Physiotherapy Equipment Market Research, 2032

The global physiotherapy equipment market size was valued at $1.6 billion in 2022, and is projected to reach $2.8 billion by 2032, growing at a CAGR of 5.6% from 2023 to 2032. Physiotherapy equipment refers to a variety of specialized devices, tools, machines, and instruments used by physiotherapists to assess, treat, and aid in the rehabilitation of patients. This equipment is designed to assist in improving mobility, strength, flexibility, and overall physical function. Physiotherapy equipment plays a crucial role in enhancing the effectiveness of treatment plans and helping patients achieve their therapeutic goals. Equipment aids in delivering therapeutic interventions such as exercises, stretches, and modalities to address specific conditions or goals. Equipment used in physiotherapy are electrotherapy equipment, cryotherapy equipment, ultrasound therapy, heat therapy equipment, combination therapy equipment, laser therapy equipment, magnetic therapy equipment and others.

Market Dynamics

Growth of the global physiotherapy equipment market size is majorly driven by increase in prevalence of chronic diseases, rise in number of orthopedic surgeries, and increase in number of geriatric population. Increase in prevalence of chronic diseases such as musculoskeletal diseases, cardiopulmonary disorders and others is anticipated to drive the demand for physiotherapy. Thus, this factor is anticipated to boost the growth of physiotherapy equipment market. For instance, physiotherapy such as electrotherapy, cryotherapy, laser therapy, ultrasound therapy and others are used in different musculoskeletal diseases such as arthritis, ligament sprain, muscle sprain, bone fracture and others.

Thus, increase in prevalence of arthritis is expected to witness rise in demand for physiotherapy and is anticipated to boost the growth of physiotherapy equipment market. For instance, according to the Center for Disease Control and Prevention (CDC), in November 2021, it was reported that, in the U.S, 24% of all adults, or 58.5 million people, have arthritis. In addition, according to published report World Health Organization (WHO) in July 2023, about 528 million people worldwide were living with osteoarthritis. 73% of people living with osteoarthritis are older than 55 years, and 60% are female. As per the same source, with a prevalence of 365 million, the knee is the most frequently affected joint, followed by the hip and the hand, over the globe.

Cardiorespiratory physiotherapy is an area of physiotherapy that specializes in the prevention, rehabilitation, and compensation of clients with diseases and injuries in the heart and lungs. Thus, rise in prevalence of cardiorespiratory diseases such as chronic obstructive pulmonary disease (COPD), asthma, bronchitis and others is anticipated to fuel the demand for physiotherapy equipment and boost the growth of market.

For instance, in September 2022, the Forum of International Respiratory Societies (FIRS), report displayed the immense burden of these lung diseases. An estimated 200 million people have COPD, of which about 3.2 million die each year, making it the third-leading cause of death worldwide. Asthma is one of the most common non-communicable diseases globally affecting 262 million people. Thus, rise in prevalence of chronic diseases such as musculoskeletal diseases, cardiopulmonary disorders and others is expected to fuel the demand for physiotherapy. Therefore, this factor is anticipated to boost the growth of physiotherapy equipment market.

Increase in the number of orthopedic surgeries such as knee replacement, joint replacement and others is anticipated to boost the growth of the market. Physiotherapy treatment after joint replacement surgery helps to build strength, improve balance, and reduce the risk of falls. Cryotherapy, continuous passive motion (CPM), neuromuscular electrical stimulation (NMES) and surface electromyographic (sEMG) are recommended for inclusion into rehabilitation protocols following arthroscopic knee surgery to assist with pain relief, recovery of muscle strength and knee function, which are all essential to accelerate recovery. Thus, this factor is anticipated to fuel the demand for physiotherapy equipment and boost the growth of the market.

For instance, according to report shared by American College of Rheumatology, in February 2023, approximately 790,000 total knee replacements and over 450,000 hip replacements are performed annually in the U.S. This number continues to grow as the population ages.

Moreover, rise in the number of geriatric populations is anticipated to increase the number of populations suffering from osteoarthritis. Thus, increase in the number of surgical procedures and demand for artificial joints is expected to fuel the growth of the physiotherapy equipment market. For instance, according to National Poll of Healthy Aging, in 2022, three in five adults of age group 50 years to 80 years (60%) reported that they have arthritis, with 30% reporting a diagnosis of osteoarthritis, that is, “wear and tear,” “bone-on-bone,” or degenerative arthritis. Less commonly reported types of arthritis were rheumatoid arthritis (8%), gout or pseudogout (7%), or another kind of arthritis (5%).

Moreover, in 2021, The Swedish Arthroplasty Register reported that around 46,777 population of age group 65 years to 74 years and around 58,020 population of 75 year to 84 years had undergone knee replacement surgery in Sweden. Thus, rise in prevalence of osteoarthritis in geriatric population is anticipated to increase the number of arthroplasty surgeries. Thus, this factor is anticipated to fuel the needs for physiotherapy in aging population and boost the growth of the market.

On the other hand, high cost of physiotherapy equipment is anticipated to hamper the growth of the market. For instance, Auto Therm 391 Shortwave Diathermy, a shortwave therapy device costs $8,783.40, Sonicator 740x Therapeutic Ultrasound therapy device costs $1,821.00. However, an unstable reimbursement scenario for physiotherapy, the shortage of skilled personnel, and the presence of alternative therapies such as acupuncture are the major factors that are expected to restrain the physiotherapy equipment market growth during the forecast period.

Segmental Overview

The physiotherapy equipment market share is segmented on the basis of type, application, end user, and region. By type, the physiotherapy equipment market share is segmented into equipment and accessories. By application, the market is divided into musculoskeletal, cardiopulmonary, neurology and others. By end user, the market is classified into hospitals, physiotherapy and rehabilitation centers, and others. Others include home care settings and specialty clinics.

On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

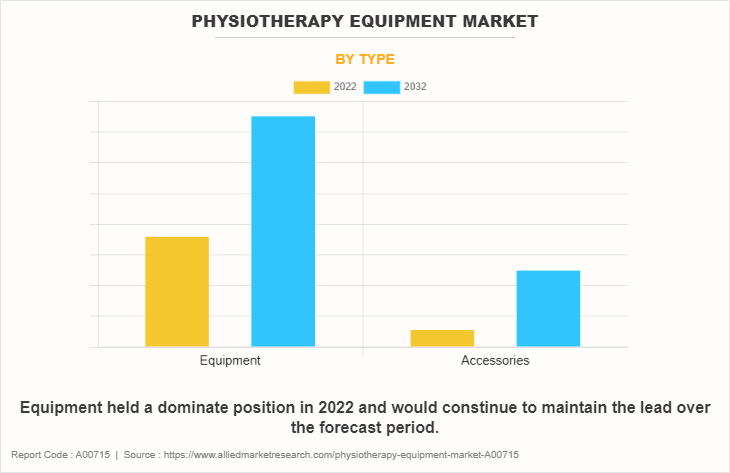

By Type

The market is segmented into equipment and accessories. The equipment segment dominated the market in 2022 and is expected to continue this trend during the forecast period, owing to rise in awareness among the population regarding physiotherapy and increase in number of populations suffering from chronic diseases such as musculoskeletal diseases, cardiopulmonary disorders, and others.

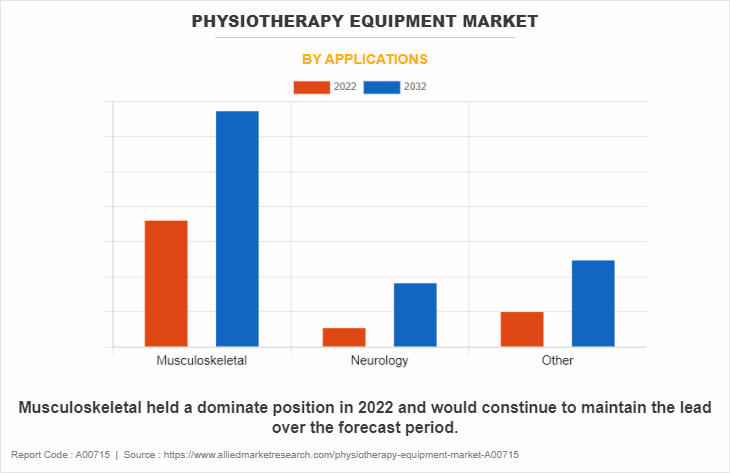

By Application

The market is classified into musculoskeletal, cardiopulmonary, neurology and others. The musculoskeletal segment dominated the market in 2022 and is expected to continue this trend during the forecast period, owing to an increase in adoption of physiotherapies to accelerate recovery of accidental injuries, rise in incidence of musculoskeletal disorder and rise in number of geriatric populations.

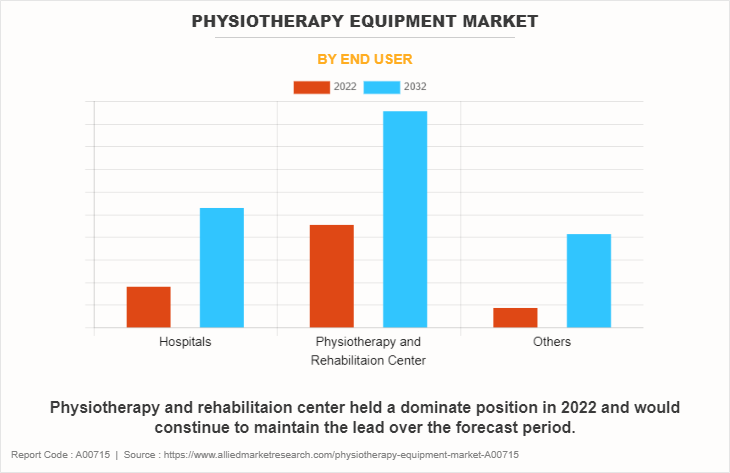

By End User

The physiotherapy equipment industry is classified into hospitals, physiotherapy and rehabilitation centers, and others. The physiotherapy and rehabilitation center segment dominated the market in 2022 and is expected to continue this trend during the forecast period, owing to increase in demand for advanced physiotherapy equipment and rise in awareness among people regarding effectiveness of physiotherapy and rehabilitation.

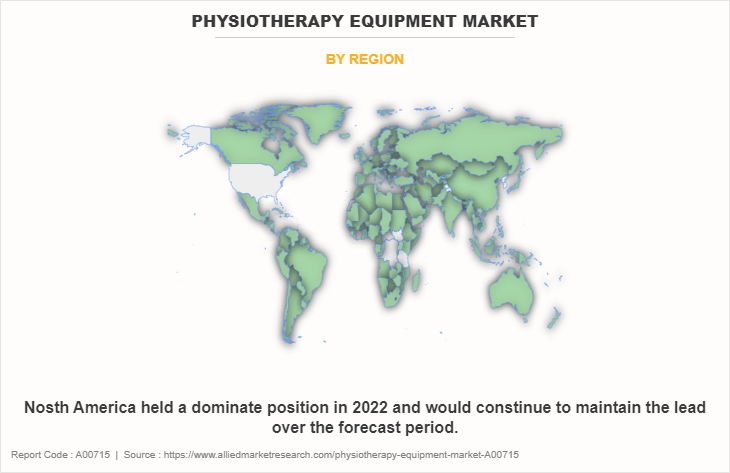

By Region

The North America physiotherapy equipment market opportunity is expected to grow during the forecast period, owing to rise in prevalence of musculoskeletal diseases. For instance, physiotherapy equipment is used in the treatment of different musculoskeletal diseases. Thus, rise in prevalence musculoskeletal diseases such as arthritis is anticipated to boost the growth of market. For instance, according to Center of Disease Control and Prevention, (CDC), in 2020, it was reported that 32.5 million U.S. adults have osteoarthritis. As per the same source, 62% of people with osteoarthritis are women.

In addition, more than 14 million Americans have symptomatic knee osteoarthritis. Therefore, rise in prevalence of osteoarthritis is anticipated to drive the demand for physiotherapy equipment to boost the growth of the market. Therefore, high presence of market players that manufacture physiotherapy equipment and increase in prevalence of chronic diseases are anticipated to boost the growth of the market in North America.

The Asia-Pacific physiotherapy equipment market forecast is expected to grow during the forecast period, owing to rise in prevalence of musculoskeletal diseases such as osteoarthritis and increase in the number of geriatric populations. The population suffering from osteoarthritis is anticipated to boost the number of arthroplasty surgeries and expected to increase the demand for physiotherapy equipment for post-surgical treatment and pain management. Thus, this factor is anticipated to drive the growth of the market in Asia-Pacific. For instance, Eva Hospital, in 2021, reported that osteoarthritis has been affecting more than 15 million adults annually in India.

In addition, geriatric population is more susceptible to osteoarthritis. Thus, rise in the number of geriatric populations is anticipated to increase the number of arthroplasty surgeries. Therefore, driving the growth of the physiotherapy equipment market in Asia-Pacific. The World Bank, in 2021 reported that, geriatric population in India was around 95,749,032.

Competition analysis

Some of the major companies that operate in the global physiotherapy equipment industry include EMS Physio Ltd, Enraf-Nonius B.V., Zimmer MedizinSysteme GmbH, Dynatronics Corporation, Performance Health, BTL Corporate, Storz Medical AG., Richmar, Enovis Corporation, and Zynex Medical Inc.

Recent product launch in the physiotherapy equipment market

In August 2023, Zynex, Inc., an innovative medical technology company specializing in the manufacture and sale of non-invasive medical devices for pain management, rehabilitation, and patient monitoring, announced the addition of three new therapy products centered around pain management. The new products include Zynex Pro Thoracic Lumbar Sacral Orthosis ("TLSO"), a dual-purpose back brace for the mid and lower spine; Zynex Pro Wrist, a wrist brace for a broad spectrum of wrist-related pain management including carpal tunnel syndrome, and Zynex Cryoheat, a localized cold or hot fluid therapy system for home or hospital use.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the physiotherapy equipment market analysis from 2022 to 2032 to identify the prevailing physiotherapy equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the physiotherapy equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global physiotherapy equipment market trends, key players, market segments, application areas, and market growth strategies.

Physiotherapy Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.8 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 363 |

| By Type |

|

| By Applications |

|

| By End User |

|

| By Region |

|

| Key Market Players | Richmar, Storz Medical AG, Performance Health, Zynex Medical Inc., EMS Physio Ltd., Enraf-Nonius B.V., Zimmer MedizinSysteme GmbH, Enovis Corporation, Dynatronics Corporation, BTL Corporate |

Analyst Review

Physiotherapy equipment are used in physiotherapy or physical therapy, which is a healthcare profession that involves the assessment, diagnosis, and treatment of patients with physical disabilities or impairments, such as musculoskeletal, neurological, and cardiovascular disorders. Physiotherapy equipment includes devices such as electrotherapy equipment, ultrasound equipment, heat therapy equipment, cold therapy equipment, compression therapy equipment, and exercise therapy equipment, among others.

Increase in number of product launch and product approvals of physiotherapy equipment is expected to drive the growth of market. For instance, in May 2021, Storz Medical received the 510(k) clearance for the MAGNETOLITH from the U.S. Food and Drug Administration (FDA). The therapy device is now cleared in the U.S. (as a class II medical device) for the relaxation of muscle spasms, prevention, or retardation of disuse atrophy, maintaining or increasing range of motion and others.

The top companies that hold the market share in physiotherapy equipment market are EMS Physio Ltd, Enraf-Nonius B.V., Zimmer MedizinSysteme GmbH and Dynatronics Corporation.

North America is anticipated to witness lucrative growth during the forecast period, owing to rise in number of population suffering from musculoskeletal diseases and high presence of market players.

The key trends in the physiotherapy equipment market are large presence of physiotherapy equipment manufacturers and rise in number of population suffering from musculoskeletal diseases, neurology diseases and others.

The base year for the report is 2022.

10 physiotherapy equipment companies are profiled in the report.

The total market value of physiotherapy equipment market is $1,621.98 million in 2022.

The forecast period in the report is from 2023 to 2032.

High cost of physiotherapy treatment is restraining factor for physiotherapy equipment market.

Loading Table Of Content...

Loading Research Methodology...