Performance Elastomer Market Size & Insights:

The global performance elastomer market was valued at $15.8 billion in 2021 and is projected to reach $31.6 billion by 2031, growing at a CAGR of 7.2% from 2022 to 2031.

How to Describe Performance Elastomer

Performance elastomers are polymers composed of long chains of atoms, primarily hydrogen, oxygen, and carbon, and consisting of repeating units of a single monomer or numerous monomers. In comparison to other materials, elastomer has increased pressure, poor intermolecular strength, and a low modulus of elasticity. They are potentially the most adaptable material due to their ability to revert to their original shape when the forces producing deformation are eliminated. Engineering materials performance elastomers are remarkably flexible. For example, the manner in which they deform and recover under load differs greatly from that of plastics and metals. They are complicated materials with unique combinations of useful qualities, resilience, and elasticity being the most important. All elastomers can be significantly deformed by compression, torsion, or stretching and then return to their original shape upon removal of the deforming force. The resilience of performance elastomers allows them to swiftly return to their original shape, allowing, for instance, dynamic seals to adapt to alterations in the sealing surface.

Performance elastomer is extensively utilized in the production of vehicle components. The increasing production of cars in both developing and developed countries is recognized as a major contributor to the expansion of the global market for performance elastomers. According to the International Organization of Motor Automobiles, the total number of vehicles produced globally in 2020 was 77.0 million units, and this number increased to 80.0 million units in 2021. Consequently, the increasing number of automobiles on the road is driving the need for performance elastomer, which is expected to raise the market growth during the forecast period.

Rising awareness of the advantages of performance elastomers

There is a rising awareness of the numerous advantages of performance elastomers, including their resistance to aging; their resilience to heat, weathering & ozone, oil & gas, and chemicals; and their durability & flexibility. It is expected that the superior qualities of performance elastomers over ordinary elastomers will increase demand for performance elastomers and drive the market growth rate. In addition, the increasing application in the transportation and automotive industries, the growing demand for performance elastomers with superior and excellent properties, and the rising disposable income and purchasing power of consumers are some of the factors that are expected to drive the growth of the performance elastomer market during the forecast period.

Fluoroelastomers possess high resistance to moisture, heat, and common chemicals which are considered to be beneficial for the industrial performance of these materials. On the other hand, the same qualities render them incapable of biodegradation, which in turn causes harm to the environment. As a result, they are likely to be regarded as a risk to both people and animals, in addition to the environment as a whole. This can restrain the market growth of the performance elastomers market.

Copper metal and hydrogen fluoride are costly components that are required in the production of silicone. Performance elastomers, such as silicone elastomers, are more expensive due to the high energy expenditures connected with their production process, which involves the transformation of sand into high-purity silica and subsequently the polymerization of this silica. Due to variations in raw material, compounding, filing, and processing costs, elastomer prices may also fluctuate substantially. High production costs may function as a hurdle to market expansion

Fluoroelastomer usage and development are anticipated to be driven by application sectors needing materials with exceptional resistance to heat and chemicals during the forecast period. Existing fluoroelastomers with enhanced performance are anticipated to be the field's emerging potential. Numerous businesses have begun to produce fluoroelastomers of pharmaceutical and food-grade quality, which are authorized by their respective governing bodies. In 2019, AGC Chemical obtained Food Contact Notifications from the US FDA (Food and Drug Association) for three of its fluoroelastomer products: AFLAS Series 100S, 100H, and 150P. This factor provides an opportunity for the performance elastomers market.

Rising awareness regarding the use of performance elastomer and tight government rules and regulations related to the use of rubber would enhance the demand for performance elastomer in numerous end-user industries, hence offering enormous opportunities for manufacturers in the performance elastomer market during the forecast period. In addition, the widespread use of elastomers in the automotive industry, as well as ongoing R&D activities and technological advancements in the field of performance elastomers, will provide lucrative growth opportunities for the performance elastomer market.

Performance Elastomer Market Segment Review:

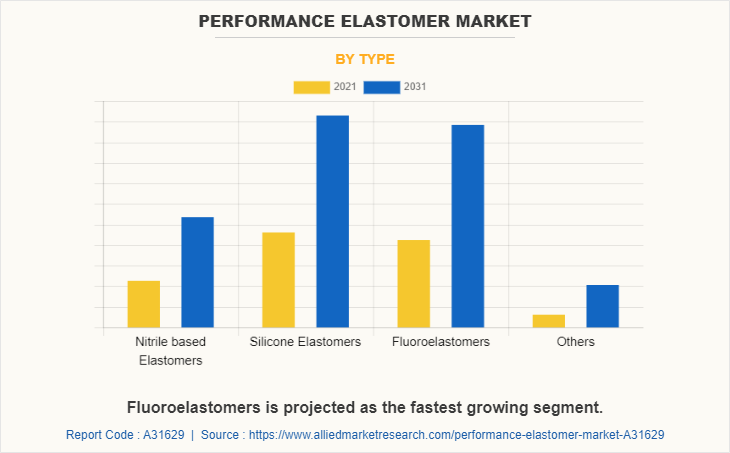

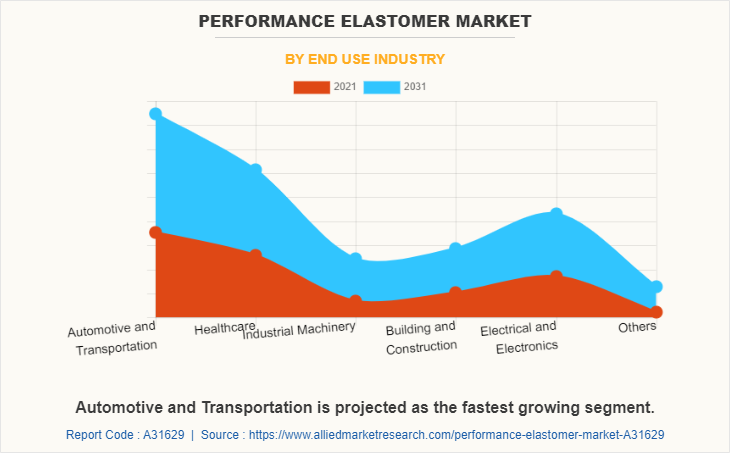

The global performance elastomers market is segmented into type, end-use industry, and region. Depending on the type, the market is divided into nitrile-based elastomers [nitrile butadiene rubber (NBR) and hydrogenated nitrile-based rubber (HNBR)], silicone elastomers (high temperature vulcanized, liquid silicone rubber, and room temperature vulcanized), fluoroelastomers (fluorocarbon elastomers, perfluoroelastomers, and fluorosilicone elastomers), and others. On the basis of end-use industry, it is categorized into automotive & transportation, healthcare, industrial machinery, building & construction, electrical & electronics, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The silicone elastomers segment accounted for the largest share i.e., 35.7%. This is due to increased demand for silicone elastomers from the construction and building industry. Silicon elastomers are utilized to create industrial tubes and pipes, hence, stimulating market demand. In addition, these elastomers are utilized by manufacturers in the production of industrial seals with a high load capacity. The Fluoroelastomers segment is the fastest-growing segment, growing around 7.5% CAGR during the forecast period. This is due to increased demand for fluoroelastomers from the automotive industry as automotive sectors are exerting significant effort to produce fuel-efficient automobiles. In the automotive industry, elastomers are replaced with fluoroelastomers due to their low resistance. The automotive sectors are exerting significant effort to produce fuel-efficient automobiles. The car makers are reducing the size of the power train, engines, and other components that place stress on the elastomers used in the vehicles, hence shortening the lifespan of these elastomers. These factors are driving the automobile industry's market demand for fluoroelastomer.

The automotive and transportation segment accounted for the largest share i.e., 28.7% This is due to increased demand for components, such as tire covers, door liners, safety belt components, instrument panels, pillar trims, and seatbacks from the automotive and transportation industry. There is an increasing demand for performance elastomers for the production of automotive interior components, such as airbags, as a result of recent constraints imposed on automotive manufacturers that made airbags necessary for all cars globally. Consequently, this aspect is the primary force propelling the market for performance elastomers in the automotive and transportation industries.

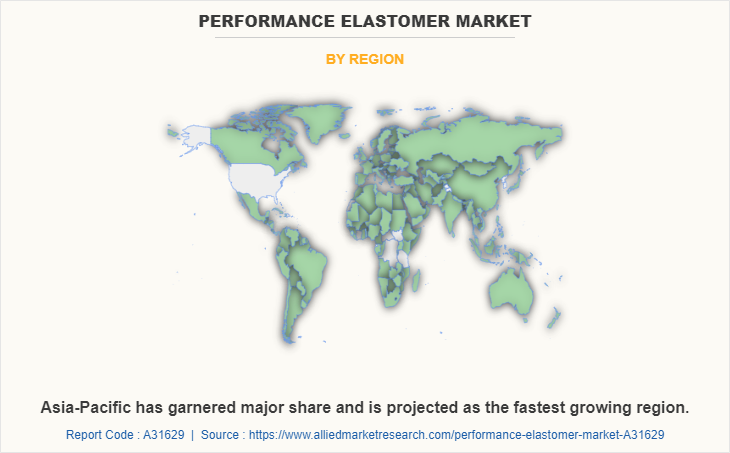

Asia-Pacific contributed 46.4% market share in 2021 and is projected to grow at a CAGR of 7.6% during the forecast period, owing to the increased demand from the building & construction, and automotive industries. Consistent GDP growth, income growth, and government support contribute to the expansion of the automotive industry in these economies. Increased urbanization and rapid industrialization in these countries to support their expanding populations are influencing the building and manufacturing industries. This contributes to the development of the global performance elastomers market.

Which are the Leading Companies in Performance Elastomer

The major players operating in the global performance elastomers market are 3M Company, BASF SE, Daikin Industries Ltd., Dow, DuPont de Nemours, Inc., Exxon Mobil Corporation, Mitsui Chemicals Inc., Solvay S.A., Wacker Chemie AG, and Zeon Chemicals L.P. Other players operating in the market are Arlanxeo, Momentive, Tosoh Corporation, Avient Corporation, and Denka Performance Elastomer.

Latest development strategies undertaken by key players:

- On Apr 27, 2021, Azelis Americas CASE, LLC exclusively distributed BASF’s polyurethane catalyst portfolio, which is marketed under the Lupragen brand in North America. The two companies concluded a contractual agreement that goes into immediate effect.

- On Sep 16, 2020, BASF expanded the application range of its simulation tool Ultrasim: as of now, the computer-aided engineering (CAE) tool also calculates component concepts based on elastomers, especially Elastollan, BASF’s thermoplastic polyurethane (TPU). The simulation covers the entire process chain from initial processing to the mechanical properties of the final product.

- On Aug 10, 2019, Dow enabled greater design freedom and process efficiency with its latest introduction to the North American elastomer market. As part of the full portfolio of high-performance SILASTIC silicone elastomers on display at the 2019 International Elastomer Conference in Cleveland, Ohio, Dow announced the launch of the SILASTIC LTC 9400 Series Liquid Silicone Rubbers. These improved low-temperature cure Liquid Silicone Rubber (LSR) open the material to new applications across a wide range of industries, including automotive, electronics, and consumer. This product launch improves Dow's product portfolio.

- On May 13, 2019, ExxonMobil has completed an expansion of its specialty elastomers manufacturing plant in Newport, Wales, which doubles the plant’s manufacturing capacity and increases the global manufacturing capacity of Santoprene thermoplastic elastomers by 25%. This expansion led to the growth in revenue of the elastomer market.

What are the Key Benefits For Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the performance elastomer market analysis from 2021 to 2031 to identify the prevailing performance elastomer market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the performance elastomer market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global performance elastomer market trends, key players, market segments, application areas, and market growth strategies.

Performance Elastomer Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 31.6 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 545 |

| By Type |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | 3M Company, Dow, DuPont de Nemours, Inc., BASF SE, Wacker Chemie AG, Zeon Chemicals L.P., Exxon Mobil Corporation, Solvay S.A., Daikin Industries Ltd., Mitsui Chemical Inc |

Analyst Review

According to the insights of the CXOs of leading companies, increasing demand for performance elastomers, such as silicone elastomers, nitrile-based elastomers, fluoroelastomers, and others, is conducive to the creation of lightweight products, curved materials, soft actuating materials, and mechanical coupling products. As a result, the market for performance elastomers is expanding. The application of performance elastomers in goods such as video surveillance, action cameras, and drones increase the stability of their high load-bearing and high resilience features. The automotive and transportation industry's demand for performance elastomers to manufacture chassis, drive belts, airbags, fuel cell gaskets, fuel seals, and tires is on the rise. Consequently, the growing demand for performance elastomers from a variety of end-use sectors will drive the performance elastomers market during the forecast period.

The global performance elastomer market was valued at $15.8 billion in 2021, and is projected to reach $31.6 billion by 2031, growing at a CAGR of 7.2% from 2022 to 2031.

The increasing demand from the automotive industry is the upcoming trend of the Performance Elastomer Market in the world.

The COVID-19 outbreak has severely affected several industries such as automobile and building and construction manufacturing activities causing a temporary shutdown of manufacturing plants, leading to a drop in sales and disturbance in the supply-demand chain. This disruption in sales has affected the demand and consumption of products, leading to a substantial decline in market growth.

3M Company, BASF SE, Daikin Industries Ltd., Dow, DuPont de Nemours, Inc., Exxon Mobil Corporation

The automotive industry is the leading end-use industry of the Performance Elastomer Market.

Increasing demand from various end-use industries and rising awareness of the advantages of performance elastomers are the Main drivers of the Performance Elastomer Market.

Asia-Pacific is the largest regional market for Performance Elastomers.

Loading Table Of Content...