Pension Funds Market Research, 2032

The global pension funds market was valued at $64.1 trillion in 2022, and is projected to reach $109.1 trillion by 2032, growing at a CAGR of 5.5% from 2023 to 2032.

A pension fund, also known as a superannuation fund in some countries, refers to any program, fund, or scheme that provides retirement income. Pension funds are investment schemes that pay for workers' retirements. Funds are paid for by either employees, employers, or both. Corporations and all levels of government provide pensions.

Key Takeaways of Pension Funds Market Report

- On the basis of fund type, the defined benefit pension funds segment dominated the pension funds market size in terms of revenue in 2022.

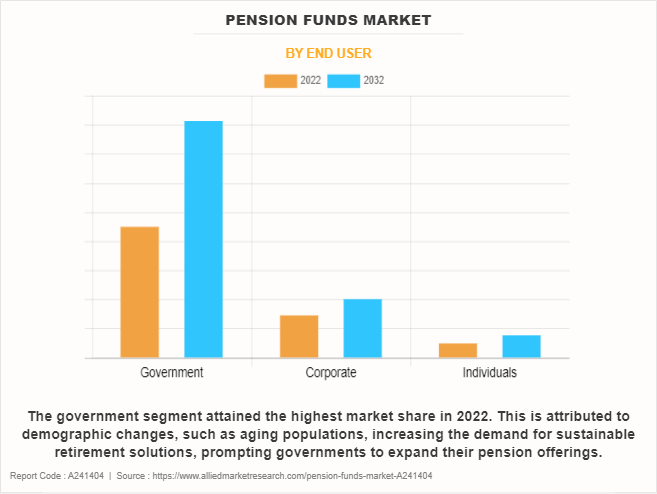

- On the basis of end user, the government segment dominated the pension funds market share in terms of revenue in 2022 and is anticipated to grow at the fastest CAGR during the forecast period.

- Region wise, North America region dominated the pension funds market in terms of revenue in 2022. However, the market in Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

The pension funds market is driven by demographic shifts and regulatory changes. As populations age across the globe, the demand for pension products and services is on the rise, compelling pension funds to adapt their investment strategies to ensure long-term sustainability. Furthermore, evolving regulatory landscapes, aimed at enhancing transparency and accountability within the pension industry, are pushing funds to adopt more sophisticated risk management practices and investment approaches.

However, economic uncertainties and low-interest-rate environments pose challenges for funds seeking to generate sufficient returns to meet their long-term obligations. Moreover, increasing longevity and healthcare costs add pressure on the pension funds market to adequately fund retirement benefits, leading to concerns about the sustainability and adequacy of pension plans.

On the contrary, technological advancements, such as artificial intelligence and data analytics, enable funds to enhance investment decision-making processes, optimize portfolio management, and personalize retirement solutions for their members will provide lucrative growth to the pension funds market opportunity.

Market Dynamics

Tax deduction for contributions

A pension fund is considered a qualified retirement plan by the IRS. To encourage retirement savings, the IRS offers a tax deduction for contributions to a qualified plan. A company can fully deduct its annual contributions from the pension plan from its income taxes. Since it takes quite a bit of money each year to fund a pension plan, the business should receive a sizable tax deduction. This creates a retirement benefit for both the company and its employees while reducing their tax bills, which drives the growth of the pension funds market.

In addition, to ensure that every employee enjoys a good life after retirement, in South Africa, key players launched a unique micro-pension fund product. For instance, in September 2022, Econet Life, an insurance unit of EcoCash Holdings Zimbabwe, launched a unique micro-pension fund product that allows people in the informal sector to save for retirement. The new product, called Dura/Isiphala Pension Fund, was launched in Kariba and is expected to drive the uptake of pensions by workers in the informal sector. With this product, anyone can make monthly contributions to their Dura/Isiphala and when the need arises after a year, two or even 10 years, they will enjoy the benefits of their investment.

Non-transferable pension funds

Pension funds provide social and financial security to people who retire. However, there are still some risk factors involved. These include non-transferable pension funds. Many of the pension fund plans offered by various companies are non-transferable. A pension with a specific company is often less flexible than a 401(k) or other defined contribution plans. For instance, if an employee is changing jobs, the accumulated funds from their previous job may not follow them. There are also certain rules in some companies that define who is eligible for a pension fund. It is based on the number of years that they have worked in the company. Therefore, non-transferable pension funds are limiting the growth of the pension funds industry.

A broader range of investment choices and asset classes

The pension funds industry across the globe has been historically challenged with generating sufficient returns to provide adequate and sustainable retirement incomes for its members. While the rapid rebound of the markets after a sharp correction in 2020 has provided some respite, this alone will not be sufficient to improve the long-term solvency of pension plans. As a result, pension funds are looking at a broader range of investment choices and asset classes (such as private markets) to improve yield and explore opportunities to optimize costs. In addition, there’s increased pressure from participants to adopt responsible investing practices by incorporating ESG principles in their investment decisions. Therefore, the adoption of technological innovation to provide a competitive edge provides mature data management capabilities to improve decision-making and improves operational efficiency will provide major lucrative opportunities for the growth of the pension funds market.

Segment Review

The pension funds market is segmented on the basis of fund type, end user, and region. On the basis of fund type, the market is categorized into defined benefit pension funds, defined contribution pension funds, and others. On the basis of end user, the market is differentiated into government, corporate, and individuals. On the basis of region, it is analyzed across North America (the U.S., and Canada), Europe (the UK, Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (GCC Countries, South Africa, and rest of Middle East and Africa).

By end user, the government segment acquired a major share in 2022 and is anticipated to be the fastest-growing segment during the forecast period. This is attributed to demographic changes, such as aging populations, increase the demand for sustainable retirement solutions, prompting governments to expand their pension offerings. Furthermore, regulatory reforms aimed at strengthening pension systems and enhancing governance further propel market growth by encouraging greater participation and increasing contributions. According to the National Conference on Public Employees Retirement Systems (NCPERS) 2023 Public Retirement Systems Study, public pension funds' average funding ratio increased to 77.8% in 2022, with the majority of pensions' revenue (68%) coming from investment returns.

Region-wise, North America dominated the pension funds market in 2022. This is attributed to the robust economic growth and favorable investment conditions which contribute to the accumulation of pension assets and drive pension funds market growth. Moreover, technological advancements enable pension funds in North America to adopt innovative investment strategies, optimize portfolio management, and enhance operational efficiency, further fueling market expansion. However, Asia-Pacific is considered to be the fastest-growing region during the pension funds market forecast period. This is attributed to the rapid economic development and urbanization across many countries in the region that have led to increased wealth accumulation and a growing middle class, driving demand for retirement savings and investment schemes. Moreover, demographic trends, including aging populations and rising life expectancies, are creating need for pension solutions to ensure long-term financial security for retirees. In India, in February 2024, the Pension Fund Regulatory and Development Authority (PFRDA) notified the National Pension System Trust (Second Amendment) Regulations 2023 and Pension Fund (Amendment) Regulations 2023 with amendments to NPS Trust Regulations. Furthermore, in China, in April 2022, China launched private pension scheme. Employees can contribute up to 12,000 yuan ($1,860) per year to their pension fund under the new scheme, which rolled out with one-year trials in some cities before being implemented nationwide. According to the World Health Organization, in 20 years, 28% of China's population will be more than 60 years old, up from 10% as of April 2022, making it one of the most rapidly-ageing populations in the world.

Competition Analysis

Competitive analysis and profiles of the major players in the pension funds market include BlackRock, Inc., Deutsche Bank AG, Wells Fargo, The Vanguard Group, Inc., Bank of America Corporation, UBS, JPMorgan Chase & Co., FMR LLC, State Street Corporation, and BNP Paribas. These players have adopted various strategies to increase their market penetration and strengthen their position in the pension funds market.

Recent Developments in the Pension Funds Industry

- In February 2024, ICICI Prudential Life Insurance introduced a new pension product called ICICI Pru Gold Pension Savings. To help individuals build a substantial retirement corpus, this tax-efficient product allows customers to make systematic contributions.

- In July 2023, BlackRock formed a partnership with the Rolls-Royce Retirement Savings Trust to support their transition to a new bespoke Target Date Fund (TDF) solution, which delivers retirement benefits to their 34,000 members.

- In September 2022, Econet Life, an insurance unit of EcoCash Holdings Zimbabwe, launched a unique micro-pension fund product that allows people in the informal sector to save for retirement. The new product, called Dura/Isiphala Pension Fund, was launched in Kariba and expected to drive the uptake of pensions by workers in the informal sector.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pension funds market analysis from 2022 to 2032 to identify the prevailing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network on the pension funds market outlook.

- In-depth analysis of the pension funds market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as pension funds market trends, key players, market segments, application areas, and market growth strategies.

Pension Funds Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 109.1 trillion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 265 |

| By Fund Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Deutsche Bank AG, FMR LLC, Bank of America Corporation, UBS, JPMorgan Chase & Co., State Street Corporation, BlackRock, Inc., The Vanguard Group, Inc., BNP Paribas, Wells Fargo |

Analyst Review

The UK and Japan had the largest number of pension funds fall out of the top 300 globally. The UK gilts crisis of September 2022 and the ensuing market instability were significant contributing factors, as is the continuing shift from defined benefit (DB) pensions to smaller defined contribution (DC) plans.

In 2022, sovereign and public sector pension funds accounted for 152 funds in the top 300, representing 70.9% of total assets. Sovereign pension funds accounted for US$ 6.2 trillion in assets, while sovereign wealth funds (SWF) totalled US$ 11.6 trillion. Sovereign wealth funds’ assets grew by 13.9% during 2022, compared to a decrease of 10.6% for the sovereign pension funds in the Thinking Ahead Institute Top 300 study.

Key players in the pension funds market adopt partnership, acquisition, and product launch, as their key development strategies to sustain their growth in the market. For instance, in February 2024, ICICI Prudential Life Insurance introduced a new pension product called ICICI Pru Gold Pension Savings. To help individuals build a substantial retirement corpus, this tax-efficient product allows customers to make systematic contributions. Therefore, such strategies adopted by key players propel the growth of the pension funds market.

The key players in the pension funds market include BlackRock, Inc., Deutsche Bank AG, Wells Fargo, The Vanguard Group, Inc., Bank of America Corporation, UBS, JPMorgan Chase & Co., FMR LLC, State Street Corporation, and BNP Paribas. These players have adopted numerous strategies to increase their marketplace penetration and strengthen their position in the pension funds market.

The size of the global pension funds market was valued at $64,054.20 billion in 2022 and is projected to reach $109,047.68 billion by 2032.

The key players operating in the global pension funds market include BlackRock, Inc., Deutsche Bank AG, Wells Fargo, The Vanguard Group, Inc., Bank of America Corporation, UBS, JPMorgan Chase & Co., FMR LLC, State Street Corporation, and BNP Paribas.

North America is the largest regional market for pension funds.

The pension funds market is segmented into fund type and end user. On the basis of fund type, the market is categorized into defined benefit pension funds, defined contribution pension funds, and others. On the basis of end user, the market is differentiated into government, corporate, and individuals.

Loading Table Of Content...

Loading Research Methodology...