sagitec Solutions, TatvaSoft Software Development Company, WTW, and Zellis. These players have adopted various strategies to increase their market penetration and strengthen their position in the pension administration software industry.

Technological advancements in the field of administration is the leading application of Pension Administration Software Market

Modern customer experience and pension administration software helps to reduce processing time are the upcoming trends of Pension Administration Software Market in the world

Loading Table Of Content...

Loading Research Methodology...