Phenolic Resin Market Research, 2031

The global phenolic resin market size was valued at $8.1 billion in 2021 and is projected to reach $12.8 billion by 2031, growing at a CAGR of 4.8% from 2022 to 2031.

Report key Highlighters:

The phenolic resin market has been analyzed in both value and volume. The value of market of the phenolic resin is analyzed in millions while the volume is analyzed in kilo tons.

- Global phenolic resin market is fragmented in nature with many players such as Akrochem Corporation, Allnex GMBH, Ashland Global Holdings Inc, ASK Chemicals GmbH, Bakelite Synthetics, BASF SE, Georgia-Pacific Chemicals, Hexcel Corporation, Kraton Corporation and Prefere Resins Holding GmbH. Also tracked key strategies such as product launches, acquisitions, mergers, expansion etc. of various manufacturers of phenolic resins.

- Included more than 20 countries in the report which covers market volume as well as market value for all the countries of phenolic resin market.

- Covered the detailed list of manufacturers by application of phenolic resin market. It covers the product information, application, and geographical presence of the companies.

- Conducted primary interviews with raw material suppliers, wholesalers, suppliers, and manufacturers of phenolic resin market to understand the market trends, growth factors, pricing, and key players competitive strategies.

Phenolic resin is synthesized from phenol and formaldehyde. It offers excellent mechanical properties, flame retardancy, flexibility, low cost, high thermal stability, and water & chemical resistance. All such attractive attributes have made it the material of choice in industries ranging from automotive, aerospace, and construction to electronics, industrial tools, paints, and coatings. Phenolic resins are used to make laminates, insulation panels, laminated paper, and waterproof adhesives & paints.

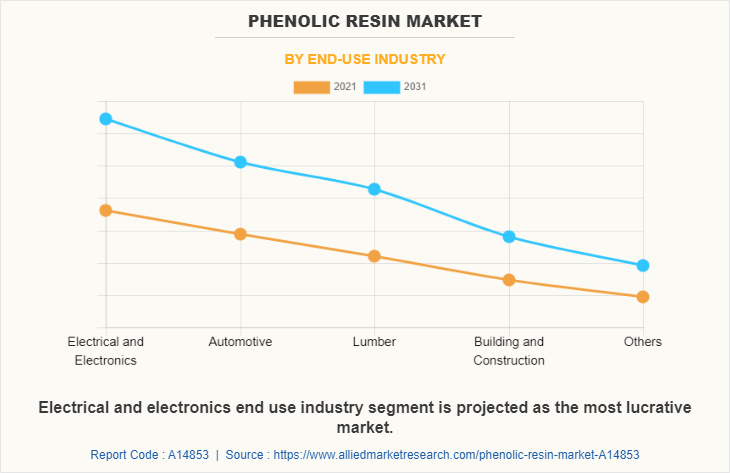

In the global phenolic resin industry, increase in demand for abrasive materials and coatings in the automotive sector is key to the growth factor. In addition, the rise in demand from the electronics and power industry for phenolic laminate drives the global phenolic resin market. Growth in population and industrialization is expected to increase demand for transformers and electronic appliances.This means more phenolic resins are used for producing laminates. In automotive end uses, phenolic resins are also used in making automotive tires, metal coatings, and seals.

Moreover, the future use of phenolic resin-based components in electric vehicle designs is expected to offer fresh opportunities for the phenolic resin market growth. Furthermore, the growth has increased demand for automotive components that make use of phenolic resins. Phenolic resins are blended with other materials to form a modified phenolic adhesive that is used in the automotive industry. Both Resol, as well as Novolac class of phenolic resins, will be used in adhesive applications during the forecast period, owing to high durability and dimensional stability. In automotive end uses, phenolic resins are also used in making automotive tires, metal coatings, and seals.

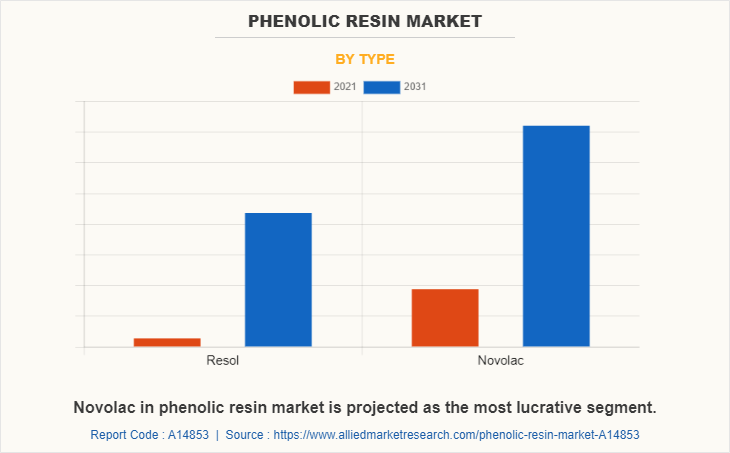

The Novolac phenolic resin is expected to show a significant growth rate over the forecast period. Novolac resins are produced by reacting an excess phenol with formaldehyde. It is available in solid as well as liquid solutions. These have a vast variety of applications that include molding additives and electrical laminates. Novolac resins are used as binding agents in making abrasive tools such as grinding wheels. These resins are also used as a tire tackifier, binder for refractories, carbon brakes, and photoresists. In the electronics industry, Novolac resins are used as epoxy curing agents for making electrical laminates. Novolac-cured epoxy resins are used to produce copper-clad laminates (CCLs) to improve thermo-mechanical and flame-retardant properties. Panels made from Novolac is ideal for producing three-dimensional components for furniture and interior design.

Rising Use of Phenolic Resin in Various Applications

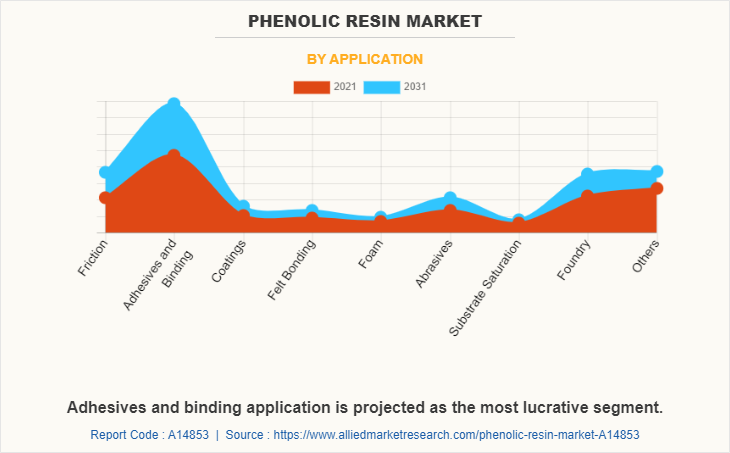

The use of phenolic resin is rising rapidly in various applications such as friction, adhesive & coating, foundry, foam, saturated substrate, etc. Phenolic resins are used as binders for friction materials, which are used for brake linings, brake pads, clutch plates of transmission, and others with superior heat resistance and adhesive performance. Phenolic resin offers superior heat resistance, good flexibility, high mechanical strength, and good friction properties. These benefits of phenolic resins for friction material drive the market during the forecast period. The use of phenolic resins in foundry applications increases energy savings and high-quality products. The use of a Novolac resin enables the use of lower temperatures than conventionally used in the shell process, thereby reducing energy consumption.

Phenolic resins are considered a very important class of adhesives as they are quite inexpensive and are available in both liquid formulations and films. In addition, the phenolic resin can withstand high temperatures with minimal deformation and when cured, it maintains its structural integrity. For instance, vinyl phenolic adhesives are a blend of phenolic resin and polyvinyl butyral resins. It shows high shear strength and has found use as a structural adhesive in the aerospace industry. All such factors drive demand for phenolic resins for adhesive applications.

Many applications use liquid phenolic resins to saturate substrates such as paper, fabrics, and wood. Phenolic resins receive preference, owing to their high mechanical strength, outstanding chemical resistance, and good flame-resistant properties. Typically, solvent-borne resol resins are used, but depending on specific products and processes, aqueous resol resins or resol-cured novolac resins in solvents are preferred. Typical application fields are paper laminates, engineered wood, and filter paper impregnation. Therefore, an increase in end-use industries of saturated substrates benefits market growth.

Insulation panels made of phenolic resins are used in building thermal insulation. It offers high-level fire, smoke, and toxicity performance. Phenolic foams are available as both open and closed cellular structures. A closed-cell structure is suitable for building insulation, whereas an open-cell structure is used for floral foam applications. In addition, low-density phenolic foams are ideally suited for orthopedic applications. Phenolic resins are also used to make floral foams, orthopedic foam, and mining foam.

In North America, Both the U.S. and Canada have a well-established furniture market and a residential housing sector that drives demand for phenolic resin-based products and materials. In North America, the U.S. is one of the biggest markets for electronics and semiconductors across the globe, thus requiring phenolic resins for photoresists.

According to data from the National Association of Manufacturers (NAM) electronics and the automotive industry are the top-tier manufacturing sectors that yield the highest revenue. These are also key end users of phenolic resins, thus driving the market growth. Similarly, Canada is also a major hub for circuit boards and computers that make use of phenolic laminates. In Mexico, the contract electronics manufacturing industry (CEM) has gained momentum in the last decade, owing to favorable investment policies in the country. This has increased demand for industrial and residential infrastructure, thereby making use of phenolic resin-based joint fillers and insulation panels. Thus, rapid urbanization and expanding end-use industries will be conducive to the North American phenolic resins market during the forecast period.

Furthermore, In Asia-Pacific, China and India are the largest countries that influence the Asia-Pacific phenolic resins market, owing to the large population and growth in residential and commercial building projects. According to a report by the United Nations (UN) in 2019, the real estate sector in India is expected to contribute 13% to the total GDP by 2025 and reach a market size of $1 trillion by 2030. This factor is expected to be conducive for the phenolic resins market. Furthermore, phenolic resins are part of the Indian specialty chemicals market and are expected to have a huge export potential during the forecast period

Development of Eco-friendly Phenolic Resin Raw Materials

However, the production of phenolic resins is expected to get hampered, owing to environmental and health concerns related to phenolic resin production. While the phenolic resin is considered relatively safe, raw materials used in their manufacture have significant safety issues. The World Health Organization (WHO) has listed formaldehyde as carcinogenic and the U.S. Occupational Safety and Health Administration (OSHA) has strictly limited their permissible exposure levels, owing to the health risk of these chemicals.

On the other hand, the development of alternative eco-friendly and sustainable feedstock for phenolic resins substitute petroleum feedstock is required in the production of phenolic resins. This is expected to reduce environmental pollution to minimize health and safety concerns pertaining to its production. Research is still required to replace conventional raw materials with clean materials completely as new products often have low mechanical strength and durability. Thus, the development of bio-based phenolic resins offers lucrative opportunities for the Global phenolic resin market growth.

The global phenolic resin market is segmented on the basis of type, application, end-use industry, and region. By type, the market is divided into resol and novolac. By application, it is divided into friction, adhesives & binding, coatings, felt bonding, foam, abrasives, substrate saturation, foundry, and others. On the basis of the end-use industry, the market is divided into electrical & electronics, automotive, lumber, building & construction, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key players in the phenolic resin industry include Akrochem Corporation, Allnex GMBH, Ashland Global Holdings Inc, ASK Chemicals GmbH, Bakelite Synthetics, BASF SE, Georgia-Pacific Chemicals, Hexcel Corporation, Kraton Corporation, Prefere Resins Holding GmbH.

Key players are focusing on acquisitions and mergers to expand their product portfolio and strengthen their production capacity. For instance, in 2022, ASK Chemicals Group completed the acquisition of the industrial resins business from U.S.-based SI Group. Purchase includes resin manufacturing sites in Rio Claro (Brazil), Ranjangaon (India), and Johannesburg (South Africa) as well as licensed technology and concluded multiple tolling agreements worldwide. With this acquisition ASK Chemicals has reinforced its position in the foundry market and at the same time taken a first and substantial step in building a phenolic industrial resins business.

Key players of phenolic resin are also focusing on launching new products for various applications to attract customers as well as to expand their product portfolio. For instance, in 2021, Allnex launched Phenodur PR 616/65B, a new, eco-friendly phenolic resin recommended for interior and exterior can coatings with a very low free formaldehyde value of < 0.1%. The new bio-based product helped Allnex to extend its product offerings.

On the basis of type, the Novolac resin segment accounted for 55.0% of the phenolic resin market share in 2021 and is expected to maintain its dominance during the forecast period. This is owing to its wide range of end-use applications in electronics, construction, automotive, and paints.

By application, it is divided into friction, adhesives & binding, coatings, felt bonding, foam, abrasives, substrate saturation, foundry, and others. The adhesives & binding segment accounted for the largest revenue share in the global phenolic resin market in 2021. Phenolic resin-based adhesives and binders have a wide spectrum of applications such as in automotive, rubber, furniture, aerospace, and machine tools.

On the basis of the end-use industry, the electrical & electronics segment accounted for the largest share in 2021 and is expected to maintain its dominance during the forecast period. This is owing to the use of phenolic resins for photoresists and circuit board applications

Region-wise, Europe accounted for the largest market share in the market and is projected to grow at a CAGR of 4.9% during the forecast period. An increase in construction and automotive markets in countries such as France and Germany has benefited the global phenolic resin market.

IMPACT OF COVID-19 ON THE GLOBAL PHENOLIC RESIN MARKET

The COVID-19 pandemic led to the temporary long-term halting of manufacturing and construction activities in major economies such as the U.S., Canada, and Germany. A similar economic decline was witnessed in other countries as well. This decline in manufacturing output and postponing of construction projects deeply hampered the global phenolic resin market.

KEY BENEFITS FOR STAKEHOLDERS

- The report provides an in-depth analysis of the global phenolic resin market trends along with the current and future market forecast.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analyses during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the phenolic resin industry for strategy building.

- A comprehensive global phenolic resin market analysis covers factors that drive and restrain market growth.

- The qualitative data in this report aims at market dynamics, trends, and developments.

Phenolic Resin Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12.8 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 350 |

| By Type |

|

| By Application |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | HEXCEL CORPORATION, PREFERE RESINS HOLDING GmbH, ASK CHEMICALS GMBH, ALLNEX GMBH, BASF SE, GEORGIA-PACIFIC CHEMICALS, ASHLAND GLOBAL HOLDINGS INC, BAKELITE SYNTHETICS, KRATON CORPORATION, AKROCHEM CORPORATION |

Analyst Review

According to leading CXOs, industries such as electronics, wood, automotive, construction, and aerospace are expected to propel the demand for phenolic resins during the forecast period. There are various grades of phenolic resins currently supplied by key players.

Modified phenolic is one such new product. Moreover, its high thermal and fire-resistant properties have made it ideal for building insulation applications. As the global construction rate rises, demand for insulation boards based on phenolic resins is expected to increase. Key players are focusing on developing and launching phenolic resins based on bio-based feedstock and looking to strengthen the Global phenolic resin market.

The global phenolic resin market was valued at $8.1 billion in 2021 and is projected to reach $12.8 billion by 2031, registering a CAGR of 4.8% from 2022 to 2031.

The global phenolic resin market is segmented on the basis of type, application end-use industry and region.

High demand for phenolic resin demand from the electronics and power industry for phenolic laminates and a rise in demand for abrasive and friction materials. These are the key factors driving the global phenolic resin market

The leading players in the market are Akrochem Corporation, Allnex GMBH, Ashland Global Holdings Inc, ASK Chemicals GmbH, Bakelite Synthetics, BASF SE, Georgia-Pacific Chemicals, Hexcel Corporation, Kraton Corporation, and Prefere Resins Holding GmbH.

Ever since the pandemic, industries across the sectors, such as electrical businesses, have experienced supply chain disruptions and significant delays in new installations in their offices as well as commercial applications. These steps hamper industries and pose challenges to their growth potential.

Loading Table Of Content...