Petroleum Resins Market Overview

The global petroleum resins market was valued at USD 2.5 billion in 2018, and is projected to reach USD 4.0 billion by 2028, growing at a CAGR of 5.2% from 2023 to 2028.

Report Key Highlighters:

- Quantitative information mentioned in the global petroleum resins market includes the market numbers in terms of value (USD Million) and volume (Kilotons) with respect to different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided based on resin type, application, end-use industry. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter's Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Arakawa Chemical Industries, Ltd., Exxon Mobil Corporation, Henan Anglxxon Chemical Co.,Ltd., INNOVA (TIANJIN) Chemical Co.,LTD, Kolon Industries, Inc., Lesco Chemical Limited, Neville Chemical Company, Puyang Tiancheng Chemical Co.,Ltd., RuiSen ReSin Co. Ltd., and Synthomer PLC, hold a large proportion of the petroleum resins market.

- This report makes it easier for existing market players and new entrants to the petroleum resins business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

The byproducts of petroleum cracking are petroleum resins. These materials are also referred to as hydrocarbon resins. These are synthetic resins created through chemical processes and polymerization. Various feedstock, including aliphatic (C5), aromatic (C9), DCPD (dicyclopentadiene), and mixtures thereof, are used to produce petroleum resins.

Petroleum resins are utilized in a variety of applications, such as paints, coatings, adhesives and sealants, rubber, inks, and plastic compounding industries, and others. Moreover, there has been an increase in the demand for petroleum resins in hot melt adhesives. This is due to its characteristics, which include low odor and high thermal stability.

Excellent adhesion of petroleum resins, even at high temperatures and pressures, is one of the primary factors driving the global market for petroleum resins. The substantial demand for petroleum resins from a variety of end-use industries, such as coatings, paints, adhesives and sealants, and inks, polymerization and chemical processing contributes toward the expansion of the market. The rise in cost of feedstock is a significant challenge for the global market since naphtha, which is derived from crude oil, is the feedstock for petroleum resins. Due to the volatility of crude oil prices, the prices of these petroleum-based resins are typically unstable.

This has a negative effect on manufacturers' profitability, which is anticipated to impede market expansion. The development of environment-friendly bio-based resin composites is another factor that impedes the expansion of the global market for petroleum resins. The bio-based alternatives have a lower volatile organic compound (VOC) content and are typically safer than petrochemical resins. There is a growing trend of expanding the product portfolio with innovative products as the market for petroleum resins is consolidated, with a small number of global players holding the majority of market shares. Manufacturers are utilizing product innovation as a differentiating characteristic to gain an advantage over their rivals. On the global petroleum resins market, there has also been continuous research and development for the creation of a higher grade with enhanced properties and thermal stability.

The producers of petroleum resins are discovering new market opportunities in applications such as protective coatings, roofing, and the closures of cases and cartons. Chemical companies are investing more money into their research bases to improve their capacity to produce resins with superior pigment wetting, thermoplastic, and non-reactive properties. This is being done to increase the amount of end-use product and raw material that is taken in.

The production of resins that are excellent at water repellency, have a low molecular weight, and provide good color stability in commercial printing inks is increasing. These resins are highly sought after due to the qualities that they possess. Both reinforcing and non-reinforcing fillers can be used by companies in the hydrocarbon resins industry to produce products with enhanced self - adhesive retention and resistance to oxygen and ultraviolet (UV) light. In the production of these goods, it is possible to make use of either reinforcing or non-reinforcing fillers as appropriate.

Countries such as Japan and South Korea are experiencing a surge as a result of the growth in urbanization as well as the robust growth of the automotive and construction sectors. This growth provides opportunities for key market players in the petroleum resins market. In addition, the building and construction industry, particularly in China and India, is a significant contributor to the expansion of the market.

Key Market Players

The major players operating in the global petroleum resins market Arakawa Chemical Industries,Ltd., Exxon Mobil Corporation, Henan Anglxxon Chemical Co.,Ltd., INNOVA (TIANJIN) Chemical Co.,LTD, Kolon Industries, Inc., Lesco Chemical Limited, Neville Chemical Company, Puyang Tiancheng Chemical Co.,Ltd., RuiSen ReSin Co. Ltd., and Synthomer PLC.

Segment Overview

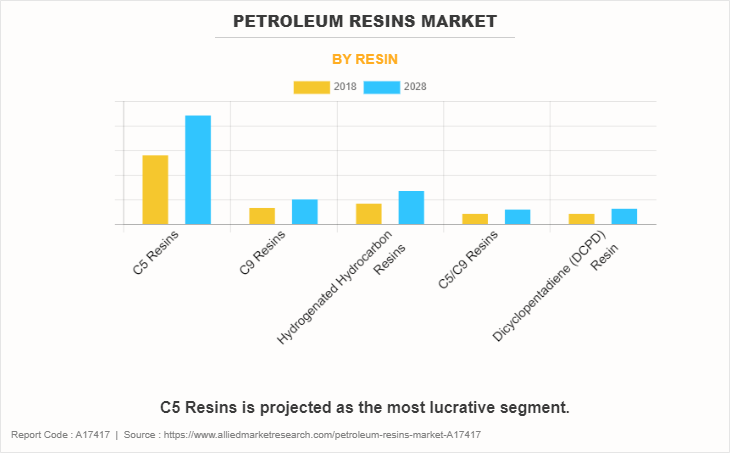

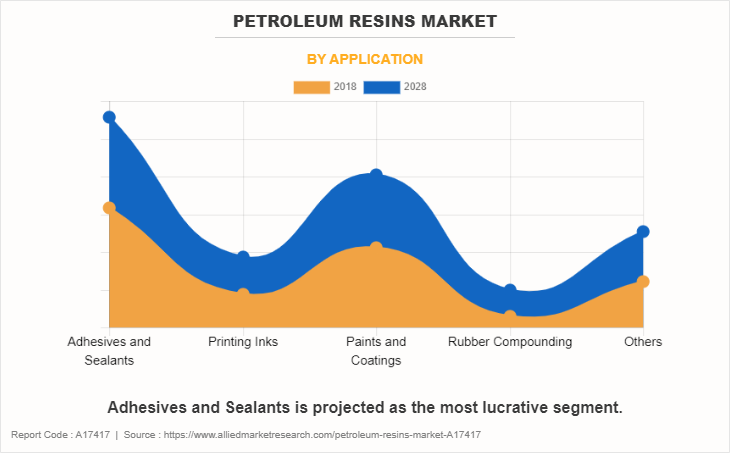

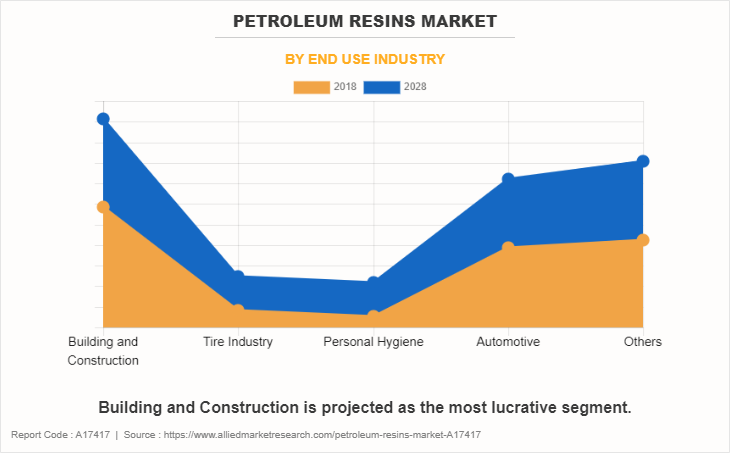

The petroleum resins market is segmented into resin type, application, end-use industry and region. Depending on resin type, the market is divided into C5 resins, C9 resins, hydrogenated hydrocarbon resins, C5/C9 resins and dicyclopentadiene (DCPD) resin. On the basis of application, it is categorized into adhesives & sealants, printing inks, paints & coatings, rubber compounding and others. On the basis of end-use industry, it is classified into building & construction, tire industry, personal hygiene, automotive and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

By resin, the C5 resins segment held the largest market share in 2022. Increased consumption of petroleum resins in paints & coatings, synthetic rubber, tapes, and labels is anticipated to drive the market growth during the forecast period. The demand for petroleum resin is expected to be fueled by its widespread use in a variety of applications, such as hot melt adhesives, rubber, plastic modification, and wax modification, as well as its many benefits, including excellent thermal stability, peeling strength, tack ability, and heat resistance.

By application, the adhesives and sealants segment held the largest market share in 2022. Increase in technical advancements and R&D activities has surged the demand for a wide range electrical & electronic devices such as tablets, smartphones, laptops, and others where adhesives and sealants are widely used for bonding various components. This acts as one of the key drivers for the growth of the adhesives and sealants industry.

By end-use industry, the building and construction segment held the largest market share in 2022. Petroleum resins are essential components in various construction materials, adhesives, sealants, coatings, and composite products, contributing to the sector's growth and innovation. Several drivers and trends shape the use of petroleum resins in this industry, paving the way for further advancements and applications. One significant driver for the increased adoption of petroleum resins in building & construction is their exceptional binding and adhesive properties.

By region, the market is categorized into North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region is one of the fastest-growing regions in the world. Asia-Pacific has experienced a surge in the use of petroleum resins in various industries due to several driving factors. First and foremost, the rapid industrialization and economic growth in countries such as China & India, and Southeast Asian nations have increased the demand for raw materials, including petroleum resins. These resins find extensive application in adhesives, coatings, and printing inks, catering to the booming manufacturing sectors.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the petroleum resins market analysis from 2018 to 2028 to identify the prevailing petroleum resins market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the petroleum resins market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global petroleum resins market trends, key players, market segments, application areas, and market growth strategies.

Petroleum Resins Market Report Highlights

| Aspects | Details |

| Market Size By 2028 | USD 4 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2018 - 2028 |

| Report Pages | 379 |

| By Resin |

|

| By End Use Industry |

|

| By Application |

|

| By Region |

|

| Key Market Players | Lesco Chemical Limited, Henan Anglxxon Chemical Co.,Ltd., Synthomer PLC, INNOVA (TIANJIN) Chemical Co.,LTD, Neville Chemical Company, Exxon Mobil Corporation, Arakawa Chemical Industries,Ltd., RuiSen ReSin Co. Ltd., Puyang Tiancheng Chemical Co.,Ltd., Kolon Industries, Inc. |

Analyst Review

According to the perceptive of the CXOs of leading companies, increase in demand for personal hygiene products, automobiles, building and construction materials, paints, packaging tapes, sealants and tires drives the growth of the petroleum resins market. The adhesive bond strength and resilience to alkalis, acids and water are enhanced by petroleum resins.

In addition, they are utilized due to their tackiness, remarkable thermal stability, high melting point and peeling strength. Governments throughout the world are enacting stringent laws addressing emissions of volatile organic compounds (VOCs) from car coatings, hence increasing the need for petroleum resins with low VOC emissions. Governments in nations such as the U.S, India, Germany, and China are expanding expenditure in the packaging industry, which is also driving market expansion.

Petroleum resins are commonly used in adhesives and sealants. The construction and automotive industries, in particular, were driving the demand for adhesives and sealants, which, in turn, was boosting the petroleum resin market.

Adhesives and Sealants application are the potential customers of Petroleum Resins market industry

Asia-Pacific region will provide more business opportunities for Petroleum Resins market in coming years

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Arakawa Chemical Industries,Ltd., Exxon Mobil Corporation, Henan Anglxxon Chemical Co.,Ltd., INNOVA (TIANJIN) Chemical Co.,LTD, Kolon Industries, Inc., Lesco Chemical Limited, Neville Chemical Company, Puyang Tiancheng Chemical Co.,Ltd., RuiSen ReSin Co. Ltd., and Synthomer PLC are the top players in Petroleum Resins market.

Loading Table Of Content...

Loading Research Methodology...