Pigments Market Size & Insights: 2032

The global pigments market was valued at $27.2 billion in 2022, and is projected to reach $45.4 billion by 2032, growing at a CAGR of 5.3% from 2023 to 2032.

Introduction

Pigments find wide usage across numerous industries, each harnessing their unique properties for specific applications. Pigments serve as the primary coloring agents for decorative paints, automotive coatings, industrial paints, and protective coatings. They provide the desired aesthetic color and protect surfaces from UV degradation, corrosion, and wear. In automotive coatings, for example, metallic and pearlescent pigments create a characteristic lustrous finish that enhances the vehicle’s appearance and value.

In addition to paints and coatings, the plastics industry extensively employs pigments to color polymer resins used in manufacturing consumer goods, packaging materials, automotive parts, and household items. Pigments incorporated into plastics must withstand high processing temperatures and maintain colorfastness over time, resisting fading from light exposure and chemicals. Special pigments in plastics can also impart functional benefits, such as UV resistance or thermal stability, crucial for outdoor applications.

Key Takeaways

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The pigments market is fragmented in nature among prominent companies such as KRONOS Worldwide, Inc., The Chemours Company, LANXESS, CLARIANT, BASF SE, and Tronox Holdings Plc.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global pigments market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,400 pigments-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global pigments market.

Market Dynamics

Pigments can be classified into two main categories: organic pigments and inorganic pigments. Organic pigments are carbon-based compounds and are typically derived from coal, petroleum, or plant sources. They offer a wide range of colors and are known for their vibrant hues, high tinting strength, and excellent colorfastness. Inorganic pigments, on the other hand, are mineral-based compounds and are derived from naturally occurring minerals or synthetic processes. They provide a broad range of colors and are valued for their lightfastness, heat stability, chemical resistance, and durability.

Growing population base has led to rapid urbanization in both developed and developing economies such as the U.S., China, India, and others. This has increased government spending on building & construction sector to develop various upcoming infrastructure projects. For instance, according to a report published by National Investment Promotion and Facilitation Agency, the infrastructure activities accounted for 13% share of the total foreign direct investment (FDI) inflows in 2021. Furthermore, rapid development of water supply, sanitation, urban transport, schools, and healthcare are aiding the growth of the building & construction sector.

Pigments are a crucial component of paints and coatings that are used in the construction sector. They provide color, enhance aesthetics, and protect surfaces from weathering, UV radiation, and corrosion. They are mixed with binders and other additives to create durable coatings for walls, ceilings, facades, and various structural elements. Moreover, pigments are added to concrete and cement-based products to give them color and improve their appearance. These factors are anticipated to fuel the demand for pigments in the growing building & construction sector.

Moreover, plastics are highly versatile materials that can be molded, extruded, and shaped into various forms. They are used in a wide range of industries, including packaging, automotive, construction, electronics, healthcare, and consumer goods. The ability of plastics to fulfill diverse requirements and replace traditional materials in many applications is driving the growth of the sector. According to a report published by the Federation of Indian Chambers of Commerce & Industry in 2022, plastic manufacturing industry is among one of the fastest growing industries in India.

Pigments are widely used in the plastics industry for various reasons. One of the primary reasons for using pigments in plastics is to provide vibrant and attractive colors as pigments offer a wide range of color options, allowing plastic manufacturers to create products in different hues and shades. Moreover, pigments are essential in the plastics industry for coloration, branding, UV resistance, concealing properties, product identification, safety, and creating visual effects. They add value to plastic products by enhancing their appearance, performance, and market appeal. These factors together are anticipated to foster the growth of the pigments market during the forecast period.

However, the environmental impact of pigments, particularly those derived from conventional sources, is a significant concern. Some pigments contain heavy metals or other toxic substances that can be harmful to ecosystems and human health. Strict environmental regulations and increasing consumer demand for eco-friendly alternatives pose challenges for conventional pigment manufacturers. This factor may restrain the growth of the pigment market during the forecast period.

Moreover, pigments used in various applications, such as cosmetics and food packaging, are subject to stringent health and safety regulations. Regulatory compliance, including restrictions on certain pigments or limitations on their use in specific applications, can impact the market growth and availability of certain pigments.

On the contrary, Volatile Organic compounds (VOCs) are compounds having low water solubility and high vapor pressure. They are emitted as gases from certain solids or liquids and include a variety of chemicals that may have short and long term adverse health effects. Furthermore, several government agencies such as the United States Environmental Protection Agency (U.S. EPA), European Union, Central Pollution Control Board, and others have laid down laws and regulations for the emission limits of VOCs. For instance, the United States Environmental Protection Agency (U.S. EPA) regulates VOCs at Federal level in 40 CFR 59, which is the National Volatile Organic Compound Emission Standards for consumer and commercial products.

There is a growing demand for sustainable and environmentally friendly pigments containing little or no VOCs. The development of bio-based, natural, or renewable source pigments offers opportunities to cater to this demand. Pigments derived from plant-based materials, algae, or waste streams can provide eco-friendly alternatives with reduced environmental impact. This factor increase the demand for eco-friendly pigments; thus, creating remunerative opportunities for the pigments market.

Segments Overview

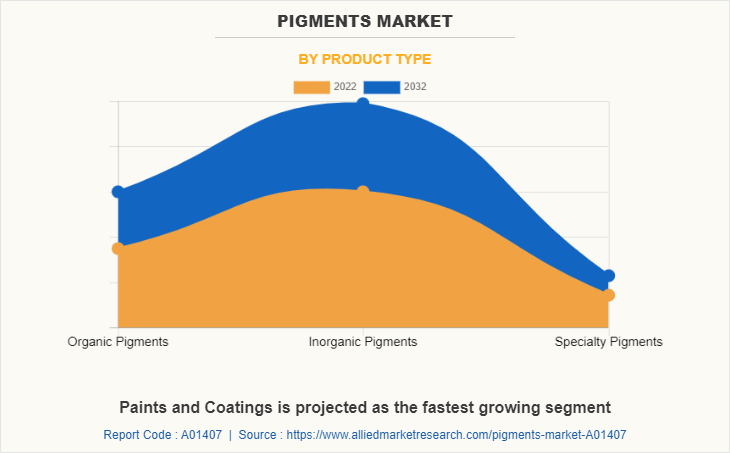

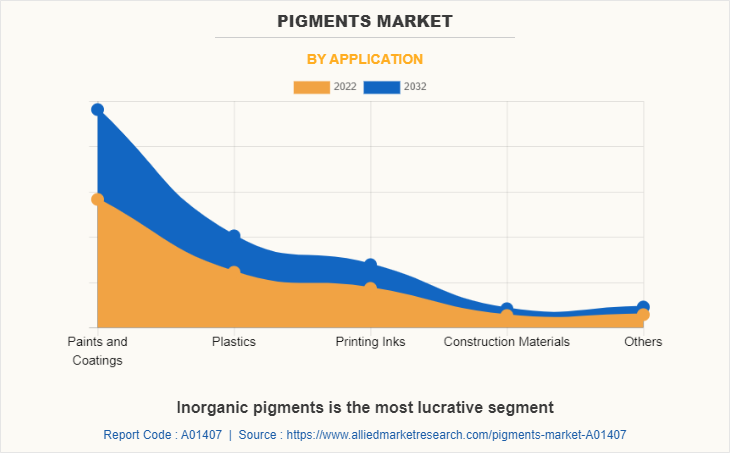

The pigments market is segmented on the basis of product type, application, and region. On the basis of product type, the market is categorized into organic pigments, inorganic pigments, and specialty pigments. By application, it is divided into paints and coatings, plastics, printing inks, construction materials, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

In 2022, the inorganic pigment segment was the largest revenue generator, and is anticipated to grow at a CAGR of 5.2% during the forecast period. Rapid urbanization and infrastructure development projects, particularly in emerging economies, drive the demand for inorganic pigments. The construction sector utilizes pigments in various applications, including paints, concrete, tiles, and coatings for buildings and infrastructure projects. This may act as one of the key drivers responsible for the growth of the pigments market for inorganic pigments type. In June 2022, Clariant introduced Dispersogen Flex 100, the first universal polymeric dispersant suitable for both organic and inorganic pigments in water-based and solvent paints. This additive improves dispersion and processing efficiency for pigment producers and paint formulators

Furthermore, rising disposable income levels and changing lifestyles have led to increased consumer spending on products like automobiles, consumer electronics, and home furnishings where inorganic pigments are used to provide attractive and vibrant colors. This factor may further augment the growth of the inorganic pigments market during the forecast period.

By application, the paints and coatings segment dominated the global market in 2022 and is anticipated to grow at a CAGR of 5.5% during the forecast period. Pigments play a vital role in the paints and coatings industry, serving as the primary agents responsible for imparting color, opacity, durability, and various functional properties to coatings. These materials, which can be organic or inorganic, are finely ground particles that are dispersed in a liquid medium to form paint. Their selection and performance directly influence the aesthetics, protective quality, and longevity of paint and coating formulations used across a wide range of sectors including construction, automotive, industrial equipment, marine, and decorative arts. In May 2025, BASF announced the sale of its coatings business (valued at ~$6.8 billion), signaling a shift toward autonomous operations in coatings, battery materials, and agriculture.

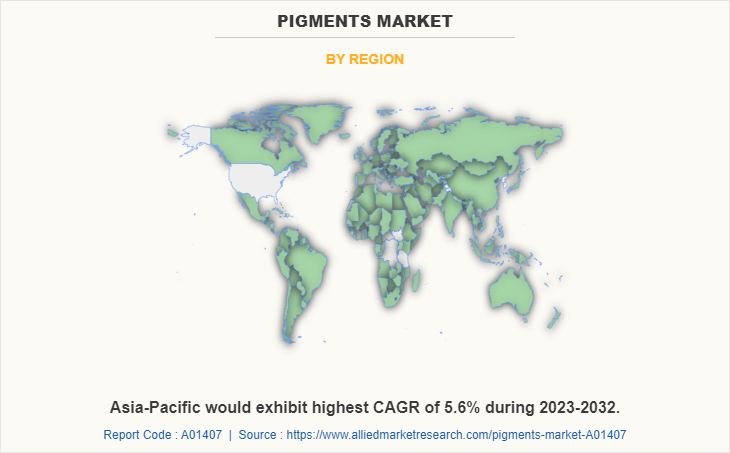

The Asia-Pacific pigments market size is projected to grow at the highest CAGR of 5.6% during the forecast period and accounted for 48.7% of pigments market share in 2022. Countries in the Asia-Pacific region, particularly China, India, and Southeast Asian nations, have been experiencing rapid industrialization. This industrial growth has led to increased production in sectors such as automotive, construction, packaging, textiles, and consumer goods, all of which require pigments for coloration and aesthetics. This factor may act as one of the key drivers responsible for the growth of the pigments market in the Asia-Pacific region.

In addition, the packaging industry in the Asia-Pacific region is experiencing robust growth. This is driven by changing lifestyles, increased consumption, and the growth of e-commerce. Pigments are extensively used in packaging materials to provide vibrant colors, brand differentiation, and visual appeal. The rising demand for packaged food, beverages, personal care products, and pharmaceuticals further fuels the demand for pigments market.

Competitive Analysis

The global pigments market profiles leading players that include KRONOS Worldwide, Inc., DIC CORPORATION, The Chemours Company, LANXESS, Venator Materials PLC, CLARIANT, BASF SE, Tronox Holdings Plc, Gharda Chemicals Limited, and Ferro Corporation. The global pigments market report provides in-depth competitive analysis as well as profiles of these major players.

In April 2023, HinaPlas introduced sustainable pigments such as Microlen® Blue 7460 ECO (compostable plastics) and Sicopal® Black K 0098 FK (heat‑stable, food-safe) to support recycling and e‑vehicle plastics.

In April 2024, in‑cosmetics Global Launched INTENZA® Hana mica-based effect pigments and natural pigments SunPURO™ and SACRANEX™ to meet eco‑friendly beauty industry demands.

Recent Key Developments in the Pigments Market

In July 2022, DIC Corporation announced a second-phase agreement with Debut Biotechnology, Inc. to create natural red pigments for nutrition, food, and cosmetic applications.

In July 2024, Merck KGaA agreed to sell its pigments unit, known as Surface Solutions, to China's Global New Material International (GNMI) for $721.46 million (€665 million). This move allows Merck to refocus on its core business areas, particularly materials for chip production.

In October 2024, Sudarshan Chemical Industries announced the acquisition of Heubach Group for (€127.5 million) $145.9 million. The acquisition strengthens Sudarshan's position in the global pigments market.

Trade Impact Analysis in Pigment Market

In 2023, the global trade value of Prepared Pigments amounted to $4.64 billion, marking a significant decline of 17.3% compared to $5.62 billion in 2022. Over the last five years, this sector has experienced a gradual decrease, with an annualized trade decline rate of 0.71%.

Prepared Pigments held a modest position among international trade goods in 2023, ranking 565th out of 1,217 traded products by value, representing just 0.021% of total world trade. In terms of product sophistication, Prepared Pigments ranked 203rd out of 1,044 products based on the Product Complexity Index (PCI), with a PCI score of 0.92, indicating a moderate level of complexity.

Trade balances varied notably across countries. Spain led with the largest trade surplus in Prepared Pigments at $934 million, followed by Japan with $395 million, and China with $272 million. On the other hand, India and Algeria each recorded the largest trade deficits of $162 million, while Saudi Arabia had a deficit of $117 million.

At a more detailed product level (HS6), the top traded subcategories within Prepared Pigments were Glass frit and other glass materials (powder, granules, flakes) valued at $1.41 billion, Vitrifiable enamels and glazes for ceramics and glass at $1.16 billion, and Liquid lusters and similar preparations totaling $1.04 billion worldwide.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pigments market analysis from 2022 to 2032 to identify the prevailing pigments market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pigments market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pigments market trends, key players, market segments, application areas, and pigments market growth strategies.

Pigments Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 45.4 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 514 |

| By Application |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | The Chemours Company, DIC CORPORATION, Gharda Chemicals Limited, BASF SE, Tronox Holdings Plc, KRONOS Worldwide, Inc., CLARIANT, LANXESS, Venator Materials PLC, Ferro Corporation |

| OTHER KEY PLAYERS IN THE MARKET VALUE CHAIN INCLUDE | CPS Color AG, Kronos Worldwide Inc., LANXESS AG, Cristal, Tronox Ltd., Lonsen, RIKA Technology Co., Ltd., Dainichiseika Color & Chemicals Mfg., Co., Ltd., Toyo Ink Mfg. Co. Ltd. |

Analyst Review

The global pigments market is expected to exhibit high growth potential owing to its use in the production of paints & coatings, plastics, packaging products, construction materials, food & beverages, and others. Moreover, there is a growing emphasis on sustainability and environmentally friendly practices across industries. This factor would prioritize sustainability initiatives in the pigments industry, such as developing eco-friendly pigments, reducing energy consumption, optimizing production processes, and ensuring compliance with environmental regulations. Additionally, pigment manufacturers would also communicate the sustainability efforts to customers and stakeholders to enhance brand value.

Furthermore, pigment manufacturers would identify and mitigate risks that could impact the pigment industry, such as raw material price fluctuations, currency exchange rate volatility, geopolitical factors, and market demand uncertainties. They would develop risk management strategies, diversify supply sources, and implement contingency plans to minimize potential disruptions.

CXOs further added that sustained economic growth coupled with rapid development of paints & coatings manufacturing sector may lead the pigments market to witness a significant growth.

Escalating demand from building and construction sector and robust demand from plastic manufacturing sector are the upcoming trends of the pigments market.

The leading applications of pigments market include paints and coatings, plastics, printing inks, construction materials, and others.

Asia-Pacific is the largest regional market for pigments

The pigments market valued for $27.2 billion in 2022 and is estimated to reach $45.4 billion by 2032, exhibiting a CAGR of 5.3% from 2023 to 2032.

KRONOS Worldwide, Inc., DIC CORPORATION, The Chemours Company, LANXESS, Venator Materials PLC, CLARIANT, BASF SE, Tronox Holdings Plc, Gharda Chemicals Limited, and Ferro Corporation are the top companies to hold the market share in the pigments market.

Loading Table Of Content...

Loading Research Methodology...