Period Care Market Summary, 2035

The global period care market was valued at $37.1 billion in 2024, and is projected to reach $69.1 billion by 2035, growing at a CAGR of 6.1% from 2025 to 2035.Period care products are used to maintain personal hygiene during menstruation, clean vaginal discharge, and keep internal body parts clean. Sanitary pads, tampons, internal cleaners & sprays, panty liners & shields, and period underwear are collectively termed as period care products. Moreover, these products are made easily available in the market through various distribution channels including online stores, supermarket/hypermarket, and specialty stores. Furthermore, rise in proliferation of online stores is expected to drive the growth of the period care products, in terms of value sales, during the forecast period.

Market Dynamics

Period care products are gaining traction globally due to rising awareness of menstrual hygiene, increasing female workforce participation, and the growing demand for sustainable and organic products. Innovations such as biodegradable pads, reusable menstrual cups, and period underwear are driving market expansion, particularly in developed regions like North America and Europe, where eco-conscious consumers prefer sustainable options.

In emerging economies, government initiatives, NGO programs, and increasing accessibility through e-commerce are enhancing adoption rates. The premiumization of products, celebrity endorsements, and brand campaigns promoting menstrual health awareness are further fueling market growth.

Additionally, the rise of gender-inclusive branding and subscription-based models is attracting a broader consumer base. Companies are investing in research and development to improve comfort, absorbency, and affordability, while regulatory support for safer ingredients and better product transparency is reinforcing consumer trust. The period care market is expected to grow steadily, driven by evolving consumer preferences and technological advancements.

Increase in awareness of menstrual health fosters a broader understanding of the importance of menstrual hygiene, leading to higher demand for diverse and specialized products. As education about menstruation improves, more consumers are becoming aware of the health risks associated with poor menstrual hygiene, such as infections or discomfort, prompting them to seek safer, high-quality products. Furthermore, awareness campaigns and social media advocacy reduce stigma, encouraging more open conversations about menstruation. This shift has led to increased demand for a variety of products, from organic and hypoallergenic options to eco-friendly and reusable alternatives. As consumers prioritize health-conscious choices, they are more willing to invest in products that cater to both their well-being and the environment, thus fueling the growth of the period care market, thus increasing the Period Care Market Size.

However, cultural taboos surrounding menstruation remain a significant restraint to the growth of the period care market, especially in regions where menstruation is viewed as a private or shameful topic. In many cultures, menstruation is considered a taboo subject, leading to reluctance in discussing menstrual health openly, which limits consumer awareness and education about period care products. This lack of awareness often results in poor menstrual hygiene practices and a preference for low-quality or inadequate products.

In addition, social stigma affects the adoption of more innovative or sustainable menstrual care solutions, as women in some cultures are hesitant to use products such as menstrual cups or tampons due to misconceptions or embarrassment. These cultural barriers slow market expansion, especially in rural or conservative areas where traditional practices prevail.It has also affected the Period Care Market Share.

Moreover, increased government initiatives create significant opportunities for the period care market by addressing menstrual health challenges and promoting better hygiene practices. Governments in many countries are implementing policies to reduce period poverty, offering subsidized or free menstrual products in schools, public institutions, and for low-income individuals. These initiatives help to improve access to period care products, especially in underserved communities, driving market growth.

In addition, governments are investing in awareness campaigns to educate the public about menstrual health, promoting the use of safe and hygienic products. This has led to a shift in societal attitudes, breaking down taboos and encouraging the adoption of modern menstrual solutions. Governments are facilitating the introduction of affordable and eco-friendly products by partnering with manufacturers and retailers, creating a more inclusive and sustainable period care market, increasing the Period Care Market Growth.

The biggest opportunity in the period care market is the growing demand for sustainable and reusable menstrual products as consumers shift toward eco-friendly options like biodegradable pads, reusable menstrual cups, and period underwear. Increasing awareness of plastic waste and its environmental impact is driving this trend, supported by government initiatives and NGO campaigns promoting sustainable menstruation.

Additionally, the expansion of e-commerce and digital platforms offers brands a wider reach, enabling direct-to-consumer sales, subscription-based models, and educational content on menstrual hygiene. Innovative product development, such as organic cotton tampons, smart period-tracking wearables, and improved absorbent materials, is further fueling market growth. Gender-inclusive branding and personalized solutions, including products tailored to different absorbency needs, are attracting diverse consumer segments.

Moreover, companies focusing on affordable, high-quality period care solutions for lower-income groups, particularly in developing nations, have significant growth potential. These trends, combined with increasing regulatory support for safer, more transparent products, are reshaping the global period care market.

Segmental Overview

The period care market is segmented into nature, type, age group, distribution channel, and region. By nature, it is bifurcated into disposable and reusable. By type, it is divided into sanitary pads, tampons & menstrual cup, panty liners & shields, and period underwear. By age group, it is classified into upto 18 years, 19-30 years, 31-40 years, 40 years and above. By distribution channel, it is segregated into department store, grocery store, convenience store, dollar store, retail pharmacy, supermarket, online, and others.

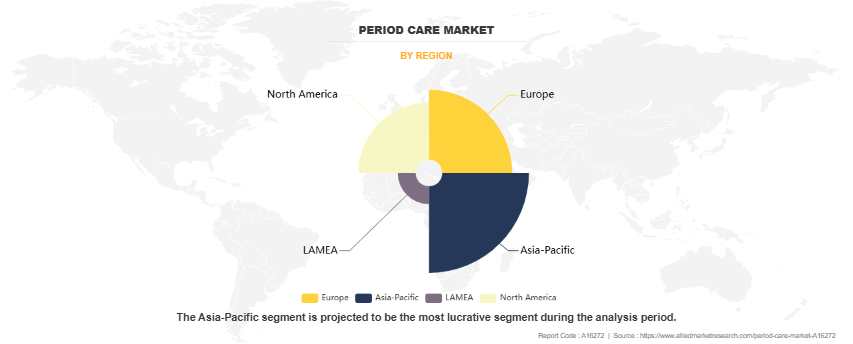

By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, India, Australia & New Zealand, Japan, South Korea, ASEAN, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, Argentina, and Rest of LAMEA).

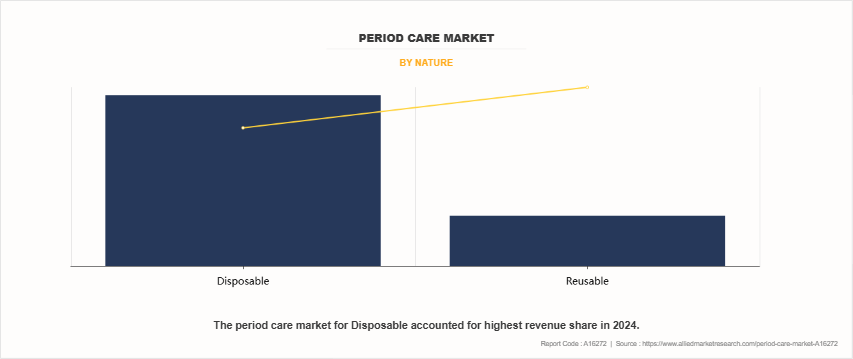

By Nature

By nature, the disposable segment dominated the period care market in 2024 and is anticipated to maintain its dominance during the forecast period. Disposable products such as pads and tampons are easy to use, hygienic, and require minimal effort for disposal, making them popular among consumers with busy lifestyles. According to Period Care Market Forecast, the increasing availability of varied absorbency levels and product innovations such as odor control and leak-proof designs further fuel the segment’s growth. In addition, affordability and the widespread distribution of disposable products in supermarkets, pharmacies, and online platforms make them the preferred choice, especially in regions with less access to reusable alternatives.

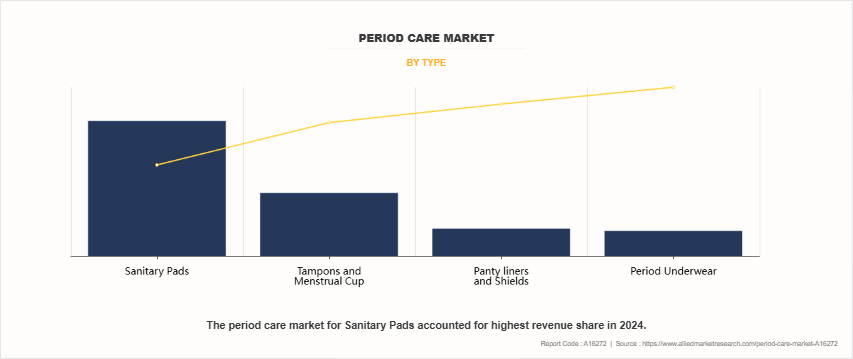

By Type

By type, the sanitary pads segment dominated the period care market in 2024 and is anticipated to maintain its dominance during the forecast period owing to its ease of use, accessibility, and widespread consumer preference. Sanitary pads are the most common menstrual product, offering comfort, convenience, and a variety of options for different flow types and personal preferences. The segment benefits from innovations in absorbency, odor control, and skin-friendly materials, improving user experience. In addition, strong distribution networks through supermarkets, pharmacies, and online platforms make sanitary pads highly accessible and affordable, particularly in regions where other products such as tampons or menstrual cups are less widely used.

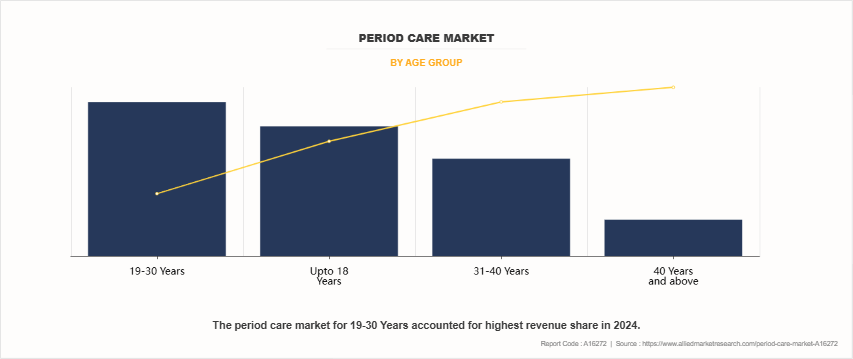

By Age Group

By age group, the 19-30 years segment dominated the period care market in 2024 and is anticipated to maintain its dominance during the forecast period owing to its higher disposable income, health consciousness, and greater willingness to invest in premium menstrual care products. This demographic is increasingly seeking innovative, ecofriendly, and sustainable options, such as organic cotton pads, menstrual cups, and period underwear. in addition, the influence of social media, wellness trends, and online platforms drives awareness and product engagement. The shift toward personalized and convenient products (such as subscription services) and the rise of digital health platforms further contribute to their dominance in the period care market.

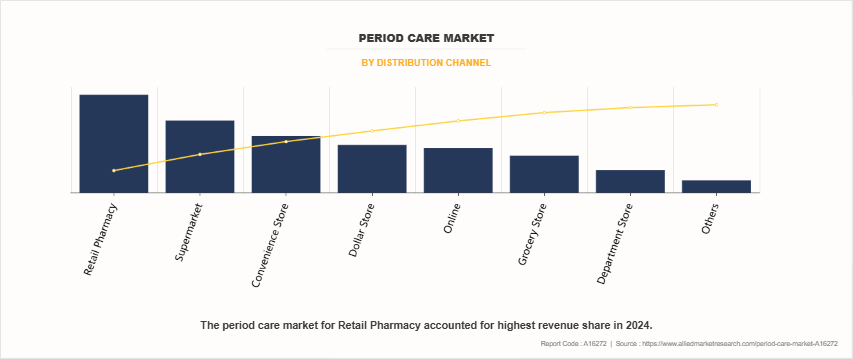

By distribution channel

By distribution channel, the retail pharmacy segment dominated the period care market in 2024 and is anticipated to maintain its dominance during the forecast period owing to its convenience, accessibility, and trust among consumers. Pharmacies offer a wide range of period care products, including pads, tampons, menstrual cups, and pain relief medications, providing one-stop shopping for menstrual health needs. In addition, pharmacies are easily accessible, often located in high-traffic areas and open for extended hours, allowing consumers to purchase products quickly and discreetly. Surge in focus on health and wellness, along with personalized advice from pharmacists, enhances the segment's appeal, further boosting its growth during the forecast period.

By Region

Region-wise, Asia-Pacific dominated the period care market in 2024 and is anticipated to maintain its dominance during the forecast period owing to its large population, rise in middle-class income, and increase in awareness of menstrual hygiene. As more women in developing countries gain access to quality period care products, the demand for sanitary pads, tampons, and other menstrual products is rising rapidly.

In addition, government initiatives aimed at improving menstrual health and reducing period poverty, along with the surge in acceptance of eco-friendly and innovative products, further fuel market growth. According to Period Care Market Report, the region’s expanding retail networks, including online platforms, make period care products more accessible, driving continued market expansion.

Competition Analysis

Some of the Period Care Market Players operating in the global period care industry analyzed in this report include Edgewell Personal Care Company, Essity Aktiebolag, First Quality Enterprises, Incorporation, Hengan International Group Co. Limited, Kenvue, Kao Corporation, Kimberly-Clark Corporation, Ontex BV, Procter & Gamble Company, and Unicharm Corporation.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the period care market analysis from 2024 to 2035 to identify the prevailing period care market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the period care market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global period care market trends, key players, market segments, application areas, and market growth strategies.

Period Care Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 69.1 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2024 - 2035 |

| Report Pages | 430 |

| By Age Group |

|

| By Nature |

|

| By Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Unicharm Corp., Kenvue, First Quality Enterprises,Inc, Hengan International Group Company Ltd.,, Proctor & Gamble Co., Kimberly-Clark Corp., Kao Corp., Essity Aktiebolag, Edgewell Personal Care, Ontex BV |

Analyst Review

According to CXOs, the period care market is undergoing a transformative shift, driven by changing consumer preferences, sustainability trends, and technological advancements. The rise of organic, biodegradable, and reusable products is reshaping industry dynamics, emphasizing the importance of sustainability.Expanding into emerging markets presents a significant opportunity, with governments and NGOs working to improve menstrual hygiene awareness and accessibility. In addition, they have also focused on continuous innovations in their products to maintain a strong foothold in the market and to boost period care products demand globally. In addition, to cater to the rise in needs from the female consumers, manufacturers are continuously developing innovative period care products in the market.

CXOs further added that rise in consciousness regarding maintaining personal hygiene among female consumers as well as working women population propels the growth of the period care market. The global period care market has witnessed a significant growth in the past few years. Asia-Pacific emerged as the largest market owing to higher penetration of sanitary pads in this region. Though discussing about menstrual hygiene is still a social taboo in Asia, personal hygiene awareness campaigns taken up by government agencies have contributed to increase in demand for sanitary products in this region.

Moreover, personal care products including period care products have witnessed prominent adoption in developing countries such as India, owing to rise in consumer awareness, increase in disposable income, and surge in need for period care products. Furthermore, increase in penetration of various online portals globally and rise in number of offers or discounts attract large consumer base to purchase period care products through online channels. In addition, online sales channels have increased consumer reach, making it the key source of revenue for many companies.

The period care market is expected to grow steadily, driven by evolving consumer preferences and technological advancements.

The period care market to exhibit a CAGR of 6.1% from 2025 to 2035.

Some of the major players operating in the global period care products industry are Edgewell Personal Care Company, Essity Aktiebolag, First Quality Enterprises, Incorporation, Hengan International Group Co. Limited, Kenvue, Kao Corporation, Kimberly-Clark Corporation, Ontex BV, Procter & Gamble Company, and Unicharm Corporation.

The period care market was valued at $37,082.1 million in 2024 and is estimated to reach $69,139.9 million by 2035, exhibiting a CAGR of 6.1% from 2025 to 2035.

Asia-Pacific is the largest regional market for Period Care.

Loading Table Of Content...

Loading Research Methodology...