Pet Perfume Market Research, 2034

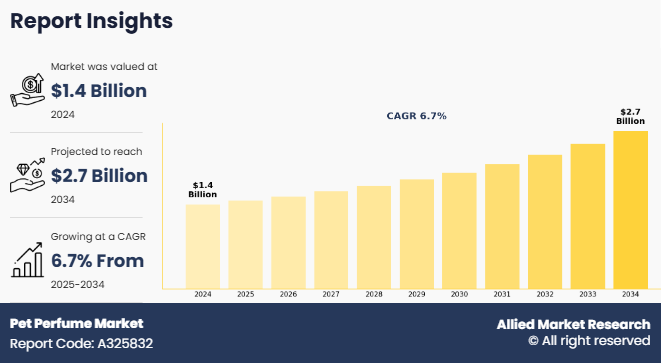

The global pet perfume market size was valued at $1.4 billion in 2024, and is projected to reach $2.7 billion by 2034, growing at a CAGR of 6.7% from 2025 to 2034. Pet perfume is a grooming product formulated to provide a pleasant scent for pets without causing skin irritation or respiratory discomfort. It is mostly alcohol-free and made using water-based solutions, mild essential oils, and natural or synthetic fragrances safe for animals. The formulation includes deodorizing agents and skin-friendly ingredients to maintain freshness between baths. Pet perfumes are designed for use on dogs and, less commonly, cats, helping to neutralize odors, support hygiene, and enhance the grooming experience. Manufacturers ensure the product is non-toxic and pH-balanced to suit animal skin, often tested under veterinary guidance.

Key Takeaways

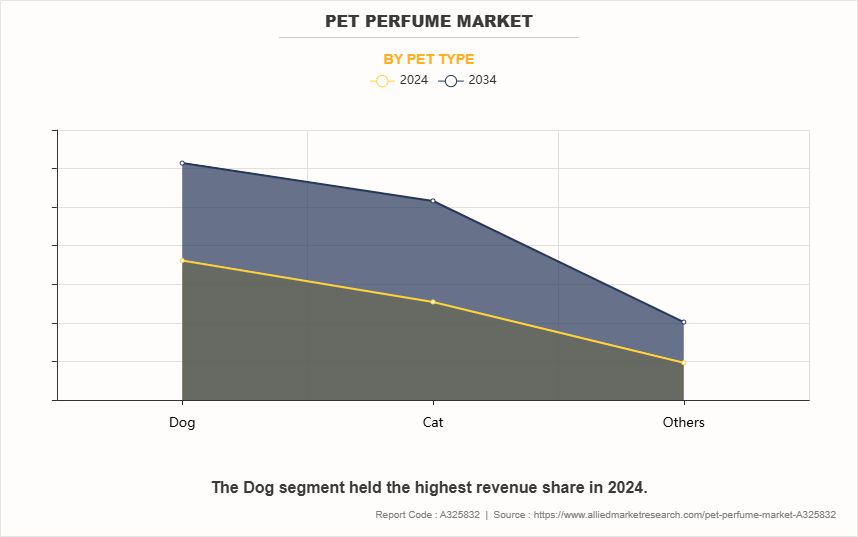

- By pet type, the dog segment dominated the global pet perfume market in 2024 and is anticipated to maintain its dominance during the forecast period.

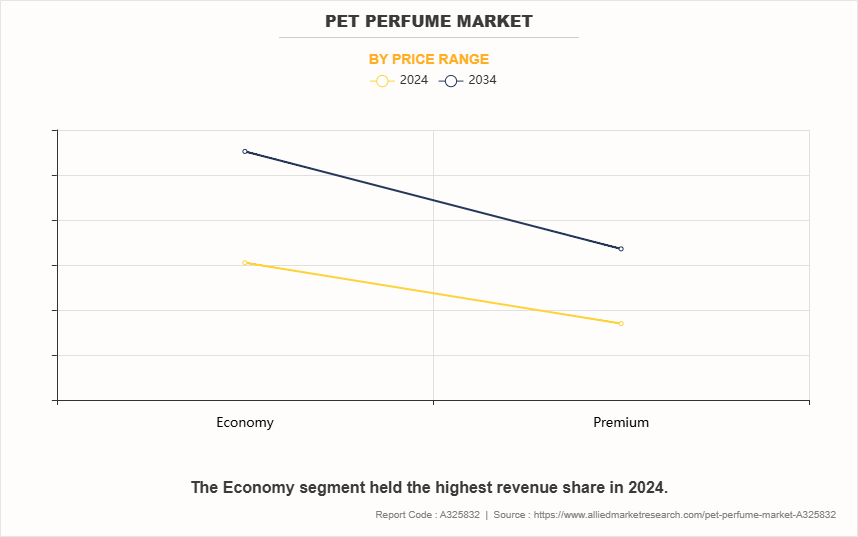

- By price range, the economy segment dominated the global pet perfume market in 2024 and is anticipated to maintain its dominance during the forecast period.

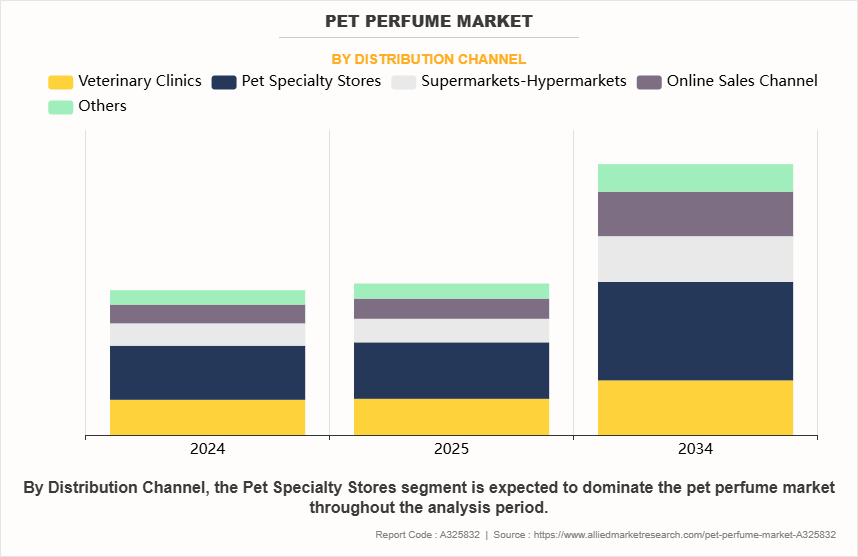

- By distribution channel, pet specialty stores segment dominated the global pet perfume market in 2024 and is anticipated to maintain its dominance during the forecast period.

Market Dynamics

The rise in demand for natural and organic pet products has directly influenced innovation and formulation strategies in the global pet perfume market. Pet owners are increasingly choosing grooming solutions free from artificial fragrances, parabens, sulfates, and alcohol-based ingredients. Pet perfume manufacturers have responded by incorporating plant-based essential oils, organic floral distillates, and non-toxic emulsifiers. The growing preference for clean-label grooming solutions aligns with broader consumer trends toward wellness and sustainability in the pet care sector. Urban households and health-conscious consumers are driving the shift toward safer, ingredient-transparent products in pet fragrance categories, thus driving pet perfume market demand.

In addition, natural and organic pet perfumes are gaining visibility across retail and e-commerce platforms owing to rising demand for hypoallergenic, eco-conscious options. Marketing strategies have emphasized safety for sensitive skin, the use of sustainable ingredients, and ethical sourcing, which has led to higher consumer interest among pet owners. The pet perfume market in North America and Europe is experiencing higher adoption rates for organic formulations, supported by premium spending patterns and regulatory emphasis on safe grooming products. The demand for natural pet care solutions has encouraged brands to differentiate with cruelty-free, alcohol-free, and biodegradable pet perfumes, contributing to steady growth in the global pet perfume market.

However, potential skin allergies or reactions in pets have hindered the market growth of pet perfumes by creating hesitancy among pet owners regarding product safety. Concerns over ingredients such as artificial fragrances, parabens, alcohol, and certain essential oils have led to increased scrutiny, especially among consumers with breeds prone to skin sensitivity such as Bulldogs, Pugs, and Persian cats. Cases of rashes, itching, and inflammation reported after the use of scented grooming products have discouraged trial purchases and reduced customer retention for pet perfume brands. Lack of standardized dermatological testing across all formulations has further intensified consumer caution in both established and emerging markets.

Moreover, veterinary recommendations often advise against frequent use of synthetic or heavily perfumed grooming products, which has shifted some consumer preference toward fragrance-free or single-function alternatives. In markets with strict regulatory environments such as Germany and Canada, compliance requirements for ingredient safety and labeling transparency have increased production costs and limited product innovation. Brands without clear evidence of hypoallergenic claims or veterinarian endorsements are facing reduced shelf presence in organized retail and pet specialty outlets. Safety concerns associated with allergic reactions are directly limiting market expansion and influencing product development strategies in the global pet perfume category.

Furthermore, partnerships with veterinary clinics and pet salons are creating targeted opportunities in the global pet perfume market by positioning pet perfumes within trusted professional environments. Veterinary clinics are introducing vet-recommended pet perfumes during wellness appointments and post-treatment grooming sessions, allowing pet owners to evaluate safety and performance under clinical supervision. Pet perfume brands offering formulations approved for sensitive skin or post-procedure use are gaining credibility and customer trust. Clinics are also stocking retail-ready pet perfumes that meet veterinary safety standards, expanding visibility beyond traditional retail channels and reinforcing confidence in daily-use products.

Also, pet salons are increasing demand for pet perfumes by incorporating branded scents into grooming routines, especially during final styling stages. Groomers often apply pet perfumes that deliver conditioning and odor-control benefits, encouraging pet owners to purchase the same product for home use. Brands are launching salon-exclusive pet perfume variants to strengthen loyalty and differentiate premium offerings. Pet salons located in high-income urban centers across countries such as Japan, Australia, and the U.S. are serving as trial and conversion points for fragrance-based grooming products. Strategic alignment with pet salons and veterinary clinics is expected to expand direct-to-consumer reach and boost product adoption in the pet perfume market.

Segment Overview

The pet perfume market is divided into pet type, price range, distribution channel, and region. Based on pet type, the market is segmented into dogs, cats, and others. Based on price range, the market is bifurcated into economy and premium. Based on distribution channel, the market is categorized into veterinary clinics, supermarket-hypermarket, pet specialty stores, online sales channel, and others. By region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Singapore, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, Saudi Arabia, UAE, and rest of LAMEA).

By Pet Type

By pet type, the dog segment dominated the global pet perfume market in 2024 and is anticipated to maintain its dominance during the pet perfume market forecast period. Dogs are more frequently taken for walks, exposed to outdoor environments, and engage in physical activities that can result in odor buildup, prompting greater use of grooming products such as pet perfumes. Many dog owners prefer regular fragrance applications as part of hygiene routines, especially in urban households where pets often share indoor spaces. The growing popularity of breed-specific grooming and personalized care kits has also contributed to higher product adoption in the dog segment.

In addition, the dog segment is anticipated to maintain its dominance during the forecast period as consumer interest in premium grooming products continues to rise. The presence of targeted formulations for different dog breeds and coat types has expanded product availability. Moreover, veterinary clinics and pet salons frequently use and retail dog-specific perfumes, strengthening purchase intent. Active marketing campaigns and social media promotion have further supported visibility and demand in this segment.

By Price Range

By price range, economy segment dominated the global pet perfume market in 2024 and is anticipated to maintain its dominance during the forecast period. High product affordability and widespread availability across supermarkets, departmental stores, and online platforms have boosted consumer adoption. Many pet owners opt for basic grooming solutions that offer odor control without premium pricing, especially in cost-sensitive regions across Asia-Pacific, Latin America, and parts of Europe.

Growth in private-label offerings, multipack deals, and entry-level grooming kits has further strengthened demand in the economy segment. Manufacturers continue to introduce water-based, alcohol-free perfumes with essential functions while maintaining low production costs. First-time pet owners and multi-pet households frequently purchase value-focused products, contributing to repeat sales. Increasing urbanization and pet humanization trends in developing markets have also played a role in expanding the customer base for economy pet perfumes. Thus, affordability, functional performance, and accessible retail channels remain the key factors driving volume growth in the economy segment.

By Distribution Channel

By distribution channel, the pet specialty stores segment dominated the global pet perfume market in 2024 and is anticipated to maintain its dominance during the forecast period. High footfall of engaged pet owners seeking wide range of grooming products has driven strong sales across specialty retail chains. Exclusive availability of niche and premium pet perfume brands at pet-focused outlets has positioned pet specialty stores as preferred points of purchase for quality-conscious consumers.

Furthermore, pet specialty stores offer expert recommendations, in-store trials, and bundled grooming packages, encouraging shoppers to explore new fragrance options tailored to specific pet needs. Strategic placement of seasonal and breed-specific perfumes has improved upselling opportunities. Retailers in this segment also maintain strong relationships with veterinarians and groomers, strengthening trust in stocked products. As pet ownership increases in urban areas, consumers continue to seek guidance from trained staff before purchasing grooming items. Personalized service, combined with targeted inventory, has made pet specialty stores a key distribution channel for sustained growth in pet perfume sales.

By Region

By region, North America is anticipated to dominate the pet perfume industry with the largest share during the forecast period. High pet ownership rates, strong purchasing power, and well-established pet grooming practices have positioned North America as the leading region in the global pet perfume market. Consumers in the U.S. and Canada consistently invest in grooming routines that include fragrance products tailored to reduce pet odors while supporting skin health. The normalization of human-like care for pets has expanded the use of perfumes as functional hygiene products rather than occasional luxury items, especially in households with indoor pets.

Moreover, retailers have strengthened distribution through pet specialty chains, veterinary clinics, and e-commerce platforms. Companies operating in North America have introduced scent-specific variants, vet-approved formulations, and organic blends to meet growing demand for safe and effective grooming solutions. Brand visibility and consumer trust are reinforced through compliance with product safety regulations and the use of certified natural ingredients. The rise of bundled offerings that include pet perfumes with shampoos and grooming tools has also supported product trial and adoption. Targeted marketing, subscription models, and packaging innovation have further sustained regional momentum, thus driving the market growth of global pet perfume category.

Competition Analysis

Players operating in the market have adopted various developmental strategies to expand their pet perfume market share, increase profitability, and remain competitive in the market.The key players operating in the global pet perfume industry include Bio-Derm Laboratories, Inc., Bodhi Dog, Christies Direct, Compana Pet Brands LLC, Cosmos Corporation, Earthwhile Endeavors, Inc., Isle of Dogs, Mipuchi New Zealand Limited, Natural Pet Innovations, LLC, and Pawfume Premium. Several well-known and upcoming brands are vying for market dominance in the expanding pet perfume market. Smaller, niche firms are more well known for catering to consumer demands and preferences in the global market. Large conglomerates, however, control most of the market and often buy innovative start-ups to broaden their product lines.

Some Examples of Product Launch in The Market

- In October 2024, TropiClean, a brand under Cosmos Corporation, has launched its Watermelon Range featuring the standout Watermelon deodorizing pet spray, which neutralizes odors, conditions coats, and leaves pets smelling fresh to boost its pet perfume product portfolio.

- In June 2023, Earthbath, under the brand Earthwhile Endeavors, Inc., launched Shea Butter Shampoo and Spray for dogs and cats, offering moisture repair and dander care with organic, hypoallergenic, and plant-based ingredients.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pet perfume market analysis from 2024 to 2034 to identify the prevailing pet perfume market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pet perfume market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pet perfume market trends, key players, market segments, application areas, and pet perfume market growth strategies.

Pet Perfume Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 2.7 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2024 - 2034 |

| Report Pages | 350 |

| By Pet Type |

|

| By Distribution Channel |

|

| By Price Range |

|

| By Region |

|

| Key Market Players | Natural Pet Innovations, LLC, Bio-Derm Laboratories, Inc., Pawfume Premium, Bodhi Dog, Earthwhile Endeavors, Inc., Mipuchi New Zealand Limited, Cosmos Corporation, Christies Direct, Compana Pet Brands LLC, Isle of Dogs |

Analyst Review

This section consists of the opinion of the top CXO in the pet perfume market. CXO perspectives on the pet perfume market highlight a transition toward lifestyle-driven pet care, where grooming products are increasingly viewed as essential components of hygiene and wellness routines. Executives recognize that changing consumer perceptions, particularly in urban markets, have increased expectations for odor control, skin safety, and coat conditioning. Pet perfume is positioned as a functional grooming aid, not a luxury item, supporting frequent use in shared living environments.

From a product strategy standpoint, CXOs highlight the importance of developing long-lasting, hypoallergenic, and vet-approved formulations that align with clean-label demands. Customization based on breed, coat type, or specific concerns such as anxiety control through calming scents is seen as a key factor to differentiation. Subscription models and grooming bundles are being explored to improve customer lifetime value and streamline inventory turnover.

Also, executives identify co-branding with fragrance developers, data-led marketing campaigns, and sustainable packaging as opportunities to enhance value perception and build brand loyalty. Investments in R&D, retail visibility, and influencer partnerships are being prioritized to maintain relevance in a growing but competitive market. Furthermore, the strategic focus of key players operating on the market remains on product performance, regulatory compliance, and consumer trust over the coming years.

The pet perfume market registered a CAGR of 6.7% from 2024 to 2034.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the pet perfume market report is from 2025 to 2034.

The top companies that hold the market share in the pet perfume market include Bio-Derm Laboratories, Inc., Bodhi Dog, Christies Direct, Compana Pet Brands LLC, Cosmos Corporation., and others.

The pet perfume market was valued at $1,424.6 million in 2024 and is estimated to reach $2,664.6 million by 2034, exhibiting a CAGR of 6.7% from 2025 to 2034.

The pet perfume market report has 3 segments. The segments are pet type, price range, and distribution channel.

The emerging regions in the pet perfume market are likely to grow at a CAGR of more than 8.8% from 2025 to 2034.

North America will dominate the pet perfume market by the end of 2034.

Loading Table Of Content...

Loading Research Methodology...