Pharmacovigilance Market Research, 2034

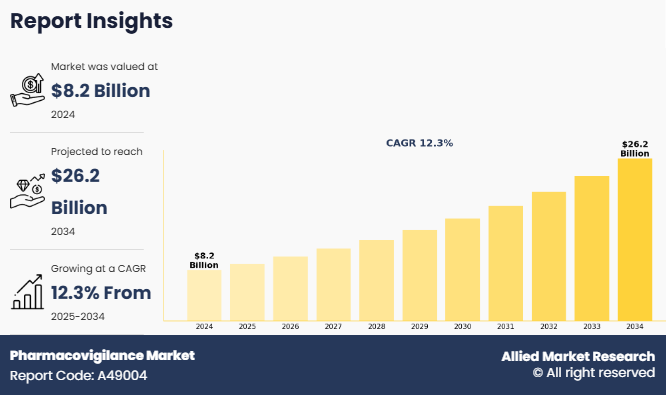

The global pharmacovigilance market size was valued at $8.2 billion in 2024, and is projected to reach $26.2 billion by 2034, growing at a CAGR of 12.3% from 2025 to 2034. The pharmacovigilance market outlook is experiencing robust growth, driven by increasing awareness about drug safety, stringent regulatory mandates, and a surge in adverse drug reaction (ADR) reporting across the globe.

There is a growing emphasis on post-marketing surveillance to ensure patient safety as pharmaceutical and biotechnology companies continue to expand their product pipelines, especially in chronic and rare diseases. According to industry estimates, adverse drug reactions rank among the top ten leading causes of death globally. For instance, the World Health Organization (WHO) reports that ADRs contribute to 5% of hospital admissions in developed countries, highlighting the need for effective pharmacovigilance systems. As a result, companies are increasingly adopting pharmacovigilance solutions to detect, assess, and prevent adverse effects, which in turn is boosting growth of the pharmacovigilance market size.

Pharmacovigilance is the scientific discipline focused on the detection, assessment, understanding, and prevention of adverse effects or any other drug-related problems. It plays a critical role in ensuring the safety and efficacy of pharmaceutical products throughout their lifecycle, from clinical trials to post-marketing surveillance. Pharmacovigilance has become essential for maintaining public health and regulatory compliance with the growing complexity of drug therapies and rising regulatory requirements. It enables pharmaceutical companies, healthcare providers, and regulatory bodies to monitor real-world drug performance, minimize risks, and make informed decisions to protect patient safety and improve therapeutic outcomes.

Key Takeaways

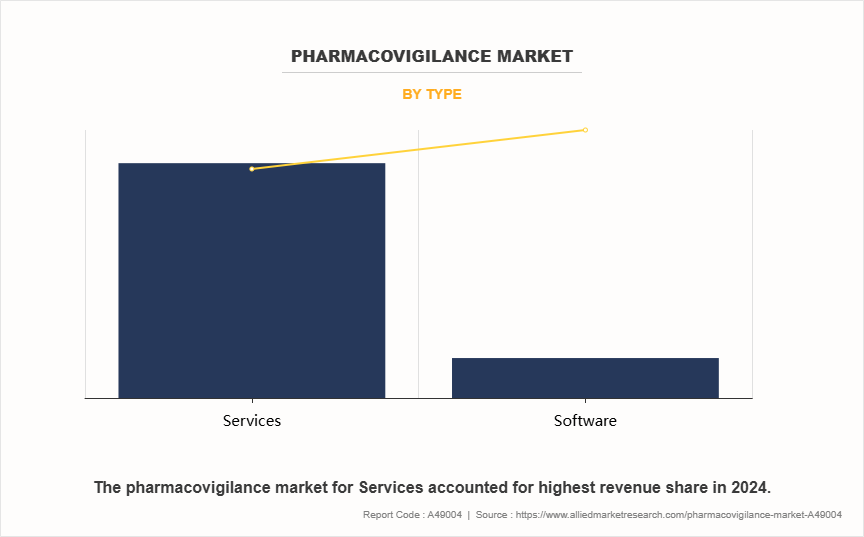

- On the basis of type, the service segment dominated the pharmacovigilance market in terms of revenue in 2024. However, the software segment is anticipated to grow at the fastest CAGR during the forecast period.

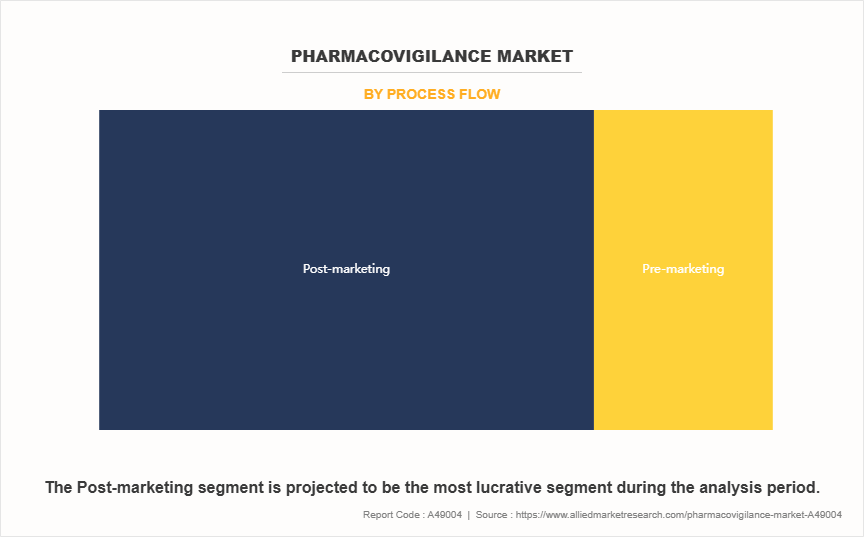

- On the basis of process flow, the post-marketing segment dominated the pharmacovigilance market in terms of revenue in 2024. However, pre-marketing is anticipated to grow at the fastest CAGR during the forecast period.

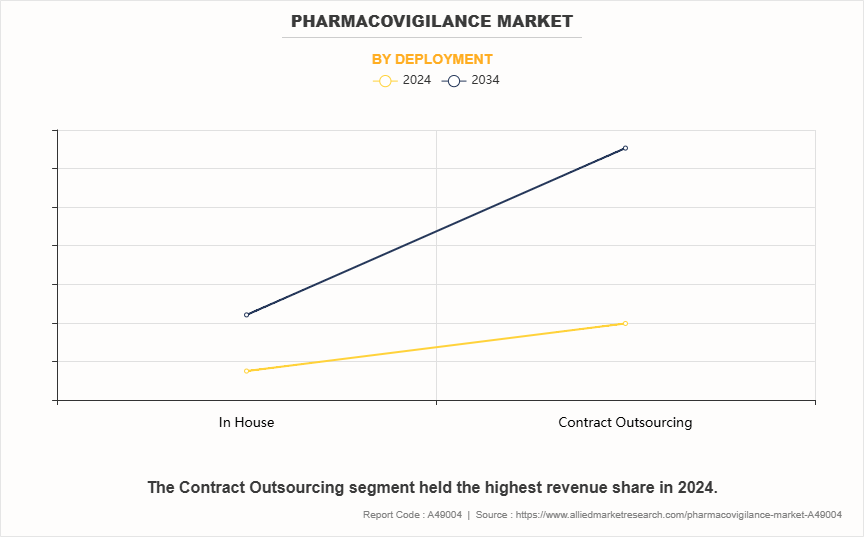

- On the basis of deployment, the contract outsourcing segment dominated the pharmacovigilance market in terms of revenue in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

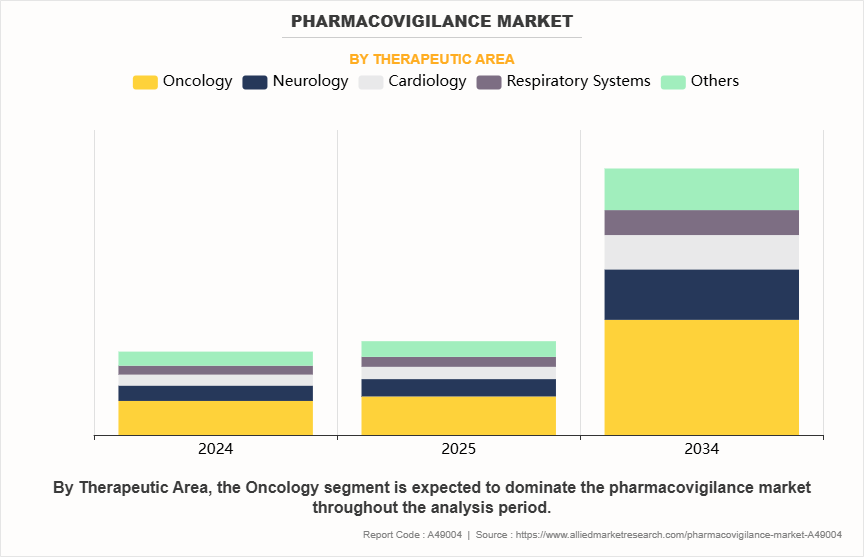

- On the basis of therapeutic area, the oncology segment dominated the pharmacovigilance market in terms of revenue in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

- Region-wise, North America generated the largest revenue in pharmacovigilance market in 2024. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The rise in drug development activities, particularly with the advent of novel biologics and personalized medicine is the major driver for the pharmacovigilance market growth. Pharmacovigilance plays a crucial role in ensuring patient safety across all phases of drug development with over 18,000 clinical trials currently active worldwide (as of 2024). Moreover, regulatory agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and India’s Central Drugs Standard Control Organization (CDSCO) have implemented stringent pharmacovigilance regulations, pushing pharmaceutical companies to invest in advanced safety monitoring platforms which further drive the pharmacovigilance market growth. For example, the implementation of the EudraVigilance system in Europe has significantly improved ADR reporting transparency and accessibility for healthcare professionals.

However, the market faces several restraints which hinder pharmacovigilance market growth. One of the major challenges is the lack of standardization and harmonization in global reporting requirements. Different countries and regions have varying regulatory expectations, making it difficult for multinational pharmaceutical companies to ensure compliance. In addition, high costs associated with setting up pharmacovigilance systems, especially in low- and middle-income countries, act as a barrier for smaller firms. There is also a shortage of skilled pharmacovigilance professionals, which limits the capacity of companies to scale up operations quickly. Data privacy and concerns about sharing sensitive patient information across borders further complicate the landscape.

Nevertheless, increase in adoption of artificial intelligence (AI) and machine learning (ML) in pharmacovigilance processes is expected to enhance signal detection, automate case processing, and reduce human error, which is opportunistic for the growth during pharmacovigilance market forecast. Startups and tech firms are now collaborating with pharma companies to build AI-driven safety platforms. Furthermore, the growing trend of outsourcing pharmacovigilance services to contract research organizations (CROs) and third-party vendors is creating a more cost-effective ecosystem. Emerging economies like India, Brazil, and South Africa are also investing in strengthening their regulatory frameworks, which is expected to create new growth avenues for pharmacovigilance market players. Additionally, real-world evidence (RWE) and electronic health records (EHRs) are increasingly being integrated into pharmacovigilance systems, offering richer datasets for comprehensive safety monitoring and proactive risk management.

Segmental Overview

The pharmacovigilance industry is segmented into type, process flow, deployment, therapeutic area, and region. On the basis of type, it is bifurcated into services and software. The service segment is further divided into spontaneous reporting, intensified ADR reporting, targeted spontaneous reporting, and others. On the basis of process flow, the pharmacovigilance market is segregated into pre-marketing and post-marketing. On the basis of deployment, the pharmacovigilance market is categorized into in-house and contract outsourcing. On the basis of therapeutic area, the pharmacovigilance market is classified into oncology, neurology, cardiology, respiratory system and others. Region-wise, the pharmacovigilance market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Type

On the basis of the type, pharmacovigilance market is bifurcated into services and software. The services segment accounted for the largest pharmacovigilance market share in terms of revenue in 2024 owing to the widespread reliance on external expertise and scalable service models offered by Contract Research Organizations (CROs), which can efficiently handle regulatory reporting, case processing, and risk management across multiple regions. Many pharmaceutical companies prefer service providers for their flexibility, rapid deployment capabilities, and ability to manage multi-country compliance in a cost-effective manner.

However, the software segment is expected to register the highest CAGR during the forecast period of pharmacovigilance market. This is attributed to the increasing shift towards automation and predictive analytics in pharmacovigilance workflows. Advanced platforms with AI-powered safety signal detection and real-time dashboards are helping companies streamline decision-making and accelerate compliance reporting, making these tools increasingly indispensable.

By Process Flow

On the basis of process flow, the pharmacovigilance market is classified into pre-marketing and post-marketing. The post-marketing segment accounted for the largest pharmacovigilance market share in terms of revenue in 2024 due to the growing volume of newly approved drugs, especially complex biologics, requiring long-term safety monitoring in diverse, real-world patient populations. Additionally, increased regulatory mandates and patient safety concerns are reinforcing the need for continuous vigilance post-commercialization.

However, the pre-marketing segment is expected to register the highest CAGR during the forecast period as companies increasingly focus on integrating safety evaluations early in the drug development process. Growing regulatory scrutiny during clinical trials and a shift towards early risk identification are compelling pharmaceutical firms to enhance pharmacovigilance protocols during Phase I–III trials.

By Deployment

On the basis of deployment, the pharmacovigilance market is classified into in-house and contract outsourcing. The contract outsourcing segment accounted for the largest share in terms of revenue in 2024 and is expected to register the highest CAGR during the forecast period. This is attributed to the increasing need for agile and cost-efficient pharmacovigilance operations, where outsourcing provides access to scalable infrastructure, specialized domain knowledge, and 24/7 global coverage. As compliance burdens rise, many life sciences companies are opting for strategic partnerships with CROs to improve focus on core R&D functions and accelerate go-to-market timelines.

By Therapeutic Area

On the basis of therapeutic area, the pharmacovigilance market is classified into oncology, neurology, cardiology, respiratory systems, and others. The oncology segment accounted for the largest share in terms of revenue in 2024 and is expected to register the highest CAGR during the forecast period. This is due to the rapid pace of innovation and approvals in oncology, including immunotherapies and precision-targeted treatments, which are associated with complex pharmaceutical safety profiles and higher risks of severe adverse events. The demand for robust and specialized pharmacovigilance in oncology is also fueled by regulatory pressure to provide comprehensive real-world safety data for drugs used in life-threatening conditions.

By Region

Region-wise, North America dominated the pharmacovigilance market share in 2024. This was attributed to the presence of a well-established pharmaceutical industry, strong regulatory frameworks led by agencies such as the U.S. Food and Drug Administration (FDA) and Health Canada, and the high volume of clinical trials conducted across the region. Additionally, the early adoption of advanced pharmacovigilance technologies such as artificial intelligence, automation, and real-time analytics by leading biopharmaceutical companies and Contract Research Organizations (CROs) has further strengthened market growth.

However, the Asia-Pacific region is expected to register the highest CAGR during the forecast period. This is due to a combination of rapidly expanding pharmaceutical manufacturing, increased government investments in regulatory capacity building, and the growing number of international clinical trials being conducted in cost-effective markets like India and China. The region's rising commitment to global pharmacovigilance standards and the adoption of digital health platforms are significantly boosting growth prospects.

Competition Analysis

The major companies profiled in the report include Accenture, Cognizant, Oracle Corporation, Labcorp, ICON Plc., Capgemini, Clario, Wipro Limited, IQVIA, and Parexel. The key players operating in the market have adopted collaboration and partnership as their key strategies to expand their product portfolio.

Recent Developments in Pharmacovigilance Industry

- In January 2025, IQVIA partnered with NVIDIA aimed at advancing "agentic AI" applications across the therapeutic lifecycle. By integrating IQVIA’s vast data assets and analytics framework—known as Connected Intelligence with NVIDIA’s AI Foundry services, the collaboration seeks to automate complex R&D and commercialization workflows while maintaining rigorous privacy, safety, and regulatory standards.

- In January 2025, Cognizant partnered with Medidata, a Dassault Systems brand and leader of clinical trial solutions to the life sciences industry, to provide support for Medidata's life sciences clients and expand the strategic alliance partnership.

- In April 2025, Parexel announced a collaboration with Palantir to enhance clinical trial delivery. Through this partnership, Parexel will integrate Palantir’s Foundry and Artificial Intelligence Platform (AIP) into its clinical data infrastructure to improve trial efficiency, enhance data transparency, and accelerate the time-to-market for new therapies.

- In March 2023, ICON plc and LEO Pharma announced a strategic partnership aimed at accelerating the execution of clinical trials in the field of medical dermatology.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pharmacovigilance market analysis from 2024 to 2034 to identify the prevailing pharmacovigilance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pharmacovigilance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pharmacovigilance market trends, key players, market segments, application areas, and market growth strategies.

Pharmacovigilance Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 26.2 billion |

| Growth Rate | CAGR of 12.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 391 |

| By Type |

|

| By Process Flow |

|

| By Deployment |

|

| By Therapeutic Area |

|

| By Region |

|

| Key Market Players | Clario, Accenture, Cognizant, labcorp, Oracle Corporation, IQVIA, Parexel, Capgemini, Wipro Limited, ICON Plc |

Analyst Review

The market has witnessed steady growth due to increasing regulatory scrutiny, rising volumes of adverse drug reaction (ADR) reports, and the expanding complexity of drug development. Pharmaceutical and biotechnology companies are increasingly prioritizing drug safety and compliance throughout the product lifecycle, which has significantly driven demand for pharmacovigilance services and software solutions. CXOs emphasized that the surge in clinical trial activity across therapeutic areas especially in oncology, neurology, and rare diseases combined with global harmonization of safety standards, has expanded the need for real-time and scalable pharmacovigilance systems.

Additionally, the trend toward outsourcing pharmacovigilance functions to Contract Research Organizations (CROs) has enabled cost-effective and streamlined operations, particularly for small and mid-sized sponsors. They also highlighted that technological advancements such as artificial intelligence (AI), natural language processing (NLP), and automated signal detection are transforming traditional pharmacovigilance processes by enhancing data accuracy, reducing turnaround time, and improving compliance. Cloud-based platforms, integrated safety databases, and regulatory analytics dashboards are also gaining traction and reshaping how companies manage pharmaceutical safety monitoring globally.

North America accounted for the largest revenue share in 2024, supported by a mature pharmaceutical ecosystem, well-defined regulatory mandates from the U.S. FDA and Health Canada, and the presence of leading players like IQVIA, Parexel, and Labcorp. In contrast, the Asia-Pacific region is expected to register the highest CAGR over the forecast period, driven by rising clinical research activity, expanding pharmaceutical manufacturing, and growing regulatory emphasis on drug safety in countries like India, China, and South Korea.

The global pharmacovigilance market is witnessing trends such as increased adoption of AI and automation for signal detection and case processing, growing reliance on real-world evidence (RWE), and expanding outsourcing to specialized CROs. Integration of digital health data and harmonization of global regulatory frameworks are also shaping the market's future.

The leading application of the pharmacovigilance market is post-marketing surveillance (Phase IV), as it plays a critical role in monitoring the safety and effectiveness of drugs after they have been approved and are widely used by the public. This phase helps in detecting rare or long-term adverse events and ensuring ongoing regulatory compliance.

North America is the largest regional market for pharmacovigilance, driven by stringent regulatory requirements, high pharmaceutical R&D spending, widespread adoption of advanced technologies, and the presence of major pharmaceutical companies and CROs, particularly in the United States.

The pharmacovigilance market was valued at $8,202.49 million in 2024 and is estimated to reach $26,212.81 million by 2034, exhibiting a CAGR of 12.3% from 2025 to 2034.

The major companies profiled in the report include Accenture, Cognizant, Oracle Corporation, Labcorp, ICON Plc., Capgemini, Clario, Wipro Limited, IQVIA, and Parexel.

Loading Table Of Content...

Loading Research Methodology...