Pet DNA Testing Market Research, 2034

The global pet DNA testing market size was valued at $394.1 million in 2024, and is projected to reach $960.7 million by 2034, growing at a CAGR of 9.3% from 2025 to 2034. The growth of the pet DNA testing market is driven by rising pet ownership and a growing emphasis on personalized pet care. According to the American Pet Products Association (APPA), nearly 70% of U.S. households owned a pet in 2023, a trend echoed globally, with increasing pet adoption rates in Asia-Pacific, Europe, and Latin America. In parallel, the humanization of pets has led to heightened demand for advanced veterinary diagnostics and genetic insights to inform proactive care. Pet owners are increasingly investing in DNA testing to uncover breed composition, screen for hereditary diseases, and optimize nutrition and training strategies tailored to their pets’ genetic profiles. This growing awareness of genomic health in companion animals continues to propel the demand for pet DNA testing services worldwide.

Pet DNA testing involves the use of genetic analysis tools typically through cheek swab kits or blood samples to provide detailed insights into a pet’s breed ancestry, health risks, carrier status for genetic conditions, and unique traits. These tests empower pet owners, veterinarians, and breeders with actionable information to guide healthcare decisions, breeding programs, and wellness plans. Leading companies offer both direct-to-consumer testing kits and veterinary-focused genomic services, fostering a dual-channel market structure. Widely applied in dogs and cats, and expanding to include horses and exotic species, pet DNA testing supports early disease detection, personalized treatment, and responsible breeding. As consumer demand for precision pet care grows and genomic technologies become more accessible, pet DNA testing is emerging as a transformative tool in modern animal health and wellness systems.

Key Takeaways

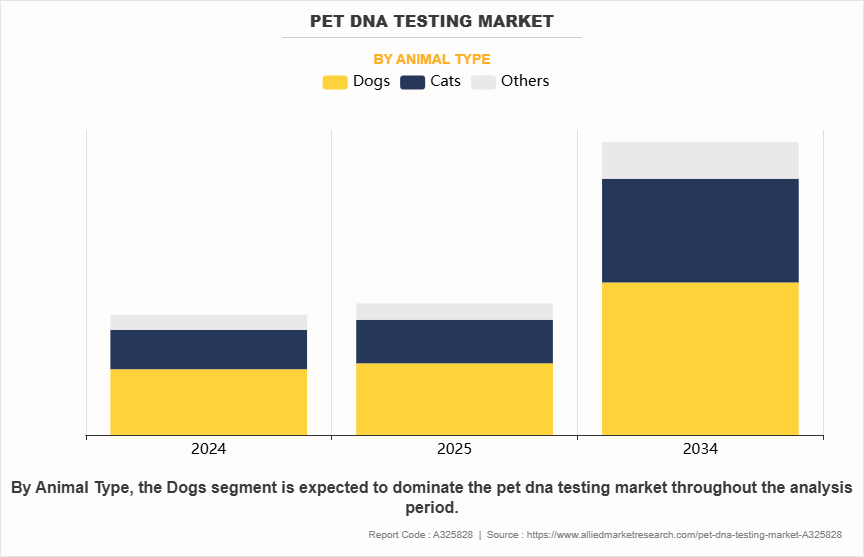

- On the basis of animal type, the dogs segment dominated the pet DNA testing market in terms of revenue in 2024. However, the cats segment is anticipated to grow at the fastest CAGR during the forecast period.

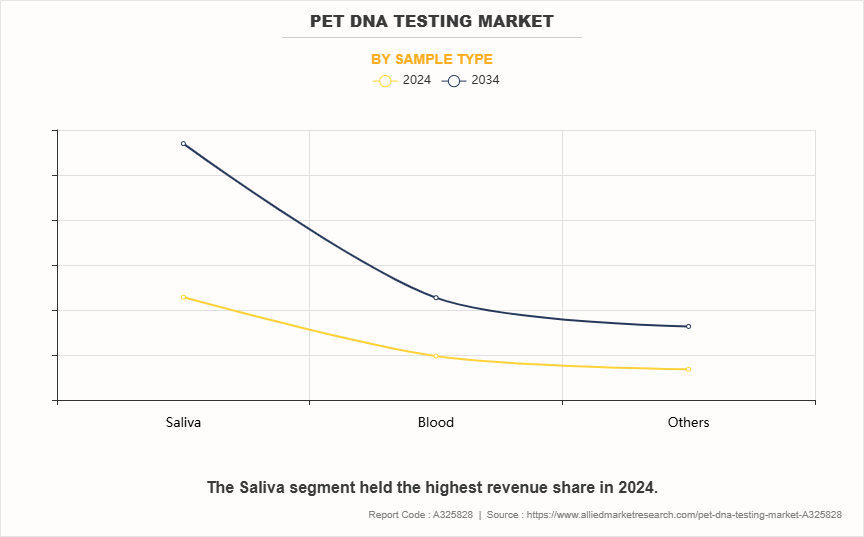

- On the basis of sample type, the saliva segment dominated the pet DNA testing market in terms of revenue in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

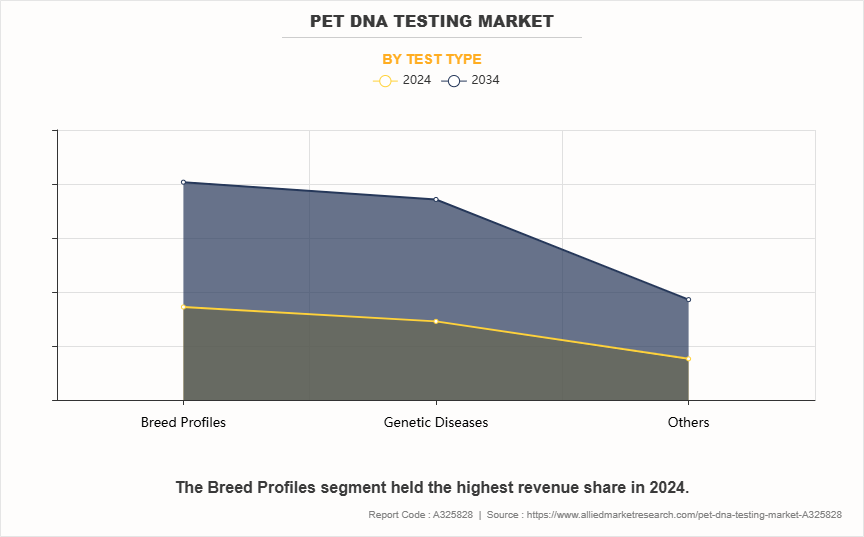

- On the basis of test type, the breed profile segment dominated the market in terms of revenue in 2024. However, the genetic disease segment is anticipated to grow at the fastest CAGR during the forecast period.

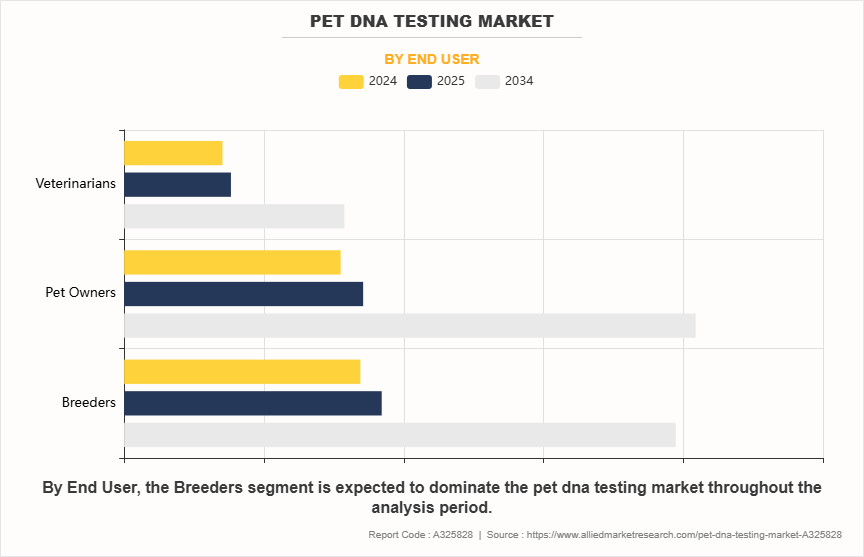

- On the basis of end user, the breeders segment dominated the pet DNA testing market in terms of revenue in 2024. However, the pet owners segment is anticipated to grow at the fastest CAGR during the forecast period.

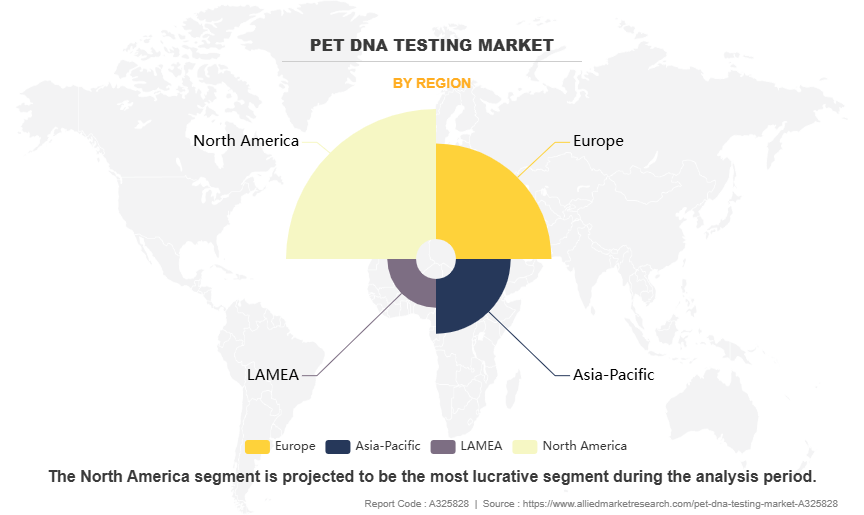

- Region-wise, North America generated the largest revenue in pet DNA testing market in 2024. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The pet DNA testing market size is experiencing robust growth, driven by a blend of socio-demographic trends, technological innovation, and increase in emphasis on preventive pet healthcare. One of the primary drivers is the rising trend of pet humanization, where owners increasingly view pets as family members. This emotional connection has spurred demand for personalized and proactive veterinary care. Pet DNA testing enables owners to gain insights into breed composition, inherited traits, and genetic predispositions to various health conditions, supporting informed decisions on diet, behavior management, and medical interventions.

Another key pet DNA testing market growth factor, as highlighted in the pet DNA testing market outlook, is the rising incidence of genetic disorders and breed-specific health concerns, particularly in purebred animals. Veterinary professionals and breeders are using genetic testing to screen for hereditary diseases such as degenerative myelopathy, cardiomyopathies, and hip dysplasia. This is especially prominent in North America and Europe, where early detection and preventive care are central to pet wellness strategies. As a result, both direct-to-consumer test kits and veterinary-grade genomic tools are gaining widespread acceptance in clinical and home-based applications and drive the growth of the pet DNA testing market size.

Technological advancements are further accelerating the pet DNA testing market growth, with next-generation sequencing (NGS), microarray platforms, and bioinformatics enabling faster, more accurate, and cost-effective genetic testing. Companies are expanding their offerings to include comprehensive wellness reports, carrier screening, trait analysis, and even relative finder services. Integration with mobile apps and digital platforms allows users to access interactive health dashboards, reminders, and data-sharing features with veterinary professionals, enhancing user engagement and continuity of care.

Moreover, rising disposable income and growing awareness about animal health are encouraging higher spending on premium veterinary services in emerging pet DNA testing markets such as Asia-Pacific and Latin America which further drive the pet DNA testing market growth. Urbanization, dual-income households, and the proliferation of nuclear families have led to increased pet adoption and advanced pet care solutions. Government initiatives promoting animal welfare and the expansion of companion animal veterinary networks further support expansion during pet DNA testing market analysis.

The pet DNA testing market is also witnessing increased activity from start-ups and established veterinary diagnostics firms. These players are focusing on innovations such as saliva-based testing, breed-specific panels, and subscription-based health monitoring. Strategic partnerships, product launches, and geographic expansion into underpenetrated regions are key tactics being used to capture pet DNA testing market share. As demand for personalized pet care grows, the market is expected to witness continued evolution, with broader species coverage and deeper integration of genomics into everyday pet healthcare.

Segmental Overview

The pet DNA testing industry is segmented into animal type, sample type, test type, end user, and region. On the basis of animal type, it is classified into dogs, cats and others. On the basis of sample type, the market is segregated into manual saliva, blood, and others. On the basis of test type, the market is categorized into breed profile, genetic disease, and others. On the basis of end user, the market is categorized into breeders, pet owners, and veterinarians. Region-wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Animal Type

On the basis of animal type, the dogs segment dominated the pet DNA testing market share in 2024 due to the high rate of dog ownership globally, particularly in North America and Europe, where dogs are the most commonly kept companion animals. Dogs are also more likely than other pets to exhibit breed-specific behaviors and genetic health conditions, prompting owners to seek DNA tests for ancestry verification, health risk assessments, and behavioral insights. The wide availability of dog-focused DNA test kits, supported by extensive breed databases, has also facilitated higher adoption.

However, the cats segment is expected to witness the highest CAGR during the forecast period owing to increasing cat ownership, rising awareness of feline-specific genetic conditions, and the gradual expansion of DNA testing services tailored to cats. Companies are increasingly launching test kits specifically for cats, with improved databases and disease screening capabilities, thereby driving demand in this previously underserved segment.

By Sample Type

On the basis of sample type, the saliva segment dominated the pet DNA testing market in 2024 and is anticipated to register the highest CAGR during the forecast period. This growth is fueled by the non-invasive, convenient nature of saliva-based testing, which makes sample collection stress-free for both pets and owners. Saliva swab kits can be administered at home without the need for veterinary intervention, increasing accessibility and appeal among pet owners. Moreover, advancements in DNA extraction and amplification technologies have enhanced the reliability and accuracy of saliva-based testing, making it the preferred method for both direct-to-consumer and clinical applications. The widespread availability of commercially available saliva kits and the ability to store and ship samples easily without refrigeration are expected to further support the growth of this segment during the forecast period.

By Test Type

On the basis of test type, the breed profile segment dominated the pet DNA testing market share in 2024 due to high consumer interest in uncovering a pet’s ancestry, especially for mixed-breed or rescue animals. Understanding breed composition helps owners predict traits such as behavior, exercise needs, size, and susceptibility to breed-specific conditions. Breed identification also satisfies curiosity and strengthens the emotional bond between owners and pets. In addition, many DNA kit providers initially focused on breed identification, resulting in wider availability and marketing of breed-focused kits compared to other test types.

However, the genetic disease segment is expected to witness the highest CAGR during the forecast period owing to the growing awareness of inherited health conditions in companion animals. Pet owners and veterinarians are increasingly leveraging genetic testing for early disease detection, preventative care, and tailored treatment plans. The integration of genetic disease testing into routine wellness and breeding programs further contributes to this segment’s rapid growth.

By End User

On the basis of end user, the breeders segment dominated the market in 2024, driven by the need for genetic screening to ensure responsible breeding practices. Breeders use DNA testing to confirm lineage, identify carriers of hereditary conditions, and enhance the health and quality of future litters. DNA test results also add value to breeding stock, improve buyer confidence, and support breed registration requirements. Breeders often perform multiple tests across their breeding populations, contributing to higher test volumes and revenues in this segment.

However, the pet owners segment is expected to witness the highest CAGR during the forecast period owing to the increasing trend of pet humanization and personalized pet care. As awareness about genetic testing grows, more pet owners are using these tools to understand their pets’ health, behavior, and ancestry. The availability of affordable, user-friendly home testing kits and integration with digital health platforms is further boosting uptake among individual pet owners.

By Region

Region-wise, North America held the largest pet DNA testing market share in 2024, due to the high rate of pet ownership, advanced veterinary healthcare infrastructure, and widespread consumer awareness about genetic testing. The region also hosts several leading players in the pet genomics industry and has well-established distribution channels for both direct-to-consumer and veterinary-focused DNA kits. In addition, the presence of pet insurance covering preventive diagnostics and strong e-commerce adoption supports regional dominance.

However, Asia-Pacific is projected to register the highest CAGR during the pet DNA testing market forecast period owing to rising disposable incomes, increased pet adoption in urban centers, and growing awareness of pet wellness. Countries such as China, Japan, South Korea, and India are witnessing a cultural shift towards pet humanization, which is fueling demand for advanced diagnostic services. Furthermore, the expanding presence of DNA test providers and local startups in the region is making testing more accessible and affordable.

Competition Analysis

Competitive analysis and profiles of the major players in pet DNA testing market include Zoetis Inc. (Basepaws Inc.), Mars Inc. (Wisdom Panel), Orivet Genetic Pet Care Limited, Embark Veterinary, Inc., Urban Animal, DNA MY DOG, Neogen Corporation, Genetic Technologies (EasyDNA), Prenetics Global Limited, and Macrogen, Inc. The key players operating in the market have adopted acquisition, product launch, and partnership as their key strategies to expand their product portfolio.

Recent Developments in Pet DNA Testing Industry

- In December 2024, Orivet announced a strategic partnership with SHOWSIGHT Magazine, an essential resource for dog show exhibitors, breeders, and enthusiasts. The collaboration aims to enhance canine health and breed preservation through Orivet’s advanced genetic testing. SHOWSIGHT readers can now access exclusive discounts of up to 30% on Orivet’s Health & Trait DNA testing kits, helping elevate breeding programs with science-backed insights and ongoing support.

- In September 2024, Orivet acquired Animal DNA Diagnostics, marking a major step in expanding its global footprint. Known for its personalized service under founder June Swinburne, Animal DNA Diagnostics will now operate from a new Orivet office in London. Orivet has committed to maintaining the same customer-centric approach, with UK-based care overseen by Ryley, ensuring a smooth transition and localized support.

- In July 2024, Mars acquired Cerba Vet and ANTAGENE to enhance Veterinary Diagnostics in Europe. This move aims to expand Mars' veterinary diagnostics capabilities and reach within Europe, particularly for veterinarians. The acquired companies, specializing in veterinary diagnostics and DNA testing, will join other Mars-owned veterinary businesses like Antech and Wisdom Panel.

- In May 2023, Basepaws, a Zoetis company, launched its most comprehensive DNA test for dogs, focused on health-related genetic insights and early disease risk detection. This next-generation test evaluates over 280 genetic markers across a broad spectrum of inherited conditions, providing pet owners and veterinarians with actionable data for personalized care. With this launch, Basepaws strengthens its position as a frontrunner in pet genetic testing, supporting Zoetis’ broader mission of precision animal health.

- In June 2022, Zoetis Inc., a global leader in animal health, acquired Basepaws, a privately held petcare genetics company known for its innovative direct-to-consumer genetic testing for cats and dogs. The acquisition aims to enhance Zoetis’ portfolio in precision animal health, enabling more proactive pet care through early disease detection and genetic insights. Basepaws' pioneering work in pet DNA testing aligns with Zoetis' strategy to deliver advanced diagnostics and personalized health solutions for companion animals.

- In January 2022, Alcon, the global leader in eye care dedicated to helping people see brilliantly, announced the European launch of the newest addition to its innovative portfolio of dry eye products Systane Complete Preservative-Free Lubricant Eye Drops, now in an easy-to-use, multi-dose bottle.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pet DNA testing market analysis from 2024 to 2034 to identify the prevailing pet DNA testing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pet DNA testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pet DNA testing market trends, key players, market segments, application areas, and market growth strategies.

Pet DNA Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 960.7 million |

| Growth Rate | CAGR of 9.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 340 |

| By Sample Type |

|

| By Animal Type |

|

| By Test Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Urban Animal, Orivet Genetic Pet Care Limited, Zoetis Inc., Genetic Technologies Ltd., Neogen Corporation, Prenetics Global Limited, DNA My Dog, Mars Inc., Embark Veterinary, Inc., Macrogen, Inc. |

Analyst Review

The market has witnessed steady growth due to the rising trend of pet humanization and growing awareness about genetic health in companion animals. Pet owners are increasingly seeking personalized care, preventive healthcare solutions, and detailed insights into their pets’ breed, ancestry, and potential genetic disorders, which has significantly driven demand across key markets. The growing pet adoption rates, especially in urban areas of North America and Europe, combined with rising disposable incomes, have expanded the consumer base for DNA testing services.

Additionally, increased awareness among breeders and veterinarians about the benefits of genetic screening in responsible breeding and disease prevention is further propelling market growth. They also highlighted that technological advancements such as next-generation sequencing (NGS), enhanced trait analysis, and user-friendly at-home saliva collection kits are enhancing the accuracy and convenience of testing, thus encouraging wider adoption. Direct-to-consumer platforms, app-based result tracking, and integration with tele-vet services are reshaping the pet healthcare experience and expanding market reach.

North America accounted for the largest revenue share in 2024, supported by a mature pet care industry, established testing providers like Wisdom Panel and Embark, and higher consumer willingness to spend on pet wellness. In contrast, the Asia-Pacific region is expected to register the highest CAGR over the forecast period, driven by increasing pet ownership, growing awareness about pet health, and expanding digital pet health ecosystems in countries like China, India, and South Korea.

The pet DNA testing market was valued at $394.07 million in 2024 and is estimated to reach $960.66 million by 2034, exhibiting a CAGR of 9.3% from 2025 to 2034.

Top companies holding significant market share in the pet DNA testing market include Embark Veterinary, Wisdom Panel (Mars Petcare), DNA My Dog, Basepaws (Zoetis), Orivet, and Paw Print Genetics.

The leading application of the global pet DNA testing market is breed identification, helping owners and breeders determine a pet’s breed composition, lineage, and associated characteristics. This application remains dominant due to pet owners' curiosity about their pet’s ancestry and its implications for behavior, health, and care.

North America currently stands as the largest regional market for pet DNA testing, holding over 40%–45% of global market share due to its high pet ownership rates, advanced veterinary infrastructure, and strong consumer inclination toward pet health and wellness

Upcoming trends in the global pet DNA testing market include the integration of AI for more accurate genetic analysis, expanding applications beyond dogs to include cats and exotic pets, and the rise of personalized pet care plans based on genetic insights. Direct-to-consumer testing is also gaining momentum with enhanced digital platforms.

Loading Table Of Content...

Loading Research Methodology...