Pet Supplement Market Summary, 2035

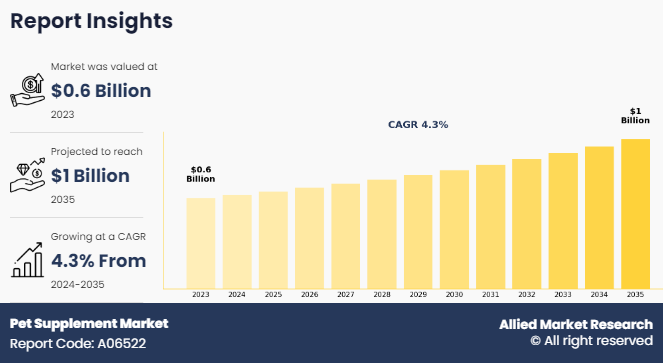

The global pet supplement market size was valued at $619.4 million in 2023, and is projected to reach $1,017.8 million by 2035, registering a CAGR of 4.3% from 2024 to 2035. The growth of pet supplements is driven by factors such as rise in pet ownership, growing awareness of pet health, rise in demand for premium pet care products, and the humanization of pets among consumers.

Pet supplements are processed form of food, which are composite of added nutrients, proteins, and minerals. They improve the health of pets and meet the nutrient and mineral requirements in pets. Blinders, flavoring agents, fillers, and preservatives are added to pet supplements that improve the shelf life. Pet supplements are given according to the type of deficiencies, symptoms, and disorders in pets.

Key Takeaways

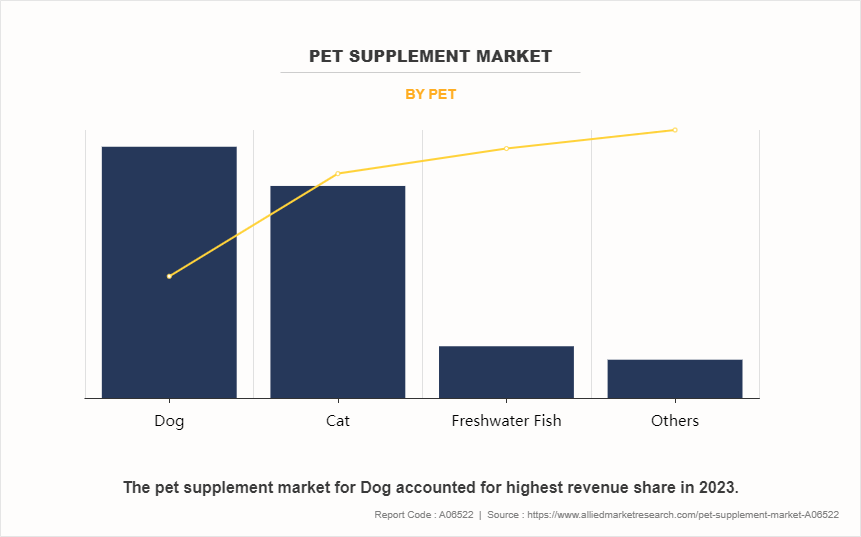

By type, the dog segment was the highest revenue contributor to the market in 2023.

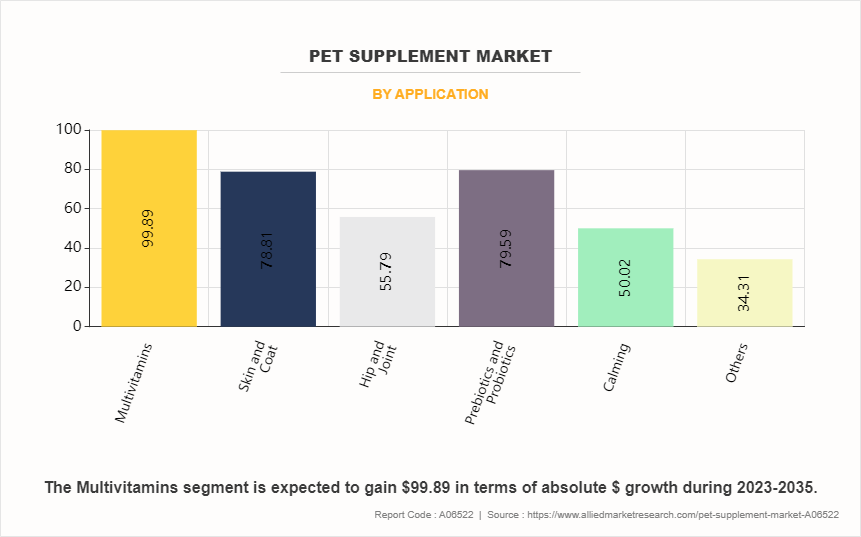

By application, the multivitamins segment was the largest segment in the global pet supplement market during the forecast period.

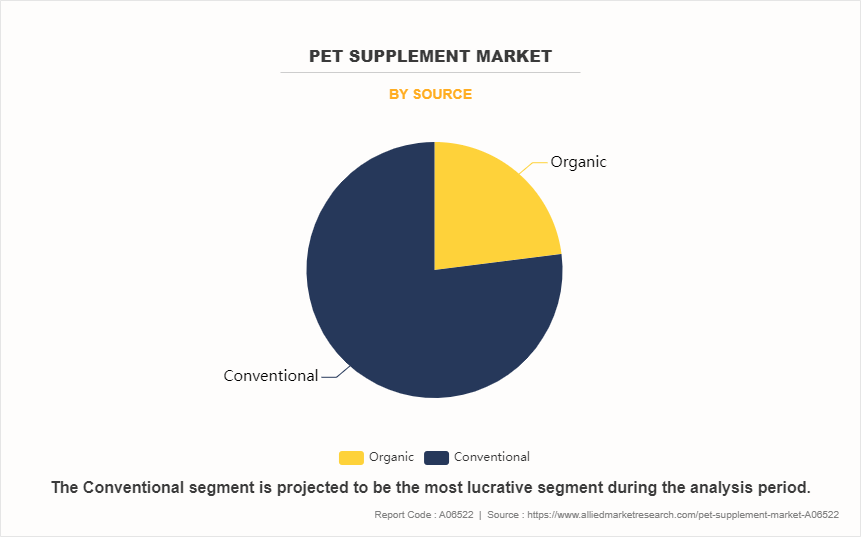

By source, the conventional segment was the largest segment in the global pet supplement market in 2023.

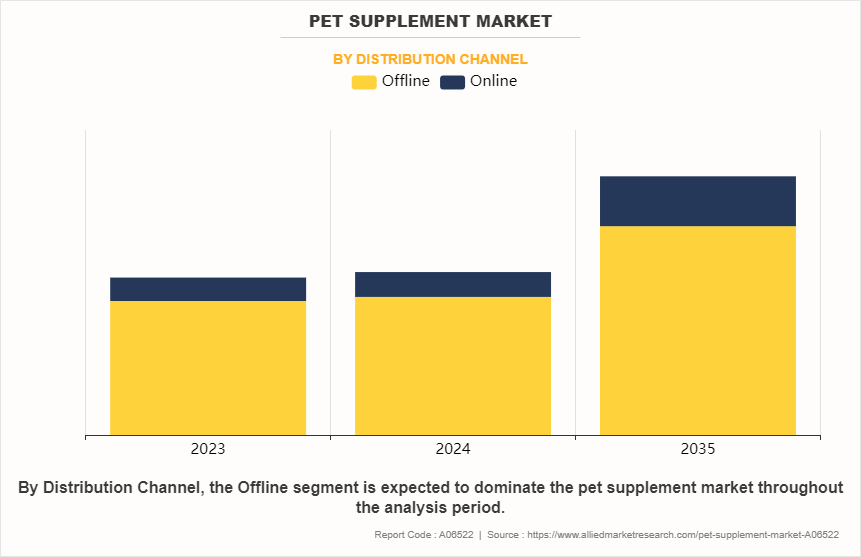

By distribution channel, the offline segment was the highest revenue contributor to the market in 2023.

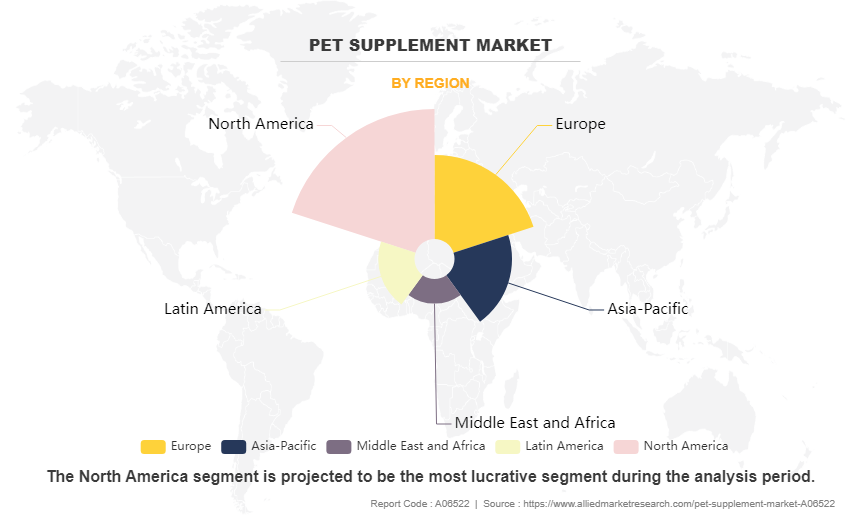

Region-wise, North America was the highest revenue contributor in 2023.

Market Dynamics

Increase in pet ownership rates has been a significant driver in boosting demand for the market. According to the American Pet Products Association (APPA), 63% of households in the U.S. own a pet in 2024. Among these pet-owning households, 44% own dogs, while 30% own cats.

In addition, APPA has anticipated that by 2030, pet ownership is expected to increase to 67% in the U.S. households. The association has further forecasted that 46% of these households will own dogs, and 35% will own cats.

As more individuals bring pets into their homes, they become increasingly invested in ensuring the health and well-being of their furry companions. The increased sense of responsibility leads pet owners to seek out products that can enhance the health and longevity of pets, including nutritional supplements.

Moreover, as pet owners develop stronger emotional bonds with their pets, they are more inclined to invest in products that can help improve their pets' quality of life. As a result, the emotional connection often translates into a willingness to spend more on premium pet care products, including pet supplements such as multivitamins, omega-3 fatty acids, and joint support formulas that addresses specific health concerns and provide additional nutritional support.

With a larger population of pets in households, the overall market potential for pet supplements is expected to expand, creating pet supplement market opportunities for manufacturers and retailers to meet the rise in demand.

However, rise in regulatory constraints in the pet supplement industry are expected to negatively affect the pet supplement market during the forecast period. For instance, in the U.S., pet food is highly regulated by the U.S. FDA to meet both federal and state requirements.

The U.S. FDA has imposed laws on both, finished pet supplements and their ingredients. An ingredient cannot be used in pet food supplement until it has been accepted by the FDA and by Association of American Feed Officials (AAFCO). These organizations develop model bills and legislation for pet supplements.

In addition, the Food Safety Modernization Act of 2010 (FSMA) introduced guidelines related to certification, sterilization, hygiene, and labeling of ingredients for pet supplement manufacturers in the U.S. In addition, owing to the lack of a universal regulatory structure, global trading becomes difficult.

Huge investments are made in manufacturing feed additives and different regulations lead to severe losses for manufacturers. Hence, it becomes expensive to frequently update technologies and facilities in accordance with changing guidelines. Therefore, strict regulatory guidelines are expected to hinder the growth of the market during the forecast period.

Introduction of organic and natural ingredients in pet supplement products has created market opportunities for pet supplement providers in recent years. People are getting more conscious about the beneficial and healthy effects of organic pet supplements, so pet owners find organic labeled pet food and supplements. Introduction of new products made from organic and natural ingredients is expected to disrupt the assumption that the pet supplement sector uses artificial ingredients or ingredients made from chemical additives.

Consumers are increasingly adopting products with organic labels to not get affected by chemicals and artificial ingredients. Hence, many pet food and supplements processing industries are coming up with organic ingredient-based products, which are heavily demanded by pet owners. Growing innovation in ingredients and acceptance of organic pet supplements are likely to bring lucrative opportunities for pet supplement manufactures.

Segmental Overview

The market is segmented into pet, application, source, distribution channel, and region. On the basis of pet, the market is categorized into dog, cat, freshwater fish, and others. By application, it is segregated into multivitamins, skin & coat, hip & joint, prebiotics & probiotics, calming, and others.

On the basis of source, the market is categorized into organic and conventional. Depending on distribution channel, it is bifurcated into offline and online. Region-wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Russia, Italy, Spain, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By Pet

By pet, the dog segment dominated the global pet supplement market in 2023 and is anticipated to continue the same trend during the forecast period. Adoption of dogs is on the rise as compared to other pet animals. Dogs, currently represent one of the most preferred pets across the globe. Owners are increasingly concerned about the health of their pets and thus feed their dogs with various premium and super premium supplements, including natural-and organic ingredient-based supplements.

Dog supplements comprise a combination of carbohydrates, minerals, proteins, fats, vitamins, and water. These supplements help dogs to fight infection, perform daily activities, repair teeth & bones, and maintain their build and muscle tone.

Moreover, various health issues can be observed in dogs such as unplanned weight loss, joint & hip, skin & coat, fear and anxiety, which can be controlled by the pet supplements. For instance, calming supplements are increasingly given to dogs, when they have fear-related anxiety. Thunder, fireworks, sirens, and separation from the owner are common reasons for anxiety in dogs.

Furthermore, cross breed dogs are increasingly getting adopted, owing to their unique look, reduced heath issues, and increased lifespan, which is anticipated to increase pet ownership of dogs. This is expected to create opportunities for manufacturers during pet supplement market forecast.

By Application

By application, the multivitamin segment led the global pet supplement market in 2023 and is anticipated to maintain its dominance during the forecast period. The growth of multivitamins supplements is attributed to rise in concerns about pet health and humanization of pets. Various vitamins can be provided to pets through multivitamin supplements such as vitamin A, B, C, D, E, K, and Choline.

For instance, Vitamin D for dogs allows their bodies to balance minerals such as phosphorous and calcium for healthy bone growth, without which a dog could not be able to develop properly or maintain healthy muscles and bones.

In addition, Choline vitamin supports healthy brain and liver function, and is occasionally used as part of treatment plans for pets with epilepsy. Multivitamins are considered as complete health supplements for pets, and they also provide fatty acids to reduce shedding and improve coat’s shine.

By Source

By source, the conventional segment held a major pet supplement market share in 2023 and is anticipated to maintain its dominance during the forecast period. People often prefer conventional pet supplements owing to their familiarity, perceived effectiveness, and easy availability. Conventional supplements have been in the market longer, building trust among consumers.

In addition, conventional ones are often recommended by veterinarians and widely advertised, reinforcing their credibility. Many pet owners believe that these supplements deliver consistent results and are backed by scientific research.

Moreover, conventional supplements are readily accessible in pet stores, online platforms, and pharmacies, which makes them convenient to purchase. The established reputation and widespread availability of conventional supplements reassure pet owners of their efficacy and safety, leading them to choose these products over newer or alternative options.

By Distribution Channel

By distribution channel, the offline segment registered the highest growth in 2023 and is anticipated to maintain its dominance during the forecast period. Offline stores such as supermarkets/ hypermarkets distribute pet animal snacks and foods with a variety of other products and thus is widely accepted across the globe. It provides a widespread option for pet owners to compare various pet supplement brands along with procuring their regular monthly grocery. Various giants such as Walmart, Kroger, Tesco, and Carrefour, with numerous outlets/stores play a crucial role in such distribution channels.

Specialized pet food shops provide special food products for particular pet animals such as cats or dogs. People considerably prefer to buy pet supplements from vet clinics or pharmacies. This is majorly attributed to the fact that customers can get proper guidance and suggestions along with accurate pet supplements from the stores.

Rise in urbanization and formation of nuclear families, especially in metro cities has increased the preference of consumers to buy from hypermarkets and supermarkets, which, in turn, favors smooth distribution of pet supplements and propels the pet supplement market growth.

By Region

Region-wise, North America is anticipated to be the major shareholder during the forecast period. High number of pet ownership and increase in spending capacity on pet care products, including healthcare and grooming products are some of the major attributes for growth of the market in this region.

Increasing pet humanization, growing trend of nuclear families, and adoption rate of pet especially among the young population are some of the factors that boosted the demand for pet supplements across the North America region.

Moreover, rise in awareness among pet owners about nutritional diversification is positively influencing them to opt for customized treats and supplement products. In addition, rise in adoption of pets and demand for premium and super premium supplements including organic and natural ingredient-based pet supplements, is expected to escalate the pet supplement market demand during the forecast period.

Competitive Analysis

The key players in the pet supplement market include Virbac, Ark Natural Company, Bayer AG, Food Science Corporation, Kemin Industries, Nestle S.A, Novotech Nutraceuticals, Inc., Now Health Group, Inc., Nutramax Laboratories, Inc., and Virbac and Zoetis, Inc.

Several upcoming brands are vying for market dominance in the expanding pet supplement industry. Smaller, niche firms are more well-known for catering to consumer demands and tastes. Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they have different recognition or range of products than well-known companies.

Some major important competition components are innovation in pet supplement products, ingredient sourcing, and sustainability policies, which are expected to provide a competitive edge over rivals in the market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pet supplement market analysis from 2023 to 2035 to identify the prevailing pet supplement market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the pet supplement market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global pet supplement market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global pet supplement market trends, key players, market segments, application areas, and market growth strategies.

Pet Supplement Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 291 |

| By Pet |

|

| By Application |

|

| By Source |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Nestle S.A., Ark Natural Company, Virbac SA, Zoetis, Inc., FoodScience, LLC, NOW Health Group, Inc., Novotech Nutraceuticals, Inc., Nutramax Laboratories, Inc., Elanco Animal Health Incorporated., Kemin Industries, Inc. |

Analyst Review

As per the perspective of top-level CXOs, the global pet supplements market is expected to offer various business opportunities in the developing economies such as India and China. This is attributed to increase in adoption of pets, especially dogs and cats, and awareness regarding various pet care and pet grooming products such as supplements, medicines, and nutraceuticals.

CXOs stated that manufacturers are focusing on premium and super-premium pet supplements, including natural and organic-based supplements, which have been gaining considerable traction in the developed countries such as the U.S., Russia, Spain, and Italy. Furthermore, pet supplement manufacturing companies are displaying the transparency of ingredients, which are added in the product, as most consumers choose products by reading labels. In addition, consumers prefer products with organic and plant-based ingredients. Moreover, a study on pet behavior and pet diseases is further expected to broaden the scope of the pet supplement market during the forecast period.

Furthermore, CXOs believe that the rise in rate of internet penetration around the major parts of the world makes way for manufacturers to initiate several key online marketing programs. These online platforms are the easiest ways to create awareness about the benefits of pet supplements with respect to various problems associated with baby pets and well grown pets.

Key players in the market have adopted product launch, continuous innovation, and acquisition as their key developmental strategies to cater to rise in demand for pet supplements. Due to growing demand for vegan and organic pet food and supplements, most of the companies strengthen their product portfolio. For instance, Carnivore Meat Company, the maker of Vital Essentials pet food and treat products, on June 30, 2020, launched a new line of freeze-dried raw pet nutrition products named Nature’s Advantage. The brand’s first product is a freeze-dried beef treat for dogs, formulated without artificial ingredients or additives.

The growth of pet supplements market is driven by factors such as rise in pet ownership, growing awareness of pet health, rise in demand for premium pet care products, and the humanization of pets among consumers.

Region-wise, North America is anticipated to be the major shareholder during the forecast period.

The top companies analyzed for the global pet supplement market report are Virbac, Ark Natural Company, Bayer AG, Food Science Corporation, Kemin Industries, Nestle S.A, Novotech Nutraceuticals, Inc., Now Health Group, Inc., Nutramax Laboratories, Inc., and Zoetis, Inc.

The global pet supplement market to register a CAGR of 4.3% from 2024 to 2035.

The global pet supplement market was valued at $619.4 million in 2023, and is projected to reach $1,017.8 million by 2035, registering a CAGR of 4.3% from 2024 to 2035.

Loading Table Of Content...

Loading Research Methodology...