Pipeline Equipment Market Research, 2031

The global pipeline equipment market size was valued at $12.5 billion in 2021, and pipeline equipment industry is projected to reach $18.7 billion by 2031, growing at a CAGR of 4.2% from 2022 to 2031.

Report Key Highlighters:

- The pipeline equipment market has been analyzed in value. The value of the pipeline equipment market is analyzed in millions.

- The report provides top investment pockets with respect to region and provides the top player positioning.

- Global pipeline equipment market is fragmented with many players such as Destec Engineering Limited, Siderforgerossi, LTS Energy, Arnco, Avesta Steels & Alloys, RBV Energy, Fittinox S.R.L., Arabian Oilfield Supplies & Services, Aqueterra Group Ltd., Weir Oil & Gas, and AFG Holdings Inc. Key strategies such as product launches, acquisitions, mergers, expansion, etc. of various manufacturers of pipeline equipment are tracked.

- Conducted primary interviews with raw material suppliers, wholesalers, suppliers, and manufacturers of the pipeline equipment market to understand the market trends, growth factors, pricing, and key player’s competitive strategies.

Pipeline equipment is machinery that is frequently used in the construction of pipeline infrastructure for the transportation of oil, gas, and chemical resources. Numerous different kinds of pipes, flanges, valves, OCTG, compressors and other pieces of machinery make up most of the pipeline equipment.

The rising oil and gas consumption has led to the expansion of pipeline capacities, and new pipeline projects that are being commissioned. Moreover, an increase in offshore activities, such as deepwater and ultra-deepwater production and development, is driving the oil and gas pipeline market. However, the global shift toward renewable sources for electricity generation poses a massive threat to oil and gas demand, is expected to be a significant challenge for oil and gas pipeline equipment market growth in the coming years.

The availability of abundant natural gas reserves and the lower cost in comparison to other fossil fuel types, among others, are expected to supplement the demand for natural gas from multiple end-use sectors, including power generation. This, in turn, is expected to boost the gas pipeline market during the forecast period.

Natural gas consumption increased significantly, reaching 3,822.8 billion cubic meters (BCM) in 2020, owing to the increasing demand for natural gas in multiple industries, including power generation and transportation. This trend is expected to continue in the coming years and is projected to drive the gas pipeline infrastructure significantly. By 2030, due to environmental benefits and the quest for energy security in regions such as the Middle East, Africa, and Asia-Pacific, the demand for natural gas is expected to witness significant growth among all fuel types. With exports of 197.2 billion cubic meters of gas per year in 2020, Russia continued to be the largest LNG exporter globally. The LNG trade is expected to witness a significant increase globally, resulting in increased demand for the natural gas pipeline network.

Moreover, in January 2020, the Indian government approved $774 million for a natural gas pipeline network in the northeast region as part of a national gas grid being built to span remote locations in the country. The 1,656 km pipeline is expected to cost up to $1.13 billion and is expected to be completed by 2023. The development of new sources of natural gas, such as shale gas deposits, and the resulting price pressure are increasing the international trade of natural gas. Hence, these developments are expected to consequently result in increasing the demand for pipeline network expansion during the forecast period.

Pipeline equipment usage in a variety of end markets

The use of pipeline equipment is rising rapidly in various end uses such as in oil and gas, chemical, food manufacturing, and water & wastewater industries. Pipelines are the most economical way to transport large quantities of oil, refined oil products, and natural gas over land. There are three types of pipelines that carry oil: gathering systems, crude oil pipeline systems, and refined products pipeline systems. The crude oil pipeline system carries crude oil to refineries; refined product pipelines transport refined products from refineries to the market.

Chemicals play an important role in industrialization and the development of civilization. Pipelines are used to transport chemicals from refineries and chemical plants to storage, and other processing plants or distribution facilities. Large quantities of ammonia are transferred from a production site to other plants to produce several derivatives such as nitric acid.

Water pipelines are useful for transporting water for drinking or irrigation over long distances. Middle Eastern countries have increased investment in desalination and wastewater management plants across the globe. Saudi Arabia's Saline Water Conversion Corporation has completed a water pipeline tunnel project with a diameter of 8.4 meters and 12.5 Km which has led to the demand for pipeline equipment.

The presence of large-scale wineries and milk-related products for consumption across the globe led to the demand for the management of these products. An increase in population and development of animal husbandry in an agriculture-based country such as India will provide ample opportunities for the growth of the pipeline equipment market.

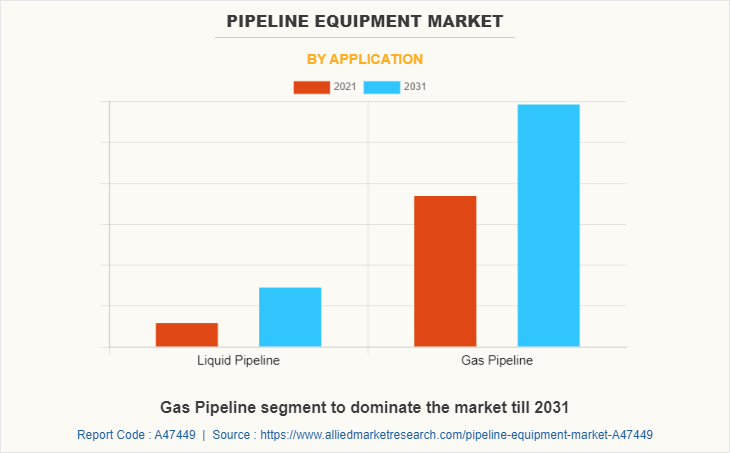

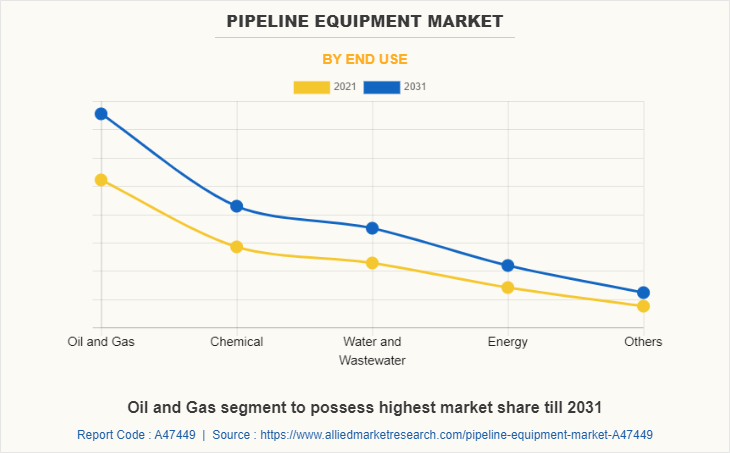

The global pipeline equipment market forecast is segmented on the basis of application, end use, and region. By application, the market is divided into liquid pipelines and gas pipelines. By end use, it is divided into oil and gas, chemicals, water & wastewater, energy, and others. By region, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

On the basis of application, the gas pipeline segment accounted for 75.0% of the pipeline equipment market share in 2021 and is expected to maintain its dominance during the forecast period. This is owing to its application in the oil & gas industries, chemical industries, and other industries.

By end use, it is divided into oil & gas, chemicals, water & wastewater, energy, and others. The oil & gas segment accounted for the largest revenue share in the global pipeline equipment market in 2021. This growth in demand can be attributed to the progression of the investment of the oil companies toward offshore exploration and the developing country’s investment towards oil refineries.

Region-wise, North America accounted for the largest market share in the market and is projected to grow at a CAGR of 3.7% during the forecast period. The presence of top detection and management technologies in this region is also driving the growth of the market. The Mexican government’s support for the expansion of the country’s gas infrastructure, over the past few years, led to investment in the construction of more than 1,200 Km of the pipeline transport system. The development of favorable guidelines by the Energy Regulatory Commission to coordinate with National Pipeline Systems based on roll-in rates resulted in forming of the National Integrated Transportation and Storage System will provide lucrative opportunities for the growth of the pipeline equipment market.

North America region dominated the market in 2021. This region is the second largest region accounting for nearly 26% of the global pipeline transportation industry. Pipeline transportation companies are using augmented reality for efficient maintenance operations. In the U.S. there are more than 210 pipeline systems which total more than 305,000 miles of interstate and intrastate pipelines.

The Colonial Pipeline is the largest pipeline system for refined oil products in the U.S. It consists of two tubes around 8,850 Km long and carries 3 million barrels of fuel per day between Texas and New York. The U.S. houses the greatest number of oil pipelines in the world. As of 2020, there were 111 operational pipelines in the country and a further 25 oil pipelines are under development. It is also the country with the most gas pipelines in the world. The above factors will provide ample opportunities for the development of the pipeline equipment market in this region during this forecast period.

Asia-Pacific region is growing at a rapid pace with a CAGR of 4.8% during the forecast period. India and China are major players in this region majorly due to their huge populations and due to their demand for oil and resources for power generation and transportation. The presence of developing countries in this region and the need for technological renovation in these countries has led to an increase in the demand for pipeline equipment. Countries such as India, China, Japan, and others are experiencing high demand for pipeline equipment due to an increase in investment in the development of various manufacturing industries which provide ample opportunities for the development of the market.

In Europe, the increase in demand for pipeline equipment is surging rapidly due to renovation of old oil and gas pipelines. The European gas network was established during the last 70 years and is developed around national gas fields in southern France, Northern Italy, Germany, and Romania. In Europe, most of its natural gas and oil reserves come from Russia; hence, the future of European development rests on Russia’s energy supply to the European Union. The major feature of the EU internal pipeline is the limited connections between the western pipeline network and the Eastern infrastructure.

The presence of few oil & gas resources in the European continents led to the development of offshore exploration which fostered the demand for underwater pipeline transportation systems. The increase in the food processing industries across this region has led to an increase in the development of milk, beer, and other fluid-based food manufacturers.

The demand for pipeline equipment will increase significantly in the Middle East countries which has a significant impact on market growth. The LAMEA region has significant demand for the pipeline equipment market as the countries in this region have abundant natural energy resources such as crude oil and natural gas. The increase in demand for fossil fuels across the world has led to the investment of government and private industries to expand the production capacity of crude oil and related petroleum products. The increase in population and tourism activities in Saudi Arabia led to an increase in the demand for freshwater; hence, propelling the investment toward the desalination water plant. This factor will provide ample opportunities for the development of the market.

IMPACT OF COVID-19 ON THE GLOBAL PIPELINE EQUIPMENT MARKET

The COVID-19 pandemic led to a decline in the demand for the pipeline equipment market due to a decrease in the demand for power generation and chemical manufacturing industries across the globe. In addition, the shutdown of manufacturing industries and the demand for power from various industries have a significant impact on the market. Pipeline projects witnessed delays due to imposed lockdown restrictions in major countries like the U.S., India, and other countries. The decreased gas demand due to the decline in electricity consumption and travel restrictions also negatively affected gas consumption in several countries.

The rising oil and gas consumption and pipeline capacities are being expanded, and new pipeline projects are being commissioned in developing countries to counter pandemic situations in the future. The above-mentioned factors will drive the growth of the global pipeline equipment market.

Competitive Landscape

Key players in the pipeline equipment industry include Destec Engineering Limited, Siderforgerossi, LTS Energy, Arnco, Avesta Steels & Alloys, RBV Energy, Fittinox S.R.L., Arabian Oilfield Supplies & Services, Aqueterra Group Ltd., Weir Oil & Gas, and AFG Holdings Inc. These players have adopted various strategies to gain a higher share or retain leading positions in the market

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pipeline equipment market analysis from 2021 to 2031 to identify the prevailing pipeline equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pipeline equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pipeline equipment market trends, key players, market segments, application areas, and market growth strategies.

Pipeline Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 18.7 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 193 |

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Market Players | RBV Energy, AFG Holdings, Inc., Aqueterra Group Ltd, Weir Oil & Gas, Arnco, Arabian Oilfield Supplies & Services, Destec Engineering Limited, Siderforgerossi Group SpA, LTS Energy, Avesta Steels & Alloys, Fittinox S.R.L. |

Analyst Review

As per CXO perspective, the global pipeline equipment market is expected to witness increased demand during the forecast period. The surge in the demand for pipeline equipment is mostly due to the increase in the investment of the government toward the pipeline transportation of oil and gas resources from the neighboring countries.

Pipeline equipment is equipment that is widely used in the construction of pipeline system infrastructure to transport oil & gas and chemical resources. Most of the pipeline equipment consists of various types of pipes, flanges, valves, OCTG, compressors, and other equipment.

Increasing demand for oil and gas resources across the globe and improper distribution of resources has led to the utilization of pipeline transportation to transport various oil and gas resources. The increased demand for premium quality pipeline equipment products in new areas of unconventional resources has created opportunities for businesses specializing in providing premium quality pipeline equipment, and the extensive expansion of oil and gas resources in both onshore and offshore areas will provide good commercial development opportunities. The U.S. shale gas revolution is encouraging investors to invest in the exploration of unconventional fuel resources. The government and private entities are showing a strong interest in discovering new oil wells and developing new oil and gas fields, providing much-needed support to the industry. Increased policies aimed at reducing reliance on hydrocarbon imports by discovering conventional and unconventional reserves within territorial borders will provide ample supply. This has consequently boosted the demand for premium quality pipeline equipment and services, creating a market that is ripe with potential. In addition to this, rapid innovation, and the development of IoT with practical applications in the pipeline transportation industry have created major importance for the pipeline equipment market. The facts indicate that the pipeline equipment market will expand considerably throughout the projected period.

The global pipeline equipment market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Among the analyzed regions, Asia-Pacific is expected to account for the highest CAGR throughout the forecast period, followed by LAMEA, Europe, and North America. Asia-Pacific region hosts some of the fastest developing countries such as China and India where there is a huge demand for pipeline equipment due to an increase in the investment of the government in the manufacturing industries, and oil & gas pipeline infrastructure. The presence of a huge population and rapid urbanization in these countries has increased the demand for petroleum products, and other commercial products which are highly dependent on the chemical manufacturing industries which led to investment in the development of pipeline equipment. In addition, India being an agriculture-dependent country has led to an increase in the construction of food manufacturing industries and pharmaceutical industries which led to the demand for various pipeline equipment which is used to transport various raw materials utilized in the production of the products.

Abundant natural gas resources and presence of large-scale projects and the growing global offshore rig count and exploration for resources are the key factors boosting the Pipeline equipment market growth.

The market value of Pipeline equipment in 2031 is expected to be $18.7 billion

Destec Engineering Limited, Siderforgerossi, LTS Energy, Arnco, Avesta Steels & Alloys, RBV Energy, Fittinox S.R.L., Arabian Oilfield Supplies & Services, Aqueterra Group Ltd., Weir Oil & Gas, and AFG Holdings Inc.

Oil and gas is projected to increase the demand for Pipeline equipment Market

The global pipeline equipment market analysis is segmented on the basis of application, end use, and region. By application, the market is divided into liquid pipelines and gas pipelines. By end use, it is divided into oil and gas, chemicals, water & wastewater, energy, and others. By region, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

Extensive expansion of oil and gas resources is the Main Driver of Pipeline equipment Market.

The rising oil and gas consumption and pipeline capacities are being expanded, and new pipeline projects are being commissioned in developing countries to counter pandemic situations in the future. The above-mentioned factors will drive the growth of the global pipeline equipment market.

Loading Table Of Content...