Personalized Medicine Market Research, 2031

The global personalized medicine market size was valued at $300 billion in 2021 and is projected to reach $869.5 billion by 2031, growing at a CAGR of 11.2% from 2022 to 2031. Personalized medicine, also known as precision medicine, is an approach to healthcare that involves tailoring medical treatment to the individual characteristics of each patient. This approach recognizes that every patient is unique and that treatments that work for one patient may not work for another.

Personalized medicine aims to use an individual's specific genetic makeup, lifestyle, and medical history to develop more effective and targeted treatments. In personalized medicine, healthcare providers use advanced diagnostic tests and tools to identify genetic variations or other biomarkers associated with specific diseases. By analyzing this information, the healthcare provider can develop personalized treatment plans that are tailored to the specific needs of each patient. In addition, personalized medicine is a rapidly evolving field that has the potential to transform healthcare by improving the accuracy and effectiveness of medical treatments, reducing healthcare costs, and improving patient outcomes.

Market Dynamics

Growth of the personalized medicine market size is mainly attributed to the rise in prevalence of chronic conditions such as cancer, diabetes, and others. Increase in prevalence of these conditions increases the demand for personalized diagnostic and personalized therapeutics solutions. In addition, presence of large number of key players in the market is further expanding the market growth. Aadi Bioscience, Inc., Abott, ARIEL Precision Medicine, Inc., Atlas Biomed Group Limited, BASF SE and others are few of the key players offering personalized medicine solutions. These key players are adopting various growth strategies to expand its business and remain in competition with other key players. For instance, in January 2021, Roche announced the CE-IVD launch of its automated digital pathology algorithms, uPath HER2 (4B5) image analysis and uPath HER2 Dual ISH image analysis for breast cancer for precision patient diagnosis in breast cancer. More such product offering, and strategies adopted by the key players is boosting the market growth.

In addition, companion diagnostics, an important component of personalized medicine, allows for the identification of patients who are likely to benefit from a particular treatment, and also help to monitor the patient's response to that treatment over time. By using companion diagnostics, physicians can make more informed decisions about which treatments are most appropriate for the patients, and adjust those treatments as necessary based on the patient's individual response. Thereby driving the personalized medicine market growth. Although various factors are driving the growth of the market, factor such as lack of awareness about personalized medicine among the population in underdeveloped countries is causing hindrance to the market growth. In addition, high cost of the therapies makes it inaccessible for the people in poor countries, which further acts as a restraint to the personalized medicine market growth.

The global market for personalized medicine expanded as a result of the COVID-19 outbreak. Although the COVID-19 pandemic had a significant impact on healthcare systems around the world, personalized medicine's incorporation into clinical care had a huge potential to enhance disease identification and management. The COVID-19 infection had a wide range of symptoms, from mild infections to serious potentially fatal symptoms.

Moreover, due to individual susceptibility to infection as well as inter-individual variability in course of illness, prognosis, and treatment response, personalized medicine gained a significant attention during the pandemic. Although the pandemic had a favorable effect on the market for personalized medicine during that period, there was a decline in the number of people visiting hospitals for conditions other than COVID-19, which had a slight negative effect on the market. However, as targeted medicines and vaccinations are now being developed for the prevention of such outbreaks, it is anticipated that the personalized medicine industry would expand after the pandemic. This will boost market expansion in the near future.

Personalized Medicine Market Segmental Overview

The personalized medicine industry is segmented on the basis of product, application, and region. By product, the market is categorized into personalized medicine diagnostics, and personalized medicine therapeutics. On the basis of application, the market is segregated into oncology, infectious disease, neurology or psychiatry, cardiovascular and others. On the basis of end user, the market is segmented into hospitals & clinics, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America is further analyzed across U.S., Canada and Mexico, Europe is analyzed across UK, Germany, France, Italy, Spain and Rest of Europe. Asia-Pacific is studied across Japan, China, Australia, and Rest of Asia-Pacific and LAMEA is studied in Latin America and Middle East & Africa.

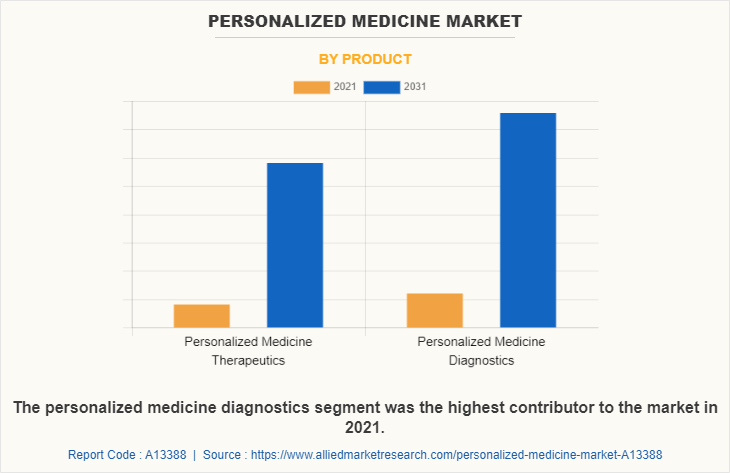

By Product

The personalized medicine diagnostics segment dominated the global personalized medicine market share in 2021, and is anticipated to drive the market during the forecast period, owing to the growing burden of chronic diseases such as cancer, diabetes, and cardiovascular disease, and subsequent rise in demand for personalized medicine diagnostics for its detection. Also, rising awareness among the people and healthcare providers about advanced personalized medicine solutions is boosting the segment growth.

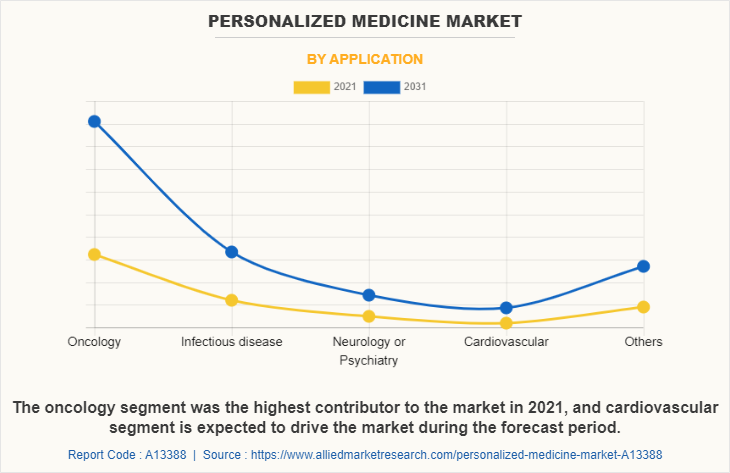

By Application

The oncology segment dominated the global market in 2021, and is anticipated to continue this trend during the forecast period, which is attributed the increasing demand for personalized medicines in cancer treatment. In addition, personalized medicine allows for precise diagnosis of cancer at the molecular level, which helps healthcare providers to identify the specific genetic mutations or other biomarkers driving the cancer. This boosts the personalized medicine market growth. On the other hand, cardiovascular segment is anticipated to grow at a fastest rate during the forecast period, owing to the increase in prevalence of CVS disorders and rise in adoption of personalized medicines in its treatment.

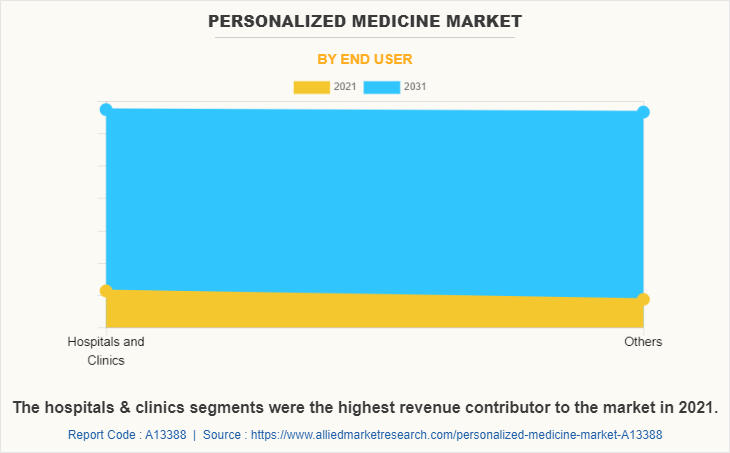

By End User

On the basis of end user, hospitals & clinic segment dominated the market in terms of revenue in 2021, owing to the specialized facilities offered by hospitals for personalized treatments and solutions for various diseases. On the other hand, others segment is anticipated to grow a fastest rate during the personalized medicine market forecast, owing to rise in investment by the pharma and biotech companies in personalized medicines fields and wide product offering by the diagnostic tool companies in personalized medicines.

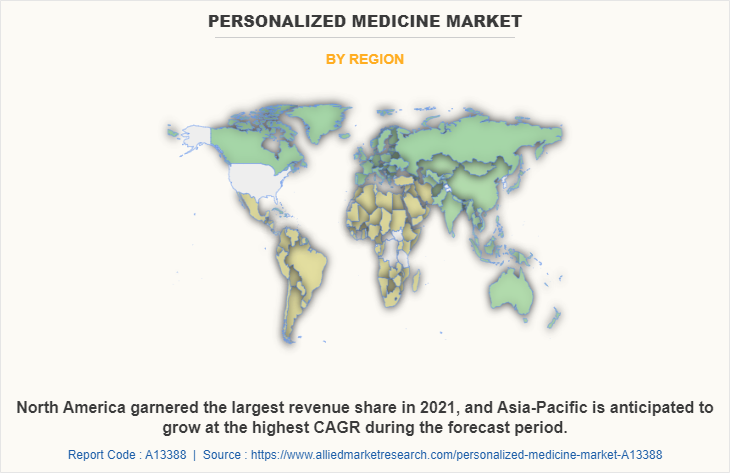

By Region

The personalized medicine market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major personalized medicine market share in 2021, and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Abbott, Qiagen, GE Healthcare and BASF SE is the prime factor boosting the growth of personalized medicine market in this region. In addition, the high prevalence of chronic diseases such as cancer, cardiovascular disease, and diabetes in North America, is increasing the demand for personalized medicines solutions that can provide more targeted and effective treatments.

Furthermore, North America has a highly advanced healthcare infrastructure, with a strong emphasis on innovation and the adoption of new technologies. This has enabled the development and widespread adoption of personalized medicine technologies in the region.

Asia-Pacific expected to grow at the highest rate during the personalized medicine market forecast. The market growth in this region is attributable to presence of pharmaceutical companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, rise in personalized medicine expenditure and adoption of high-tech processing to improve the production of personalized solutions, is anticipated to drive the growth of the market. Furthermore, Asia-Pacific region has a large and growing population, which is driving demand for more personalized healthcare solutions, including personalized medicines. Also, the prevalence of chronic diseases such as cancer, cardiovascular disease, and diabetes is increasing in the Asia-Pacific region, which is driving demand for more effective and targeted treatments.

Competition Analysis

Competitive analysis and profiles of the major players in the personalized medicine market, such as Aadi Bioscience, Inc., Abbott Laboratories, ARIEL Precision Medicine, Inc., Hoffmann-La Roche Ltd, GE Healthcare, Illumina, Inc., Takeda Pharmaceutical Company Ltd, Eli Lilly and Company, Abbvie Inc. and Qiagen are provided in this report. Major players have adopted product launch, product approval, partnership, acquisition, collaboration, branding, expansion and others as key developmental strategies to improve the product portfolio of personalized medicines.

Product Approvals in the Personalized Medicine Market

In January 2020, Abbott received approval from the U.S. Food and Drug Administration (FDA) for Infinity Deep Brain Stimulation (DBS) system to target an area of the brain called the internal globus pallidus. With this approval, Abbott continues to advance its Infinity DBS system to provide personalized and patient-centric innovations for people with movement disorders.

Recent Product Launches in the Personalized Medicine Market

In December 2021, Roche announced the launch of the AVENIO Edge System to advance sequencing technologies, built with best-in-class foundational capabilities to deliver a fully-automated, integrated sequencing solution and thus advance its precision medicine solutions.

Acquisitions in the Personalized Medicine Market

In January 2019, Qiagen announced the acquisition of N-of-One, a leader in identifying patient-specific therapeutic options for precision medicine in oncology, thereby expanding its clinical bioinformatics capabilities in molecular oncology decision support.

Strategic Alliance in the Personalized Medicine Market

In June 2020, Ariel Precision Medicine, Inc. announced an alliance with Mission Cure Holdings, LLC, and Path BioAnalytics, Inc. to develop innovative treatments for patients with pancreatitis and other rare diseases which there is currently no treatment.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the personalized medicine market analysis from 2021 to 2031 to identify the prevailing personalized medicine market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the personalized medicine market segmentation assists to determine the prevailing market personalized medicine market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global personalized medicine market trends, key players, market segments, application areas, and market growth strategies.

Personalized Medicine Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 869.5 billion |

| Growth Rate | CAGR of 11.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 286 |

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Illumina, Inc., Abbvie Inc, F. Hoffmann-La Roche Ltd., GE Healthcare,Inc, Eli Lilly and Company, Abbott Laboratories, Aadi Bioscience, Inc., ARIEL Precision Medicine, Inc., QIAGEN, Takeda Pharmaceutical Company Ltd |

Analyst Review

The global personalized medicine market is expected to exhibit high growth potential attributable to factors such as rise in in R&D activities in pharmaceutical industry for manufacturing of the precision medicines; increase in prevalence of cancer along with increase in incidences of various chronic disorders such as diabetes, respiratory disorders, cardiovascular disorders, and others.

Furthermore, the personalized medicine market has gained interest of many pharmaceutical companies, owing to surge in demand for the advanced treatment procedures, due to rise in the patient pool in the regions such as North America, and

Asia-Pacific. Moreover, rise in demand for customized medicine usage in neurology, pulmonary, antiviral, and psychiatry, is offering new potential for the personalized medicine market. Moreover, there is a rise in research and development activities in the field of personalized medicine which leads to its huge adoption in the diagnosis and treatment of various diseases. Also, technological advancements in personalized medicine are anticipated to boost the market growth during the forecast period.

North America was the largest contributor to the market in terms of revenue in 2021, and Asia-Pacific is expected to witness the highest growth during the forecast period, owing to the presence of key players, rising government initiatives, developing healthcare infrastructure, and rising prevalence of chronic health issues.

Top companies such as Aadi Bioscience, Inc., Abbott Laboratories, ARIEL Precision Medicine, Inc., Hoffmann-La Roche Ltd, GE Healthcare, Illumina, Inc., Takeda Pharmaceutical Company Ltd, Eli Lilly and Company, Abbvie Inc. and Qiagen.

Personalized medicines are the advanced diagnostic and treatment approach which is an exception for the term ‘one-size-fits-all'.

Rise in prevalence of chronic diseases, rise in awareness about precision medicines among people, and increase in R&D activities to develop new personalized medicines, are the major factors contributing to the growth of personalized medicine market.

personalized medicine diagnostics segment is the most influencing segment in personalized medicines market which is attributed to the surge in demand for personalized diagnostic services.

The base year is 2021 in personalized medicines market.

The total market value of personalized medicines market is $300.00 billion in 2021.

The market value of personalized medicines market in 2031 is $869.48 billion

The forecast period for personalized medicines market is 2022 to 2031

Loading Table Of Content...