Pet Treats Market Overview: 2031

The global pet treats market was valued at $20.1 billion in 2021, and is projected to reach $29.7 billion by 2031, growing at a CAGR of 4.2% from 2022 to 2031. Pet treats are small portions of food items that are specially designed for domestic pets/companion animals, including cats, dogs, and rodents. Pet treats are given to pets as a reward, nutrition supplement, and as an oral health booster. The pet treats are different and unique from traditional pet food and are often available in different forms and varieties such as biscuits, jerky, and dental chews. Pet treats are majorly made up of vegetables, meats, grains, and include added vitamins and minerals. These treats assist in meeting the special requirements of companion animals, whether for taste, health, or flavoring. Furthermore, some specific variants of pet treats which include added vitamins and minerals provide specific health advantages, such as improving joint health & digestion or lowering the accumulation of tartar and plaque on the teeth.

Pet Treats Market Value Projections and Insights:

The North America pet treats industry is significantly impacted by the customized pet treat box and subscription services offered by major pet treats market players.

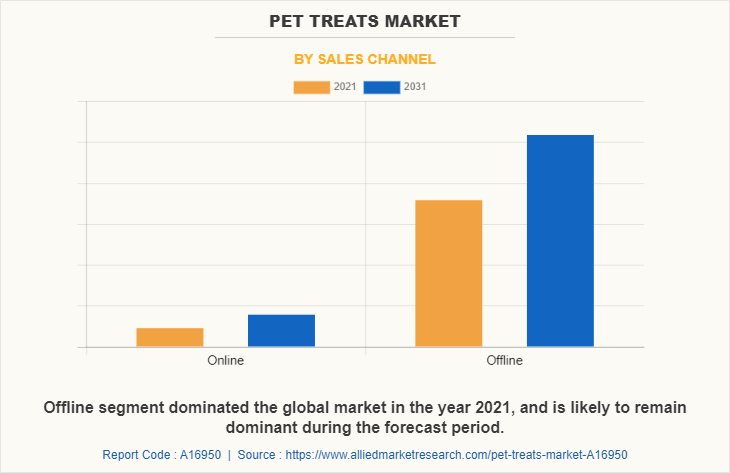

Offline stores are the primary physical locations to purchase pet treats and hold the highest pet treats market share.

Dog pet treats have gained enormous success, due to the availability of different forms of dog pet treats in different flavors and package sizes

The pet industry has witnessed a rapid humanization of pets in developed and developing regions. Pet owners are increasingly nursing their cats, dogs, birds, and other pets like family members. With pet food constituting around 76% of the pet care industry, manufacturers are focusing on offering quality treats as per the owners’ tastes & preferences. According to the Pet Food Industry, around 95% of pet owners consider their pets to be a part of the family. Therefore, the ingredients used for manufacturing pet treats are taken into consideration while purchasing. Furthermore, pet owners across the globe expect pet treat ingredients to be the same used in human food manufacturing, particularly for proteins, fats, and moisture which majorly induces the process of food spoilage. In 2020, around 14 cats died during routine taste-testing conducted by defunct Menu Food and a few pets also suffered from kidney failure after eating cuts and gravy. Therefore, millions of pet treats containers were recalled which resulted in huge losses. Moreover, around 28 pet food recalls were declared and more than 35% of them were Salmonella contaminated which included risks of Listeria, low levels of vitamin B1, and high levels of vitamin D in 2020.

Industry Highlights

The demand for healthy pet treats is highlighting the importance of nutrition and well-being of pets.

The pet treats industry experienced a rise in the number of products designed as pet treats for allergies.

Low availability of sustainable pet treats and organic pet treats poses a challenge

The availability of personalized/customized pet treat boxes and packages attracts a major stream of pet owners.

The accessibility of personalized pet treat boxes has given pet owners the possibility of selecting numerous sorts of treats, piquing their interest as they seek personalized options for their companion's needs and preferences. These personalized packages allow pet owners to design a variety of treats depending on characteristics such as nutritional requirements, age, species, pet size, and special health issues such as allergies or oral protection. Subscription-based businesses offering personalized treat boxes occasionally offer home delivery, which increases their attractiveness. The choice of treats manufactured with natural, grain-free, or high-quality components not only benefits canine health but also develops a stronger emotional bond between individuals and their companions. This degree of customization guarantees that pets enjoy treats they like while addressing nutritional or health needs, hence increasing consumer loyalty and happiness.

Key Areas Covered in the Report

Addressing intricate food safety and regulatory standards is a major hurdle for businesses.

The pet treats market is competitive due to an influx of new brands and goods, making it harder for individual enterprises to stand out and retain client loyalty.

Natural or preservative-free treats have a lower shelf life, leading to loss of stock for businesses.

Organic, grain-free, or specialty treats might be prohibitively expensive for pet owners on a tight budget.

The pet treats industry has grown increasingly competitive because of the influx of new brands and goods, making it difficult for individual businesses to differentiate themselves and maintain customer loyalty. With more alternatives accessible, customers are presented with an overwhelming number of options, ranging from organic and grain-free sweets to those that target health advantages such as joint support or dental care. This flood has decreased visibility for brands, making it challenging for smaller or growing businesses to compete with established firms that have higher marketing resources. To keep customers loyal, firms must continually innovate, provide novel value propositions, and foster trust via clean labels, assurance of quality, and constant delivery of goods.

Topics discussed in the report

Challenges from market competition

Rise of organic and grain-free pet treats

The influence of personalized and customized pet treat boxes

Role of sustainability in the pet treats industry

Segment Overview:

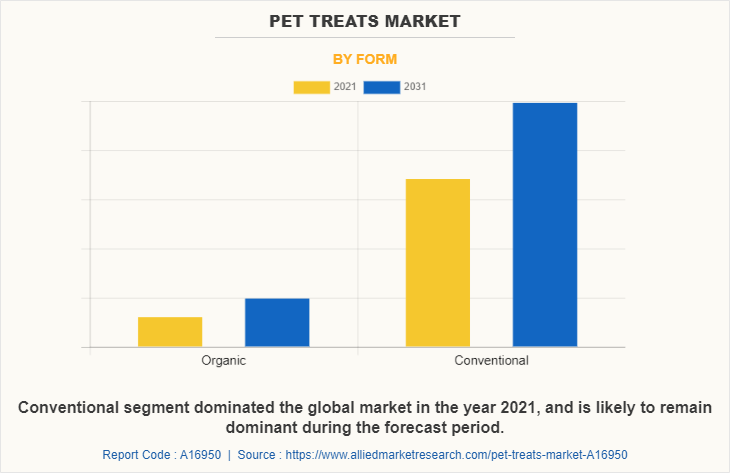

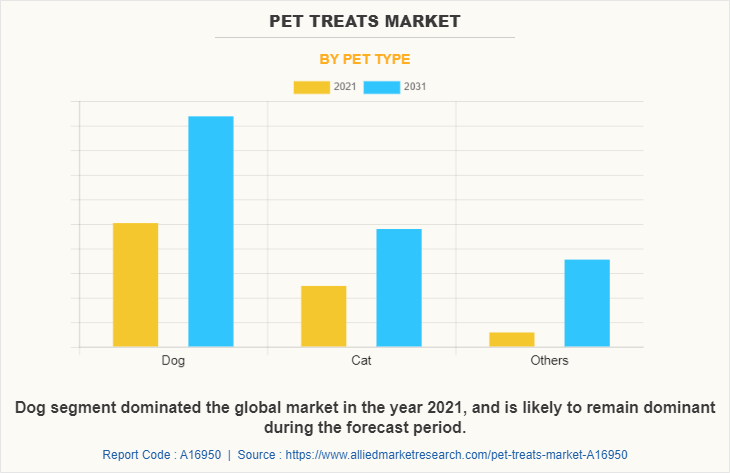

The pet treats market is segmented into pet type, form, distribution channel, and region. On the basis of pet type, the pet treats market is subdivided into dog food, cat food, and others. On the basis of form, the pet treats market is bifurcated into organic and conventional form. On the basis of distribution channel, the market is classified into online and offline. Region-wise, the pet treats market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, Russia, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, New Zealand, Australia, Singapore, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, Saudi Arabia, UAE, and rest of LAMEA).

Dog treats generated the highest revenue in 2021 owing to an increase in the trend of nuclear families and their demand to keep dogs for companionship and security. It has been observed that pet owners prefer dry treats over canned or wet treats as it is easy to store, has no refrigeration, and is more economically cost-effective. However, health and wellness trends are increasingly apparent in the dog treats market as owners are becoming more conscious of their pets' health and thus are switching from dry treats to nutritional and organic treats.

Comparative Matrix of Key Segments

Parameters | Premium Treats | Functional/Health Treats | Grain-Free/Allergen-Friendly Treats | Traditional Treats |

Market Share | High market share, widely recognized | Growing rapidly with increasing demand | Niche but increasing in popularity | Dominant in terms of traditional sales |

Distribution Channels | Primarily online, specialty pet stores, subscription boxes, and select grocery chains. | Veterinary clinics, online, health-focused pet stores, subscription boxes. | Specialty pet stores, online platforms, and subscription services. | All major channels including online and physical stores |

Challenges | High production costs, consumer price sensitivity, and ingredient transparency issues. | Consumer education, regulatory approval for health claims, and formulation complexities. | Limited consumer understanding, higher production costs, and competition from mass-market brands. | Stiff competition, commoditization, and lack of product differentiation. |

Key Players | Blue Buffalo, Wellness Pet Company, Castor & Pollux. | Greenies, Zuke’s, Hill's Science Diet, Nutramax Labs. | Earthborn Holistic, Orijen, Merrick Pet Care. | Purina, Pedigree, Milk-Bone, Meow Mix. |

Regional Dynamics and Competition

The North American market is strongly driven by pet humanization, strong growth in pet ownership, increasing consciousness towards pets’ health, and increasing trend of premium and super-quality pet treats. As per the American Pet Products Association, more than 65% of U.S. households own a pet, thus, resulting in one of the biggest markets in the world. Pet owners are progressively treating their pets like family members, resulting in an increase in premiums and personalized care alternatives. Opportunities exist in growing the availability of grain-free, allergen-free, and customized subscription-based treat boxes that cater to a variety of pet demands. As customers become more environmentally concerned, environmentally conscious packaging and sustainable ingredient sourcing provide further development opportunities.

Some of the major players analyzed in this report are Benevo, Hill’s Pet Nutrition, Evolution Diet, Freshpet, Mars, Incorporated, Nestle S.A., Supreme Petfoods, THE PACK, V-Dog, Wild harvest, Heristo AG, Diamond pet foods, Captain Zack, Pet Munchies, Arden Grange, Royal Canin SAS, and The pet beastro

Pet Treats Market News Release

In 2024, Aihtsham Rashid established a 100% halal-certified pet food company in the United Kingdom, beginning with cat food.

In 2024, Green Boy, a global provider of plant-based food components, opened a new branch dedicated to offering pet food makers a diverse selection of plant-based ingredients, such as starches, sugars, proteins, and fiber.

In 2023, Omni, a vegan pet food company located in the United Kingdom, recently introduced a meat-like vegan dog food product and wants to grow its worldwide footprint by commencing sales in Western Europe, to capture a significant portion of vegan pet food sales in these nations.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the pet treats market segments, current trends, estimations, and dynamics of the pet treats market analysis from 2021 to 2031 to identify the prevailing pet treats market opportunities.

The pet treats market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the pet treats market segmentation assists to determine the prevailing pet treats market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global pet treats market.

Pet treats market player positioning facilitates benchmarking and provides a clear understanding of the present position of the pet treats market players.

The report includes the analysis of the regional as well as global pet treats market trends, key players, market segments, application areas, and market growth strategies.

Pet Treats Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 29.7 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 237 |

| By Pet Type |

|

| By Form |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | V-Dog, The Pet Beastro, , Nestle S.A., Hill's pet nutrition Inc, The Pack, The Hartz Mountain Corporation, wild harvest, Royal Canin, Pet Munchies, Canine India, arden grange pet foods, Captain Zack, Mars Petcare Inc |

Analyst Review

The pet industry has witnessed a rapid humanization of pets in developed and developing regions. The pet owners are increasingly nursing their cats, dogs, birds, and other pets like family members. With the pet food constituting around 76% of the pet care industry, the pet treats manufacturers focus on offering the quality treats as per the owners’ tastes & preferences. According to Pet Food Industry, around 95% of pet owners consider their pets to be a part of the family. Therefore, the quality of ingredients used for the preparation of pet treats is taken into consideration while purchasing. The rising pet humanization has staggered the overall pet treats market.

However, concerns regarding the health of the pet has gained huge traction from the last few years, owing to owners’ love toward their pets and strict government policies. For instance, as per the law of Queensland government, pet owners are required to register their pets in the council areas and provide their pets with the required appropriate shelter, food, and total care. In addition, the government also provide extensive animal welfare to provide utmost care, love, and best possible quality of life to them. However, with the rise in disposable income of the pet owners, the spending over nutrition and food has raised from the owners side to minimize the risk of any possible animal diseases among their dogs. Therefore, growing awareness regarding proper vaccination and importance of pet food for dogs among owners propel the whole pet health industry, which contributes to the growth of the pet food in the market.

The global pet treats market was valued at $20,066.4 million in 2021, and is projected to reach $29,715.5 million by 2031, registering a CAGR of 4.2%.

From 2022-2031 would be forecast period in the market report

$20.1 billion is the market value of pet treats market in 2021.

2021 is base year calculated in the pet treats market report

Benevo, Hill’s Pet Nutrition, Evolution Diet, Freshpet, Mars, Incorporated, Nestle S.A., Supreme Petfoods, THE PACK, and V-Dog are the top companies hold the market share in pet treats market.

Loading Table Of Content...