Pharmacovigilance Outsourcing Market Overview 2030

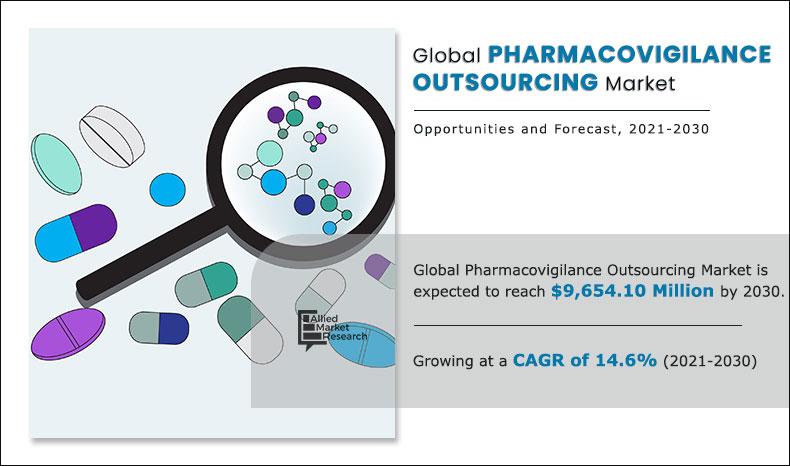

The global pharmacovigilance outsourcing market size was valued at $2,489.10 million in 2020 and is projected to reach $9,654.10 million by 2030 registering a CAGR of 14.60% from 2021 to 2030.

Transfer of drug safety operations and processes by a life science company to a third-party service provider is known as pharmacovigilance outsourcing. Collecting ADR data, case processing, developing risk management plans and risk evaluation mitigation strategies, and preparing and submitting aggregate and expedited pharmacovigilance reports are all routine pharmacovigilance activities that are commonly outsourced.

Rise in preference for outsourcing services, owing to benefits associated with pharmacovigilance outsourcing services such as cost-effective services and low operational expenses is one of the major factors that boost growth of the pharmacovigilance outsourcing market. In addition, increase in adverse drug reactions and drug toxicity associated with pharmaceutical products further fuel the market growth. Furthermore, high profile drug recalls due to safety concerns also rises the need for medical information by regulatory authorities, which anticipated to drive growth of the market. However, risk associated with data security and shortage of skilled professionals for maintaining compliance, which hampers growth of the market. In contrast, growth opportunities in emerging markets, owing to availability of cost-effective pharmacovigilance outsourcing services provided by leading CROs and BPOs in emerging economies create lucrative opportunities for the pharmacovigilance outsourcing market.

The outbreak of COVID-19 has disrupted workflows in the health care sector across the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. However, there has also been a positive effect and surge in demand for various medical services, including pharmacovigilance outsourcings. Medical monitoring and safety reporting are essential as several potential therapies are being used in the treatment of coronavirus-induced infection. Medications such as Lopinavir/Ritonavir, hydroxychloroquine (HCQ), and Remdesivir are being repurposed to treat coronavirus infection. The chances of suspected adverse drug reactions for some of these medicines have already been submitted to individual case safety reports database named VigiBase, managed by Uppsala Monitoring Centre (UMC). Thus, rise in incidences of adverse drug reactions is anticipated to accelerate demand for pharmacovigilance services amid such pandemics. Hence, the outbreak of COVID-19 has positively impacted the pharmacovigilance outsourcing market.

Pharmacovigilance Outsourcing Market Segmentation

The global pharmacovigilance outsourcing market is segmented on the basis of type, service providers, end user, and region. By type, the market is divided into adverse drug reaction capture (ADR), case processing, reporting and submission, report publishing, quality check, risk management, knowledge management, and enabling architecture. On the basis of service provider, it is segmented into contract research organization and business processing outsourcing. By end user, it is divided into pharmaceutical industry, research organization, and others. The others segment is further divided into regulatory organization and hospitals. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Review

Based on type, the case processing segment dominated the global market in 2020, and is anticipated to continue this trend during the forecast period. The key factors such as continuous increase in cases from various sources resulting from research and development and rise in need to ensure quality of data.

By Product

Case processing segment holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Based on service provider, contract research organization segment dominated the global market in 2020, and is expected to remain dominant throughout the forecast period. This is attributed to various advantages of contract research organization such as cost-effective services, time saving processes, advanced technological needs, and evolving and complex regulatory requirements.

Based on end user, the pharmaceutical industry segment held the largest market share in 2020, and is expected to remain dominant throughout the forecast period, owing to increase in adoption of outsourcing services by the pharmaceutical industry to avoid high upfront investments and fixed overhead costs, increase resource flexibility, and secure additional capacity.

By Application

Pharmaceutical industry segment is projected as one of the most lucrative segment.

Snapshot of the Asia-Pacific Pharmacovigilance Outsourcing Market

Asia-Pacific offers profitable opportunities for key players operating in the pharmacovigilance outsourcing market and is expected to register fastest growth rate during the forecast period, owing to economic development and low operating costs. The major driving factors for the market growth in this region include rise in focus in biopharmaceutical R&D, huge production of drugs, and surge in prevalence of cancer. In addition, strict regulations for reporting adverse drug reactions, coupled with large number of companies offering pharmacovigilance outsourcing services across the region. Furthermore, increase in funding for clinical trials further propel the regional pharmacovigilance outsourcing market growth.

By Region

North America is expected to experience growth at the highest rate, registering a CAGR of 13.20 % during the forecast period.

The key pharmacovigilance outsourcing market players profiled in the report include Accenture PLC., Bioclinica, Capgemini (IGate Corporation), Cognizant Technology Solutions Corporation, Ergomed Plc., Genpact Limited, International Business Machines Corporation, Icon Plc., IQVIA Holdings Inc. (Clintec), and Labcorp Drug Development (Covance).

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the global pharmacovigilance outsourcing market along with the current trends and future estimations to explain the imminent investment pockets.

- A comprehensive analysis of the factors that drive and restrict the pharmacovigilance outsourcing market growth is provided in the report.

- Comprehensive quantitative analysis of the industry from 2020 to 2028 is provided to enable the stakeholders to capitalize on the prevailing pharmacovigilance outsourcing market opportunities.

- Extensive analysis of the key segments of the industry helps to understand the application and services of pharmacovigilance outsourcing used across the globe.

- Key market players and their strategies have been analyzed to understand the competitive outlook of the market.

Key Market Segments

By Type

- Adverse Drug Reaction Capture (ADR)

- Case Processing

- Reporting and Submission

- Report Publishing

- Quality Check

- Risk Management

- Knowledge Management

- Enabling Architecture

By Service Provider

- Contract Research Organization

- Business Processing Outsourcing

By End User

- Pharmaceutical Industry

- Research Organization

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Pharmacovigilance Outsourcing Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By SERVICE PROVIDER |

|

| By END USER |

|

| By Region |

|

| Key Market Players | LABCORP DRUG DEVELOPMENT (COVANCE), BIOCLINICA INC., CAPGEMINI (IGATE CORPORATION), IQVIA HOLDINGS INC.(CLINTEC), GENPACT LIMITED, INTERNATIONAL BUSINESS MACHINES CORPORATION, COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION, ACCENTURE PLC., ERGOMED PLC., ICON PLC |

Analyst Review

Pharmacovigilance outsourcing (PVO) transfers execution of drug safety functions and processes to a third-party provider. These include primary pharmacovigilance activities such as case processing, as well as governance activities such as compliance management.

High profile drug recalls due to safety concerns, increase in trends of outsourcing services, owing to benefits offered by outsourced compliance providers over in-house compliance functions, and increase in adverse drug reactions and drug toxicity boost growth of the market. Furthermore, growth in opportunities in emerging economies create a lucrative opportunity for the market growth. However, risk associated with data security and shortage of skilled professionals for maintaining compliance are expected to hinder growth of the market.

The case processing segment is expected to remain dominant during the forecast period, owing to continuous increase in cases from various sources resulting from research and development and rise in need to ensure quality of data. Moreover, North America is expected to offer lucrative opportunities to the market during the forecast period, owing to rise in number of drug development activities in the U.S. and presence of major pharma and medical device companies in the region.

Pharmacovigilance outsourcing (PVO) transfers the execution of drug safety functions and processes to a third- party provider.

PV activities that are generally outsourced include collecting ADR information, case processing activities, development of risk management plans & risk evaluation mitigation strategy as well as creating & submitting aggregate and expedited PV reports.

High profile drug recalls due to safety concerns, increase in trends of outsourcing services owing to benefits offered by outsourced compliance providers over in-house compliance functions, and increase in adverse drug reactions and drug toxicity are some factors which boost growth of the market.

Top companies such as IBM corporation, Accenture plc., Cognizant, IQVIA holdings, and Labcorp held a high market position in 2020.

The market value of pharmacovigilance outsourcing market in 2021 is $2,827.30 million.

The total market value of pharmacovigilance outsourcing market is $2,489.10 million in 2020.

Case processing segment is the most influencing segment owing to owing to continuous increase in cases from various sources resulting from research and development and rising need for ensuring the quality of data.

High profile drug recalls due to safety concerns, increase in trends of outsourcing services owing to benefits offered by outsourced compliance providers over in-house compliance functions, and increase in adverse drug reactions and drug toxicity are some factors which boost growth of the market.

Asia-Pacific is expected to experience the highest growth rate during the forecast period, owing toStrict regulations for reporting adverse drug reactions coupled with large number of companies offering pharmacovigilance outsourcing services across the region.

The forcast period for pharmacovigilance outsourcing market is 2021 to 2030

Loading Table Of Content...